Unrelated Business Income Templates

Unrelated Business Income - Resources for Nonprofit Organizations

Welcome to our webpage dedicated to providing information and resources about unrelated business income for nonprofit organizations. Understanding unrelated business income (UBI) is crucial for nonprofits as it can have implications for their tax-exempt status and financial obligations. We are here to guide you through the complexities of UBI and ensure your organization remains compliant with tax laws.

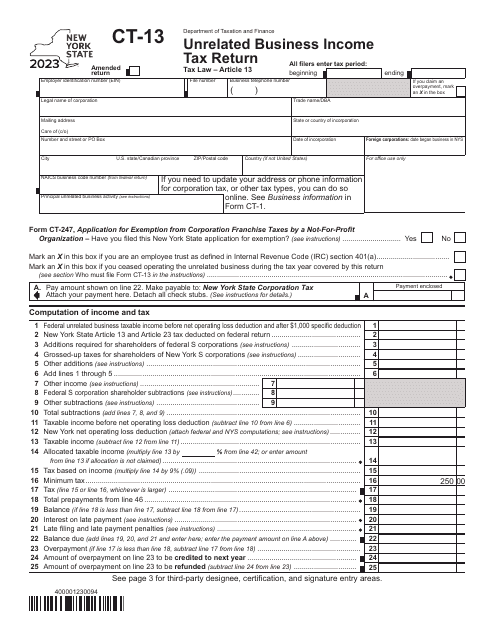

Our page serves as a comprehensive resource, offering guidance, forms, and instructions related to UBI. Whether you are a nonprofit based in Indiana, Connecticut, or any other state, we have valuable information tailored to your specific needs.

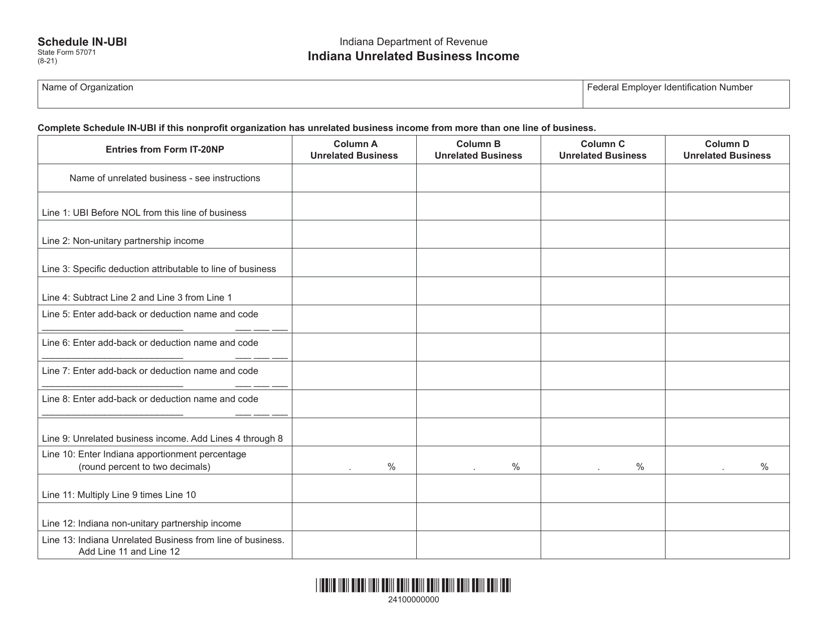

Learn about UBI reporting requirements in Indiana by accessing the Instructions for Form IT-20NP, State Form 148 Indiana Nonprofit Organization Unrelated Business Income Tax Return. This document provides step-by-step instructions on how to report UBI and file tax returns in Indiana. Additionally, the State Form 57071 Schedule IN-UBI Indiana Unrelated Business Income offers a detailed overview of what constitutes UBI in the state.

