Qualified Small Business Templates

Are you a small business owner looking for tax incentives or funding opportunities? Look no further than the qualified small business documents collection. This comprehensive library of resources provides information and guidance for qualified small businesses like yours.

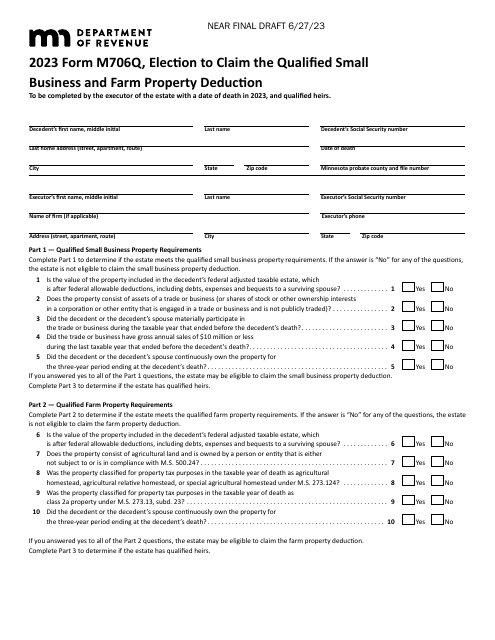

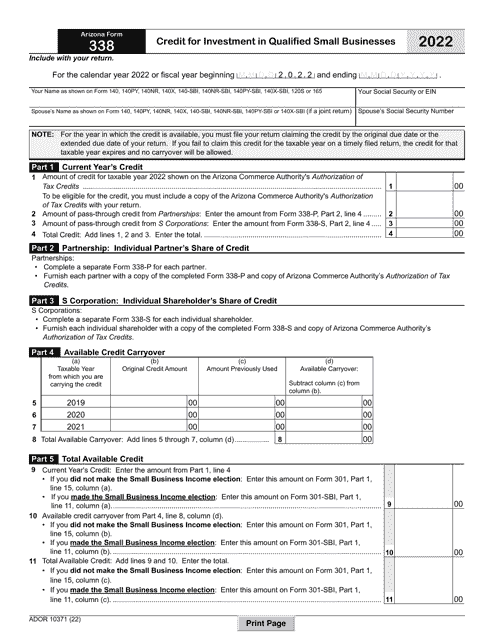

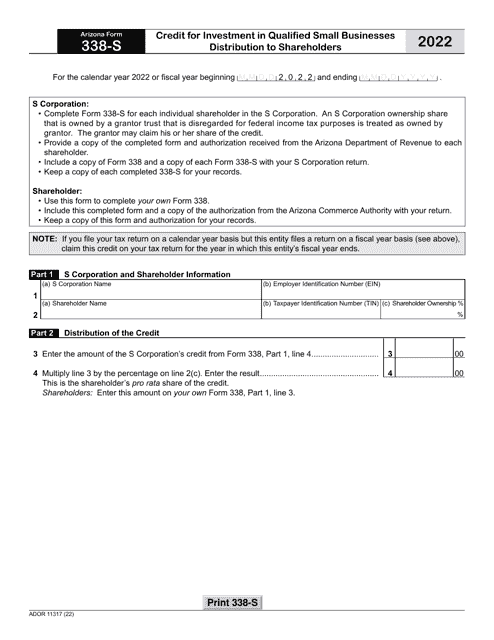

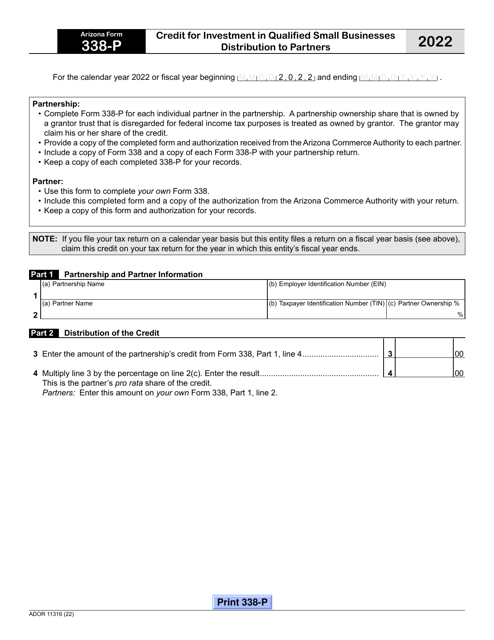

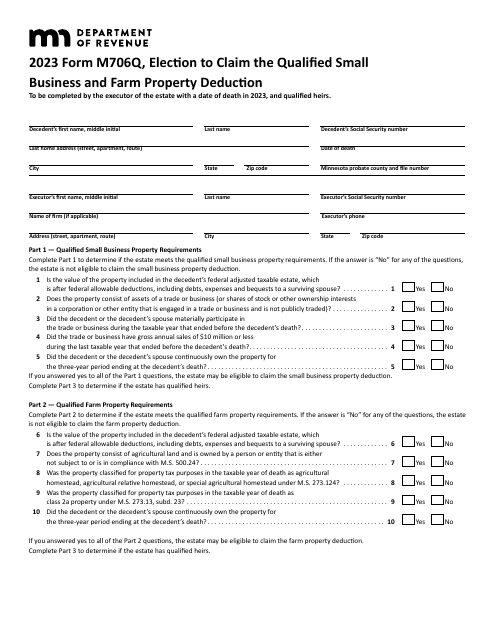

Whether you're in Arizona, Minnesota, or any other state, this collection has all the forms and instructions you need to take advantage of various tax credits and deductions. For example, you can find forms such as the Form M706Q Election to Claim the Qualified Small Business and Farm Property Deduction in Minnesota or the Arizona Form 338-S (ADOR11317) Credit for Investment in Qualified Small Businesses Distribution to Shareholders.

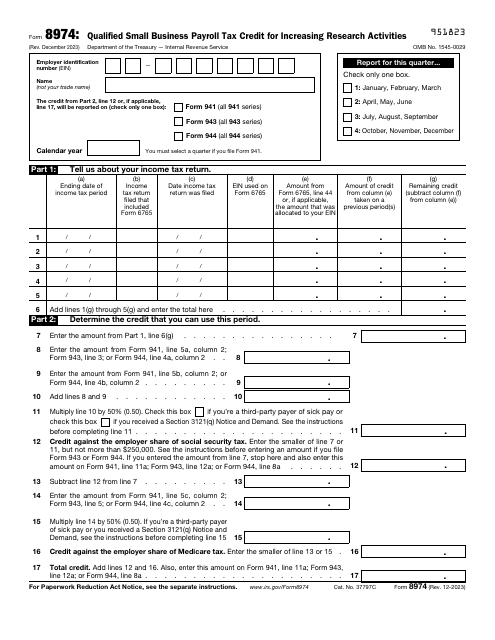

