Merchants Capital Templates

Welcome to our webpage dedicated to merchants capital, also known as machinery and tools. This collection of documents is specifically designed for businesses and individuals who own tangible personal property, machinery and tools, or merchants' capital. Whether you are in Virginia or any other state, these documents are essential for reporting and taxation purposes.

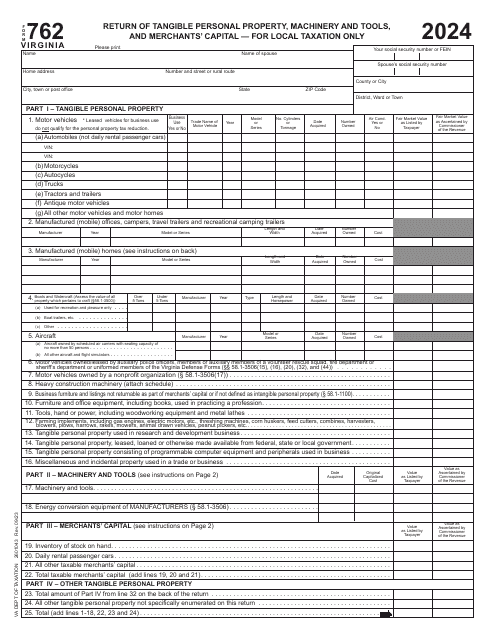

Our comprehensive collection includes documents such as Form 762 Return of Tangible Personal Property, Machinery and Tools, and Merchants' Capital - Virginia, as well as variations like Form 762 Return of Tangible Personal Property, Machinery and Tools, and Merchant's Capital - for Local Taxation Only - Virginia. These documents are specifically tailored to meet the tax requirements and regulations in Virginia, ensuring that you can accurately report your assets and satisfy your tax obligations.

By utilizing these documents, you can effectively report your tangible personal property, machinery and tools, and merchants' capital, ensuring compliance and avoiding any potential penalties. Our collection of documents covers a wide range of scenarios, allowing you to confidently navigate the complex world of taxation and asset reporting.

So, whether you are a business owner, an individual with significant machinery and tools, or a merchant with substantial capital, our merchants capital documents, also known as machinery and tools documents, provide a convenient and reliable solution for your reporting needs. Trust us to simplify the process and ensure that you remain in good standing with state taxation authorities.

Browse through our diverse collection of documents today and take the first step towards accurate and efficient reporting of your merchants capital, machinery and tools, and tangible personal property. Let us help you streamline your tax obligations and stay on top of your financial responsibilities.