Gross Income Templates

Are you looking for information about gross income? Look no further! Our website provides comprehensive resources on everything you need to know about gross income. Whether you are a small business owner or an individual taxpayer, understanding your gross income is crucial for accurate financial reporting.

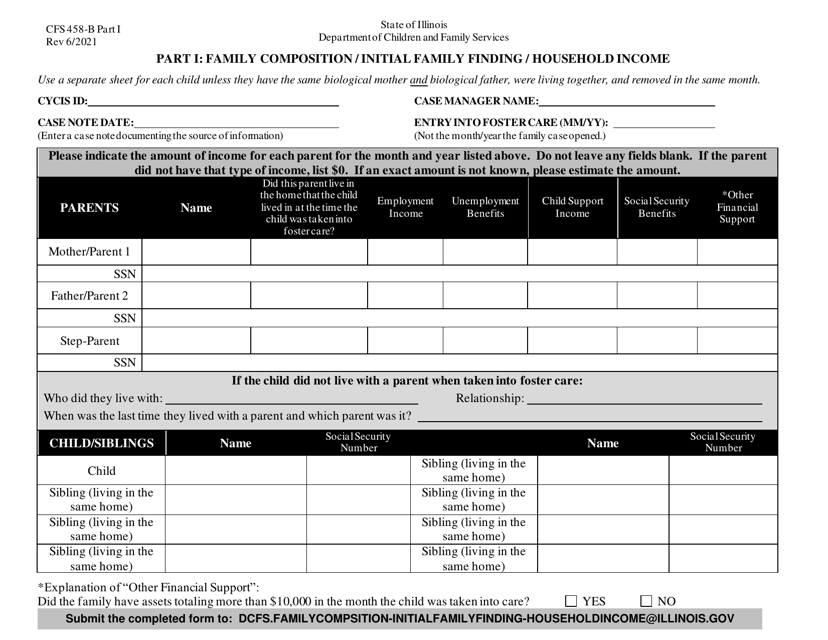

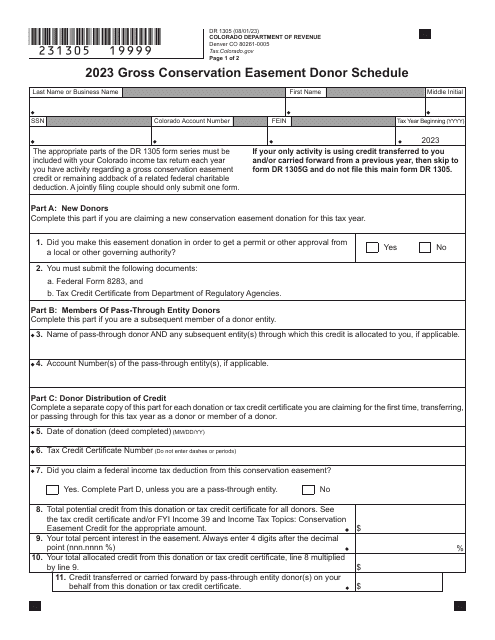

Gross income refers to the total amount of income earned before any deductions or taxes are taken out. It includes various sources of income such as wages, salaries, self-employment income, rental income, and investment income. Knowing your gross income is essential for calculating your tax liability and determining eligibility for certain financial programs.

