Payroll Compliance Templates

Payroll compliance is an essential aspect of running a business smoothly and without any legal complications. Ensuring that your payroll practices align with the regulations set by the government is crucial in maintaining the trust and satisfaction of both your employees and the authorities. Our comprehensive collection of payroll compliance documents provides you with the necessary tools and resources to stay compliant with payroll laws and regulations in your state or territory. From payroll certification forms to authorization forms, our documents cover all aspects of payroll compliance. With our extensive library of payroll compliance documents, you can streamline your payroll processes and ensure that you are fulfilling your obligations as an employer. Stay on top of your payroll compliance with our convenient and easy-to-use collection of documents.

Documents:

8

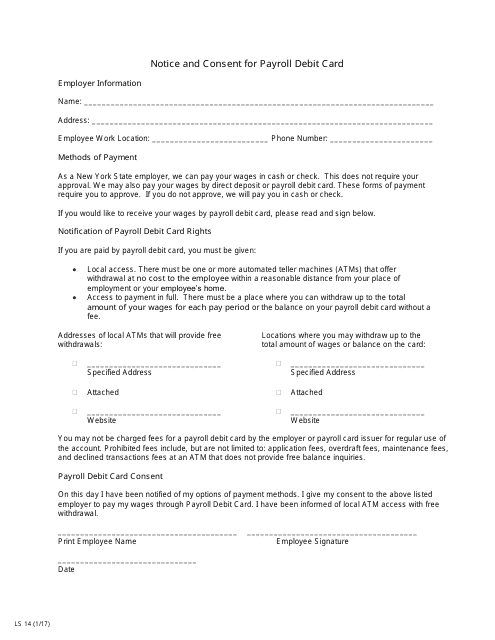

This form is used for obtaining the employee's notice and consent to receive wages through a payroll debit card in the state of New York.

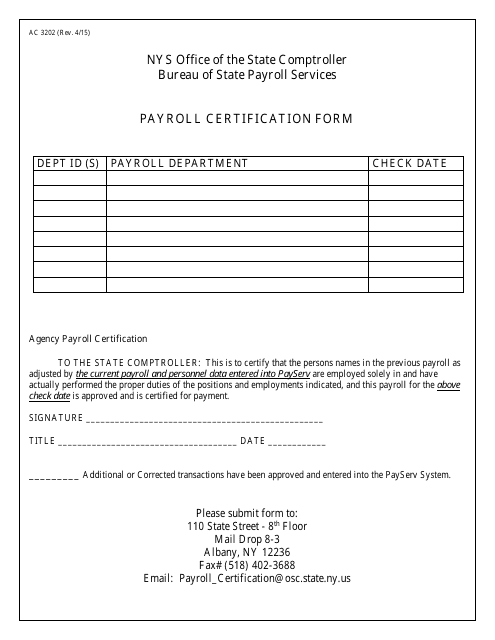

This Form is used for certifying payroll information in order to comply with New York state regulations.

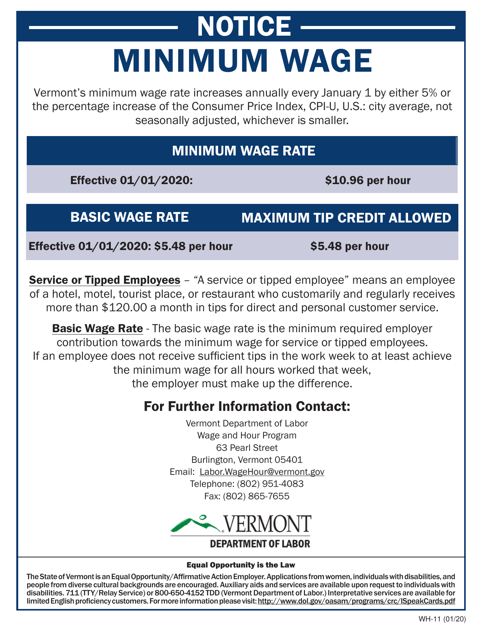

This form is used for determining the minimum wage rate in the state of Vermont. It contains information that employers need to calculate and ensure compliance with the minimum wage laws in the state.

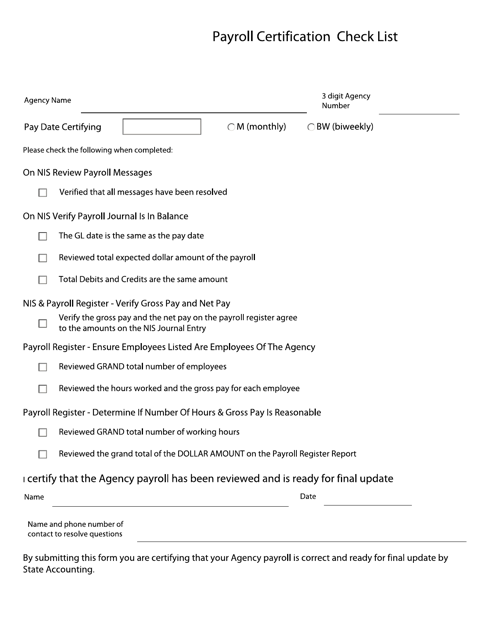

This document is a checklist used for payroll certification in Nebraska. It helps ensure that all necessary steps are followed and requirements are met for payroll processing. It can be used by employers to verify compliance with state regulations.

