Decedent Estate Templates

Decedent Estate Documents - Safeguarding the Future

When a loved one passes away, dealing with their estate can be a complex and emotionally challenging process. To ensure a smooth transition of assets and protect the interests of all parties involved, it is crucial to have the necessary legal documentation in place. This collection of decedent estate documents encompasses a wide range of forms and paperwork required to manage the affairs of the deceased.

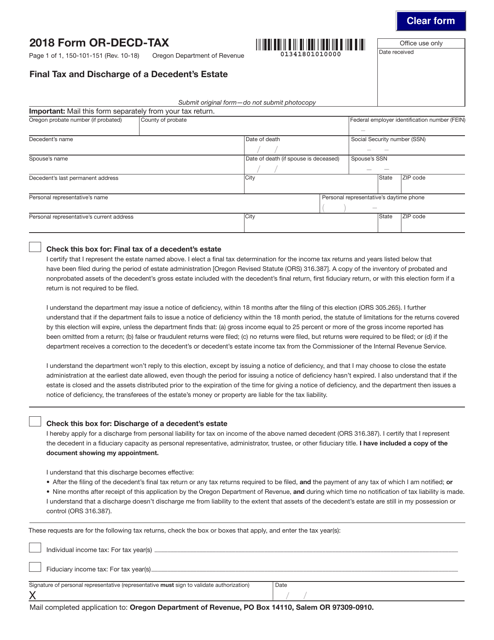

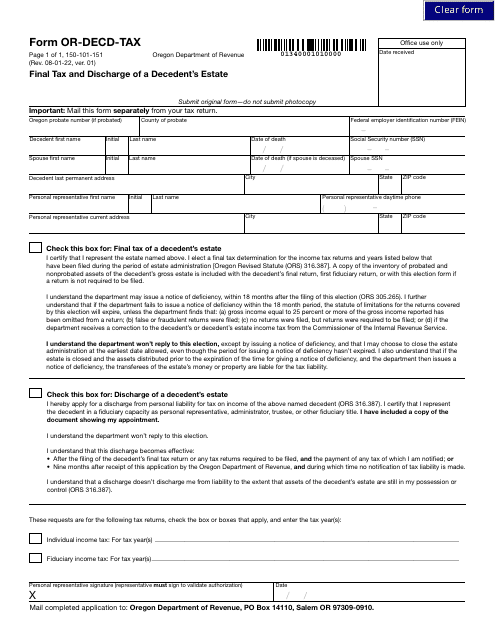

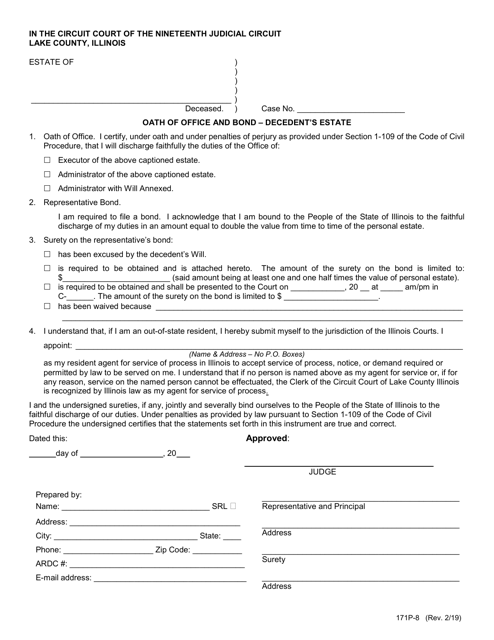

Also known as decedents' estate forms, this comprehensive collection includes vital documents for different jurisdictions, such as Form DE-172 Creditor's Claim in California, Form 150-101-151 (OR-DECD-TAX) Final Tax and Discharge of a Decedent's Estate in Oregon, and Form 171P-8 Oath of Office and Bond for Decedent's Estate in Lake County, Illinois, among others.

These documents serve various purposes, from documenting the claims of creditors to finalizing tax obligations and administering the estate. By using the appropriate decedent estate forms, individuals can ensure that they are fulfilling their legal responsibilities and protecting the rights of beneficiaries and heirs.

Navigating the intricacies of handling a decedent's estate can be overwhelming, which is why having access to a comprehensive collection of decedent estate documents is invaluable. Whether you are an executor, administrator, or legal professional, these forms provide the framework necessary to properly settle the estate in accordance with applicable laws and regulations.

