Distilled Spirits Templates

Are you a distillery, liquor store, or other business that deals with distilled spirits? Looking for information on the necessary forms and regulations for purchasing, receiving, and selling distilled spirits? Look no further than our comprehensive collection of documents and resources on distilled spirits.

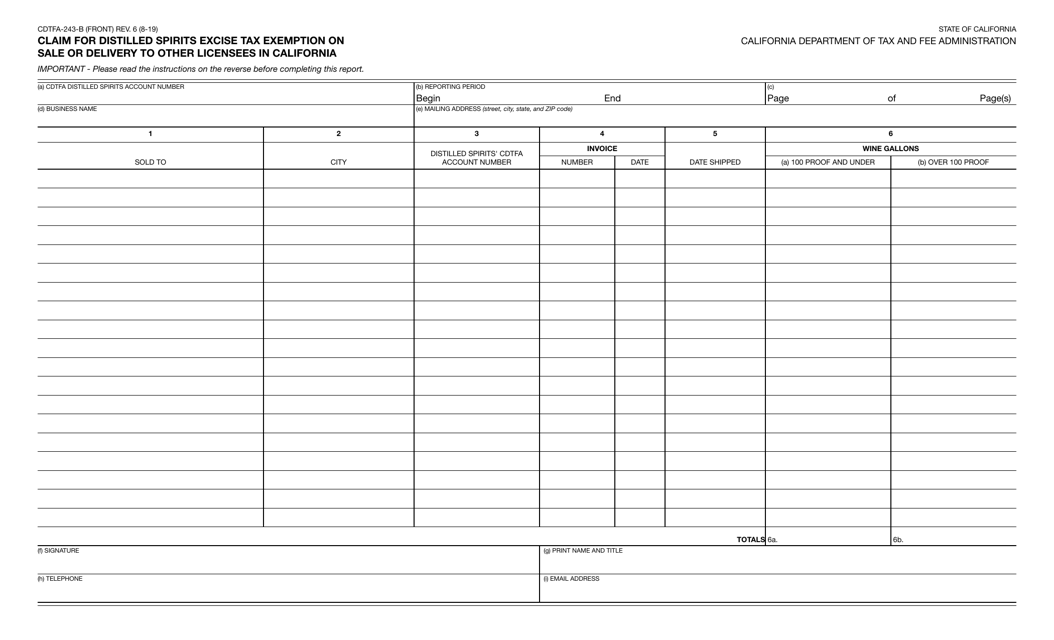

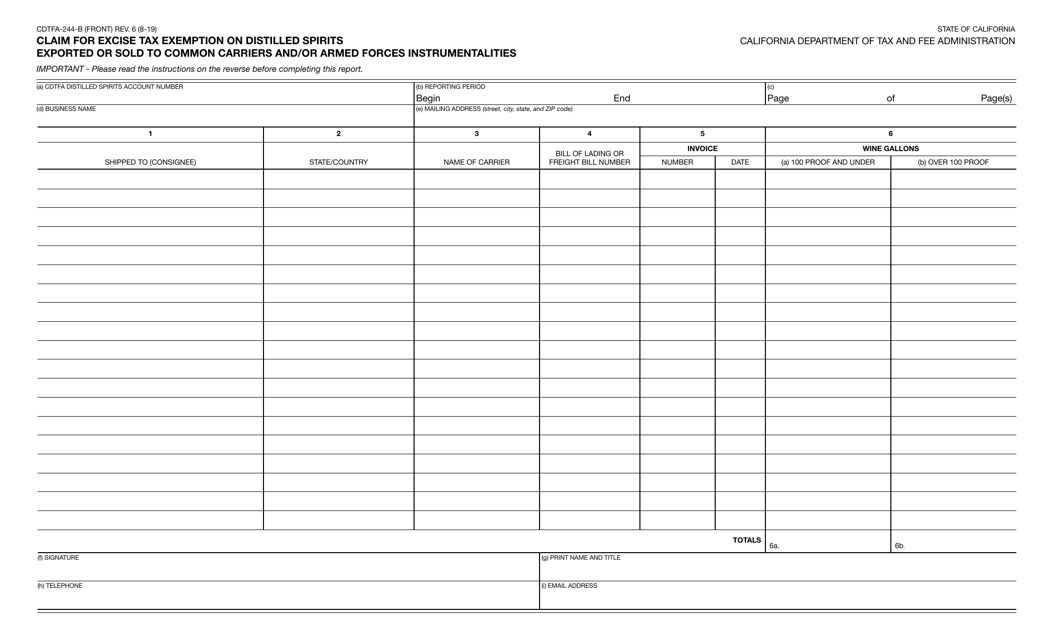

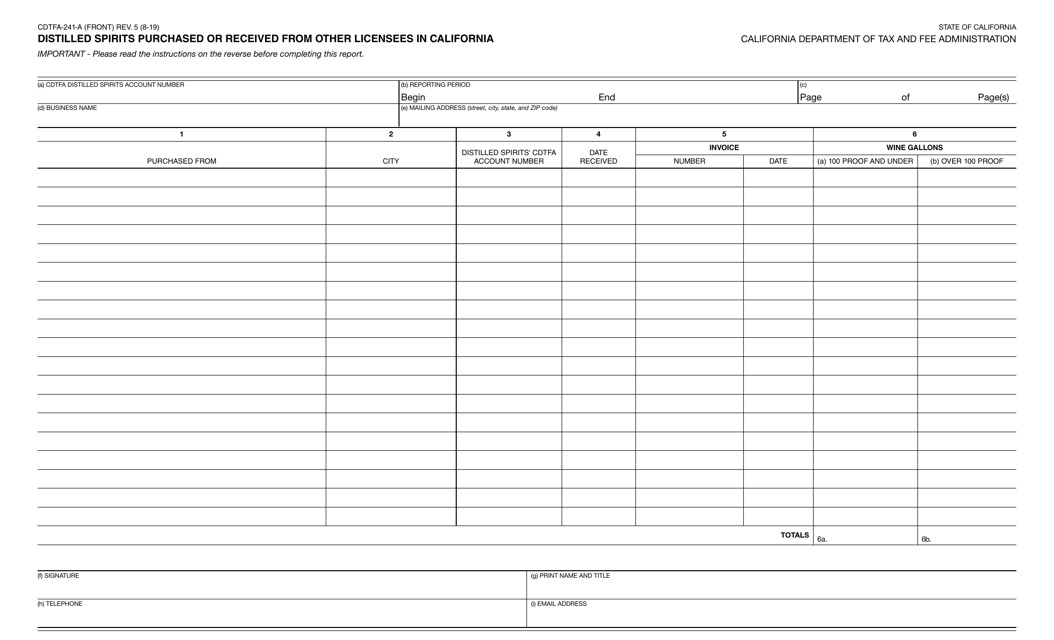

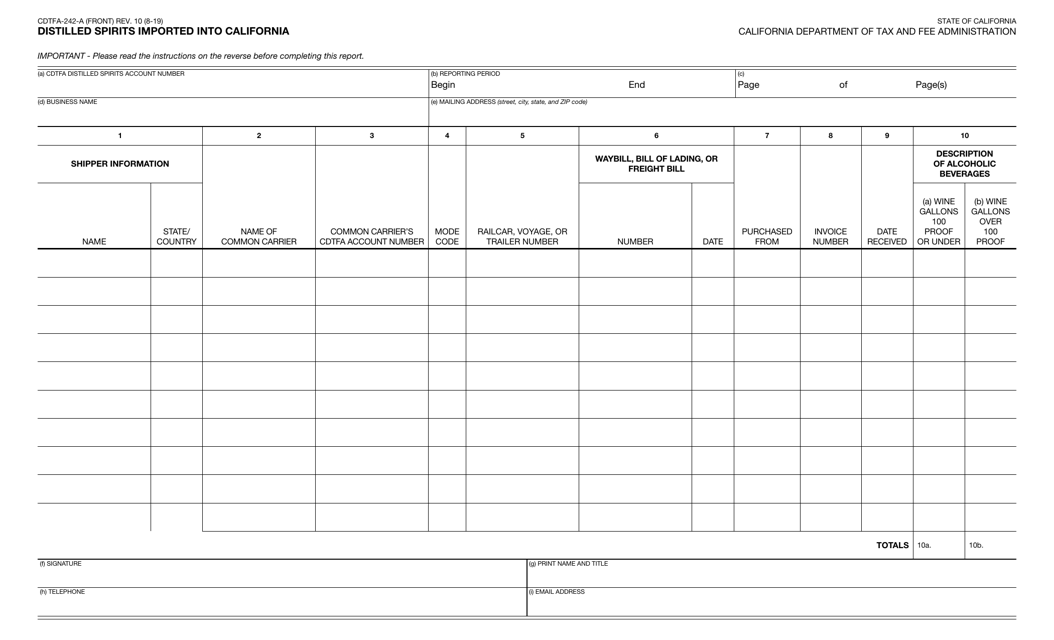

