Capital Cost Allowance Templates

When it comes to managing your capital costs, having access to accurate and up-to-date information is crucial. Our Capital Cost Allowance documents provide you with the necessary guidelines and forms to navigate through the complexities of capital cost allowances.

Also known as CCA, the Capital Cost Allowance documents offer detailed instructions and forms to help individuals and businesses in the USA, Canada, and other countries accurately calculate and claim their capital cost allowances. By properly assessing the depreciation of your capital assets, you can maximize your tax deductions and optimize your cash flow.

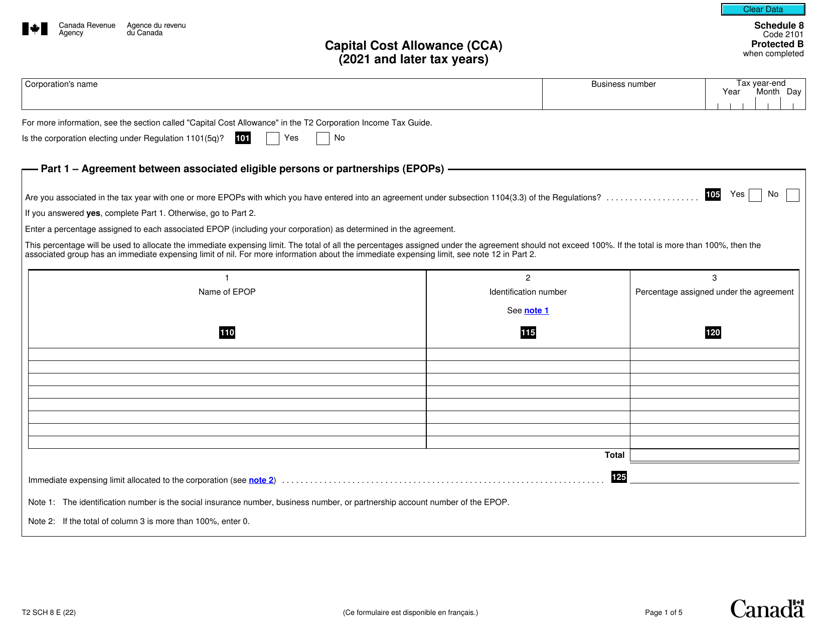

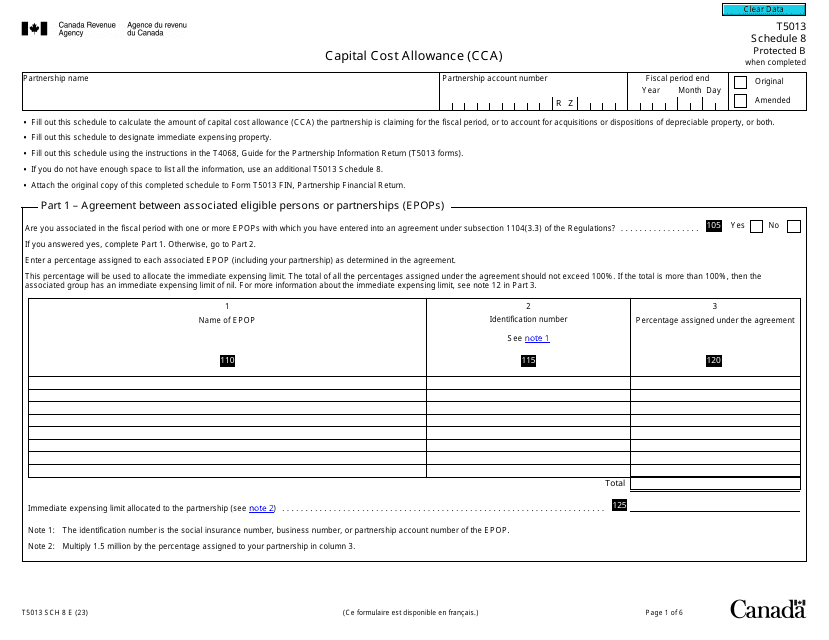

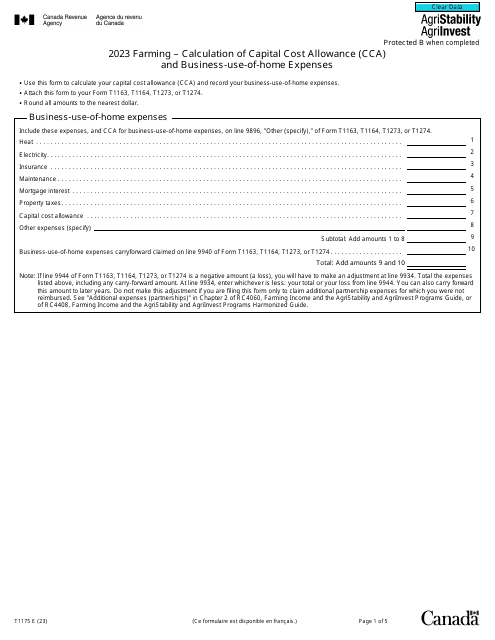

Our collection of Capital Cost Allowance documents include various forms such as Form T2 Schedule 8 Capital Cost Allowance (Cca) (2018 and Later Tax Years), Form T5013 Schedule 8 Capital Cost Allowance (Cca), and