Capital Credit Templates

Capital Credit, also known as tax capital credit, is a valuable tax incentive program offered by various states, including Alabama. This program rewards individuals and businesses for investing in qualifying projects that promote economic growth and development.

At its core, capital credit is a mechanism that allows individuals and businesses to reduce their state tax liability by claiming credits based on their investments in eligible projects. The program encourages investment and job creation in key industries such as manufacturing, infrastructure development, renewable energy, and more.

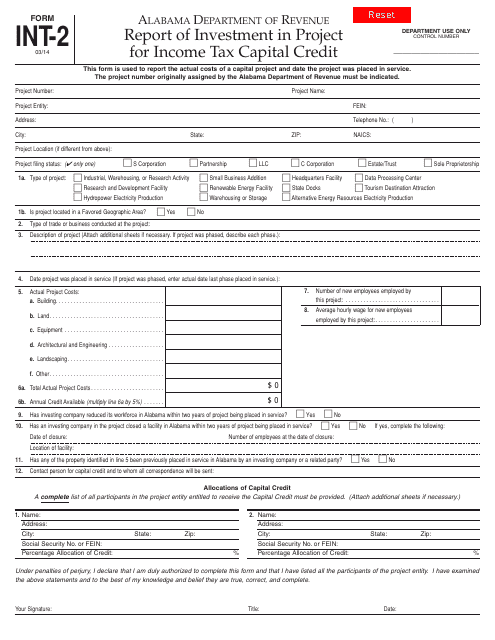

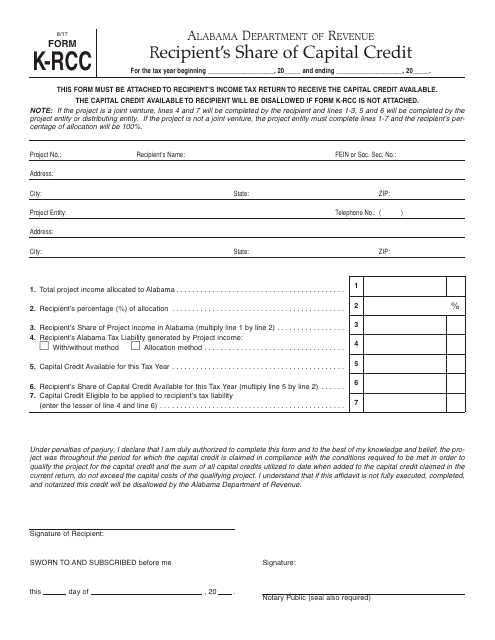

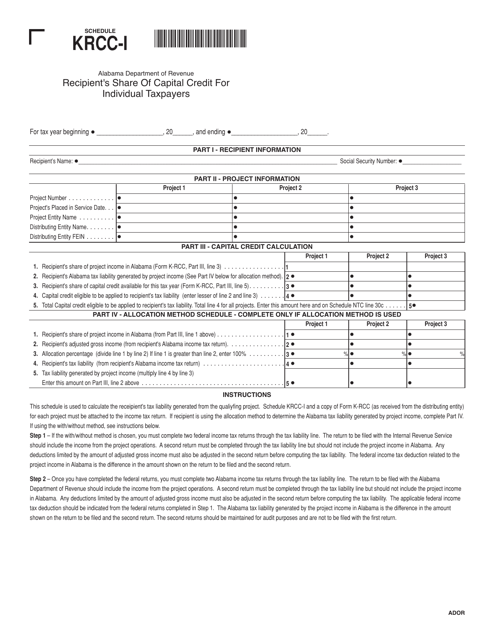

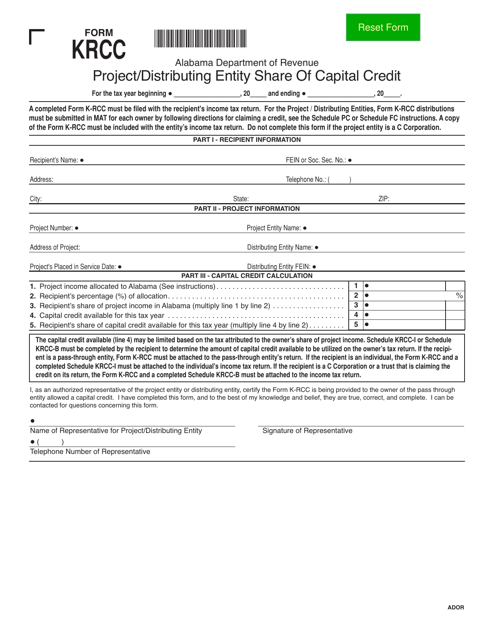

One of the key documents associated with capital credit is the Form INT-2 Report of Investment in Project for Income Tax Capital Credit. This document is used by individuals and businesses to report and claim their investment in qualifying projects for the purpose of receiving capital credit. Additionally, there are other documents such as the Form K-RCC Recipient's Share of Capital Credit, Schedule KRCC-I Recipient's Share of Capital Credit for Individual Taxpayers, and Form KRCC Project/Distributing Entity Share of Capital Credit, which provide specific information on the recipient's share of capital credit based on their investment.

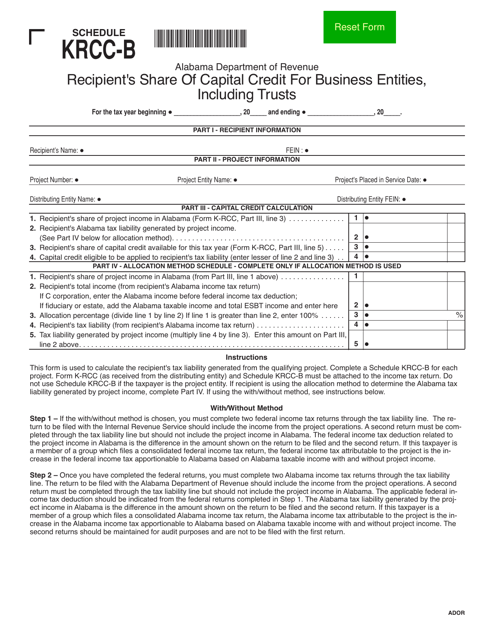

For businesses, the Schedule KRCC-B Recipient's Share of Capital Credit for Business Entities, Including Trusts is used to calculate and report the share of capital credit for business entities and other trusts.