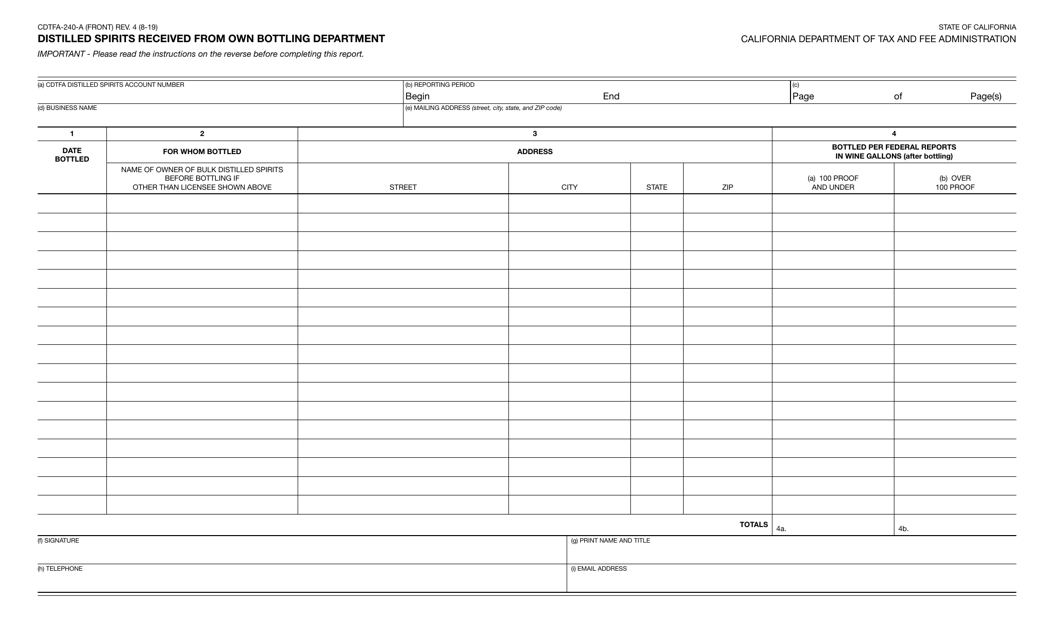

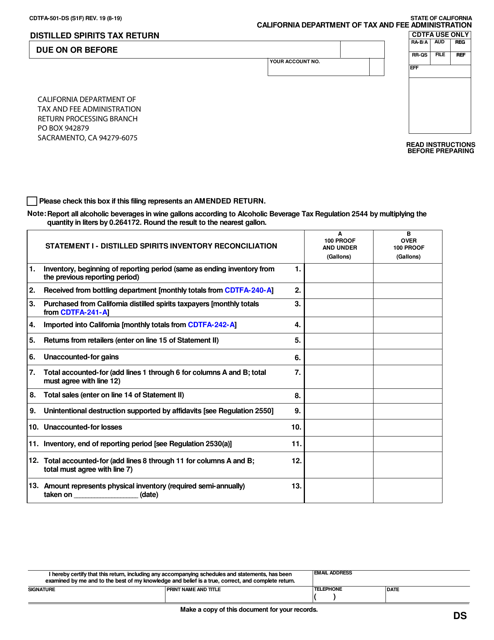

Our collection, also known as Form CDTFA-241-A Distilled Spirits Purchased or Received From Other Licensees in California - California and Form CDTFA-240-A Distilled Spirits Received From Own Bottling Department - California, provides all the necessary information and forms you need to comply with California state regulations. Whether you're purchasing distilled spirits from other licensees