Form T1175 Farming - Calculation of Capital Cost Allowance (Cca) and Business-Use-Of-Home Expenses. These forms cater to different industries, ensuring that each business can find the relevant information and guidelines tailored to their specific needs.

With our Capital Cost Allowance documents, you can stay compliant with tax regulations while making the most of available tax benefits. Our user-friendly forms and comprehensive instructions simplify the process of calculating and reporting your capital cost allowances, saving you time and effort.

Whether you are an individual or a business owner, understanding and effectively managing your capital cost allowances is essential for financial success. Explore our Capital Cost Allowance documents today and take control of your tax planning and reporting.

Documents:

10

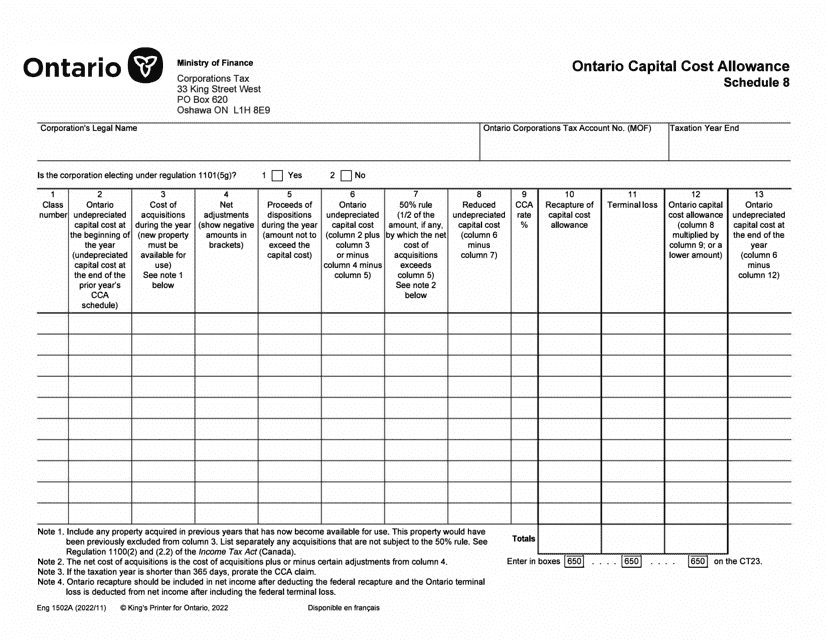

This Form is used for reporting capital costs and claiming deductions for the Ontario Capital Cost Allowance in Ontario, Canada.