With our extensive range of decedent estate documents, you can have peace of mind, knowing that you have the right tools at your disposal to manage the estate efficiently and effectively. Be it establishing an executor testimonial, obtaining a court order appointing a representative, or filing the necessary tax returns, our collection covers a wide array of essential paperwork.

Save time and ensure accuracy by utilizing our decedent estate documents collection. Simplify the often complex and intricate process of settling an estate, and protect the interests of all parties involved. Trust in our reliable and comprehensive documentation to safeguard the future for heirs and beneficiaries alike.

Documents:

35

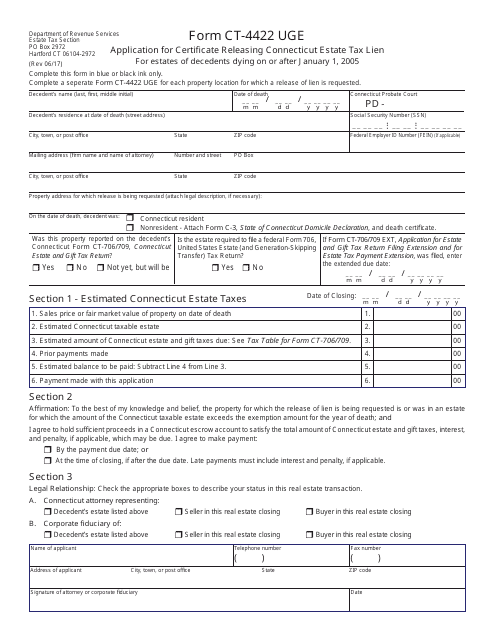

This form is used for applying to release the Connecticut estate tax lien for estates of deceased individuals who passed away on or after January 1, 2005.

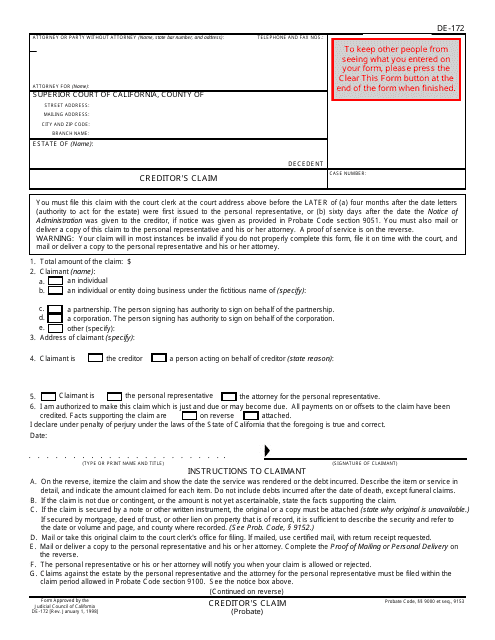

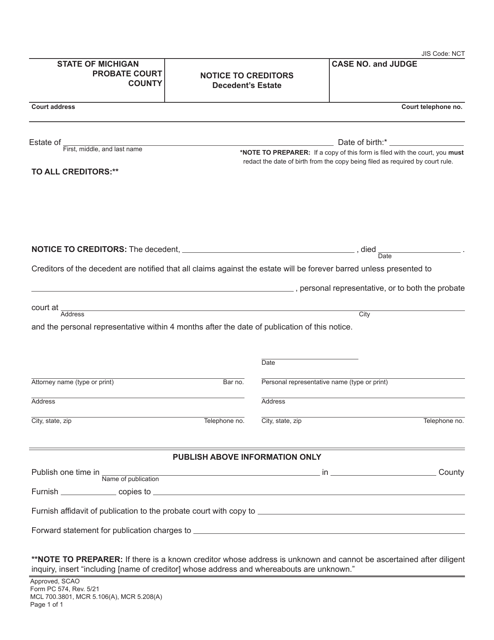

This form is used for filing a creditor's claim in the state of California.

