Gas Tax Templates

When it comes to funding transportation infrastructure and maintaining roads, one of the primary sources of revenue is the gas tax. Also known as gas taxes or gas tax forms, these taxes are levied on the sale of gasoline and other motor fuels to generate funds for road construction, repairs, and improvements.

Gas taxes play a crucial role in ensuring that our transportation infrastructure remains safe, efficient, and up-to-date. By collecting a small percentage of the purchase price of each gallon of fuel, governments can accumulate significant funds to invest in maintaining and expanding our road network.

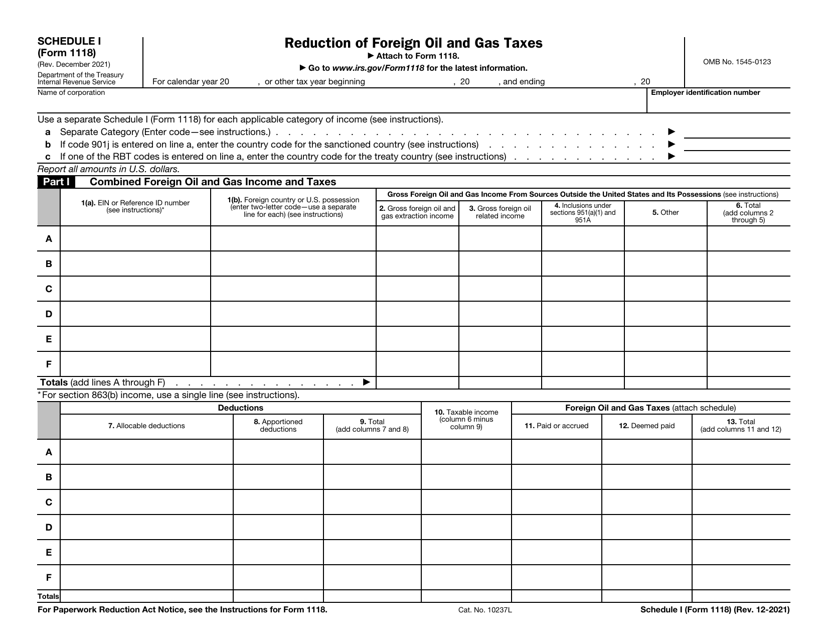

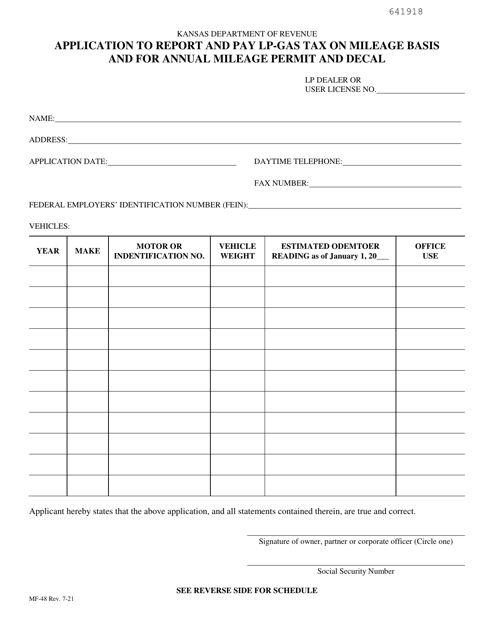

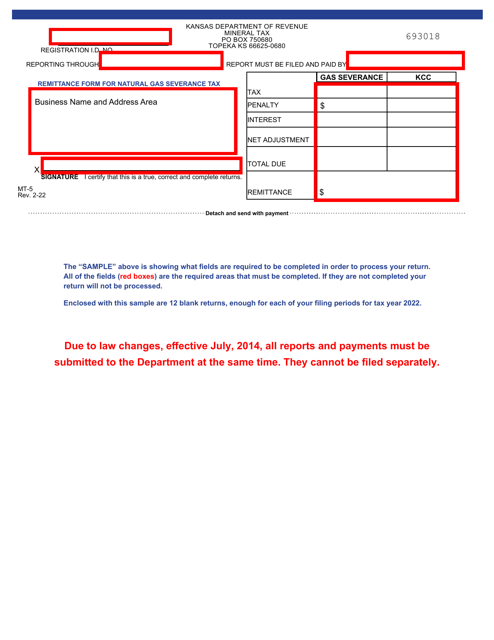

If you are a business or individual involved in the sale or distribution of motor fuels, it is essential to understand the various forms and procedures associated with gas tax reporting and payment. For instance, you may come across forms like Form MF-48 Application to Report and Pay Lp-Gas Tax on Mileage Basis and for Annual Mileage Permit and Decal from the state of Kansas or IRS Form 1118 Schedule I Reduction of Foreign Oil and Gas Taxes.

