Earned Income Templates

Welcome to our webpage about Earned Income documents!

Earned income refers to the money you receive as compensation for your work from an employer or through self-employment. It is an important aspect of your financial life, and there are various documents associated with reporting and managing your earned income.

At our website, we provide information and resources related to earned income documents to help you stay organized and compliant with tax laws. Whether you are an employee or self-employed, understanding these documents is crucial to ensure accuracy in reporting and claiming the appropriate tax credits.

We offer a wide range of resources and guidance on various earned income documents, including forms such as:

-

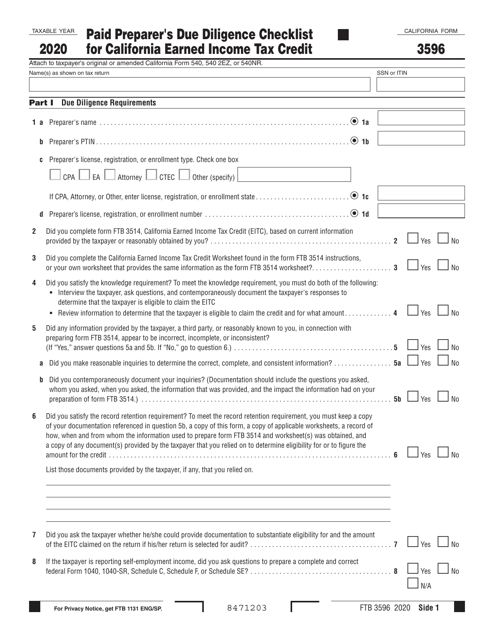

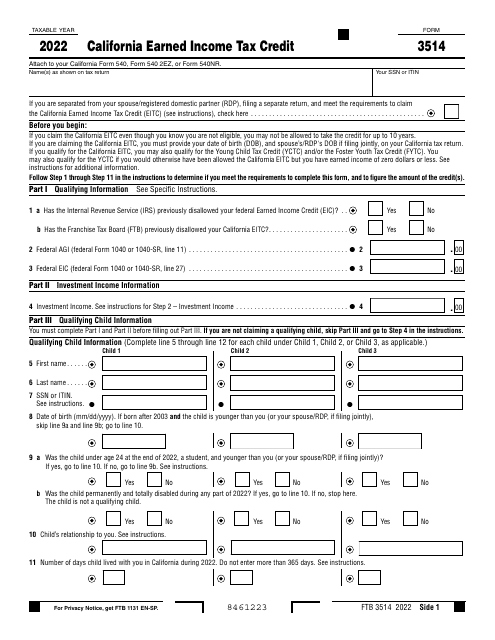

Form FTB3596 Paid Preparer's Due Diligence Checklist for California Earned Income Tax Credit: This document is specific to California residents and outlines the checklist for tax preparers to ensure compliance with the state's Earned Income Tax Credit requirements.

-

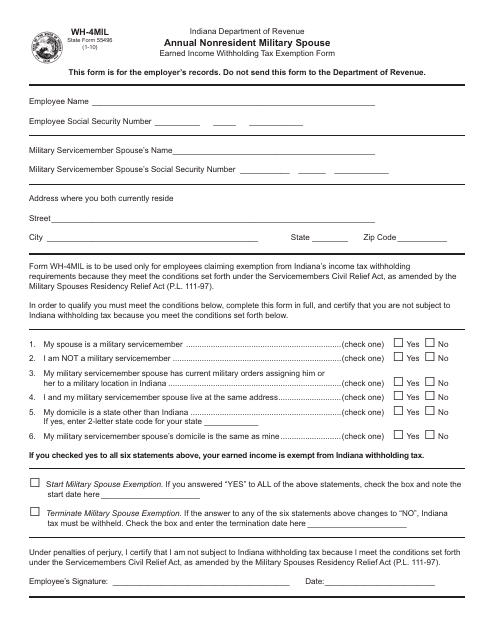

State Form 55496 (WH-4MIL) Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form: If you are a military spouse residing in Indiana but earn income outside the state, this form exempts you from withholding tax on your earned income.