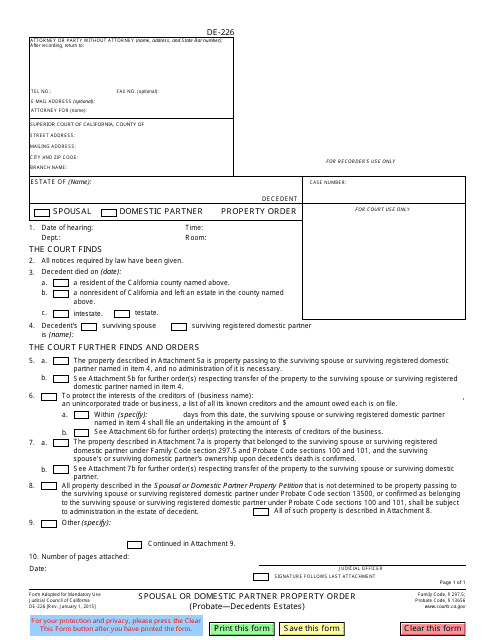

This form is used for submitting a Spousal or Domestic Partner Property Order in the case of a deceased individual in California.

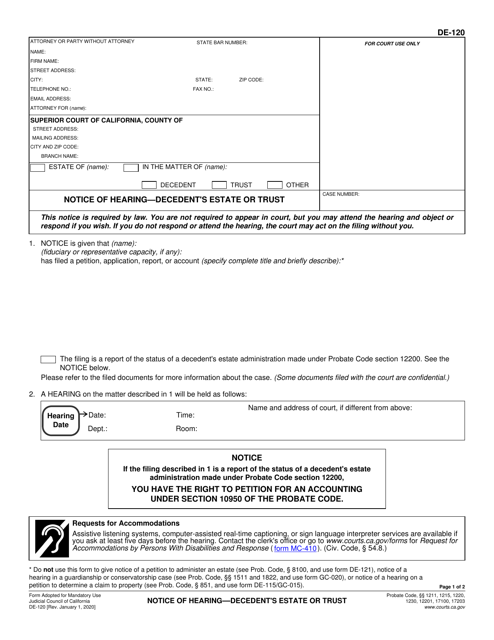

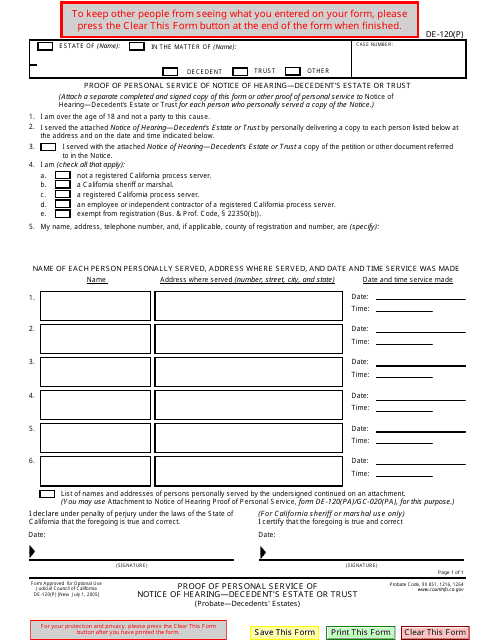

This form is used for providing proof of personal service of a notice of hearing in a decedent's estate or trust case in California.

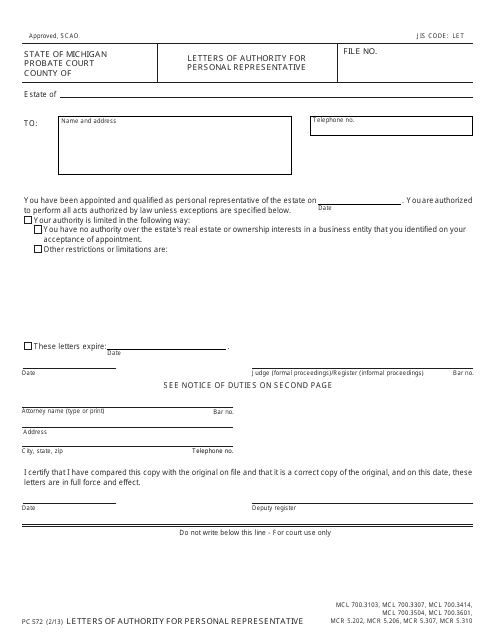

This Form is used for obtaining Letters of Authority as a Personal Representative in the state of Michigan. It grants the individual the legal authority to act on behalf of a deceased person's estate.