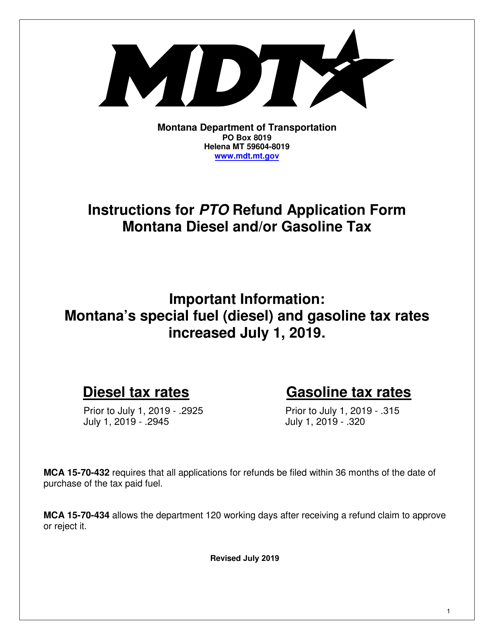

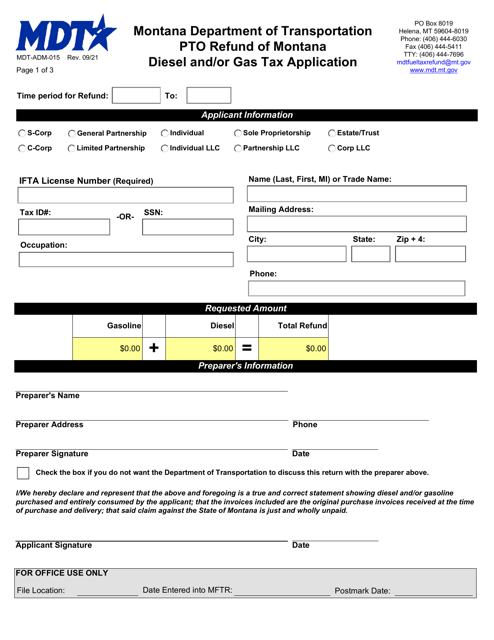

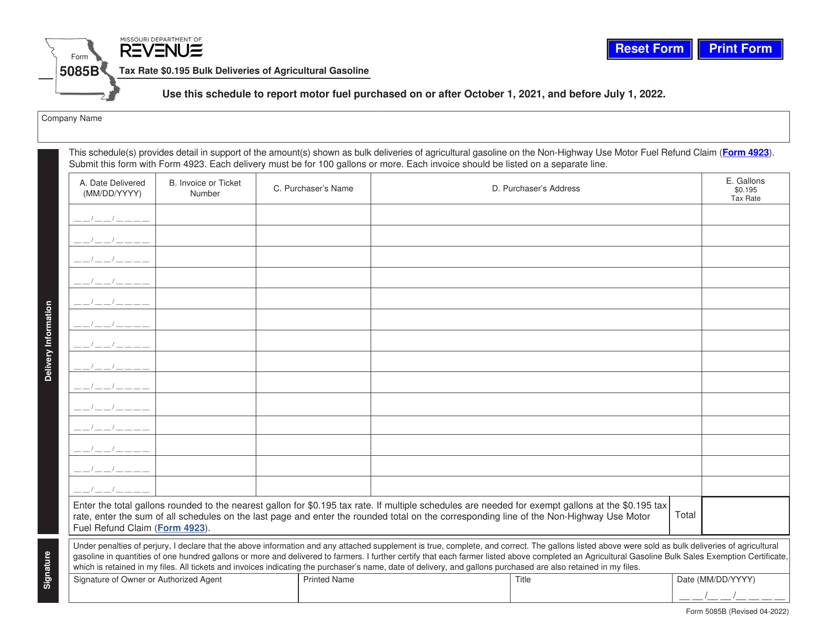

Different states and jurisdictions may have their own specific gas tax forms and instructions. For example, in Montana, there are instructions for Form MDT-ADM-015 Pto Refund of Montana Diesel and/or Gas Tax Application, while Missouri has Form 5085B Tax Rate $0.195 Bulk Deliveries of Agricultural Gasoline.