or receiving them from your own bottling department, our documents will guide you through the process and ensure you're complying with all the necessary requirements.

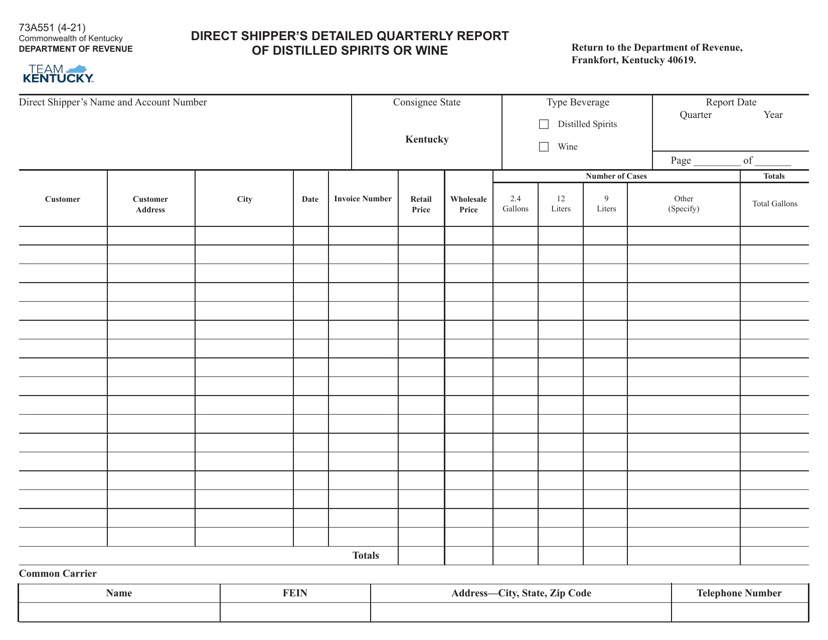

But our collection doesn't stop there. We also have Form 73A551 Direct Shipper's Detailed Quarterly Report of Distilled Spirits or Wine - Kentucky, which is essential for any business involved in direct shipping of distilled spirits in Kentucky. This document will help you keep