If you're interested in the Qualified Small Business Payroll Tax Credit for Increasing Research Activities, the IRS Form 8974 is available here too. No matter what specific tax credit or deduction you're looking to claim, this document group has you covered.

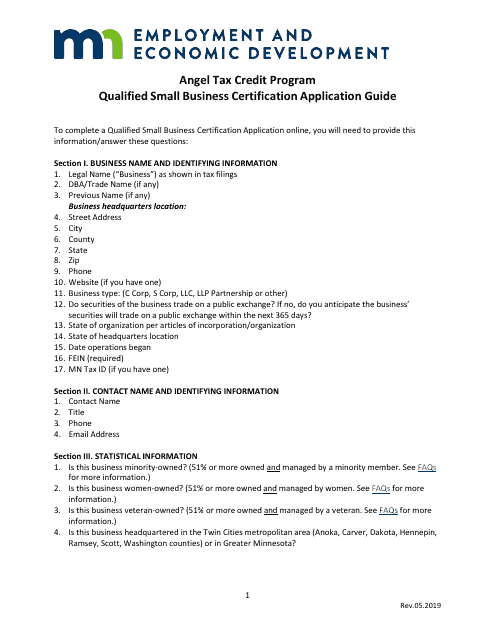

In addition to tax-related documents, you'll also find instructions for the Qualified Small Business Certification Application under the Angel Tax Credit Program in Minnesota. This application can help you access funding opportunities and support for your small business, allowing you to take your venture to the next level.

Don't miss out on the benefits available to qualified small businesses. Explore this document group today to find the resources you need to maximize your tax savings and access funding opportunities. With alternate names such as "qualified small businesses" or "qualified small business collection," this collection is a one-stop-shop for all your small business needs. Start browsing now to unlock the potential of your business.

Documents:

18

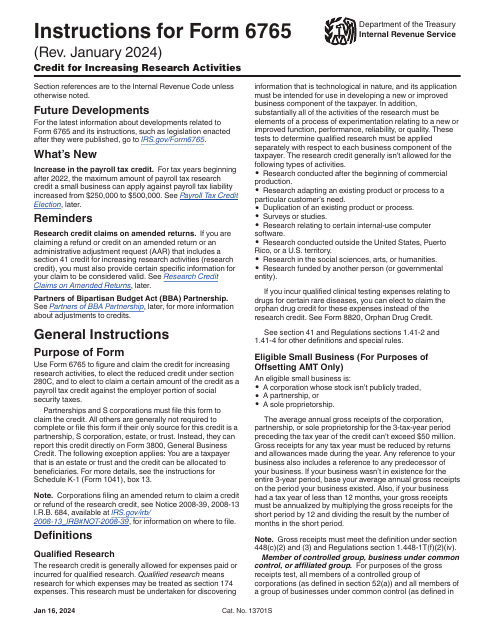

This is a document you may use to figure out how to properly complete IRS Form 6765

