Charitable Purpose Templates

Are you looking to start or work with a charitable organization? Perhaps you're interested in supporting a cause that aligns with your values and want to ensure that your donations are being used for their intended charitable purposes. In order to maintain transparency and accountability, there are several documents and forms that must be filed and registered with the appropriate authorities.

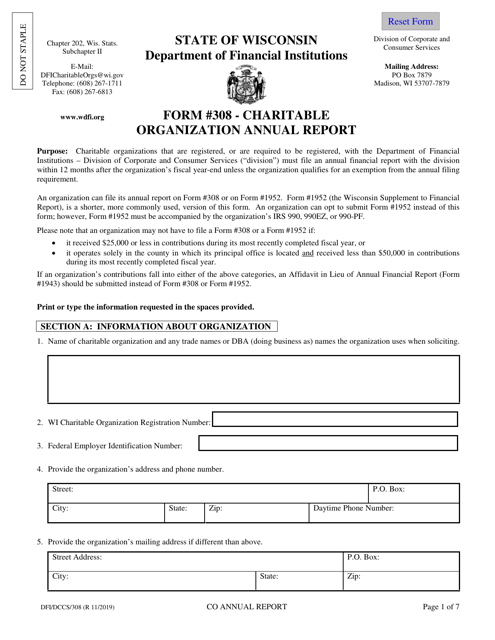

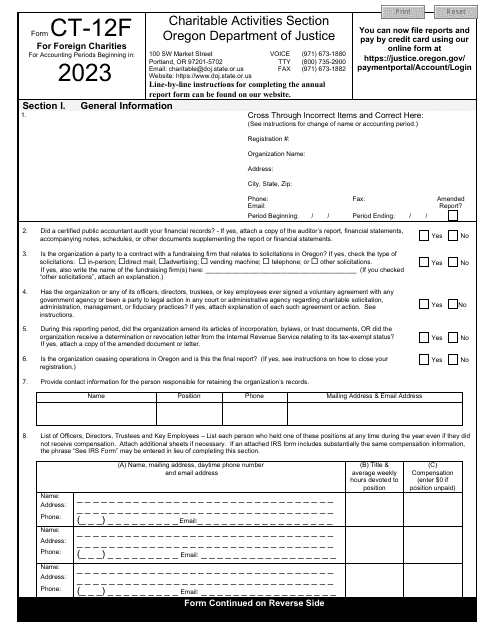

One important document is the Charitable Organization Annual Report, which is required by the state of Wisconsin. This report provides details about the organization's activities, finances, and any other relevant information that demonstrates its compliance with charitable purpose regulations.