-

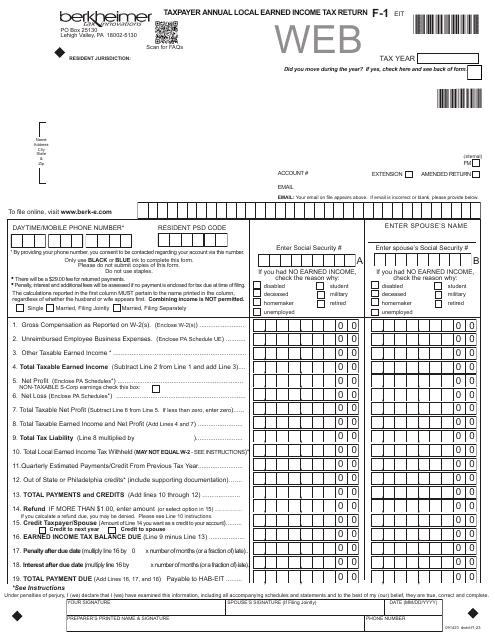

Form F-1 Taxpayer Annual Local Earned Income Tax Return: This form is applicable to Pennsylvania residents and enables them to report their annual local earned income tax liability accurately.

-

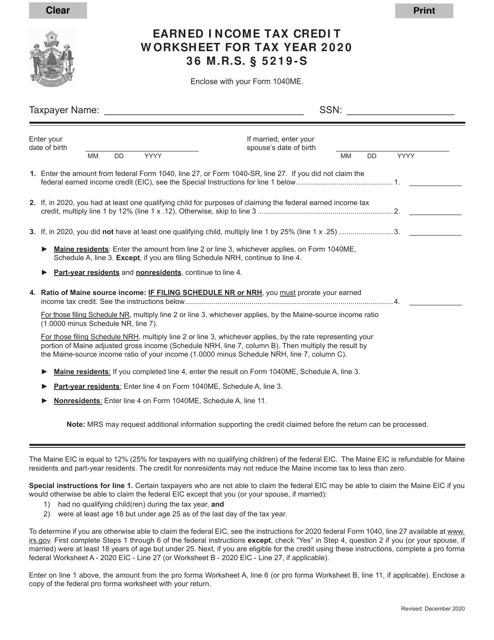

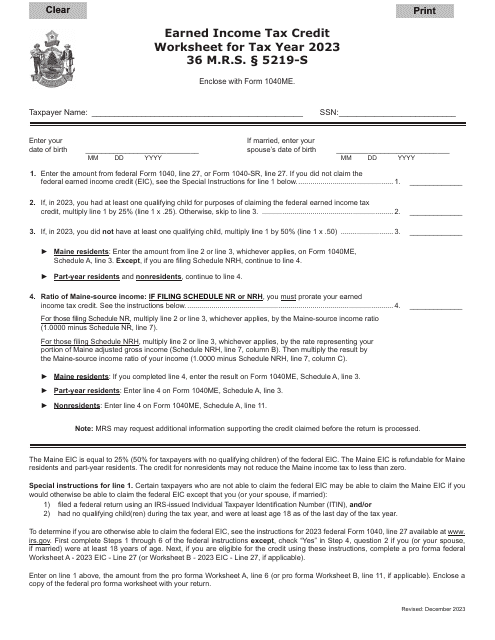

Earned Income Tax Credit Worksheet: Maine residents can use this worksheet to calculate their eligibility for the Federal Earned Income Tax Credit, which is a refundable tax credit for low to moderate-income individuals and families.

