Real Estate Withholding Templates

When it comes to buying or selling real estate, there are certain tax obligations that must be met. One such obligation is real estate withholding, which involves the withholding of taxes from the proceeds of a real estate transaction. This is done to ensure that the appropriate amount of taxes are paid to the government.

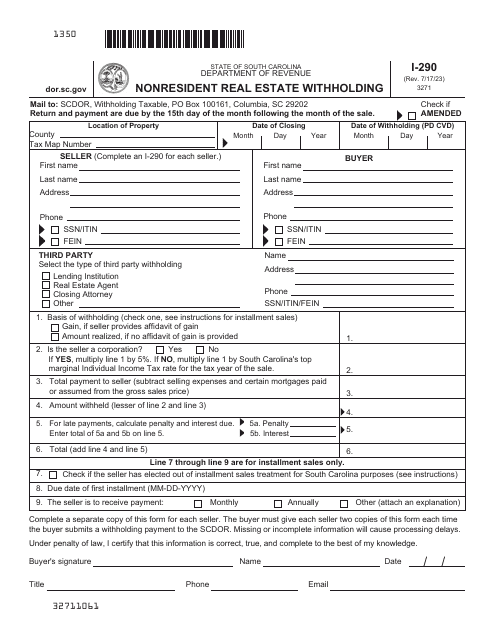

Real estate withholding can be a complex process, with different rules and requirements varying from state to state. That's why it's important to have access to accurate and up-to-date information and forms related to real estate withholding.

Our website provides a comprehensive collection of documents related to real estate withholding. Whether you're a buyer, seller, or an agent involved in a real estate transaction, you'll find the forms and resources you need to navigate the real estate withholding process.