track of your quarterly shipments and ensure you're submitting the necessary reports to the relevant authorities.

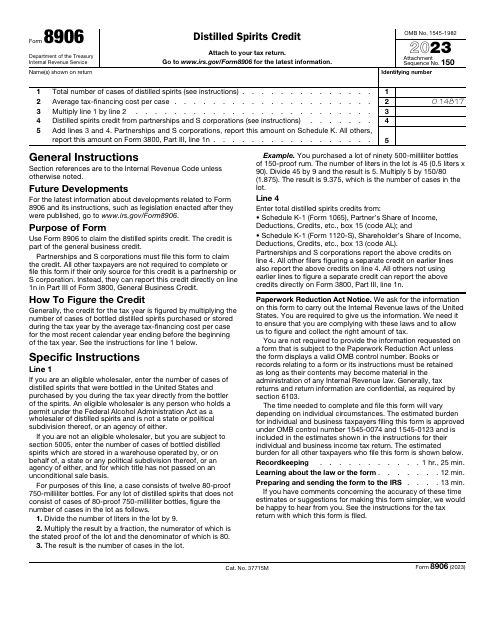

And let's not forget about IRS Form 8906 Distilled Spirits Credit. If you're eligible for a credit on distilled spirits, this form will help you claim it and reduce your tax liability. Our collection includes all the information and instructions you need to properly fill out this form and take advantage of any available credits.