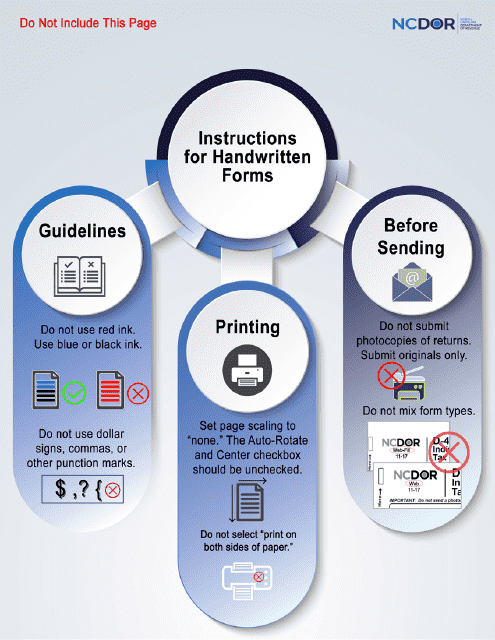

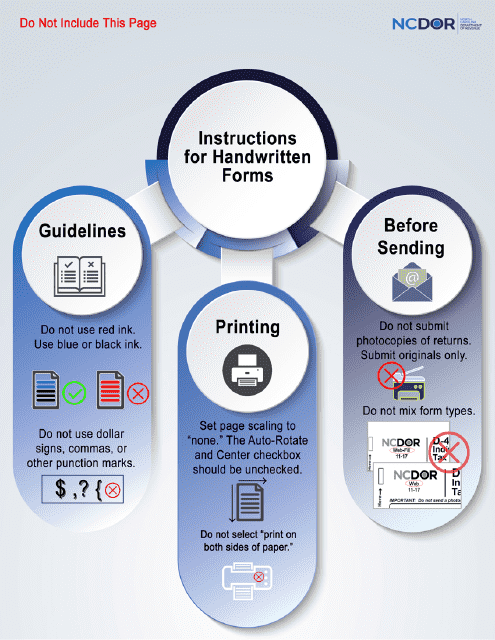

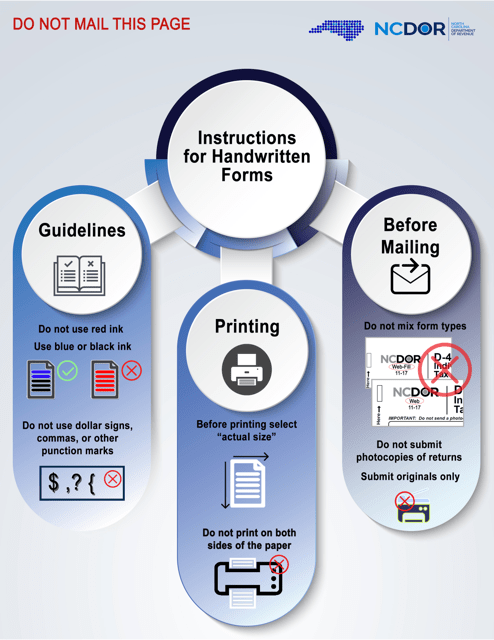

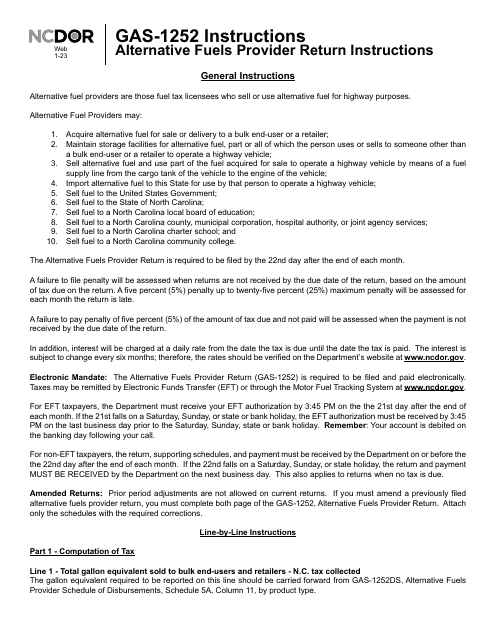

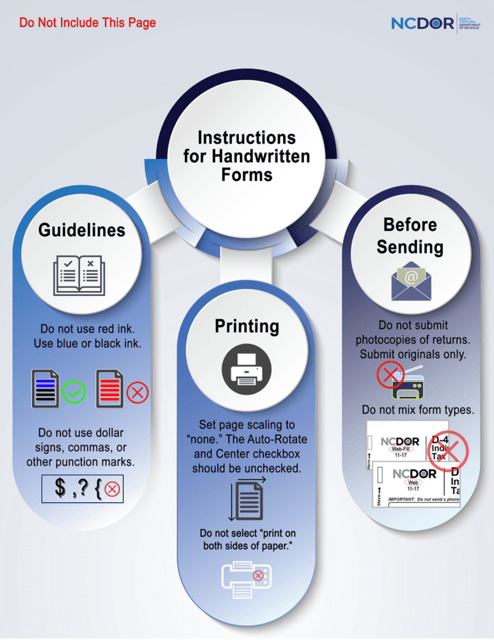

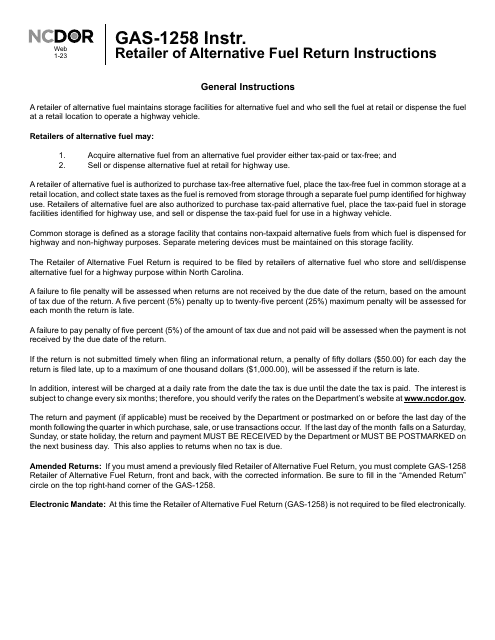

Whether you are a retailer, distributor, or a taxpayer, it is crucial to stay informed about the gas tax regulations and requirements. An understanding of the applicable forms and procedures, such as the Instructions for Form GAS-1258 Retailer of Alternative Fuel Return in North Carolina, can help ensure compliance and avoid penalties.

In summary, gas taxes, gas taxes forms, and related documentation are vital components of our transportation funding system. These taxes help finance the maintenance and improvement of our roads and highways, ensuring safe and efficient travel for all. If you are involved in the sale or distribution of motor fuels, familiarize yourself with the necessary forms and procedures to fulfill your obligations accurately and promptly.

