Refundable Tax Credit Templates

A refundable tax credit, also known as a tax credit refund, is a valuable financial benefit that can provide individuals, businesses, and organizations with a significant opportunity to receive a refund on their tax liability. These tax credits are designed to offset taxes owed and can result in a refund if the credit amount exceeds the tax liability.

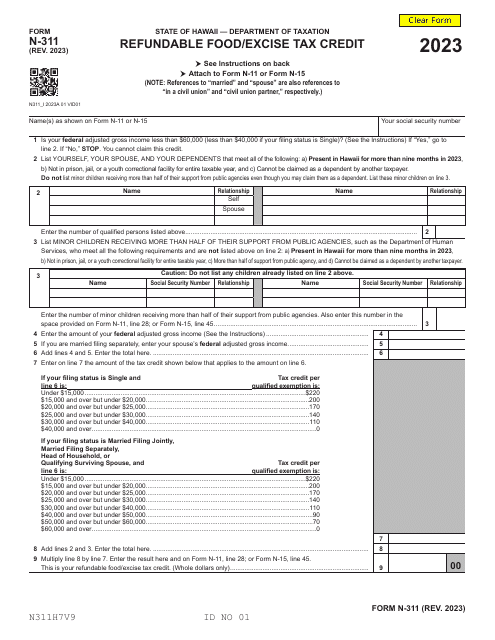

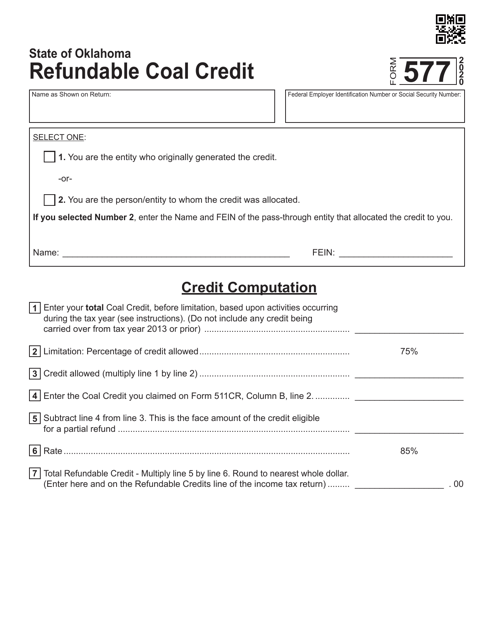

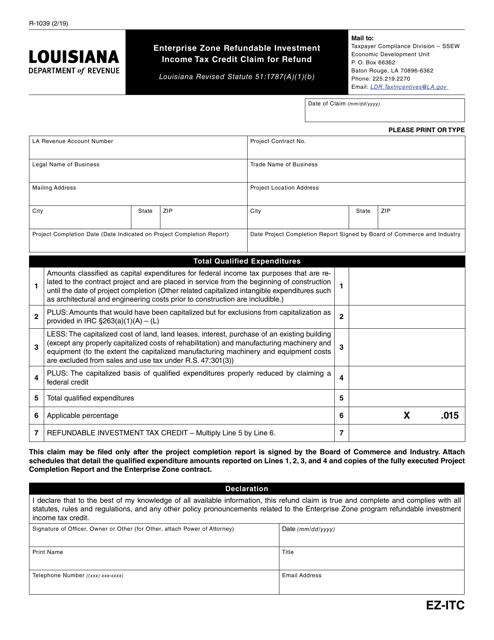

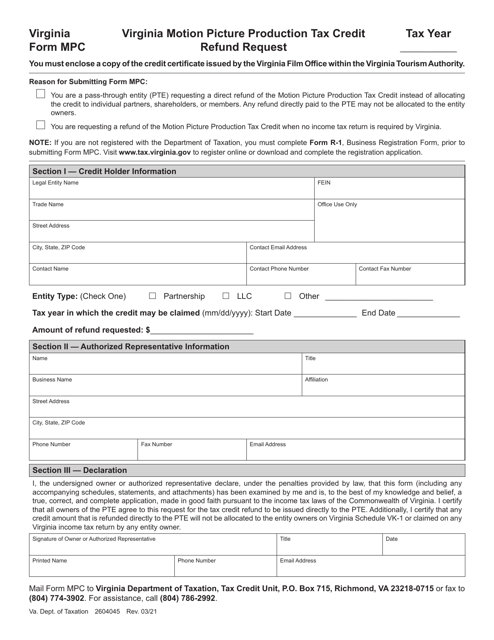

Refundable tax credits come in various forms and are offered by different states and jurisdictions in the U.S. and Canada. For example, in Hawaii, individuals and businesses can utilize Form N-311 to claim the Refundable Food/Excise Tax Credit. In Louisiana, Form R-1039 is used to claim the Enterprise Zone Refundable Investment Income Tax Credit, which could potentially result in a refund. Virginia offers the Virginia Motion PictureProduction Tax Credit, and with Form MPC, eligible individuals can request a refund. Another example is the Refundable Coal Credit in Oklahoma, which can be claimed using Form 577.

These refundable tax credits provide individuals and businesses with an excellent opportunity to not only reduce their tax liability but also potentially receive a refund. This can prove to be a valuable financial boost and incentive for various activities such as promoting economic development, supporting the film industry, or encouraging investment in certain designated zones.

Understanding and navigating the complexities of refundable tax credits can be challenging. It is crucial to ensure that you are aware of the specific eligibility criteria, documentation requirements, and submission deadlines for each credit program. By staying informed and utilizing the appropriate forms, individuals and businesses can maximize their chances of receiving a refund through these refundable tax credits.

At USA, Canada, and other countries document knowledge system, we provide comprehensive information, guidance, and resources on various refundable tax credits available across different jurisdictions. Whether you are an individual taxpayer, a business owner, or a tax professional, our platform offers valuable insights and assistance in understanding, applying for, and optimizing refundable tax credits.

Documents:

6