Tax Relief Options Templates

Are you searching for ways to alleviate your tax burden? Look no further! Our tax relief options provide individuals and businesses with various strategies and programs to help reduce or eliminate their tax liabilities. Whether you are located in Louisiana, Hawaii, Mississippi, Washington, D.C., Missouri, or any other state in the USA, we have comprehensive solutions to meet your specific needs.

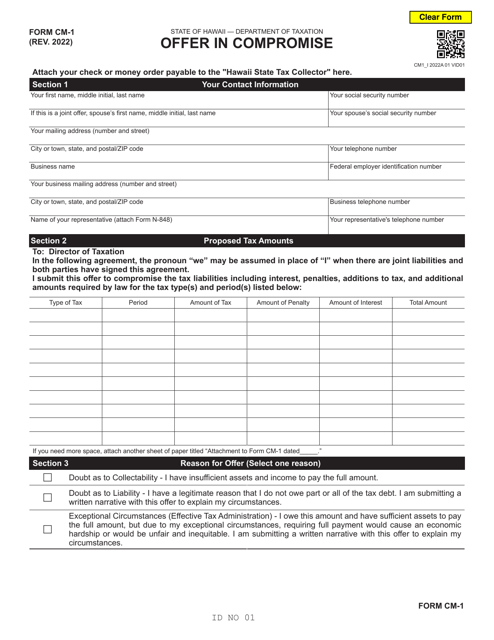

Our tax relief options include the Offer in Compromise program, which allows taxpayers to settle their tax debt for less than the full amount owed. This program provides eligible individuals and businesses with a fresh start by negotiating a manageable payment plan with the tax authorities.

Alternatively, you may qualify for a tax relief program tailored specifically for individuals or businesses in your state. These programs offer unique benefits and incentives to taxpayers who meet certain criteria. By taking advantage of these options, you can significantly reduce your tax liability and relieve the financial burden of unpaid taxes.

Don't let your tax debt hold you back any longer. Explore our wide range of tax relief options and discover the solution that best fits your individual circumstances. Our team of experts is here to guide you through the process and help you achieve the tax relief you deserve. Say goodbye to sleepless nights and excessive financial strain - take control of your tax situation today!

Documents:

5

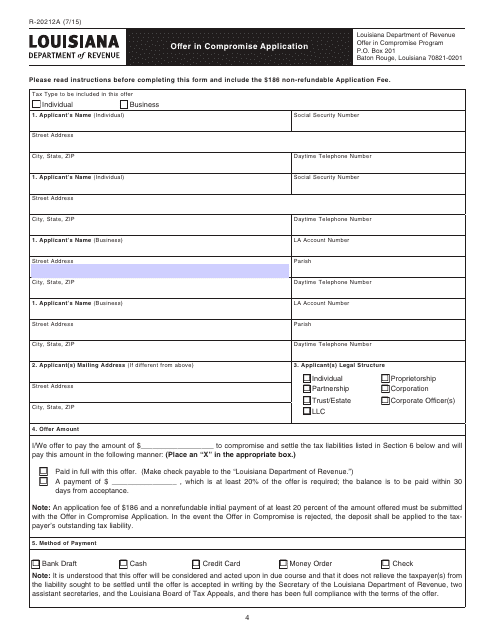

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

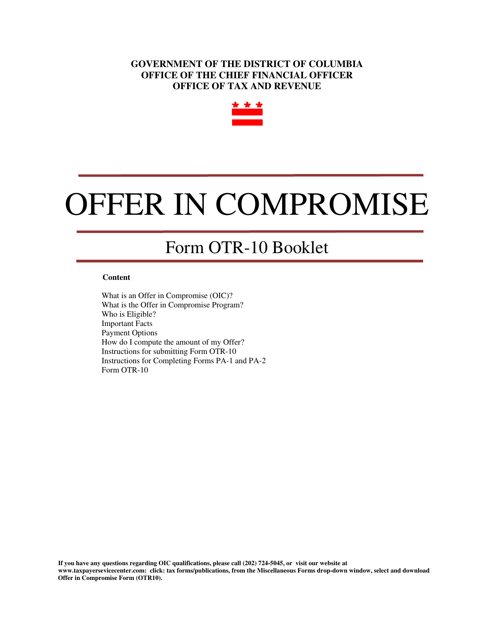

This form is used for making an offer in compromise to the Internal Revenue Service (IRS) in Washington, D.C. It allows taxpayers to settle their tax debt for less than the full amount owed.

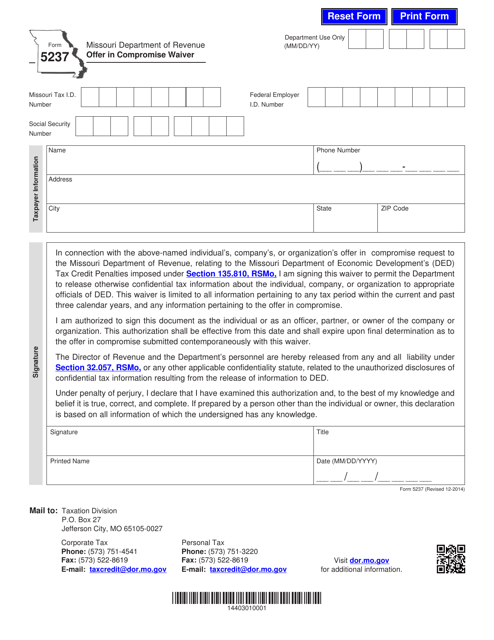

This form is used for applying for an offer in compromise waiver in the state of Missouri.