Earnings Withholding Order Templates

Are you a resident of California who owes taxes to the state? If so, you may be familiar with the process of an earnings withholding order or wage garnishment. This legal document allows the state to collect unpaid taxes directly from your earnings, ensuring that your tax liability is addressed.

An earnings withholding order, sometimes referred to as a wage garnishment, is a formal notice issued by the state to your employer. It informs them that a portion of your wages must be withheld and paid directly to the state to satisfy your tax debt. This process is designed to ensure that individuals fulfill their tax obligations and contribute their fair share to the state's revenue.

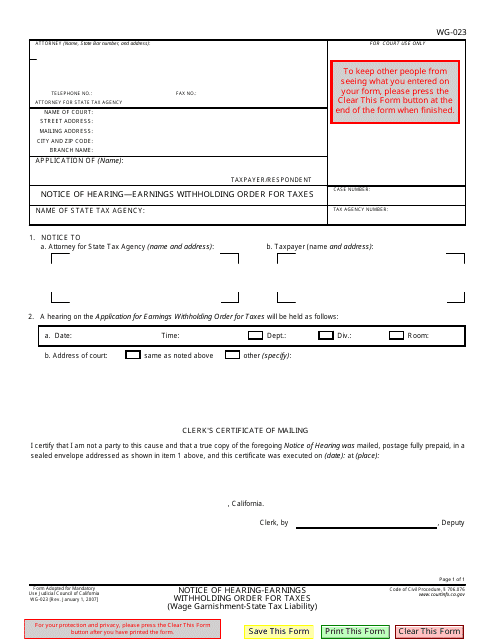

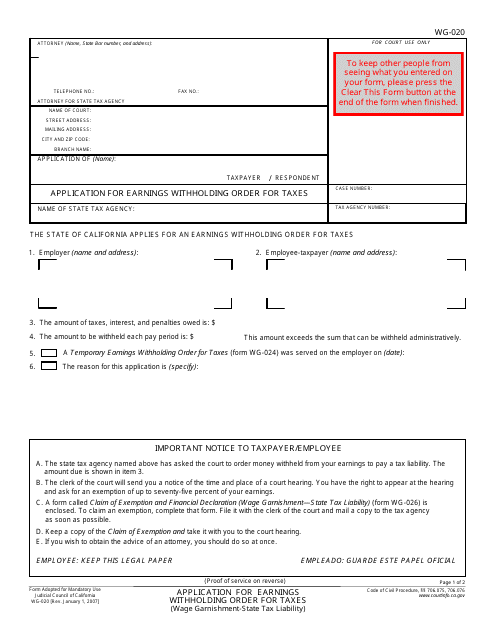

In California, there are various forms associated with this procedure, such as the Form WG-023 Notice of Hearing - Earnings Withholding Order for Taxes and Form WG-020 Application for Earnings Withholding Order for Taxes (State Tax Liability). These forms outline specific details about the order, such as the amount to be withheld and the duration of the garnishment.

By implementing an earnings withholding order, the state aims to collect the taxes owed while providing you with an opportunity to address your financial obligations responsibly. This process helps maintain the integrity of the tax system by ensuring that individuals can't avoid paying their fair share.

If you find yourself facing an earnings withholding order or wage garnishment, it's crucial to seek professional guidance to understand your rights and responsibilities. A qualified tax professional or attorney can provide valuable advice and assistance throughout the process, ensuring that your interests are protected.

Remember, an earnings withholding order is a powerful tool that enables the state to collect unpaid taxes. By addressing your tax liabilities promptly and responsibly, you can avoid the need for such measures and maintain a positive financial standing.

Documents:

11

This Form is used for notifying individuals of a hearing for an Earnings Withholding Order for Taxes in the state of California.

This Form is used for applying for an Earnings Withholding Order for Taxes (State Tax Liability) in California. It allows the state to withhold a debtor's earnings to satisfy their tax liability.

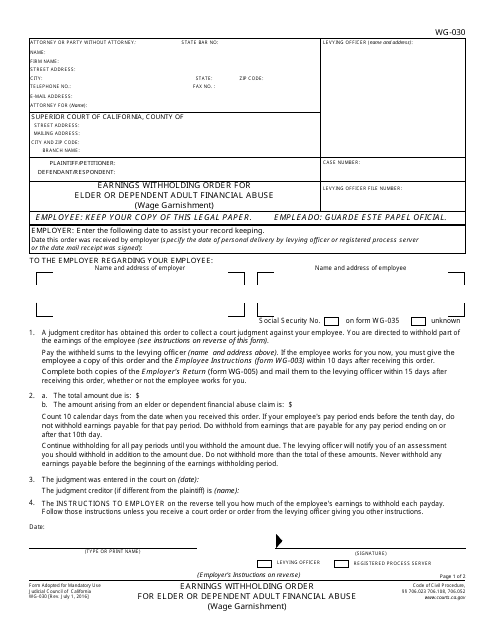

This form is used for issuing an earnings withholding order to protect elderly and dependent adults from financial abuse in the state of California.