The capital credit program offers a win-win situation for both individuals and businesses. By investing in qualifying projects, participants can not only reduce their tax liability but also contribute to the economic development of their state. This can lead to job creation, improved infrastructure, and a vibrant business environment.

To take advantage of capital credit opportunities, it is essential to understand the specific requirements and documentation needed. Working with a knowledgeable tax advisor or consulting the official guidelines provided by the state can help ensure a successful capital credit claim.

So, if you are an individual or business looking to maximize your tax savings while supporting economic growth, consider exploring the benefits of capital credit today. It's an opportunity to invest in the future of your state while reaping significant tax advantages.

Documents:

6

This form is used for reporting investments made in a project to claim income tax capital credit in Alabama.

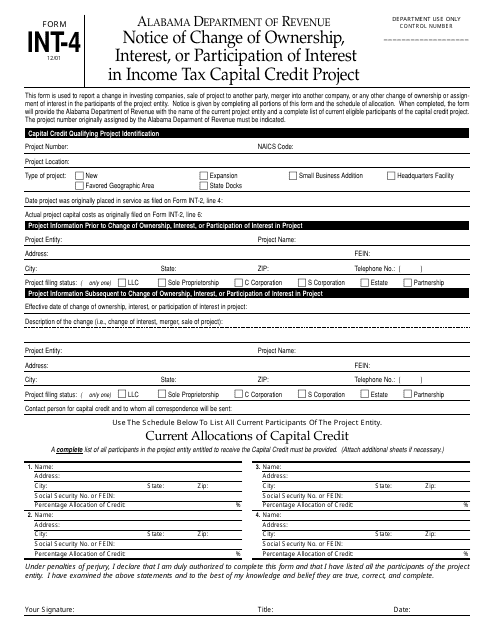

This form is used for informing the Alabama Department of Revenue about any change in ownership, interest, or participation of interest in an income tax capital credit project in Alabama.

This Form is used for Alabama residents to report their share of capital credit as a recipient.

This form is used for individual taxpayers in Alabama to schedule their KRCC-I recipient's share of capital credit.

This Form is used for reporting the distributing entity's share of capital credit for the KRCC (Kemper River Coal Cooperative) project in Alabama.

This form is used for reporting and distributing the recipient's share of capital credits for business entities, including trusts, in Alabama.