Bonding Process Templates

The Bonding Process

When dealing with legal matters and financial obligations, a crucial step is to understand and participate in the bonding process. This process, also known as the bond process, ensures protection, integrity, and assurance for all parties involved.

In the world of legal proceedings and financial agreements, various types of bonds are often required. These bonds serve as a guarantee that certain obligations will be fulfilled, and they provide financial security for both individuals and organizations.

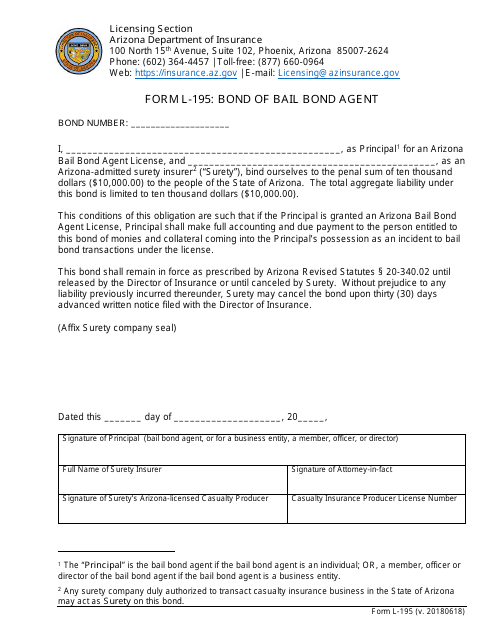

One such example is the Form L-195 Bond of Bail Bond Agent of Arizona. This document establishes the bond between a bail bond agent and the judiciary system, ensuring that the agent will fulfill their duties responsibly.

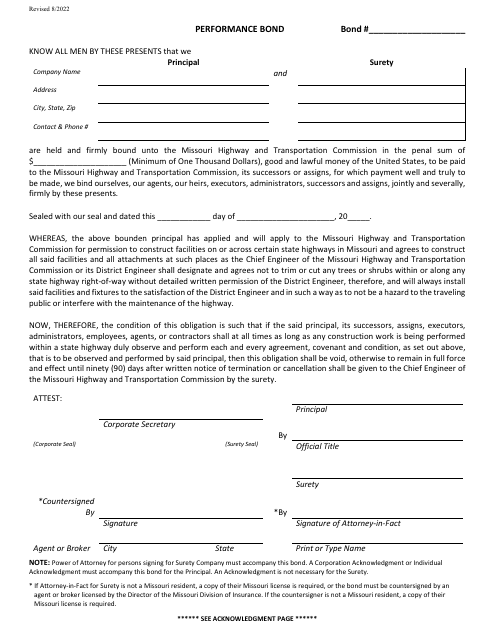

Similarly, the State Form 39284 Institutional Surety Bond of Indiana and the Performance Bond of Missouri are other forms used to secure financial responsibilities in specific contexts. These bonds protect institutions and individuals from potential financial losses.

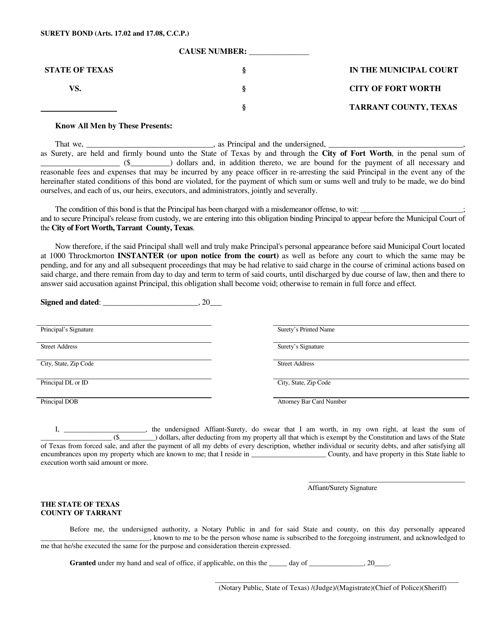

Local governments also utilize bonds, such as the Surety Bond of the City of Fort Worth, Texas. This bond ensures that contractors and construction companies complete their projects according to the agreed-upon terms and conditions.