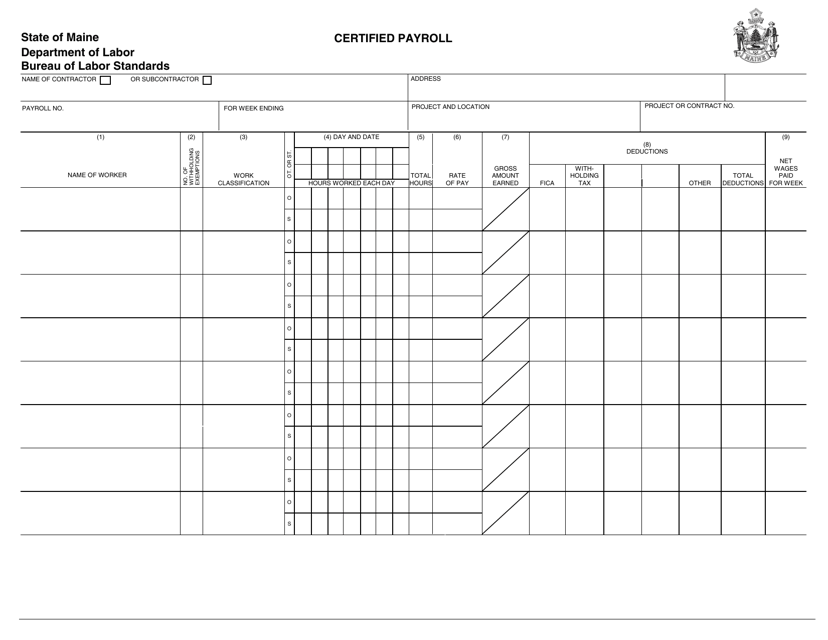

This document is used for certified payroll in the state of Maine. It provides a record of wages and benefits paid to employees on a specific project, ensuring compliance with prevailing wage laws.

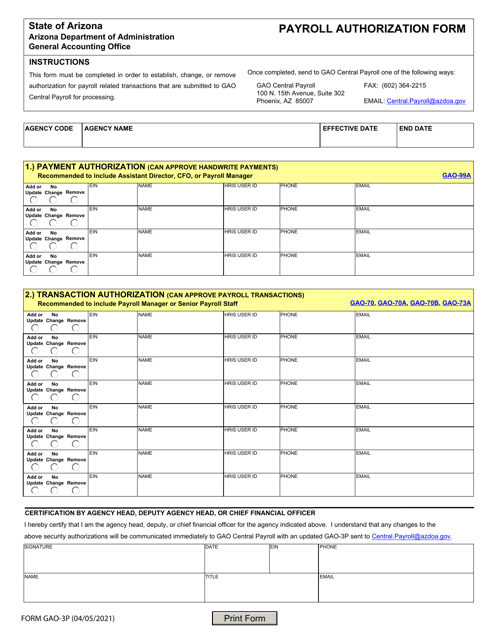

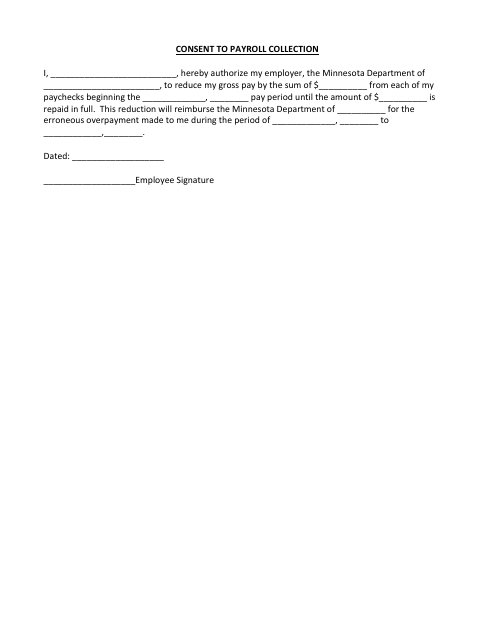

This document is used for obtaining consent from employees in Minnesota to collect and process their payroll information. It ensures that the employer has the necessary authorization to deduct and manage employee wages.