-

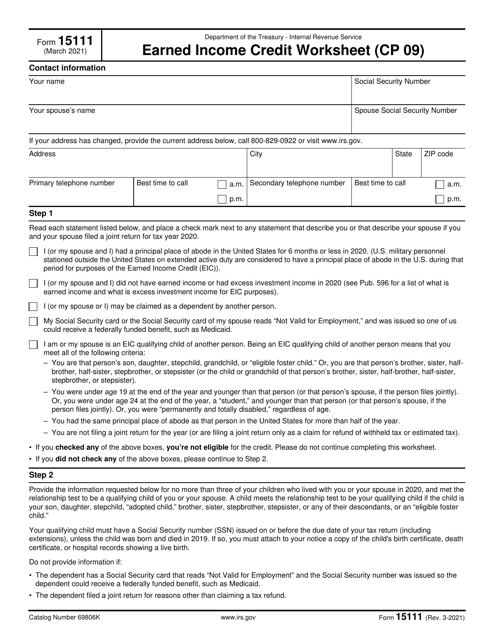

IRS Form 15111 Earned Income Credit Worksheet (CP 09): This form, provided by the Internal Revenue Service, assists taxpayers in calculating the amount of the Earned Income Credit they may be eligible for.

Our website serves as a comprehensive guide to understanding and navigating these earned income documents. We provide detailed explanations, step-by-step instructions, and important tips to help you complete these forms correctly. Additionally, we offer updates and news related to changes in tax laws that may impact your earned income reporting.

We understand that managing your earned income can be daunting, but our user-friendly website strives to simplify the process for you. We aim to be your go-to resource for all things related to earned income documents, ensuring that you have the knowledge and tools you need to fulfill your obligations and maximize your benefits.

Browse our website today to find reliable, up-to-date information on earned income documents, ensuring a stress-free experience as you manage your financial responsibilities.

Documents:

11

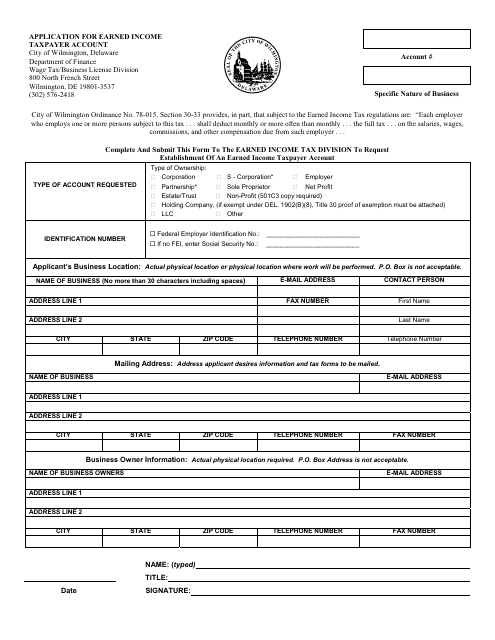

This form is used for applying for an Earned Income Taxpayer Account in the City of Wilmington, Delaware.

This Form is used for claiming an annual income withholding tax exemption for nonresident military spouses in Indiana.

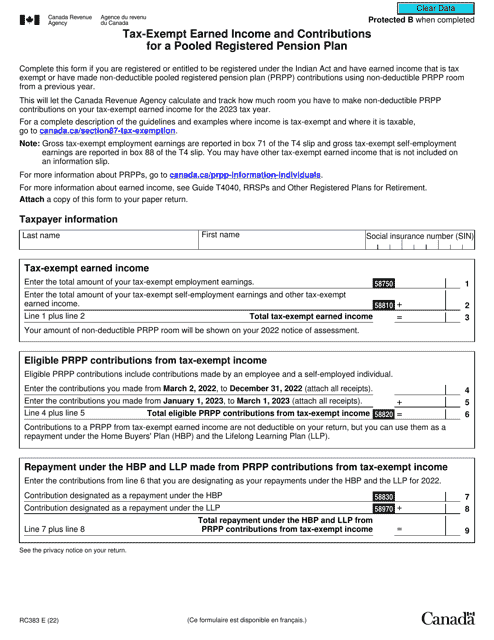

This document is used for calculating the Earned Income Tax Credit in the state of Maine. It provides a worksheet to help residents determine their eligibility and calculate the amount of credit they may qualify for.

This form is used to calculate the Earned Income Credit for eligible taxpayers.