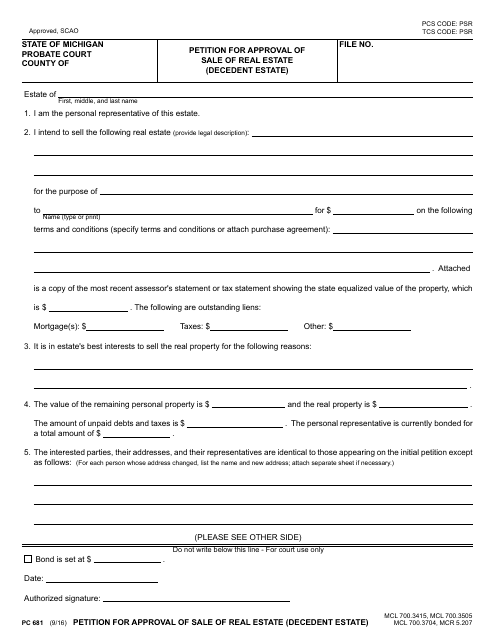

This form is used for petitioning the court for approval to sell real estate that belonged to a deceased person's estate in the state of Michigan.

This form is used for the final tax and discharge of a decedent's estate in Oregon.

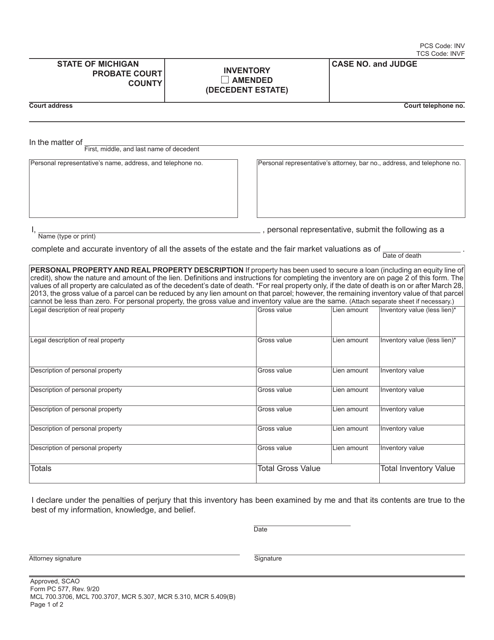

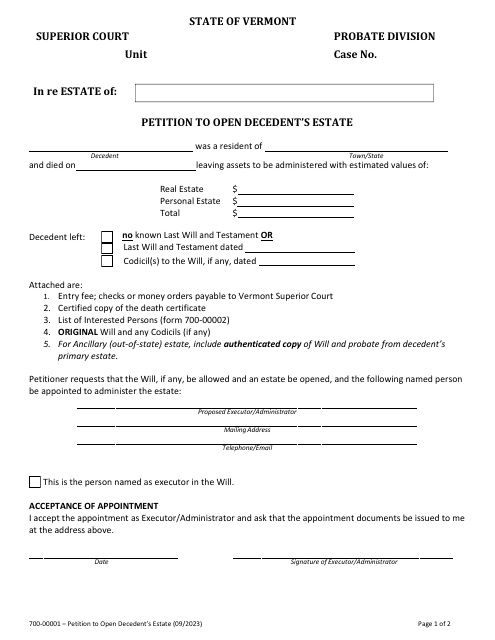

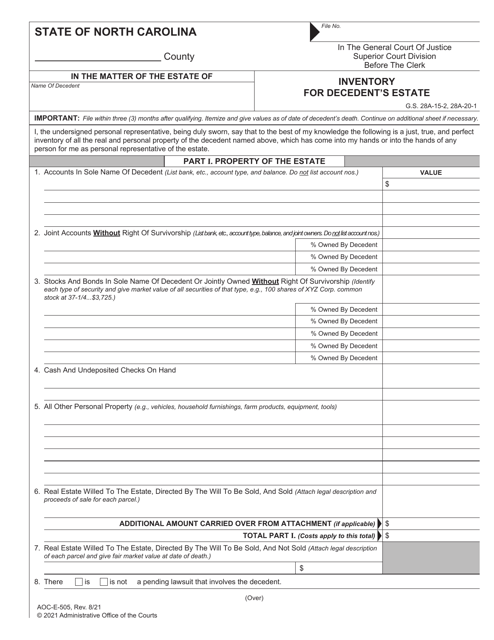

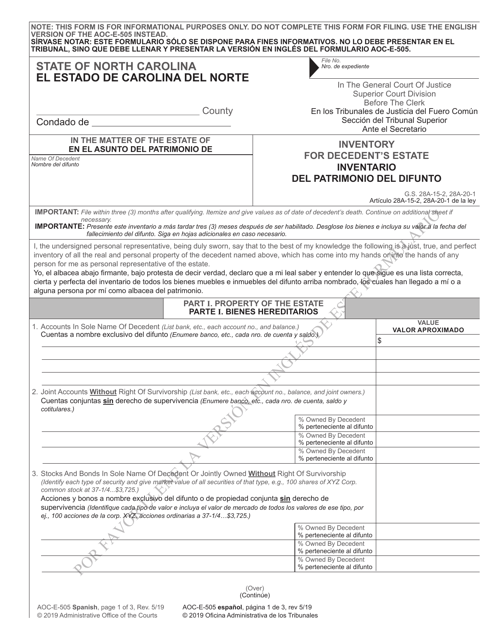

This form is used for creating an inventory of a deceased person's assets in North Carolina. It is available in both English and Spanish.