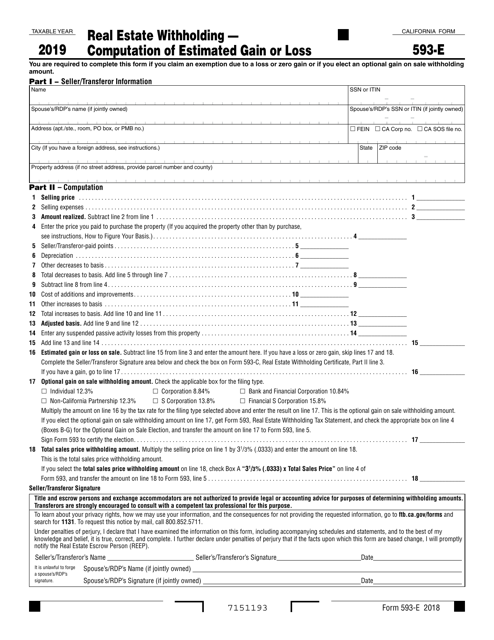

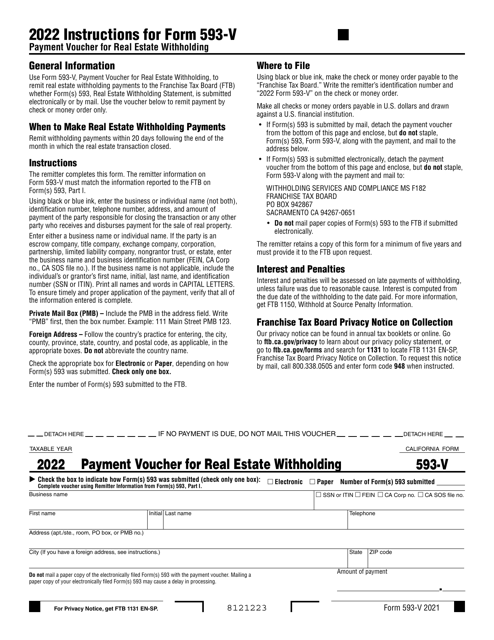

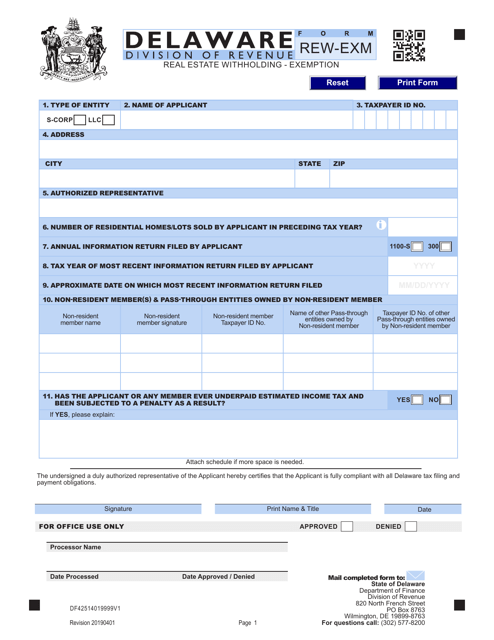

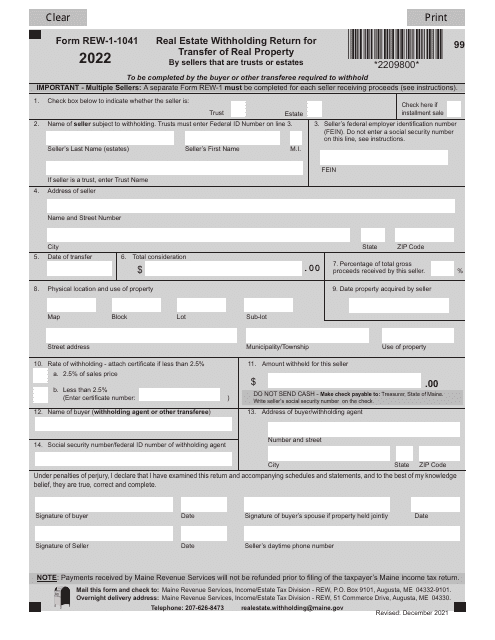

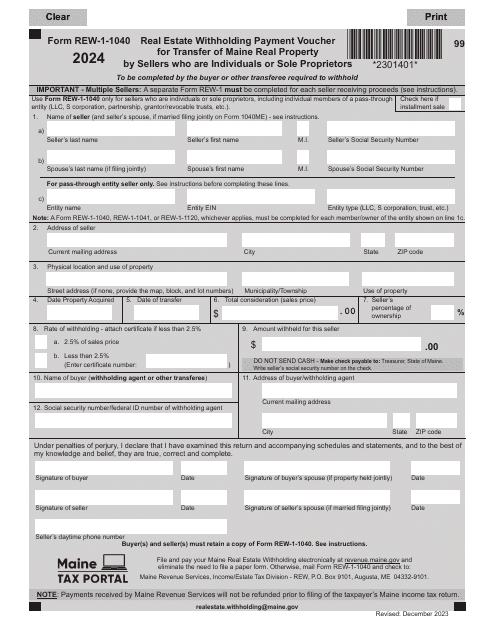

Our document collection includes forms such as Form 593-E Real Estate Withholding - Computation of Estimated Gain or Loss (California), Form 593-V Payment Voucher for Real Estate Withholding (California), Form REW-EXM Real Estate Withholding - Exemption (Delaware), and Form REW-1-1041 Real Estate Withholding Return for Transfer of Real Property by Sellers That Are Trusts or Estates (Maine). These forms are just a sample of the various documents we offer to help you meet your real estate withholding obligations.

Whether you need to calculate estimated gains or losses, make payment vouchers, or file returns for real estate withholding, our website is a valuable resource. We provide clear instructions, explanations, and guidance to ensure that you can easily comply with real estate withholding requirements.

Don't let real estate withholding cause unnecessary stress or confusion. Access our comprehensive collection of real estate withholding documents and have peace of mind knowing that you have the information and forms you need to fulfill your tax obligations.

Documents:

10

This is a California tax form required for all real estate sales or transfers for which you, the seller/ transferor, are claiming an exemption due to a loss or zero gain or if you elect an optional gain on sale withholding amount.

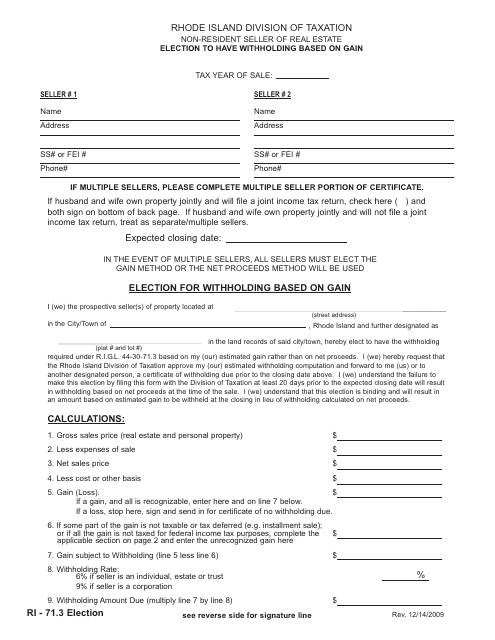

This form is used for non-resident sellers of real estate in Rhode Island to elect withholding based on gain.

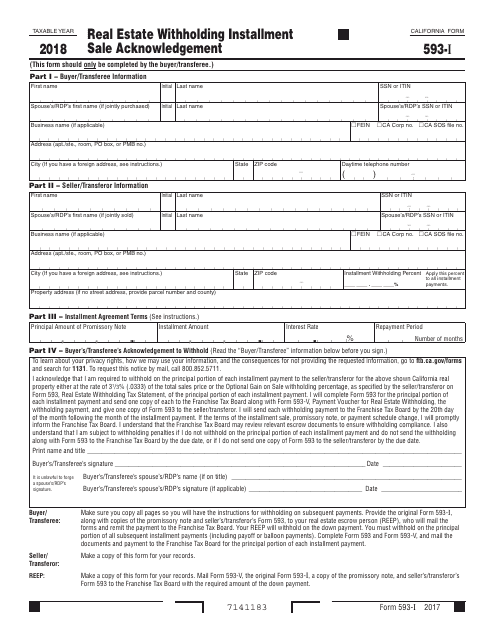

This form is used in California for acknowledging the installment sale of real estate properties and withholding taxes.

This form is used for requesting an exemption from real estate withholding tax in Delaware for certain transactions. It is specifically for individuals or entities involved in real estate transactions who meet certain criteria, allowing them to be exempt from withholding taxes.