Whether you're a small distillery, a liquor store, or a business involved in the distribution of distilled spirits, our collection of documents and resources will be your go-to guide for all things related to distilled spirits. Stay compliant, save time, and make sure you're following the necessary regulations with our comprehensive collection.

Documents:

33

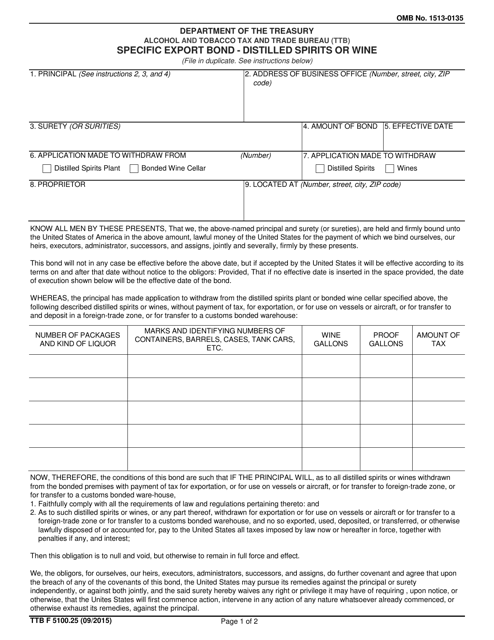

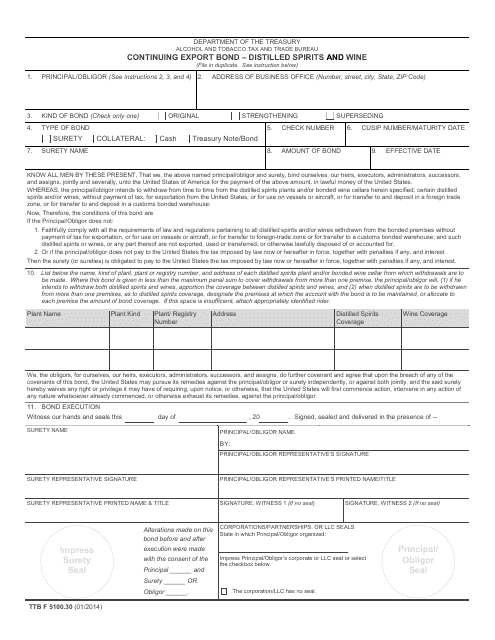

This form is used for implementing a continuing export bond for distilled spirits and wine.

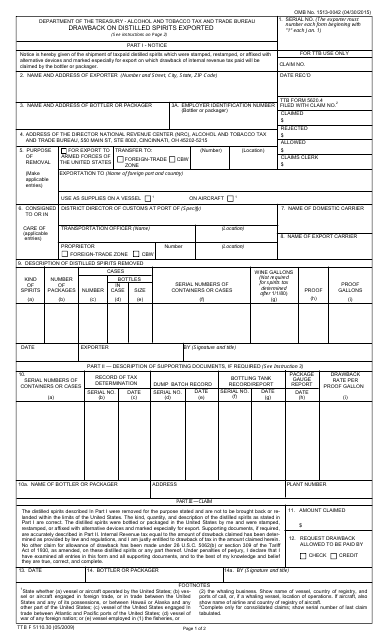

This Form is used for claiming a refund or credit for the excise tax paid on distilled spirits that are exported from the United States.

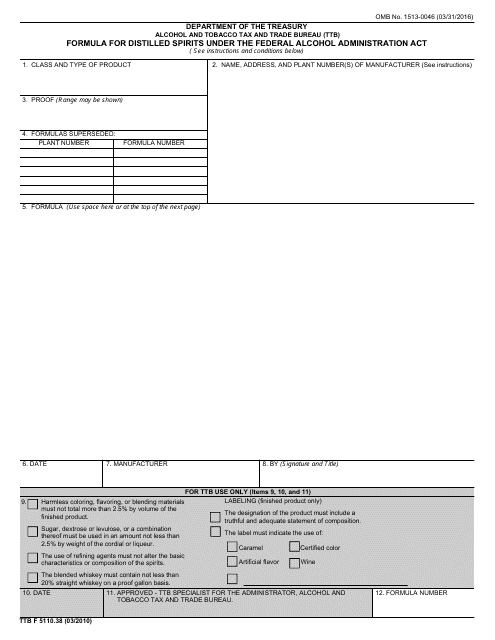

This Form is used for submitting the formula for distilled spirits under the Federal Alcohol Administration Act.