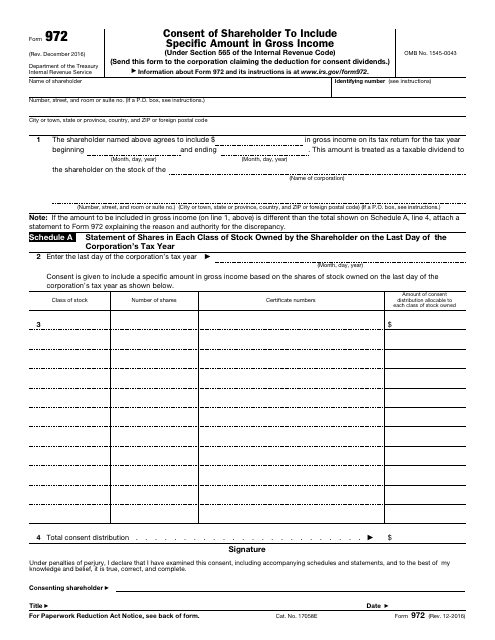

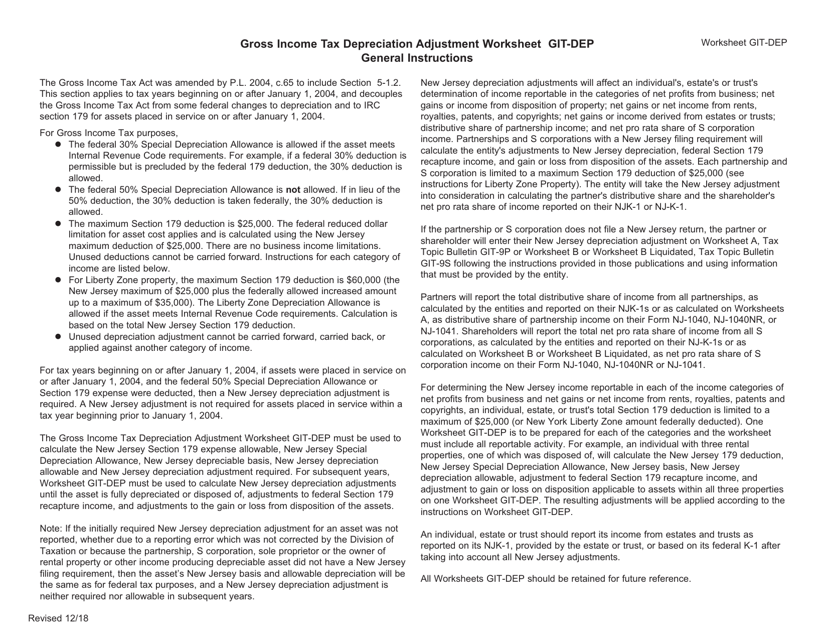

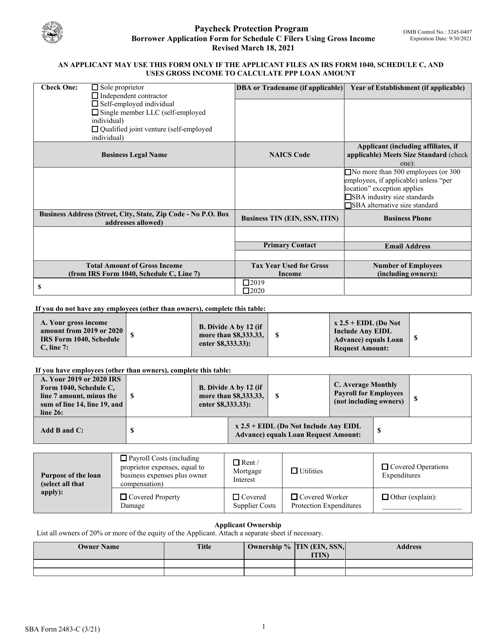

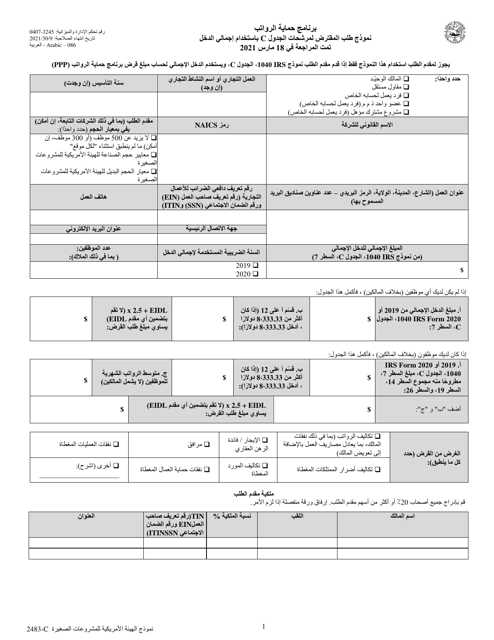

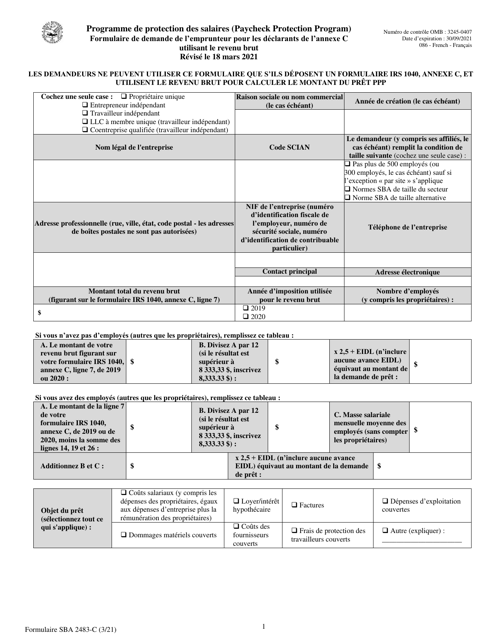

At our website, you can find detailed information on how to calculate and report your gross income accurately. We provide guidance on filling out important forms like IRS Form 972 Consent of Shareholder to Include Specific Amount in Gross Income and SBA Form 2483-C First Draw Borrower Application Form for Schedule C Filers Using Gross Income (Arabic). Whether you are a shareholder or a small business owner, these forms are essential for reporting gross income correctly.