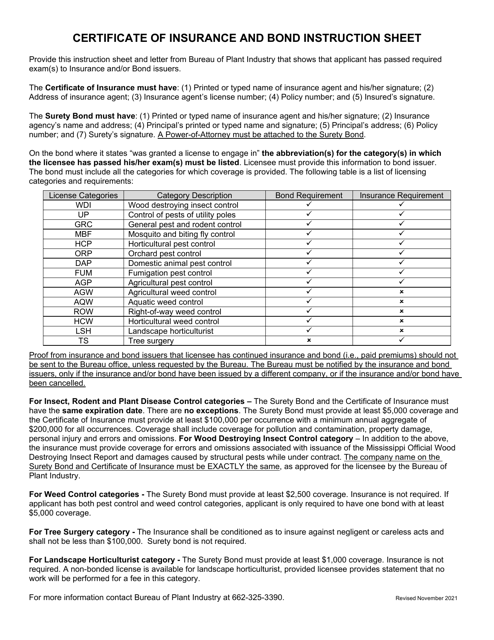

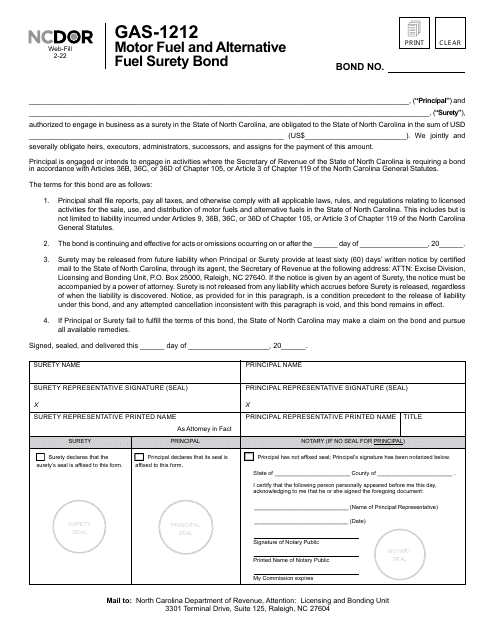

In other cases, like the Form GAS-1212 Motor Fuel and Alternative Fuel Surety Bond of North Carolina, bonds are used to regulate and control specific industries. This bond ensures compliance with regulations and provides a layer of security for consumers and suppliers of motor fuel.

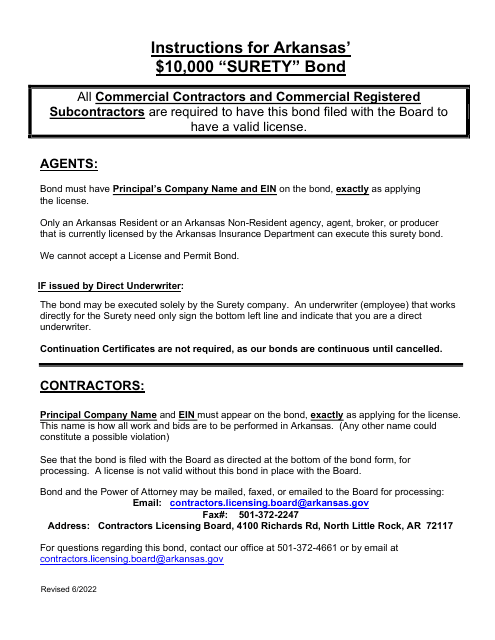

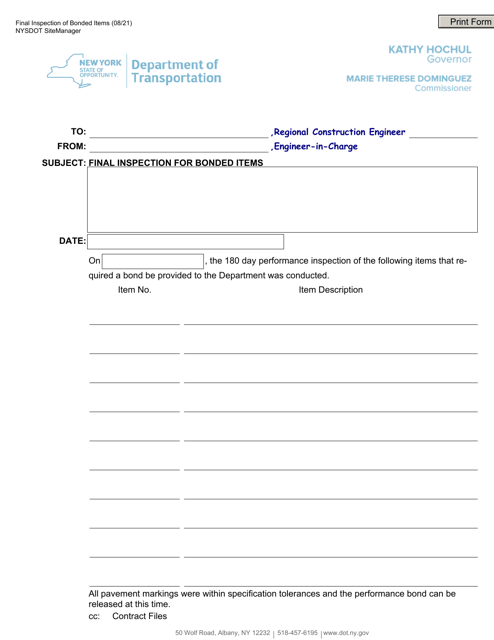

Understanding the intricacies and requirements of the bonding process is essential to navigating legal and financial matters. From bail bond agents to institutional obligations, this process plays a crucial role in upholding accountability and reliability.

