Property Transfer Tax Templates

Are you looking to understand the requirements and procedures for property transfers? Are you wondering about the applicable property transfer taxes and how to comply with them? Our website provides valuable information and resources related to property transfer taxes, also known as property tax transfers or property transfer tax forms.

Property transfer taxes are imposed by states and provinces to collect revenue when ownership of a property is transferred from one party to another. These taxes serve as an important source of income for the government and are typically calculated based on the property's value or sale price.

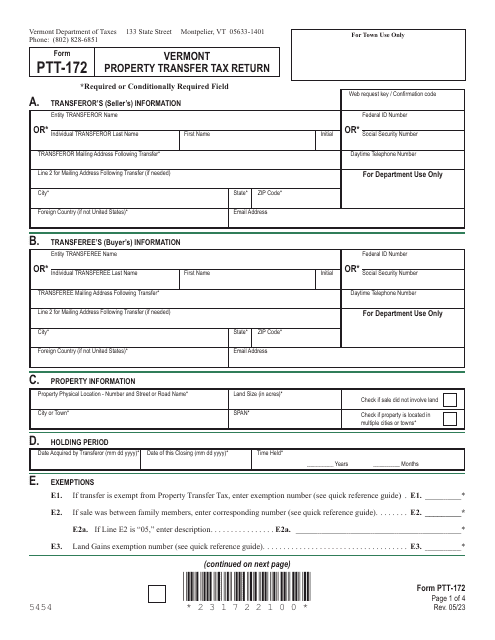

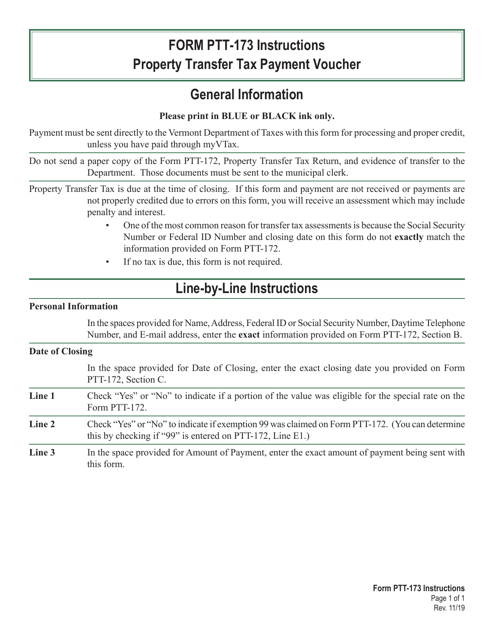

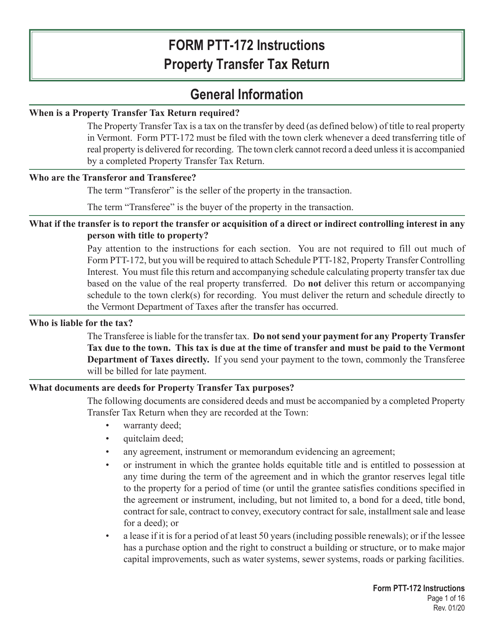

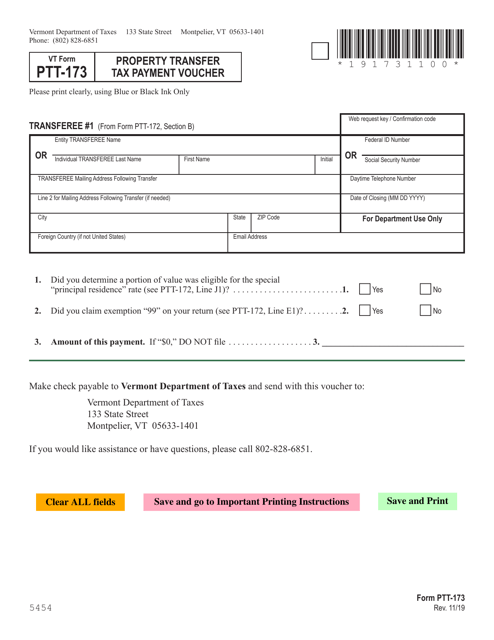

Whether you are a buyer, seller, or real estate professional, understanding the property transfer tax requirements for your jurisdiction is crucial. Our website offers a comprehensive collection of resources, including forms, instructions, and payment vouchers from various states and provinces, such as the VT Form PTT-172 Vermont Property Transfer Tax Return and the VT Form PTT-173 Property Transfer Tax Payment Voucher.

By exploring our website, you will find detailed instructions on how to complete the necessary forms and fulfill your property transfer tax obligations. We strive to provide helpful guidance to ensure a smooth and compliant property transfer process.

Don't let the complexities of property transfer taxes overwhelm you. Visit our website today to access the information and resources you need to navigate the property transfer tax landscape with ease.

Documents:

9

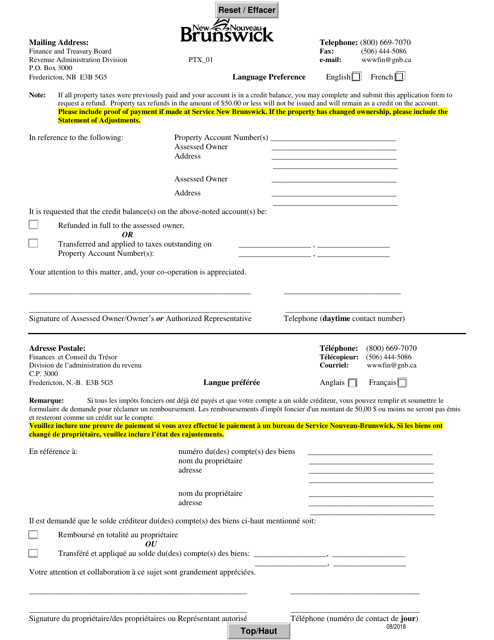

This form is used for applying for a property tax refund or transfer in New Brunswick, Canada. It is available in both English and French.

This form is used for making payments for property transfer taxes in Vermont.