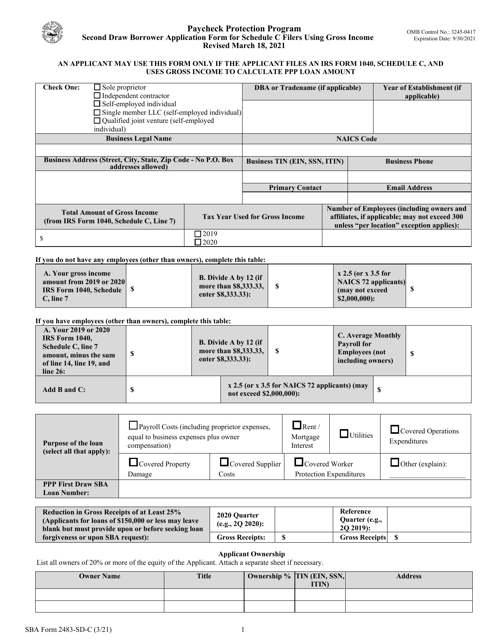

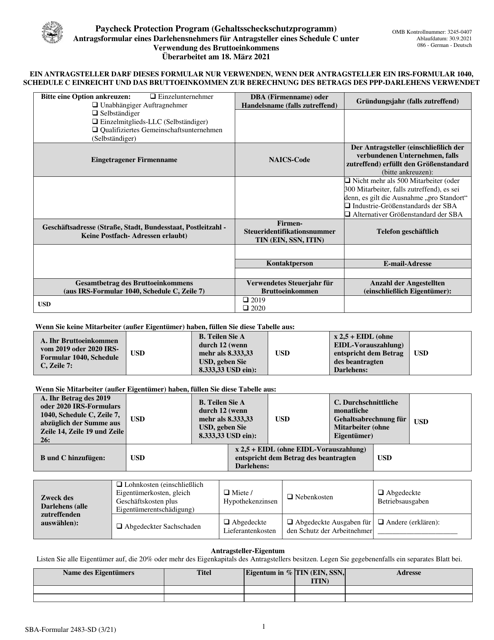

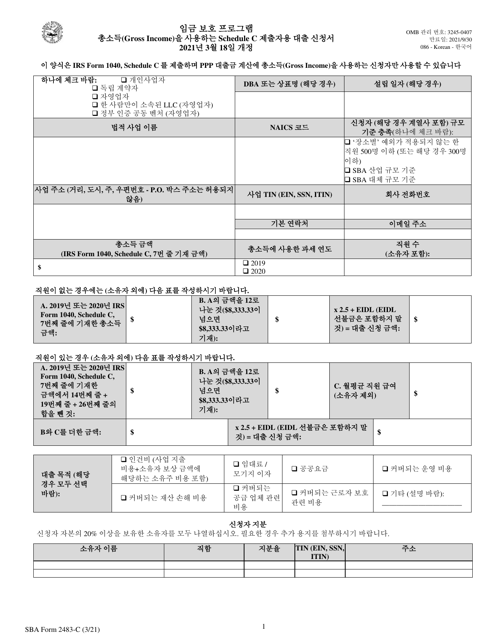

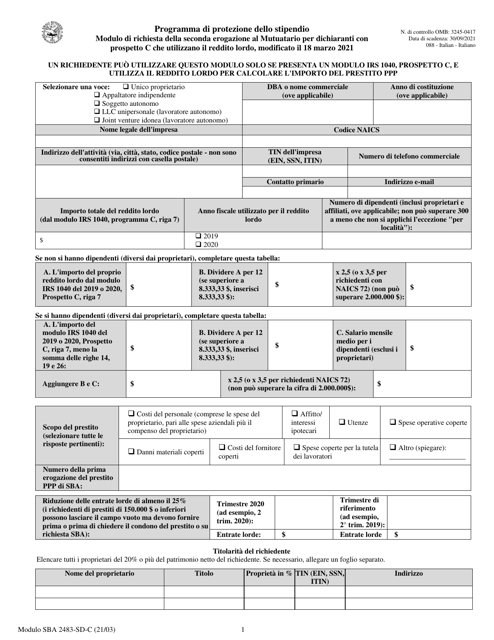

In addition to these forms, we also offer resources for international taxpayers. Our website features translated versions of essential forms like SBA Form 2483-SD-C Second Draw Borrower Application Form for Schedule C Filers Using Gross Income (Arabic, Korean, Italian). These forms cater to a diverse audience and ensure that everyone can accurately report their gross income regardless of their language preference.

Understanding and accurately reporting your gross income is vital for financial planning and compliance. Whether you are filing taxes, applying for financial assistance, or analyzing your business's financial performance, having a clear understanding of your gross income is essential. Our website is your go-to resource for all things related to gross income. Explore our articles, guides, and forms to ensure that you are on top of your financial responsibilities.

Documents:

35

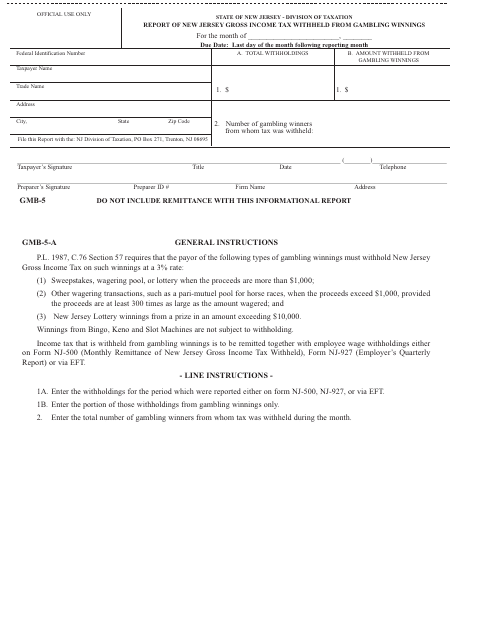

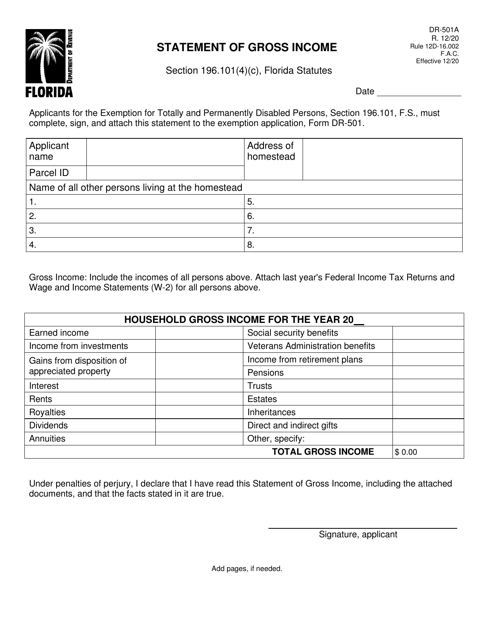

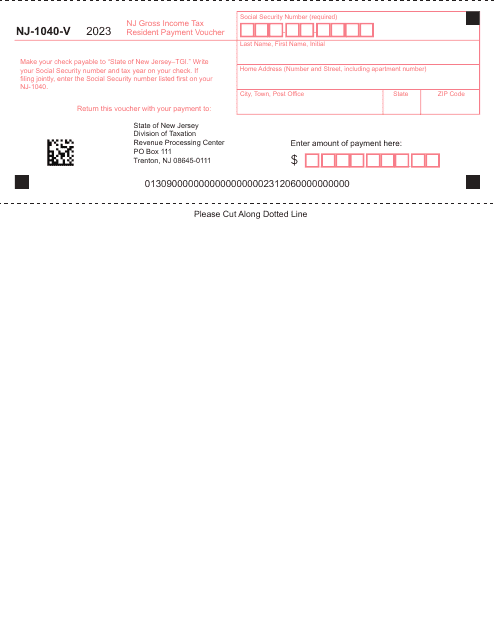

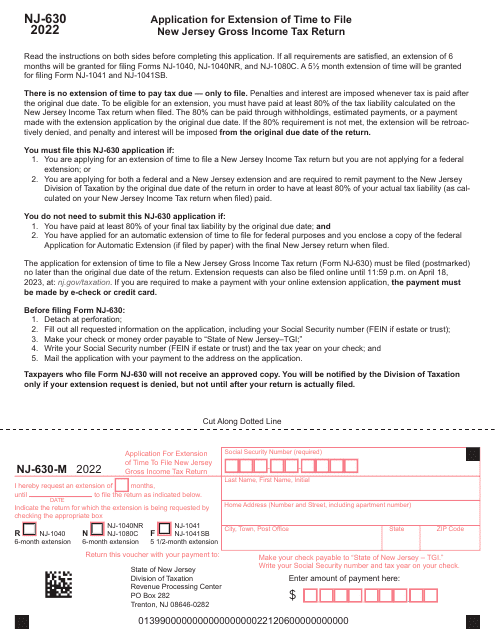

This form is used for reporting the amount of New Jersey Gross Income Tax withheld from gambling winnings in New Jersey.

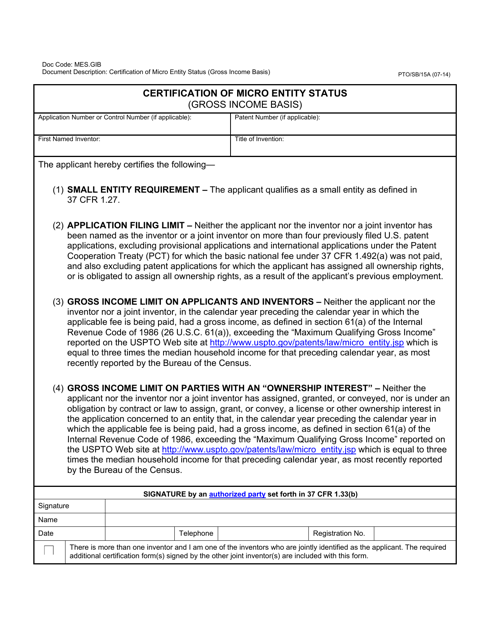

This form is used for certification of a micro entity's status based on gross income.