For comprehensive information and guidance on the bonding process, trust our team of experts. We offer in-depth knowledge, practical insights, and invaluable support throughout your bonding journey. Let us help you navigate the intricacies and achieve peace of mind in your legal and financial endeavors.

Documents:

19

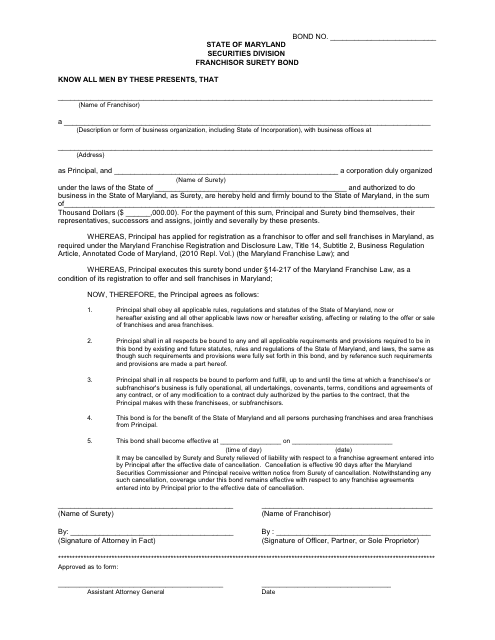

This document ensures that a franchisor will fulfill their obligations in Maryland.

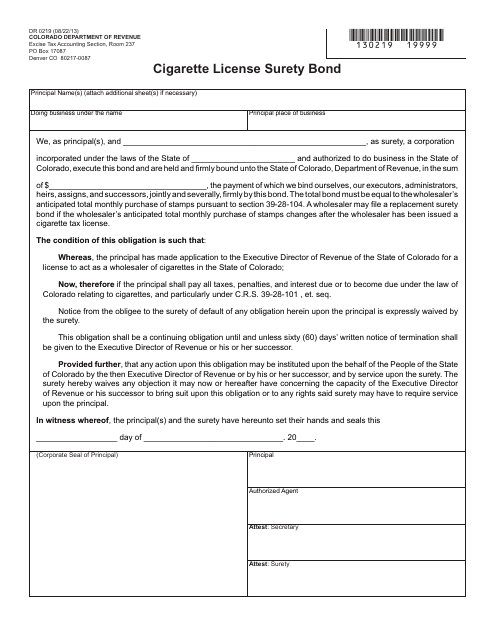

This form is used for obtaining a surety bond for a cigarette license in Colorado.

This form is used for obtaining a bond for a bail bond agent in the state of Arizona.

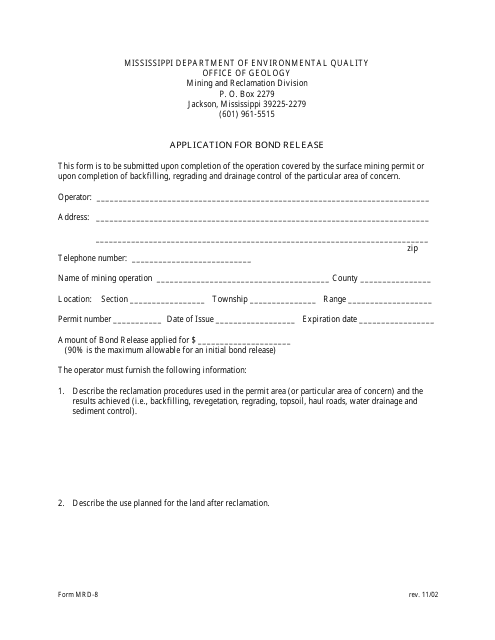

This form is used for applying for the release of a bond in the state of Mississippi.