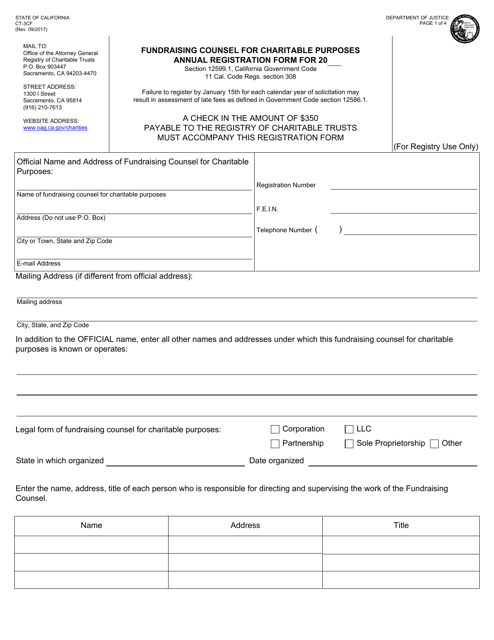

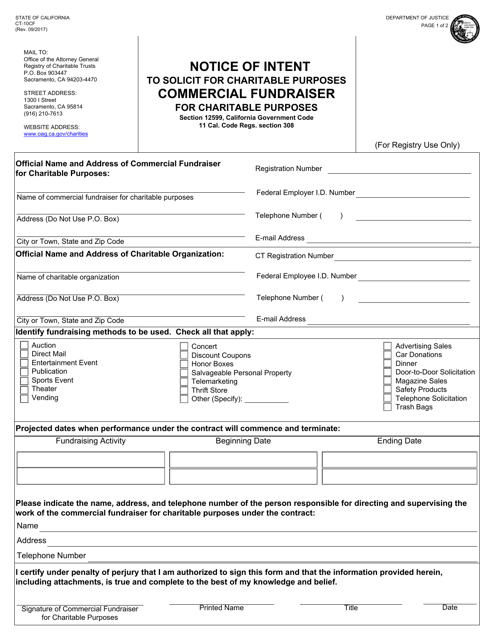

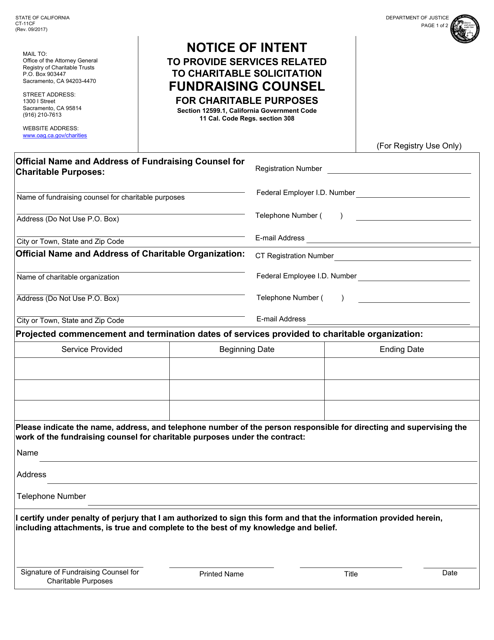

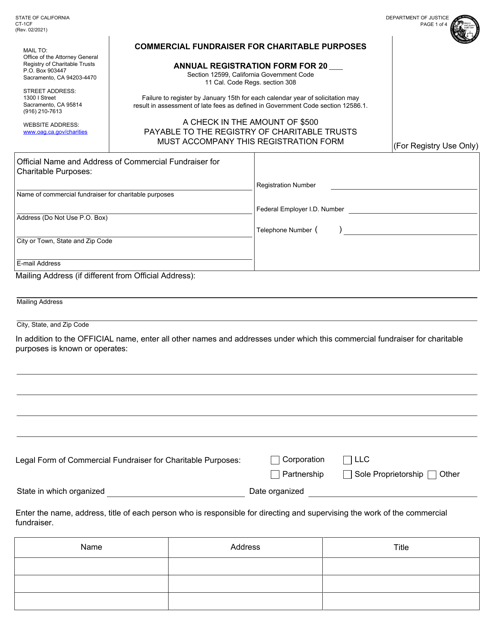

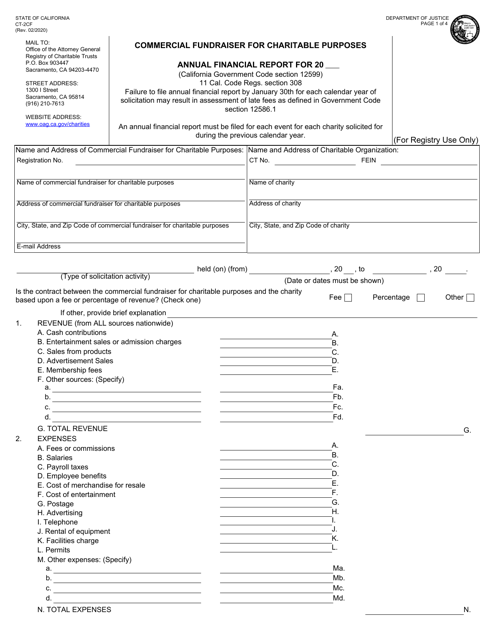

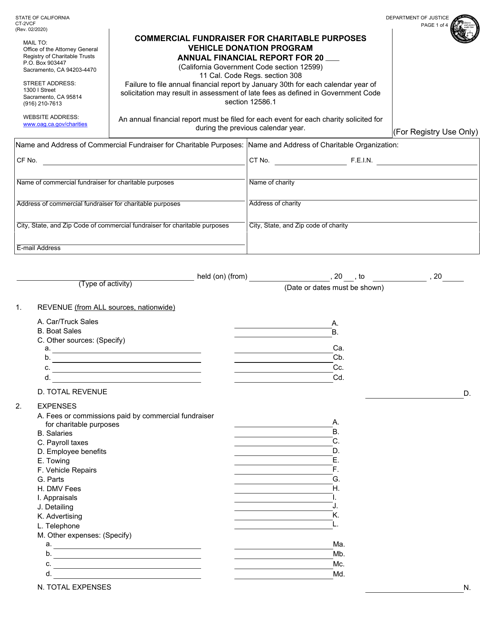

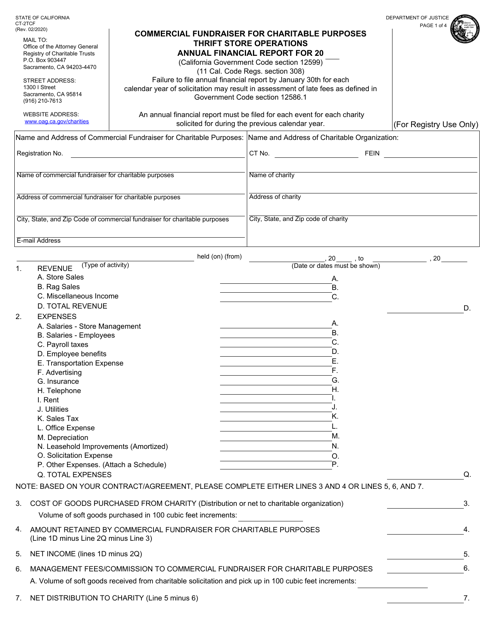

Another essential document is the Commercial Fundraiser for Charitable Purposes Annual Registration Form. This form, specific to the state of California, is necessary for any commercial entity that is engaged in fundraising activities on behalf of charitable organizations. It ensures that the fundraiser is operating within the legal framework and is transparent about the allocation and distribution of funds.