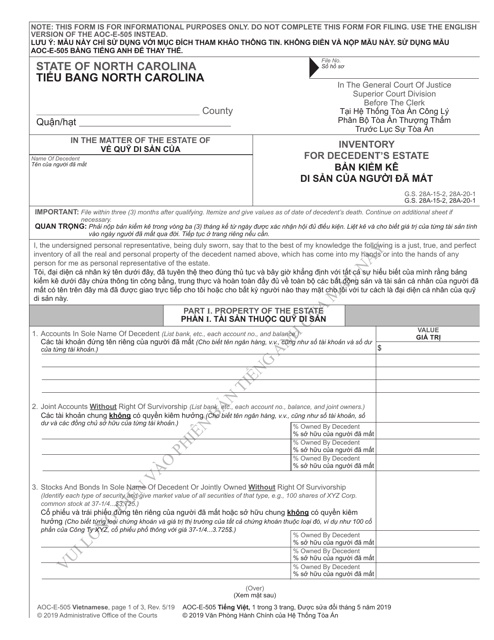

This Form is used for providing an inventory of assets in a deceased person's estate in North Carolina. It is available in both English and Vietnamese.

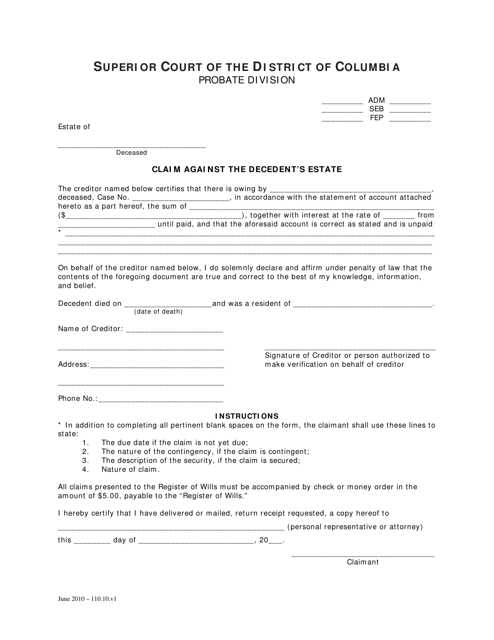

This type of document is used for making a claim against the estate of a deceased person in Washington, D.C.

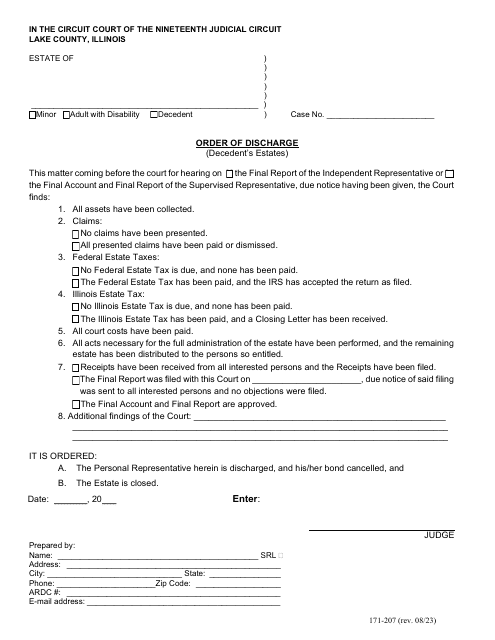

This form is used for filing an Oath of Office and Bond for the administration of a decedent's estate in Lake County, Illinois.