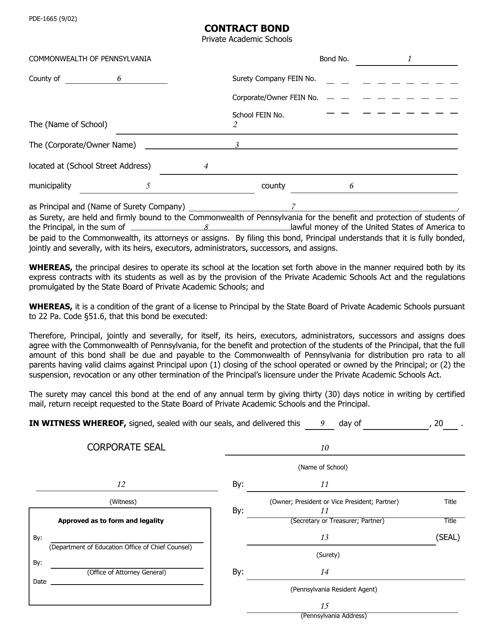

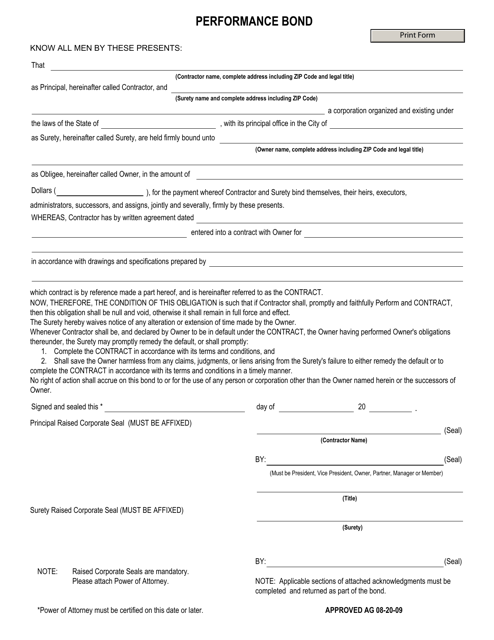

This Form is used for obtaining a contract bond in the state of Pennsylvania. It provides assurance that a contractor will fulfill their obligations as stated in the contract.

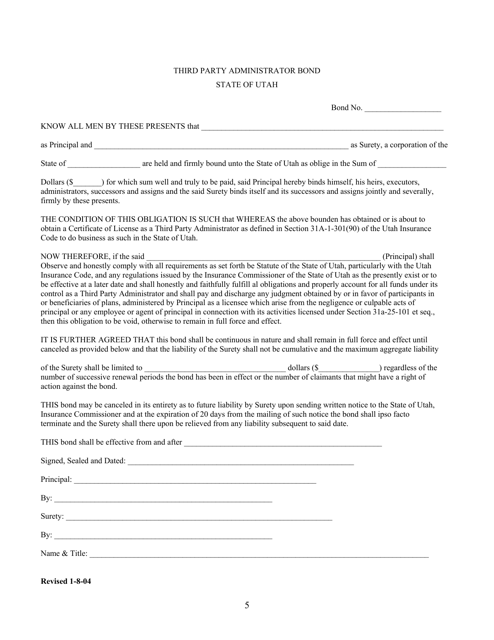

This is a type of bond required in Utah for third party administrators. It provides a financial guarantee to protect clients from financial loss resulting from the actions of the administrator.

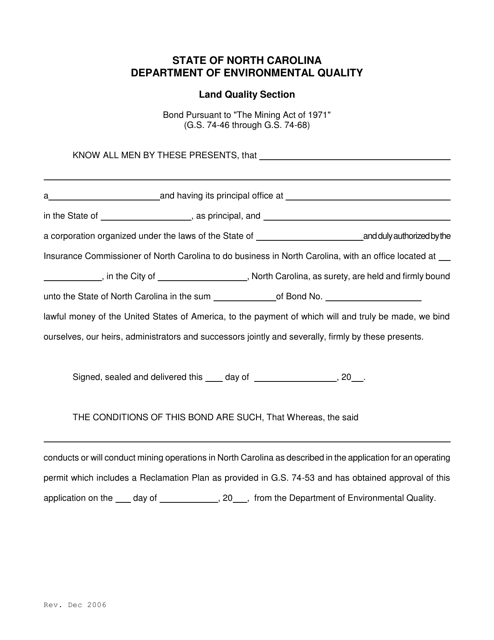

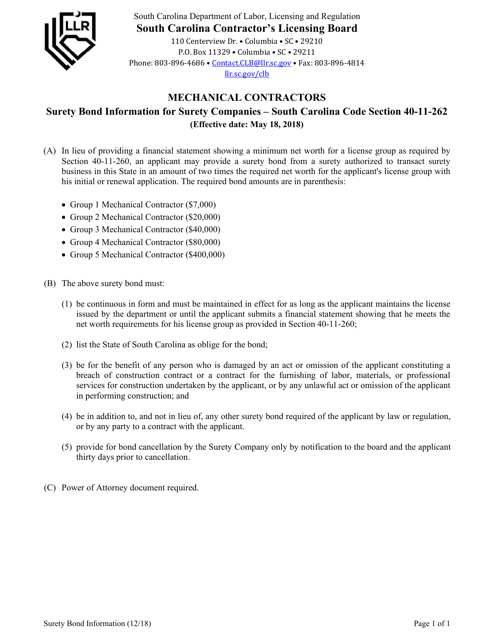

This document is a type of bond used in North Carolina. It serves as a guarantee that the bonded party will fulfill their obligations.