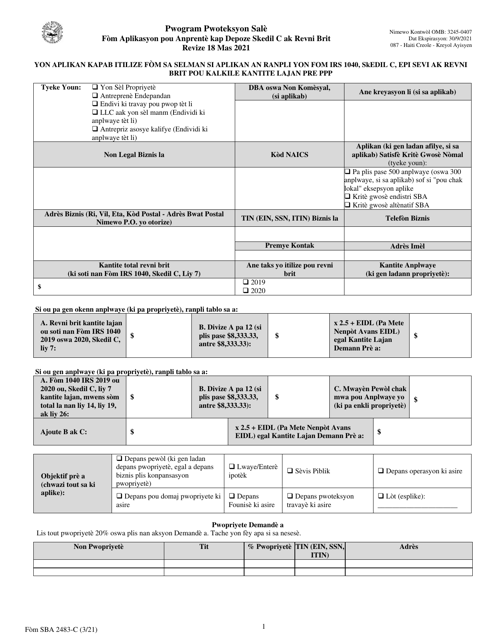

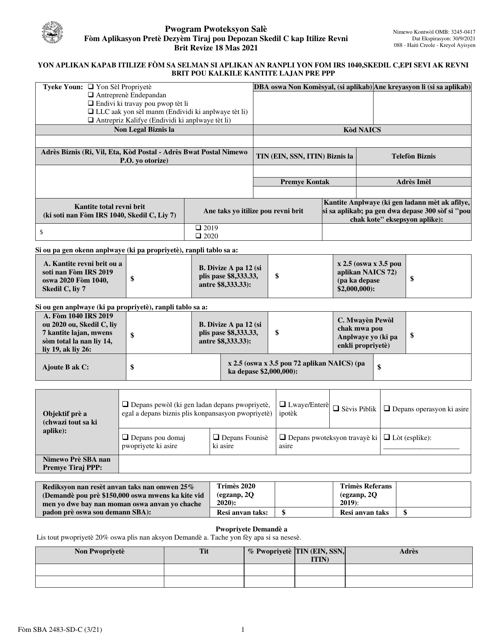

This Form is used for Schedule C filers who are applying for a loan with the Small Business Administration (SBA) and are using gross income as their method of calculation.