Documents:

29

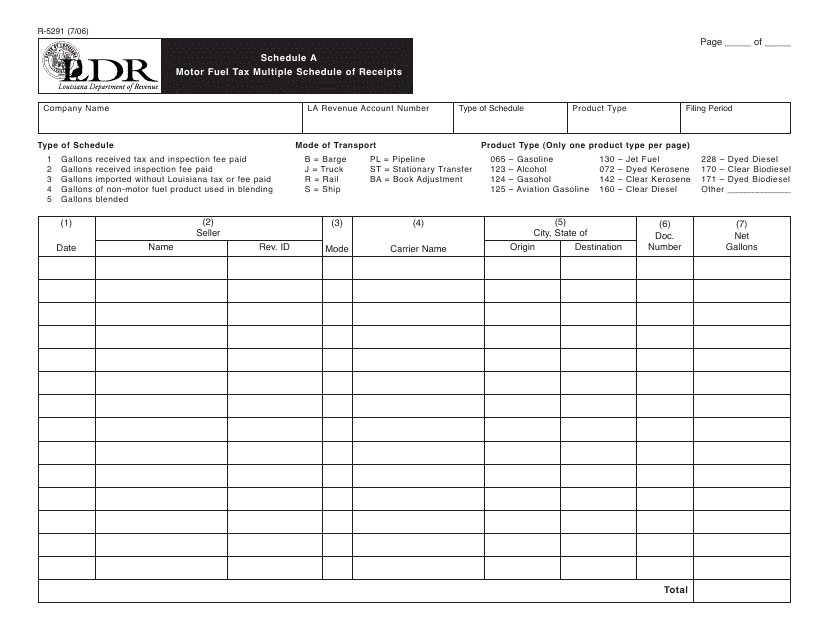

This form is used for reporting multiple motor fuel tax receipts in Louisiana.

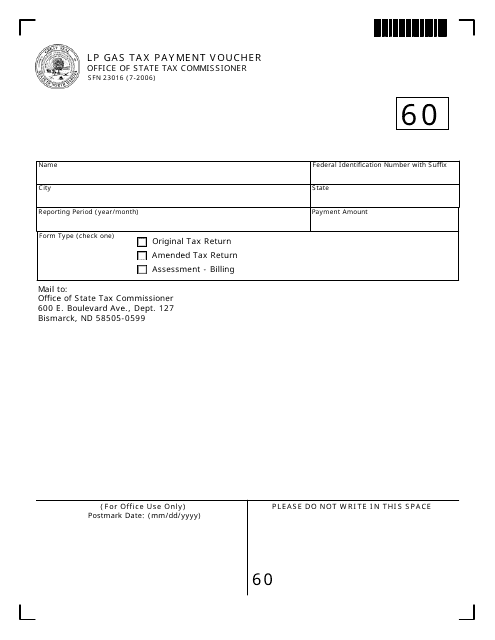

This form is used for making LP gas tax payments in North Dakota.

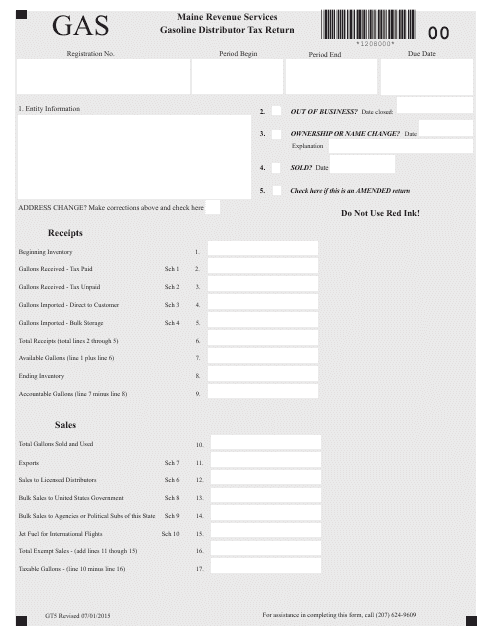

This form is used for filing the gasoline distributor tax return in the state of Maine. It is used by businesses that distribute gasoline in the state and must report and remit taxes owed.

