Beneficiary Income Templates

Are you a beneficiary? Do you receive income from a trust, estate, or other sources? Understanding and managing your beneficiary income is crucial for financial planning and compliance. This collection of documents provides valuable information and resources to help you navigate the complexities of beneficiary income.

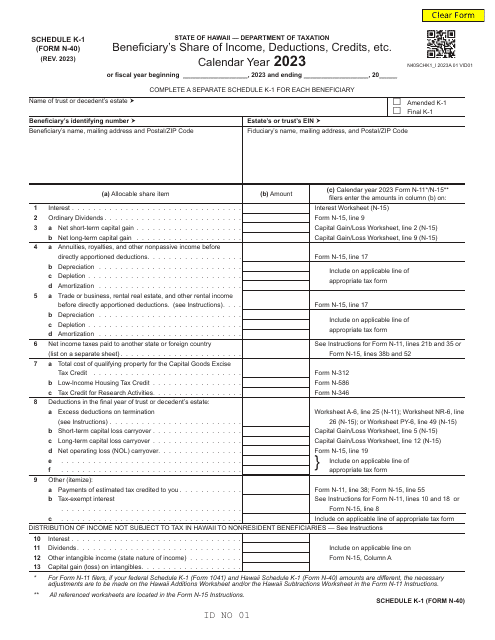

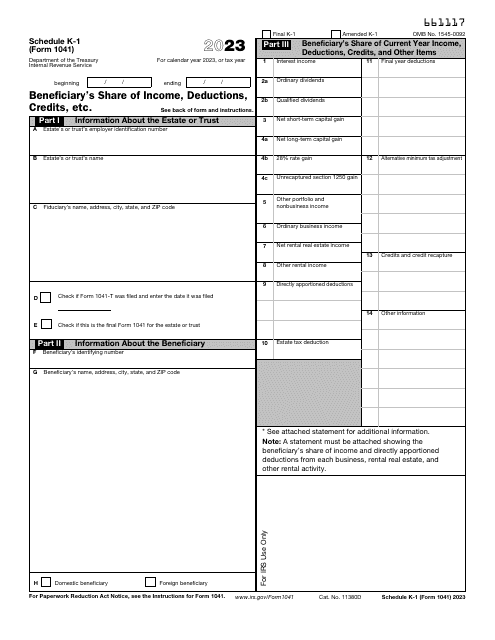

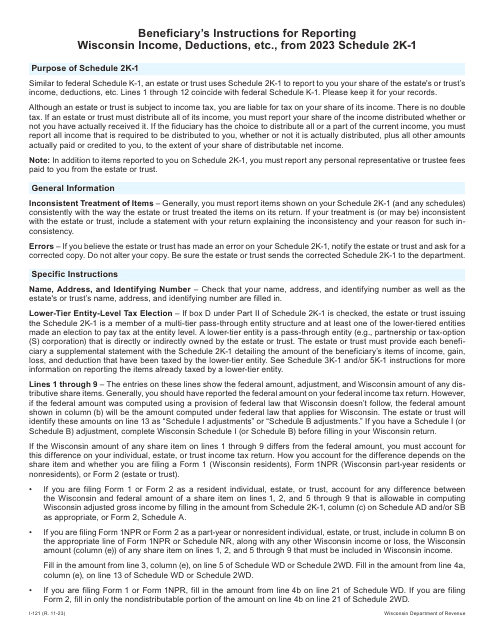

From tax forms to instructions, these documents cover a range of scenarios and requirements. For example, you may come across Form N-40 Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc. - Hawaii or IRS Form 1041 Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc. These forms help report your income and deductions accurately to the relevant authorities.

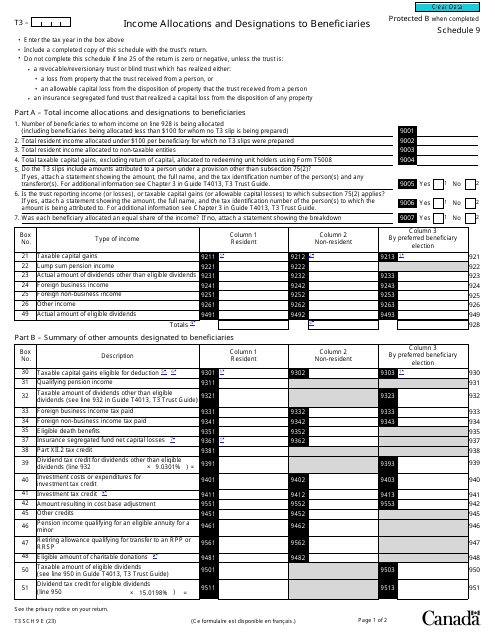

If you reside in Canada, you might encounter Form T3 Schedule 9 Income Allocations and Designations to Beneficiaries. This form is specific to Canadian beneficiaries and provides instructions on how to allocate and designate income for tax purposes.

It's worth noting that beneficiary income can go by different names, such as beneficiary's income or even beneficiarys income. No matter the terminology, these documents are designed to help you manage your income effectively.

Whether you're a beneficiary in the United States or Canada, these documents serve as essential resources. They guide you through the process of reporting, allocating, and designating income, ensuring compliance and proper financial planning. Stay informed and empowered with this comprehensive collection of beneficiary income documents.

Documents:

5