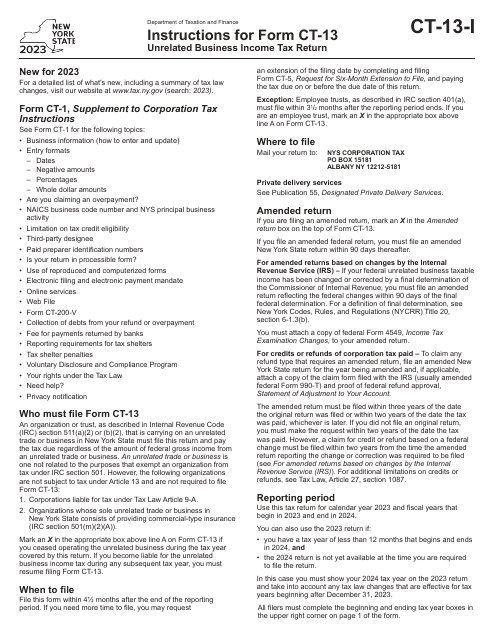

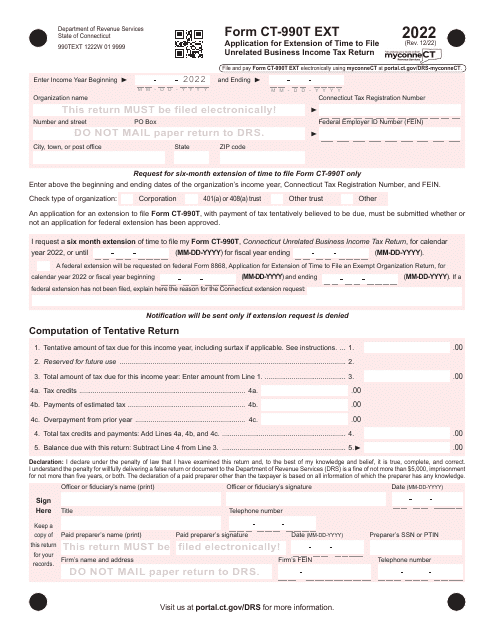

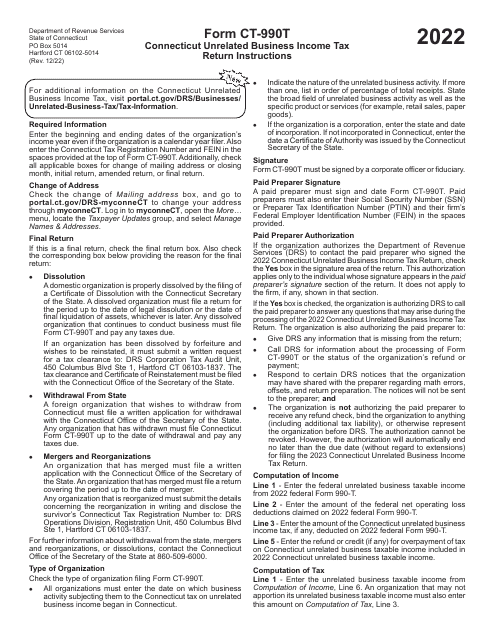

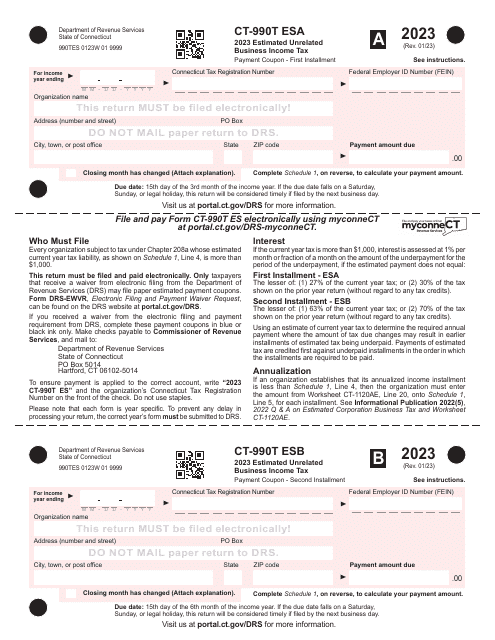

Connecticut-based nonprofits can find valuable resources in the Instructions for Form CT-990T Connecticut Unrelated Business Income Tax Return. This document provides guidance on reporting UBI and filing tax returns specific to Connecticut. Moreover, the Form CT-990T EXT Application for Extension of Time to File Unrelated Business Income Tax Return is available for organizations that require additional time to meet their filing obligations.

We understand that staying compliant with UBI regulations can be complex and time-consuming. That's why we have compiled these resources to simplify the process for nonprofits. By providing access to essential forms and instructions, we empower organizations to navigate the intricacies of UBI and ensure their financial operations remain in compliance with tax laws.

At [Organization Name], we are dedicated to supporting nonprofit organizations across the United States in fulfilling their missions. Whether you are just starting to familiarize yourself with UBI or require specific information related to your state's regulations, our webpage is your go-to resource. Take advantage of the expert guidance and forms available to ensure your nonprofit remains on solid ground and can continue making a positive impact in your community.

Please note that the information provided on this page is for informational purposes only and should not be considered legal or tax advice. We recommend consulting with a professional tax advisor or attorney for specific questions or concerns related to your organization's UBI obligations.

Documents:

11

This Form is used for reporting Indiana Unrelated Business Income for organizations in Indiana.

This form is used for making estimated tax payments for unrelated business income tax in Connecticut.