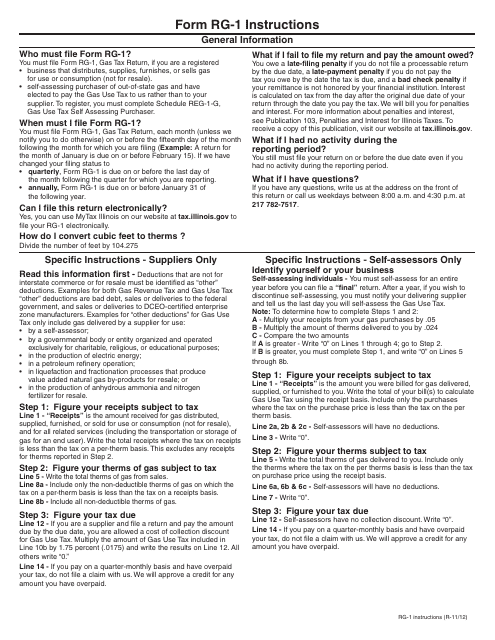

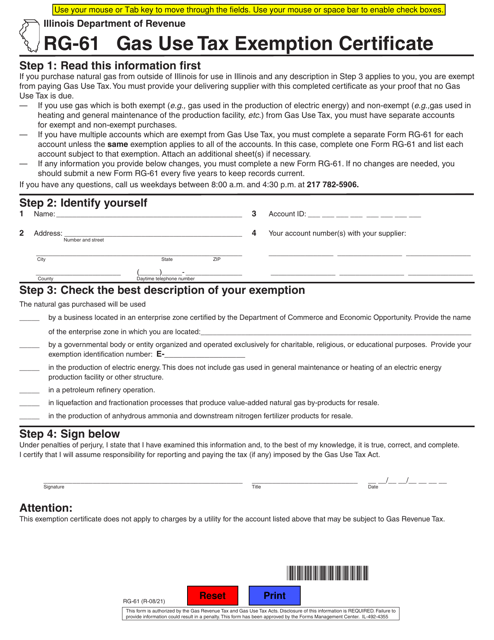

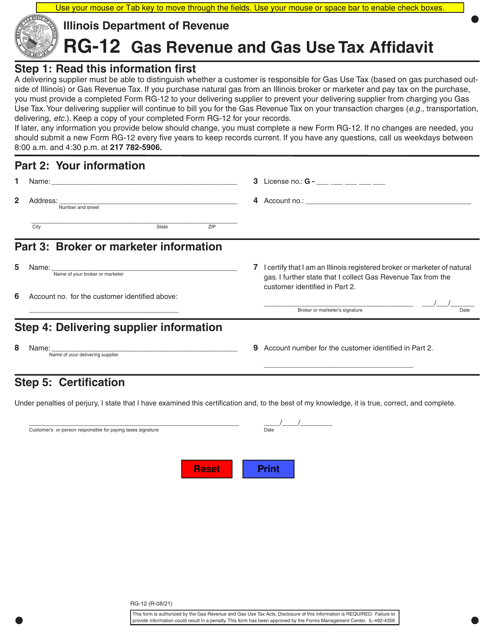

This Form is used for reporting and filing gas tax returns in the state of Illinois.