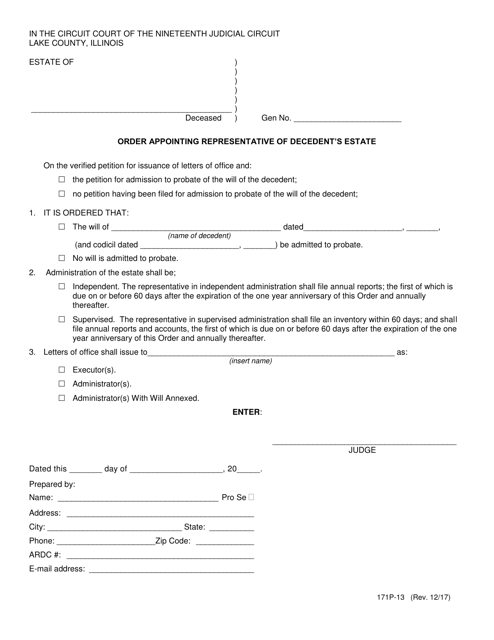

This form is used for appointing a representative of a deceased person's estate in Lake County, Illinois.

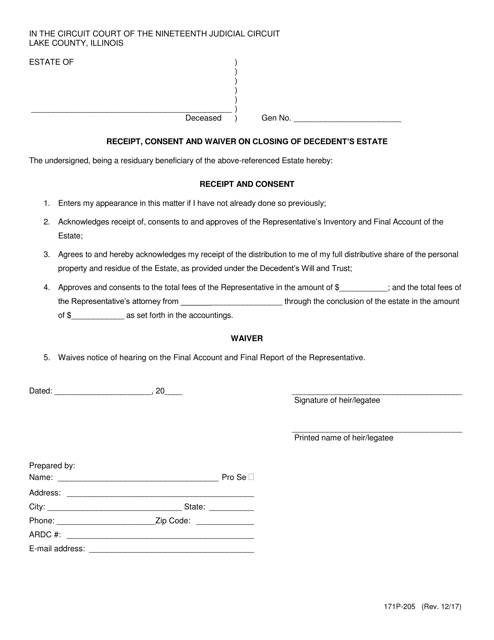

This form is used for receiving consent and waiver on the closing of a deceased person's estate in Lake County, Illinois.

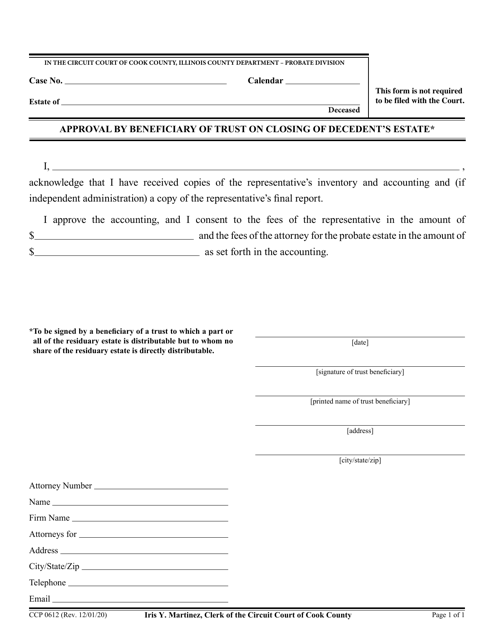

This form is used for beneficiaries of a trust to approve the closing of a decedent's estate in Cook County, Illinois.

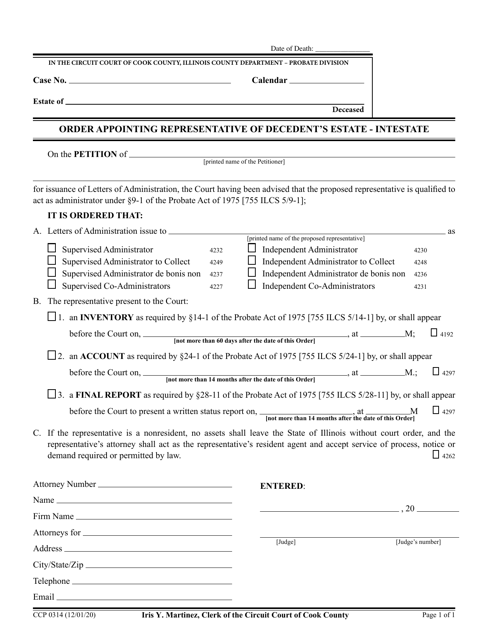

This form is used for appointing a representative of a decedent's estate in Cook County, Illinois when there is no will (intestate).