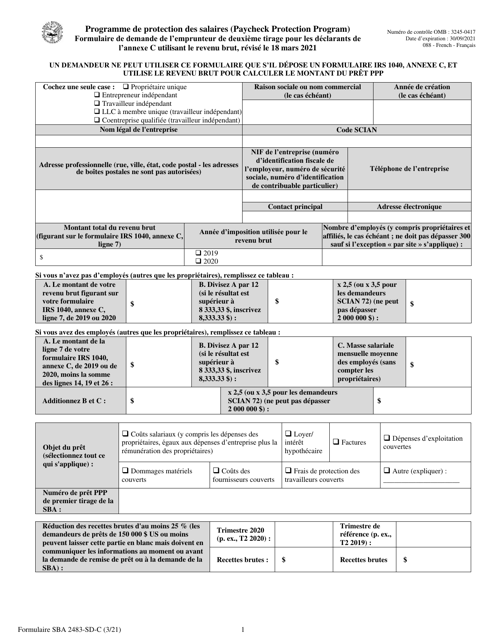

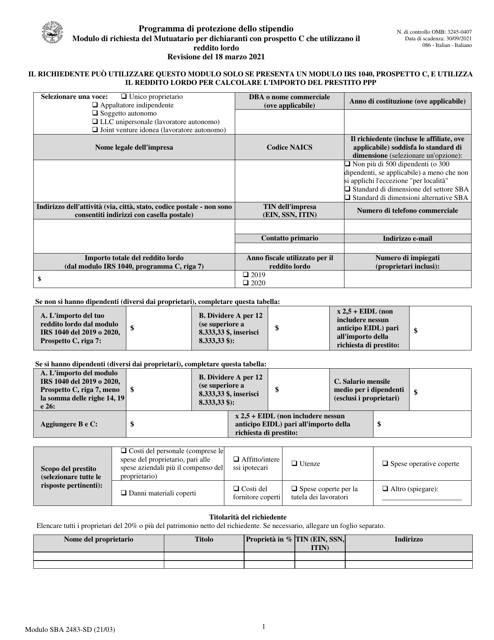

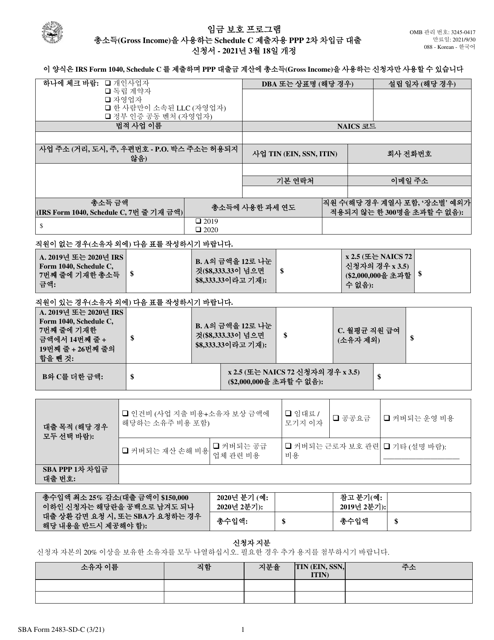

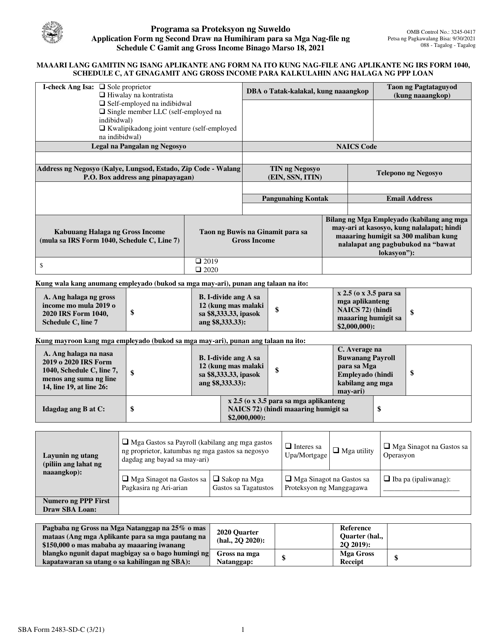

This form is used for small business owners who file their taxes with a Schedule C form and are applying for a second draw loan through the Small Business Administration. The form specifically caters to those who calculate eligibility based on gross income.

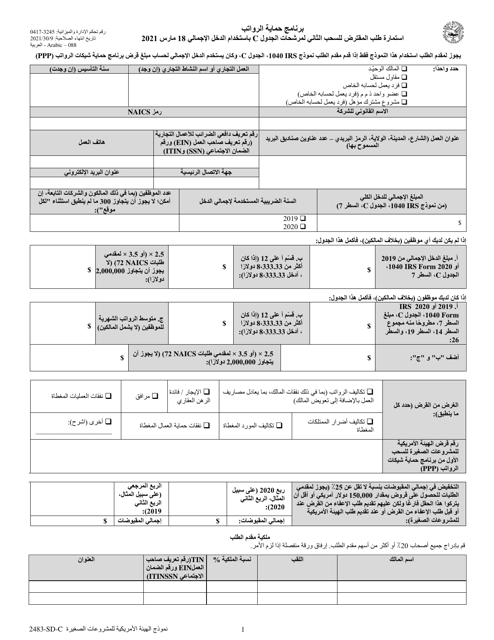

This form is used for applying for a first draw loan from the Small Business Administration (SBA) for Schedule C filers who use gross income to calculate eligibility. The form is available in Arabic language.