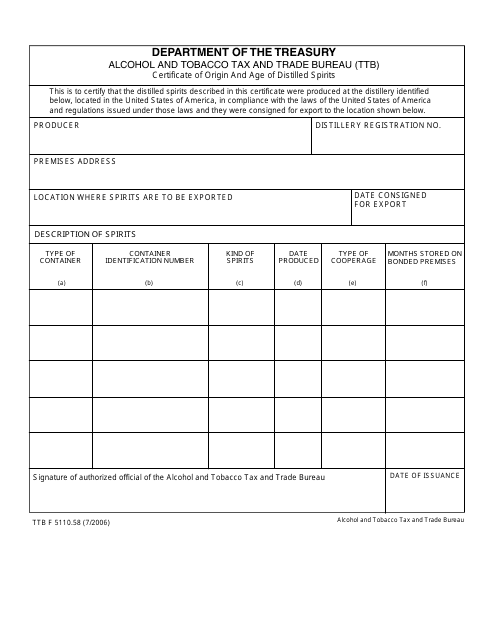

This document is used to certify the origin and age of distilled spirits.

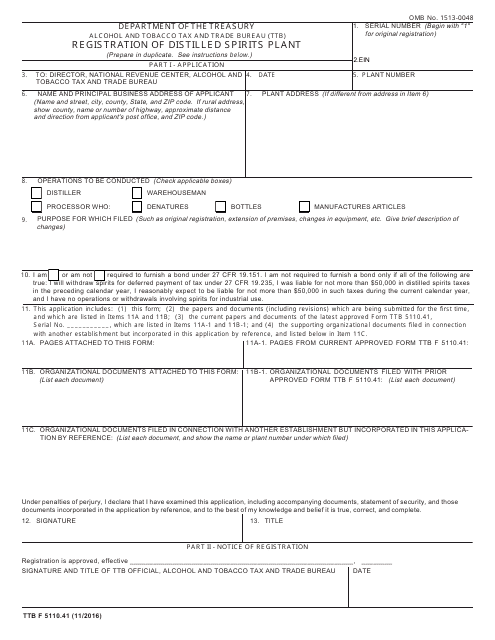

This form is used for registering a distilled spirits plant. It is required for individuals or entities who intend to produce, bottle, rectify, process, or warehouse distilled spirits for beverage purposes.

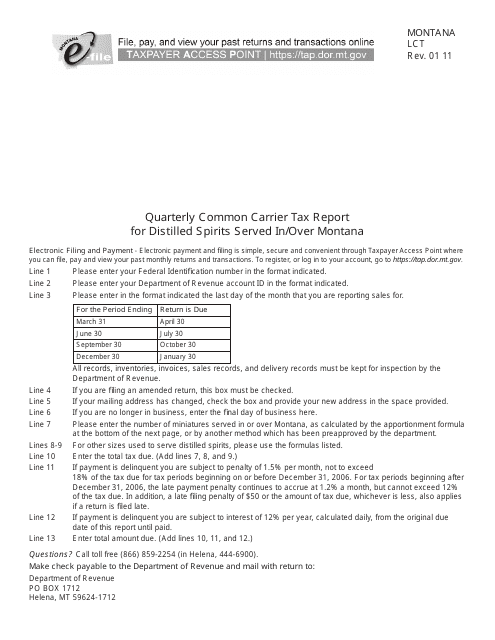

This form is used for reporting and paying the quarterly common carrier tax on distilled spirits served in or over Montana. It is specific to Montana and is required for businesses involved in the transportation or delivery of distilled spirits within the state.