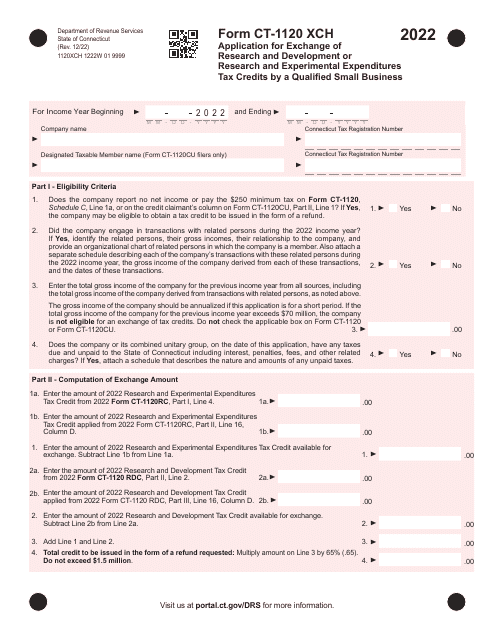

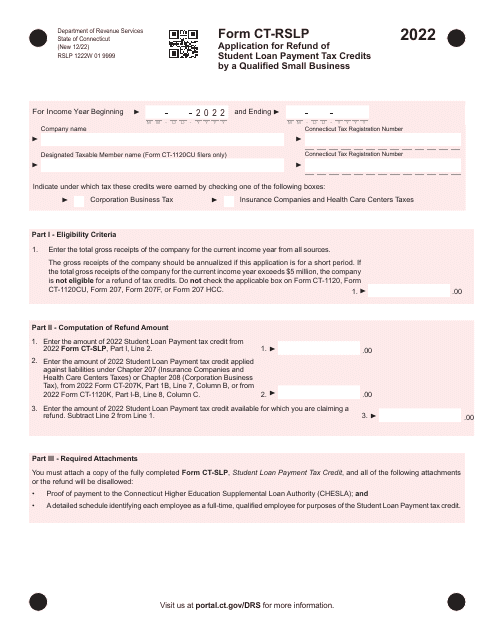

This document is used to apply for a refund of student loan payment tax credits by a qualified small business in Connecticut.

This form is used for applying for Qualified Small Business Certification under the Angel Tax Credit Program in Minnesota. It provides instructions on how to complete the application and apply for the program.

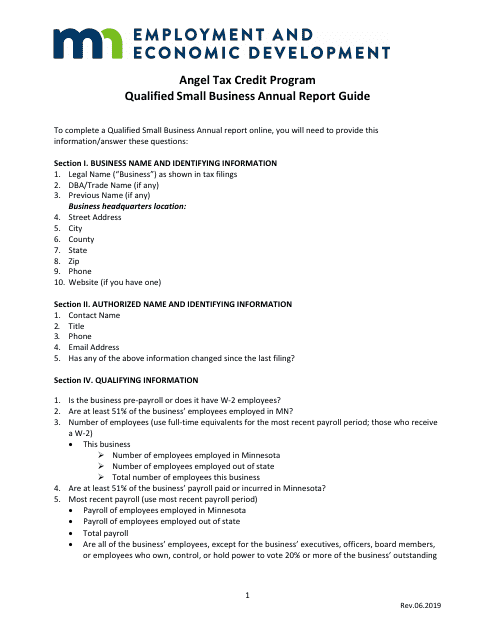

This document provides instructions for completing the Qualified Small Business Annual Report for the Angel Tax Credit Program in Minnesota. It outlines the requirements and details needed for reporting on the program's tax credits.

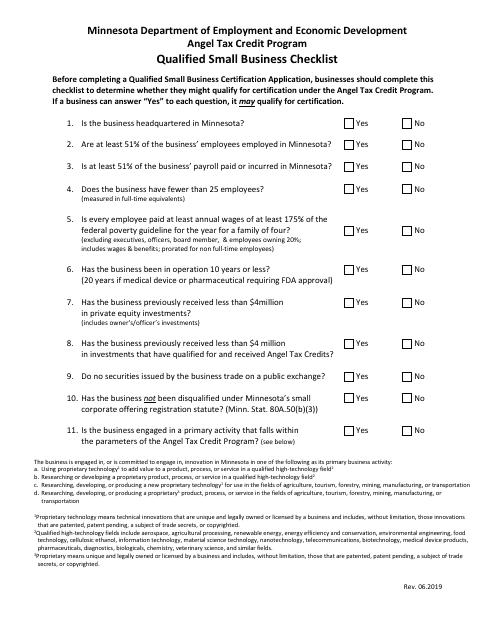

This document is a checklist for qualified small businesses in Minnesota to apply for the Angel Tax Credit Program. It provides step-by-step instructions and requirements to determine eligibility for the program.