Loan Repayment Options Templates

Are you struggling to find the best loan repayment options that suit your financial needs? Look no further. Our comprehensive collection of loan repayment options is here to help you make informed decisions about managing your loan payments.

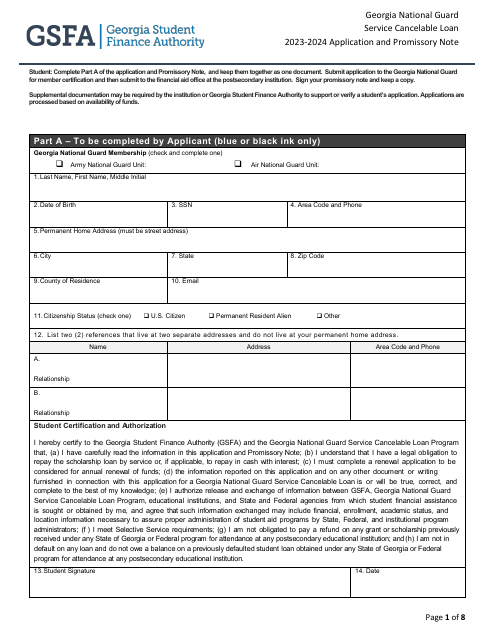

Our loan repayment options include a variety of programs tailored to different circumstances and situations. Whether you're a student looking for flexible repayment plans, a homeowner seeking mortgage assistance, or a business owner looking to streamline your loan servicing, we have the resources you need.