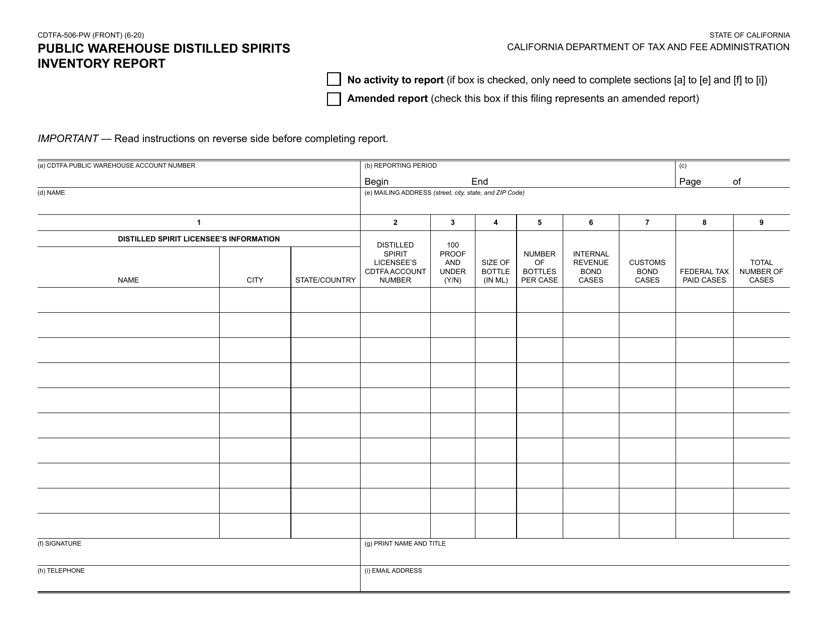

This form is used for reporting the inventory of distilled spirits in public warehouses in California.

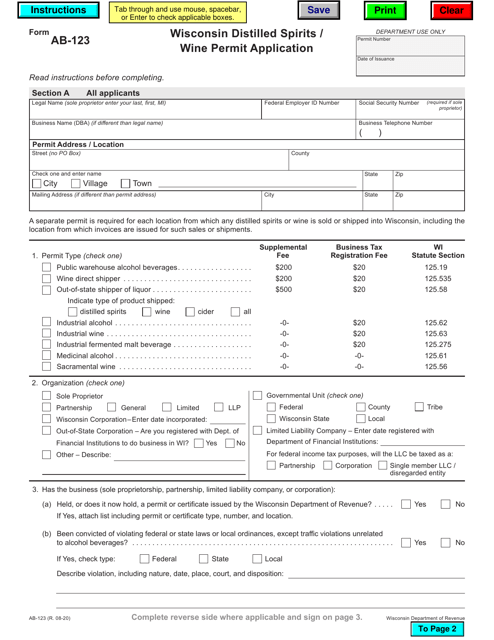

This Form is used for applying for a Distilled Spirits/Wine Permit in Wisconsin.