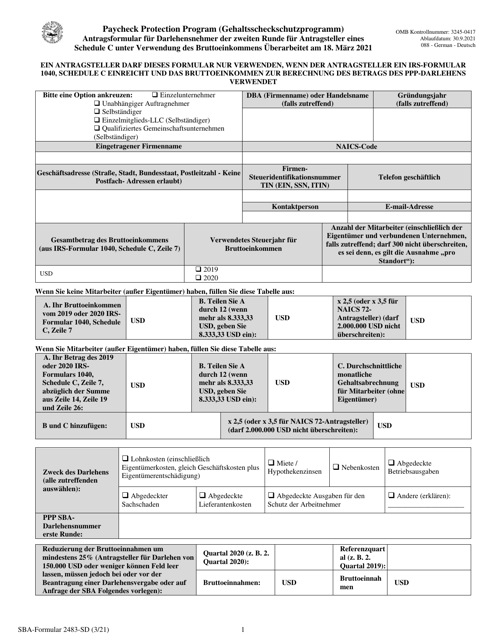

This document is for German schedule C filers who are applying for the first draw of the SBA loan. It is used to gather information regarding gross income to determine eligibility.

This document is for Korean Schedule C filers to apply for the SBA First Draw Borrower Application using their gross income.

This form is used for Schedule C filers who are applying for a second draw loan from SBA using their gross income.

This form is used for second draw borrowers who are self-employed using gross income and need assistance from the SBA.

This document is the SBA Form 2483-SD-C Second Draw Borrower Application Form specifically designed for Schedule C filers who use gross income. It is available in Haitian Creole.

This Form is used for Italian Schedule C filers applying for the First Draw Borrower Application under the SBA program.

This document is for Tagalog-speaking small business owners who are filing for a second round of SBA loan and have a Schedule C form with gross income. It is the application form (SBA Form 2483-SD-C) required for submitting the loan request.

This document is a Second Draw Borrower Application Form for Schedule C Filers using Gross Income, specifically designed for Italian applicants. It is used to apply for a loan from the Small Business Administration (SBA).

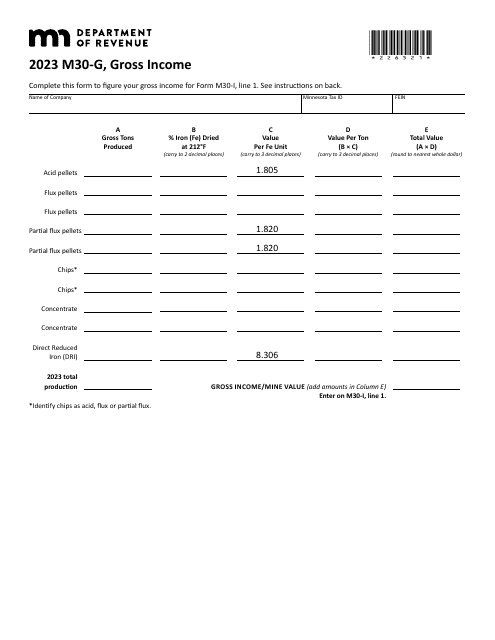

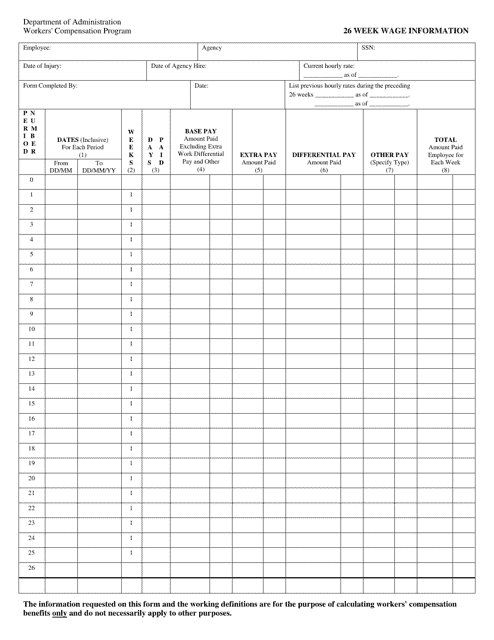

This document provides information about wages earned over a 26-week period in the state of Minnesota. It contains details on income, taxes, and other relevant information related to wages in Minnesota.