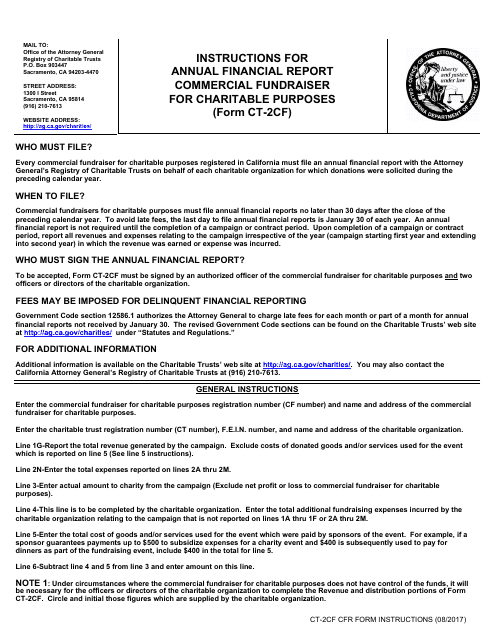

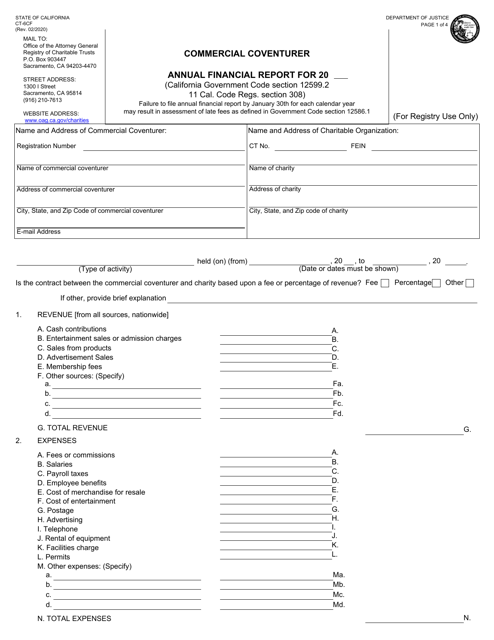

To further promote transparency, the Annual Financial Report for Commercial Fundraisers for Charitable Purposes is also required in California. This report provides detailed financial information, including revenue sources, expenses, and the percentage of funds raised that are allocated to charitable purposes.

In addition to these documents, there may be other forms and statements that need to be filed depending on the specific requirements of the state in which the charitable organization operates. These documents help to protect against fraudulent activity and ensure that charitable funds are being used appropriately.

At USA, Canada, and other countries document knowledge system, we understand the importance of compliance and transparency in the realm of charitable purposes. Our extensive collection of documents and resources can assist you in navigating the requirements and regulations associated with charitable organizations. With our guidance, you can ensure that your organization or the entity you are supporting is operating within the legal guidelines and fulfilling its charitable purpose.

Documents:

25

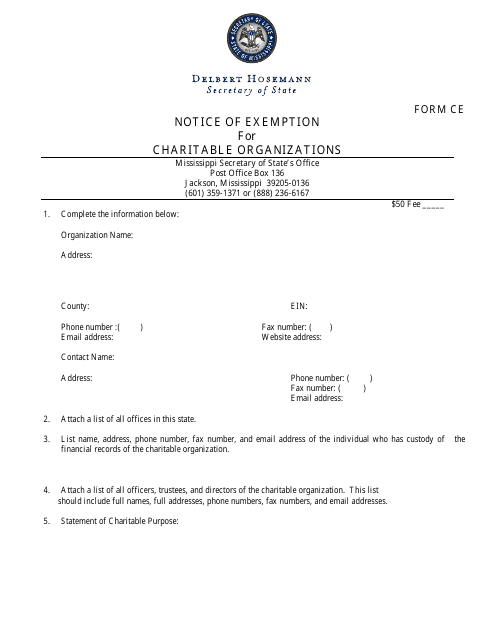

This form is used for charitable organizations in Mississippi to apply for an exemption from certain taxes.

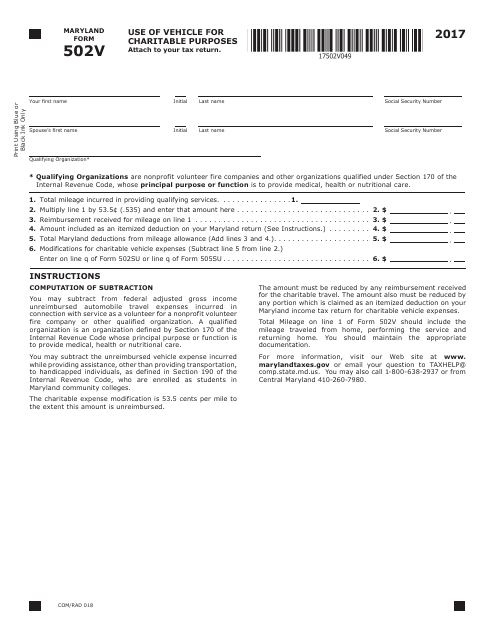

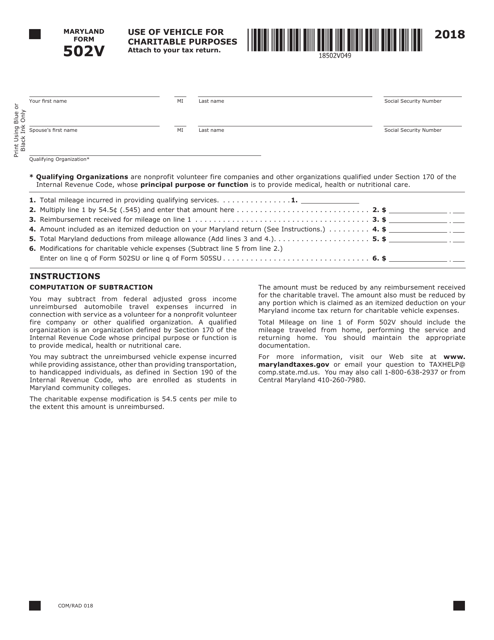

This form is used for reporting the use of a vehicle for charitable purposes in Maryland.