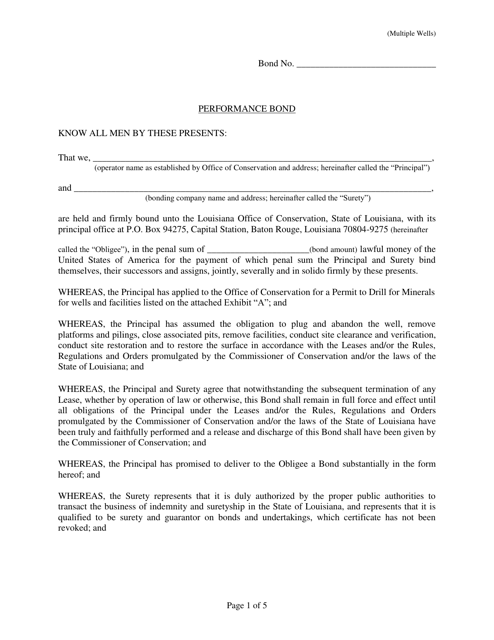

This document is a Performance Bond form specific to the state of Louisiana. It is used to provide financial assurance for the completion of a construction project.

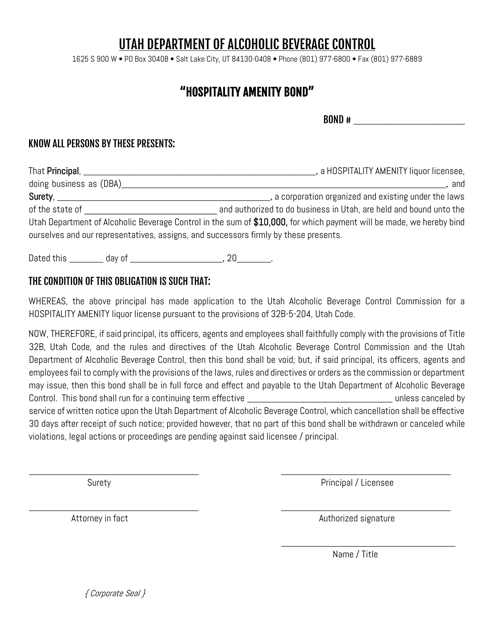

This document is a bond required by the state of Utah for certain businesses in the hospitality industry. It ensures that the business will provide certain amenities and services to guests.

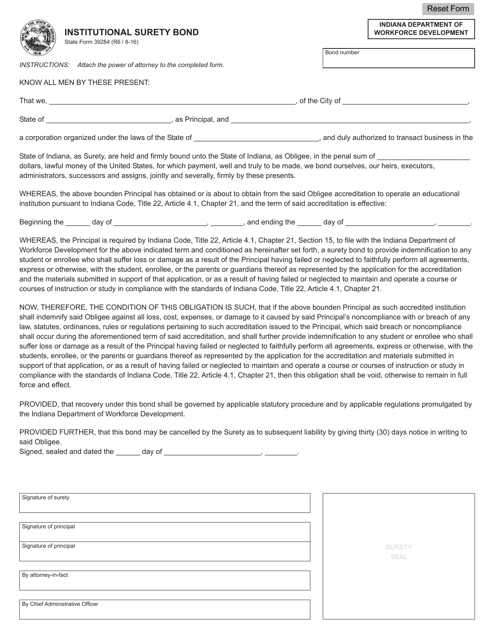

This Form is used for obtaining an institutional surety bond in the state of Indiana.

This document is a Performance Bond specific to the state of West Virginia. Performance bonds are a type of financial guarantee that ensures a contractor will complete a project according to the agreed-upon terms. The bond provides protection for the project owner in case the contractor fails to fulfill their obligations.

This document is a surety bond specific to the City of Fort Worth, Texas. It guarantees that certain obligations will be fulfilled, providing financial protection for the city and its residents.

This type of document, called a Surety Bond, is used in Mississippi as a financial agreement between three parties: the principal, the surety, and the obligee. The bond guarantees that the principal will fulfill their obligations according to the terms agreed upon.