Schedule Wd Templates

Welcome to our webpage dedicated to Schedule WD documents. Whether you are a resident of Wisconsin or have capital gains and losses that need to be accounted for, our Schedule WD documents are here to assist you.

At Templateroller.com, we understand the importance of accurate and detailed reporting when it comes to capital gains and losses. Our Schedule WD documents provide the necessary forms and instructions to ensure that you are able to properly report and calculate these transactions.

Our Schedule WD documents are designed specifically for residents of Wisconsin, and they are an essential tool for individuals and businesses alike. These documents help you accurately report your capital gains and losses, ensuring compliance with state regulations.

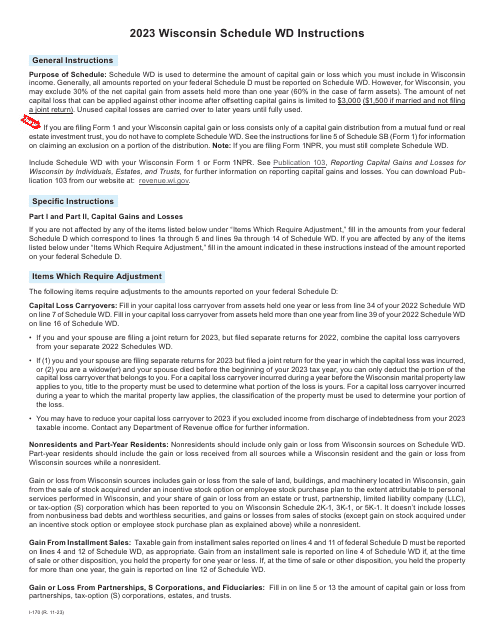

Using our Schedule WD documents, you will find step-by-step instructions on how to complete the required forms. We understand that tax documentation can be complex, so our instructions are designed to be easy to follow, making the process as straightforward as possible.