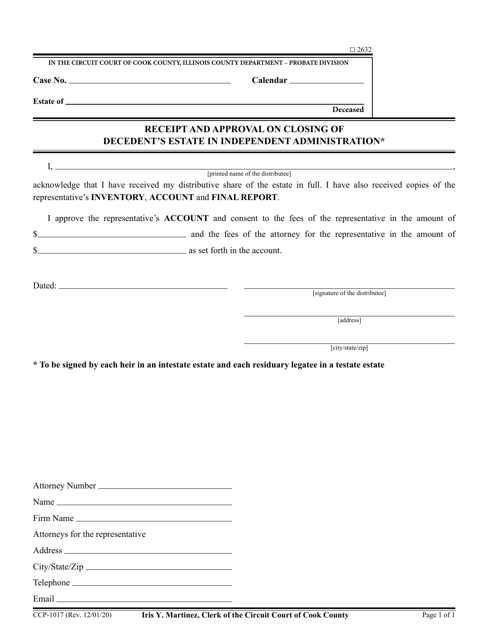

This form is used for receipt and approval on the closing of a deceased person's estate in Cook County, Illinois, under the independent administration process.

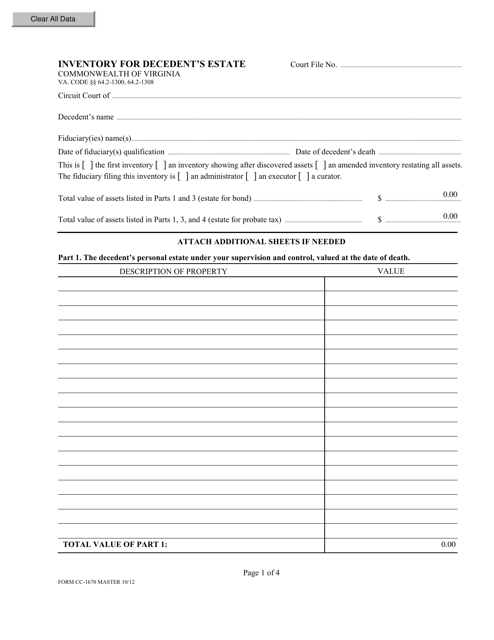

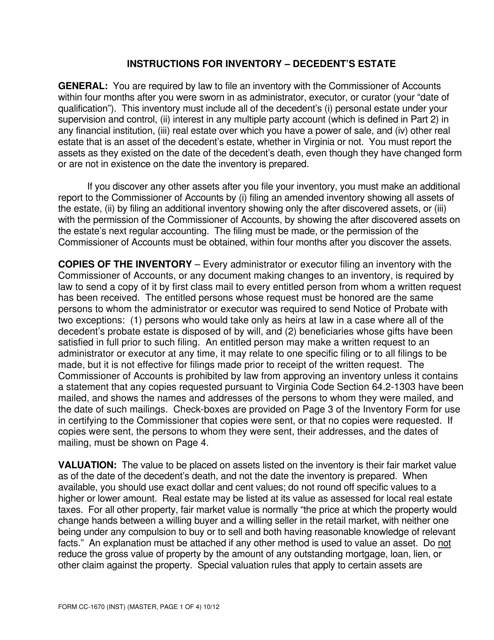

This form is used for creating an inventory of a deceased person's estate in the state of Virginia. It helps document the assets and liabilities of the estate for probate purposes.