This Form is used for filing the Annual Financial Report for Commercial Fundraisers for Charitable Purposes in California. The form provides instructions on how to report financial information for these types of fundraising activities.

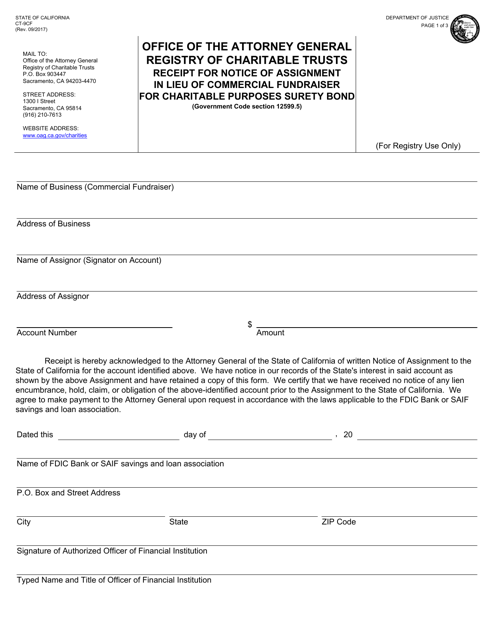

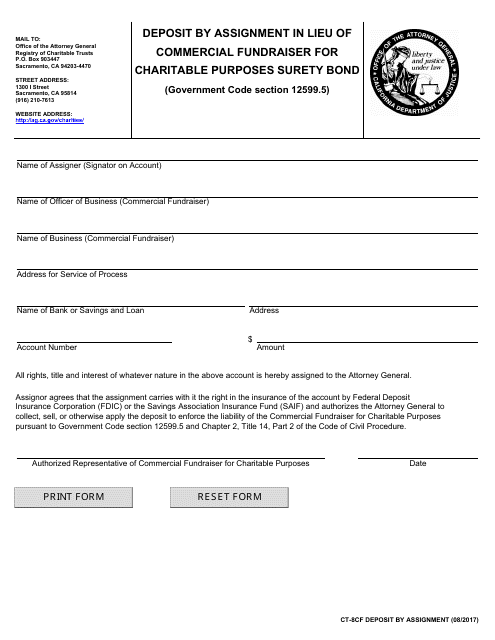

This form is used for depositing a surety bond by assigning it in lieu of hiring a commercial fundraiser for charitable purposes in California. It ensures that the funds raised are properly managed and protected.

This form is used for reporting charitable purposes in the state of Maryland. It is specifically known as Maryland Form 502V.

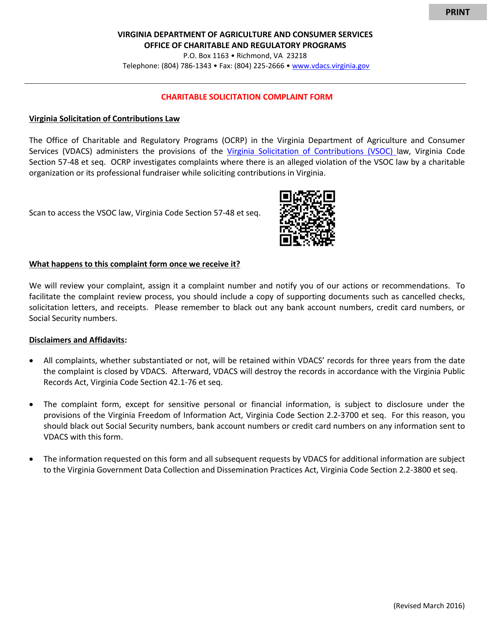

This Form is used for reporting charitable solicitation compliance in the state of Virginia. It ensures that organizations are following the necessary rules and regulations for soliciting donations.