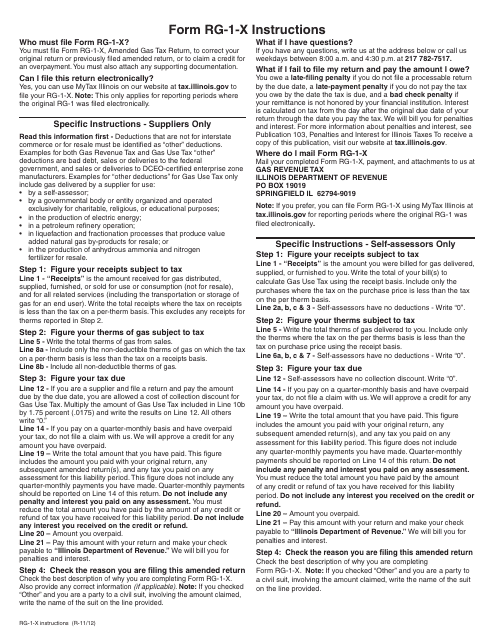

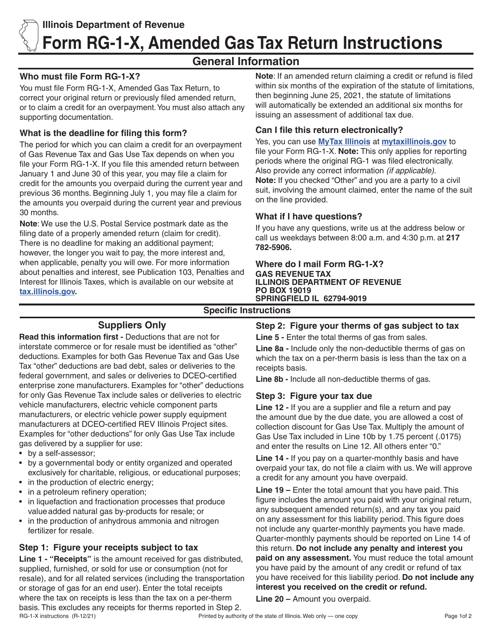

This Form is used for amending a Gas Tax Return in the state of Illinois. It provides instructions on how to correct any errors or make updates to the original return.

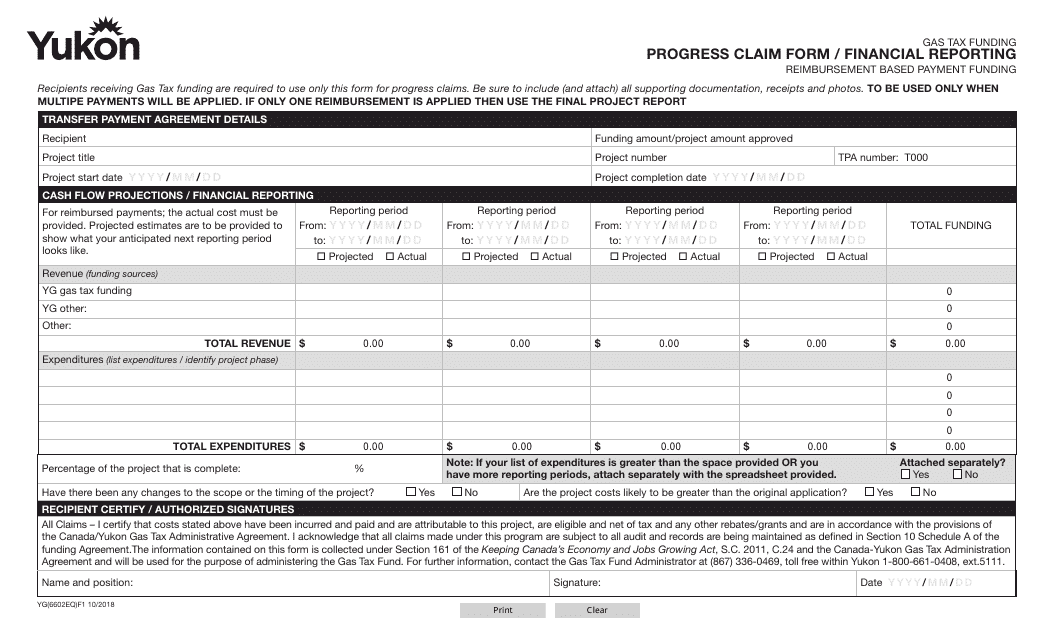

This form is used for reporting progress and financial information related to the Gas Tax Fund in Yukon, Canada.