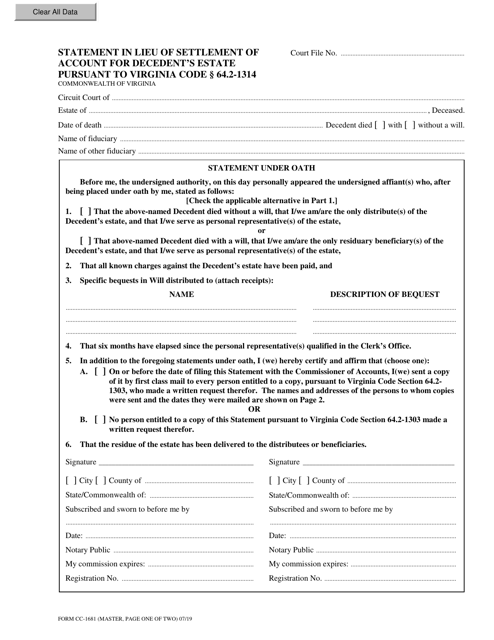

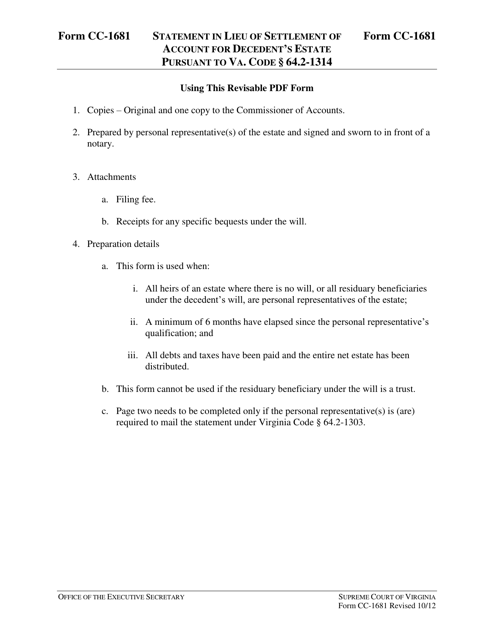

This document is used in Virginia for providing a statement instead of settling the account for a deceased person's estate.

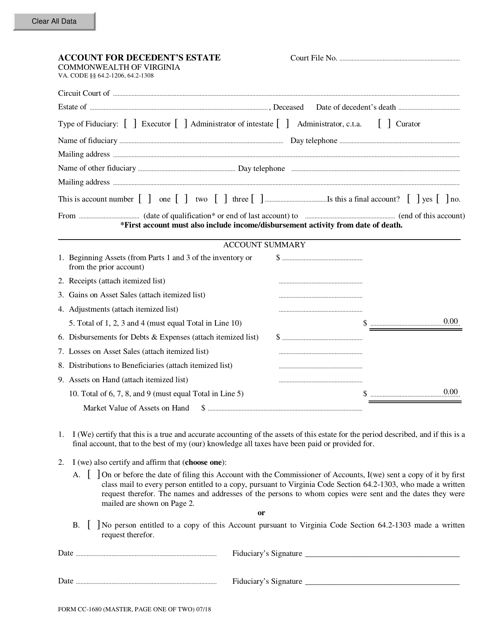

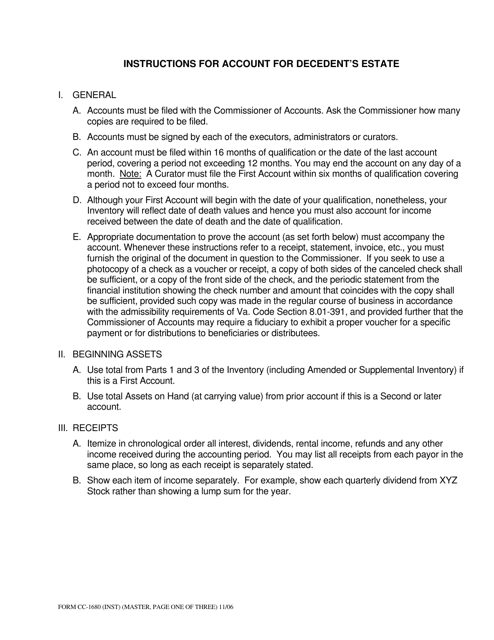

This Form is used for accounting the assets and liabilities of a deceased person's estate in the state of Virginia.

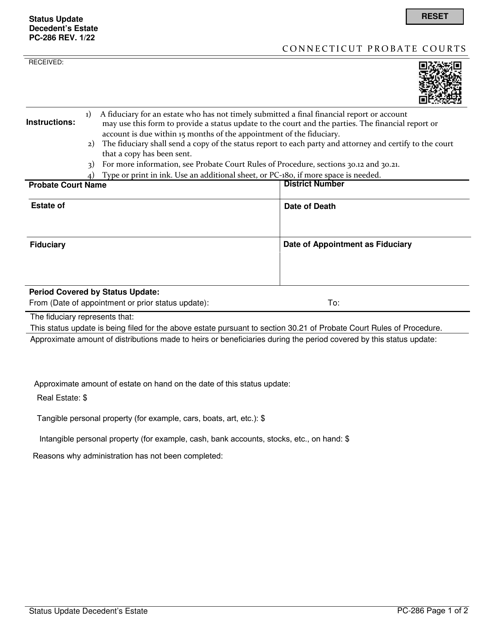

This form is used for providing a status update on a decedent's estate in the state of Connecticut.