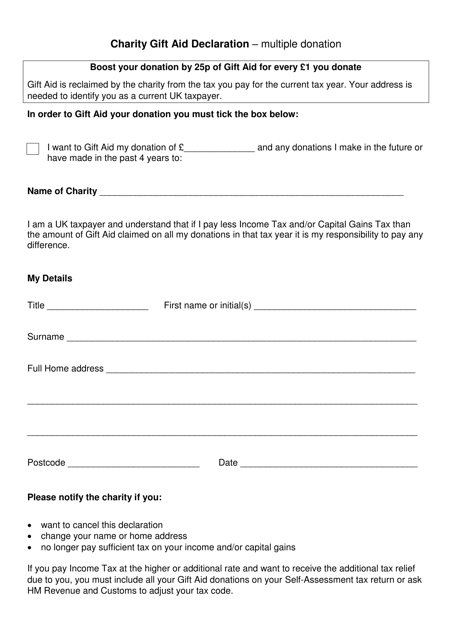

This document is used for multiple donations in the United Kingdom to declare Gift Aid and maximize the value of charitable contributions.

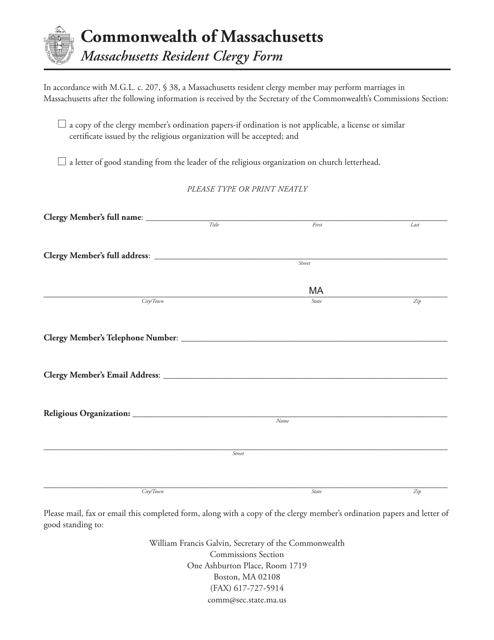

This Form is used for residents of Massachusetts who are clergy members. It is a document that clergy members in Massachusetts need to complete and submit for tax purposes or certain legal requirements.

This form is used for filing the annual report for charitable organizations in the state of Wisconsin. It must be submitted by qualifying organizations to maintain their non-profit status and provide information about their activities and finances.

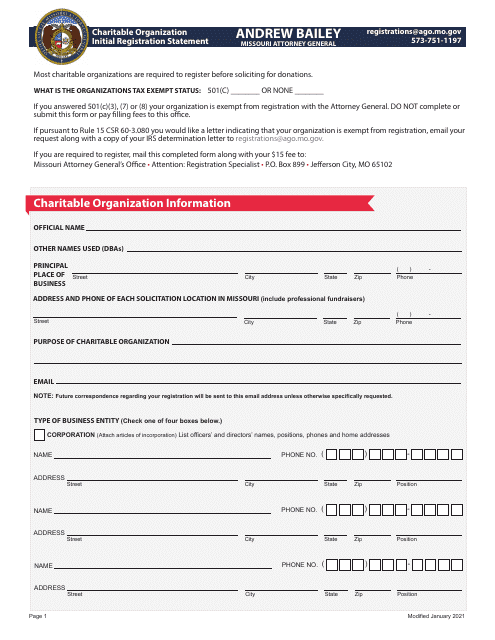

This document is used for the initial registration of a charitable organization in the state of Missouri. It is required to provide information about the organization's purpose, activities, and financial details in order to be recognized as a charitable entity in the state.