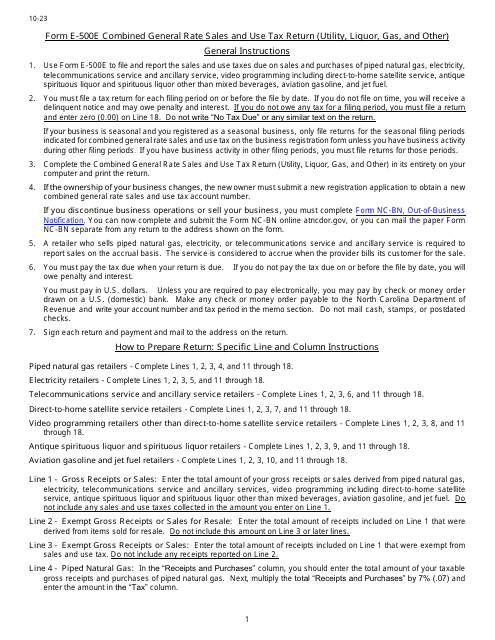

This Form is used for claiming a refund for the combined general rate of tax on utility, liquor, gas, and other items in North Carolina.

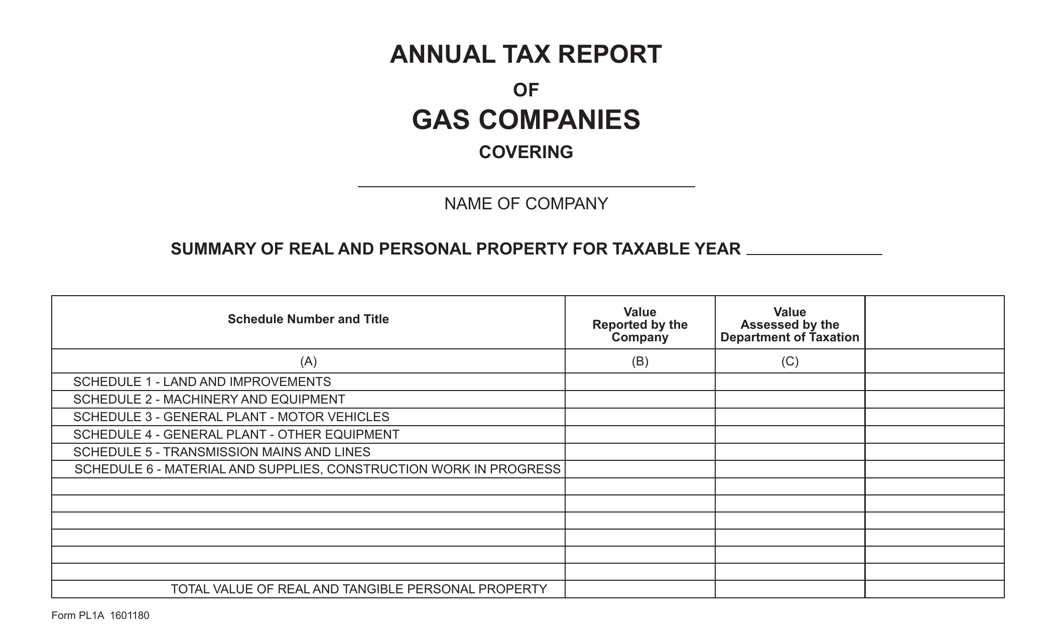

This Form is used for gas companies in Virginia to report their annual tax information. It is necessary for gas companies to submit this report to comply with tax regulations in Virginia.

This type of document provides instructions for filling out Form MDT-ADM-015, which is used for applying for a refund of Montana Diesel and/or Gas Tax in Montana.

This form is used for reporting and paying a tax rate of $0.195 on bulk deliveries of agricultural gasoline in the state of Missouri.

This document is for taxpayers in Illinois who need to amend their gas tax return. It provides instructions on how to fill out Form RG-1-X, 424.