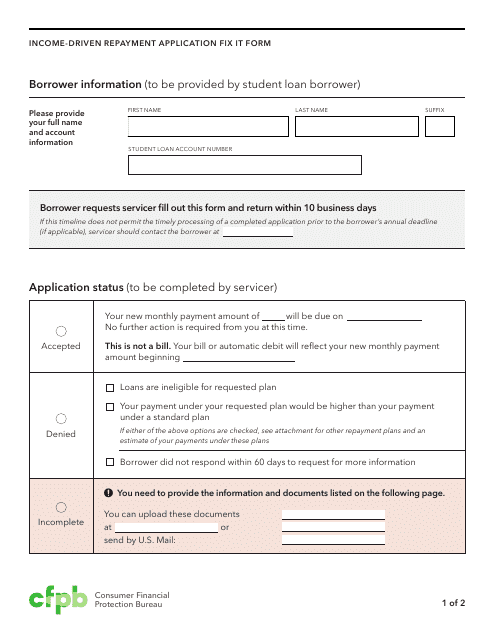

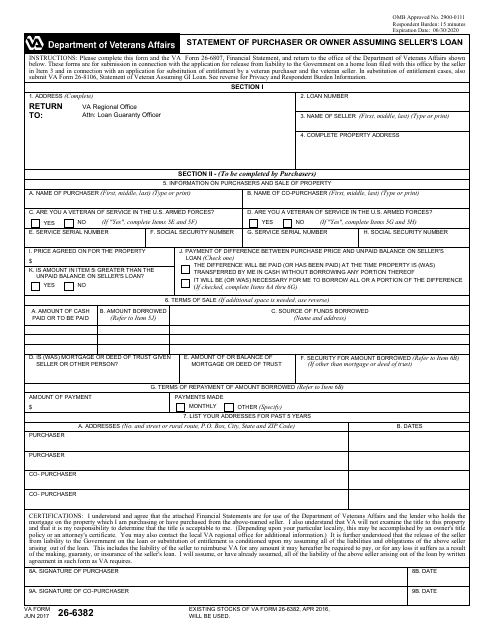

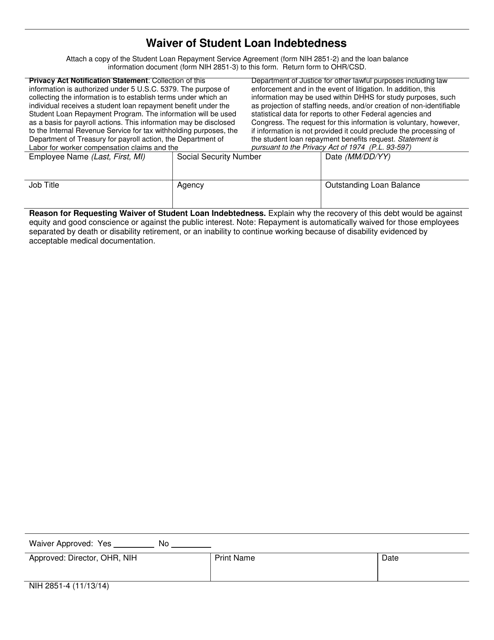

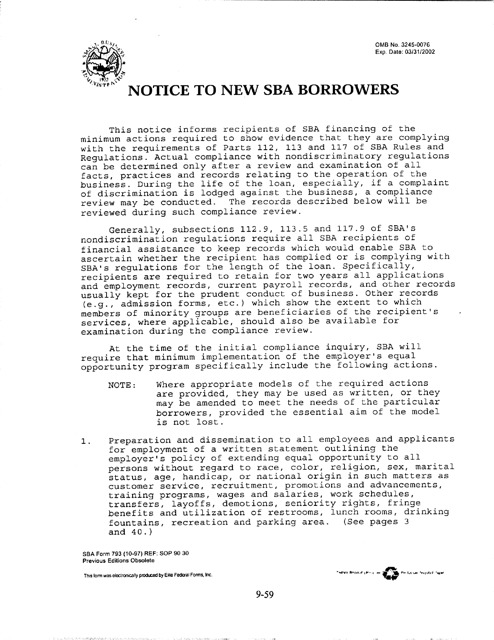

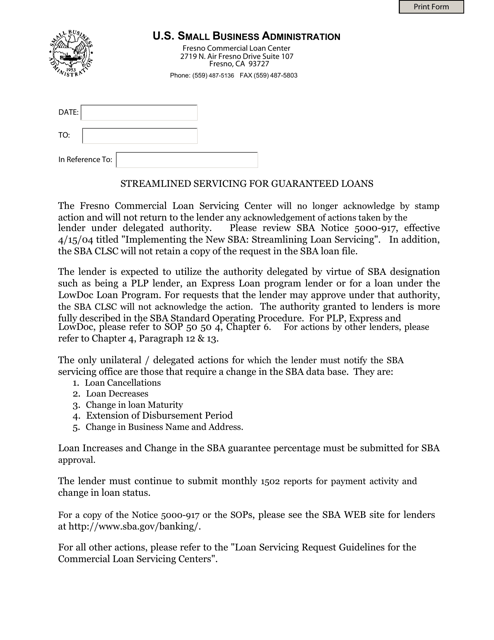

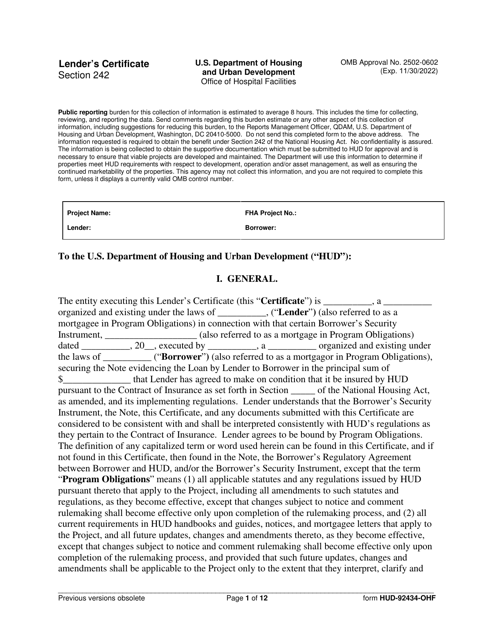

Our extensive collection of loan repayment options encompasses a range of forms and applications, such as the Income-Driven Repayment Application Fix It Form, VA Form 26-6382 Statement of Purchaser or Owner Assuming Seller's Loan, Form NIH2851-4 Waiver of Student Loan Indebtedness, Streamlined Servicing for Guaranteed Loans, and Form HUD-92434-OHF Lender's Certificate.

With our loan repayment options, you'll have access to expert guidance and support to navigate the complex world of loan repayment. We strive to provide clear, easy-to-understand information and documents that empower you to take control of your financial future.

Explore our loan repayment options today and discover the solutions that best fit your needs. Say goodbye to financial stress and hello to a brighter, more manageable loan repayment journey.

Documents:

8

This form is used for fixing errors or making corrections to an Income-Driven Repayment Application.

This Form is used for buyers or owners who are assuming the seller's loan.

This Form is used for applying for a waiver of student loan indebtedness. It allows individuals to request forgiveness of their student loans based on certain eligibility criteria.

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

This document provides questions and answers about income-driven repayment plans. These plans help borrowers manage their federal student loan payments based on their income. It covers the basics of the plans and provides answers to commonly asked questions.