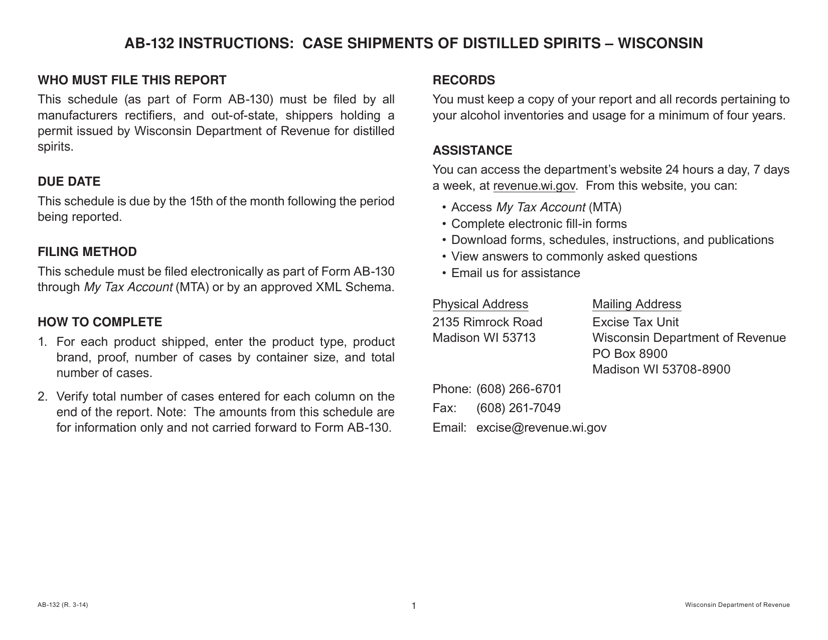

This document is used for reporting the shipment of distilled spirits in Wisconsin. It is a sample form that helps in tracking the transportation of alcoholic beverages within the state.

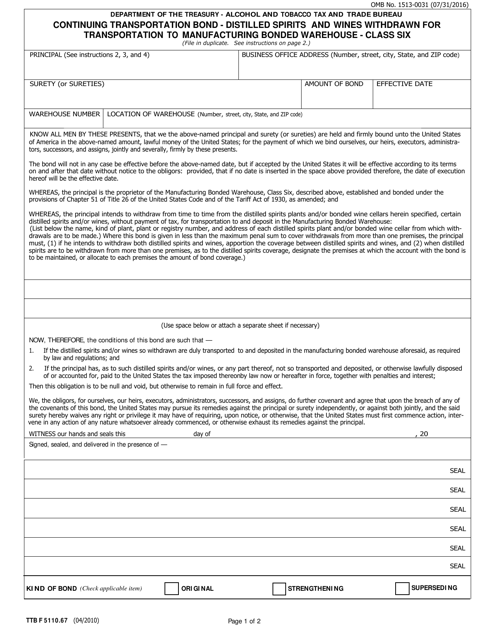

This form is used for continuing transportation bonds for distilled spirits and wines that are being withdrawn for transportation to a manufacturing bonded warehouse.

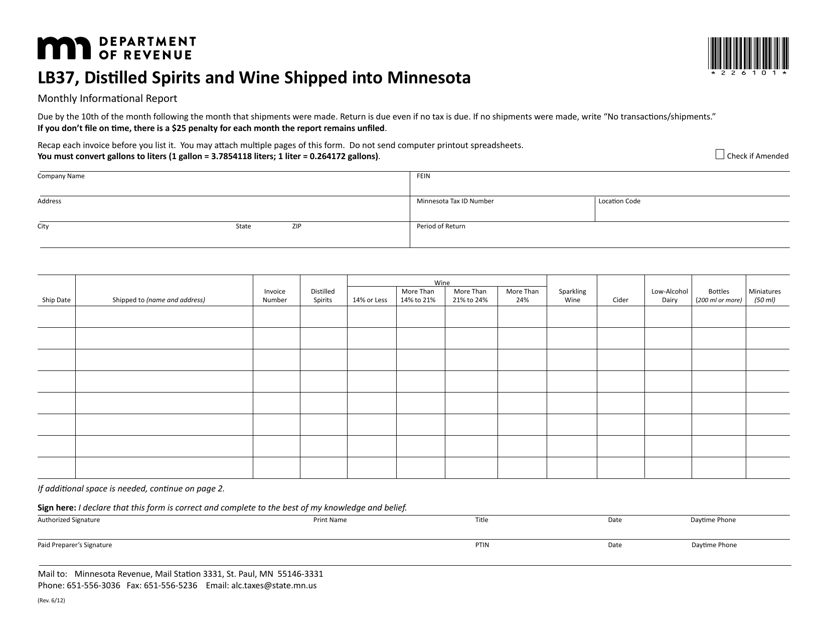

This form is used for documenting the shipment of distilled spirits and wine into Minnesota. It helps to ensure compliance with Minnesota's regulations for the importation and distribution of alcoholic beverages.