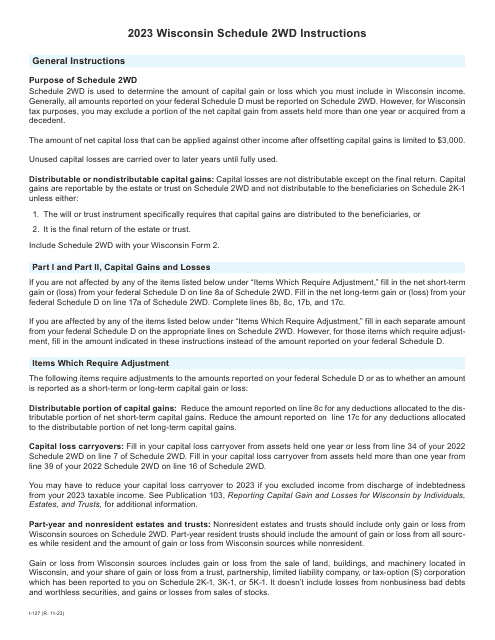

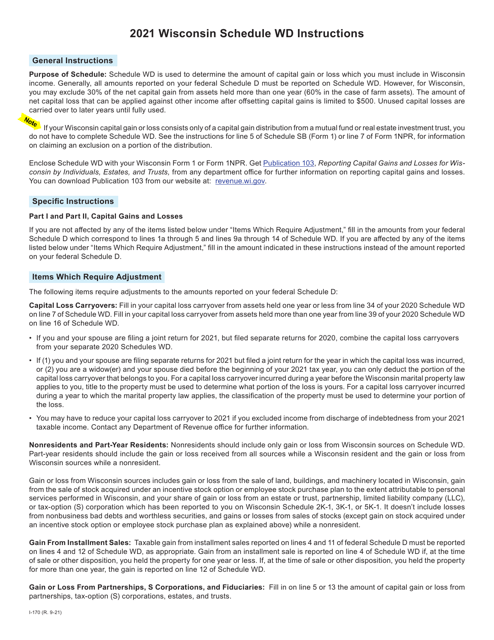

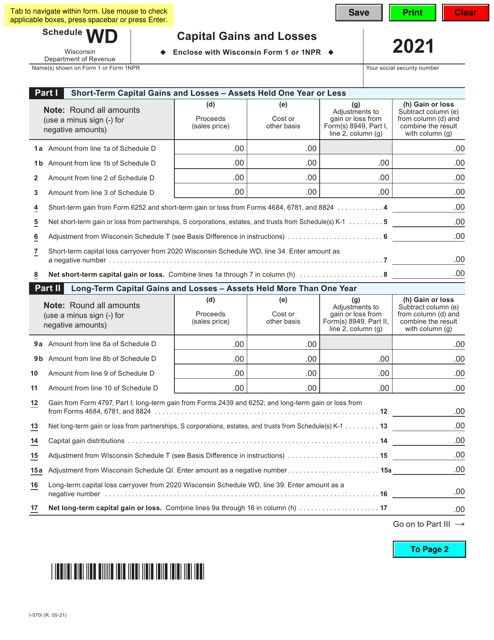

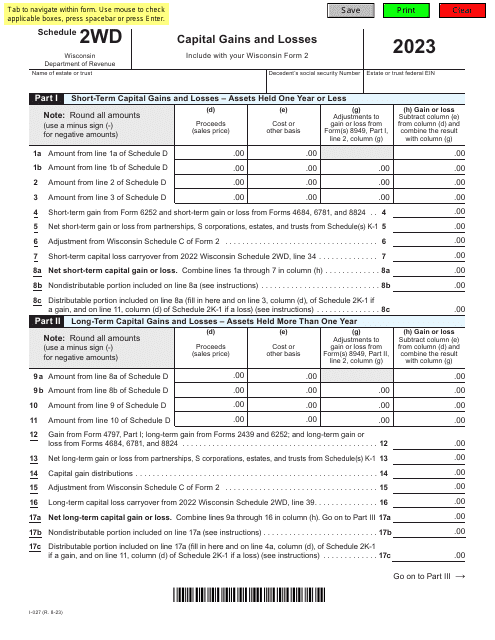

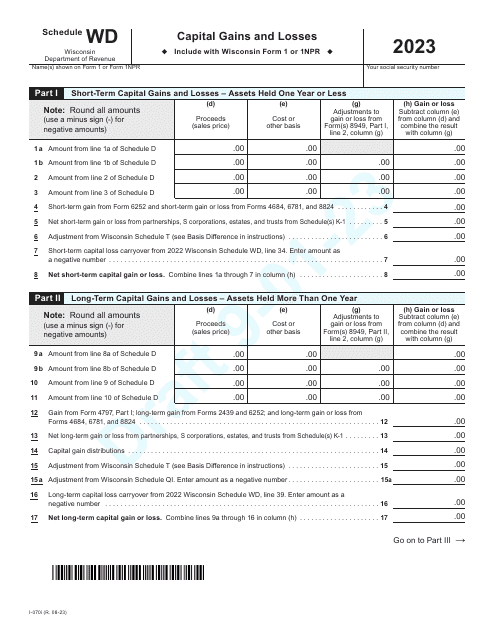

As an alternate name for these documents, you may come across the term "Form I-170 Schedule WD Capital Gains and Losses - Wisconsin" or "Form I-027 Schedule 2WD Capital Gains and Losses - Wisconsin." These variations refer to the same set of documents and instructions that we provide on our webpage.

Take the stress out of tax season by utilizing our Schedule WD documents. Our user-friendly instructions and comprehensive forms will help you accurately report your capital gains and losses, ensuring compliance with the state of Wisconsin's tax regulations.

Trust Templateroller.com for all your tax documentation needs. Our Schedule WD documents are an invaluable resource for individuals and businesses alike, providing the necessary forms and instructions to accurately report capital gains and losses. Start using our Schedule WD documents today and streamline your tax reporting process.

Make tax reporting easy with our Schedule WD documents.

Documents:

12

This form is used for reporting capital gains and losses specifically for residents of Wisconsin. The instructions provide guidance on how to accurately fill out Form I-170 Schedule WD.

This form is used for reporting capital gains and losses specifically for residents of Wisconsin on their federal tax return.