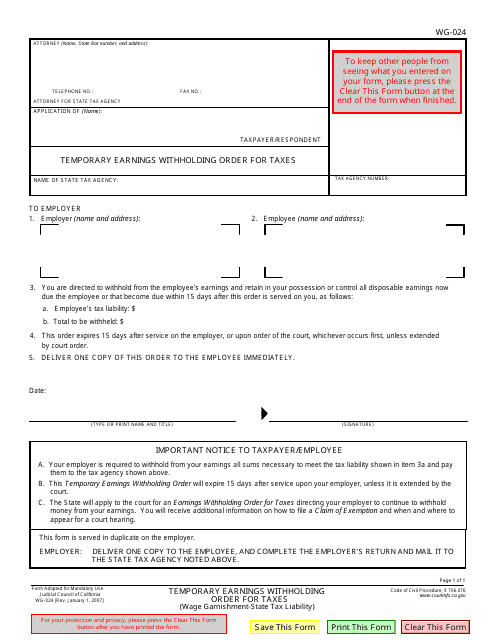

This form is used for temporarily withholding earnings for taxes in the state of California.

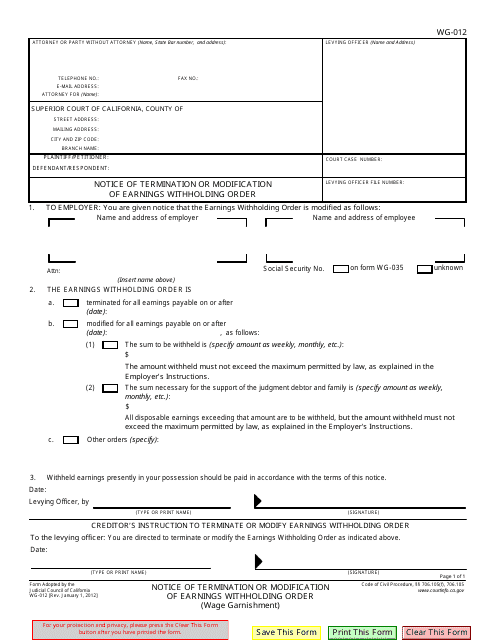

This form is used for notifying the termination or modification of an earnings withholding order in the state of California.

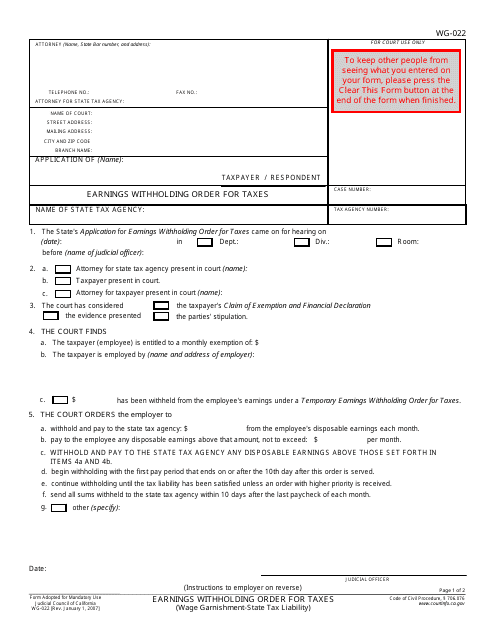

This Form is used for employers in California to withhold a portion of an employee's earnings in order to pay taxes owed to the state government. It ensures that taxes are paid on time and helps the government collect the necessary funds to fund public services.

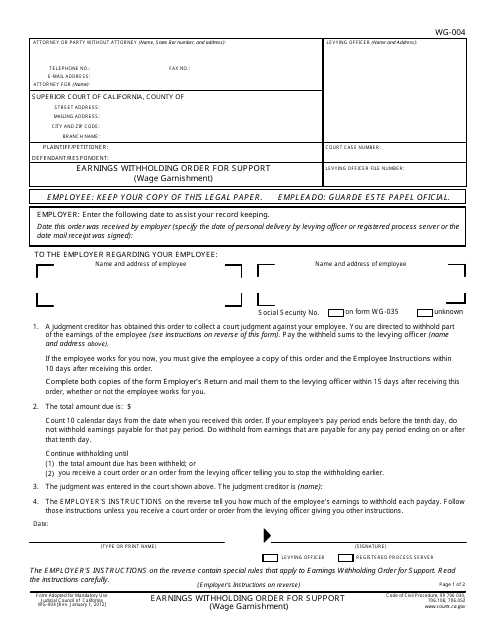

This form is used for wage garnishment in California to collect support payments.

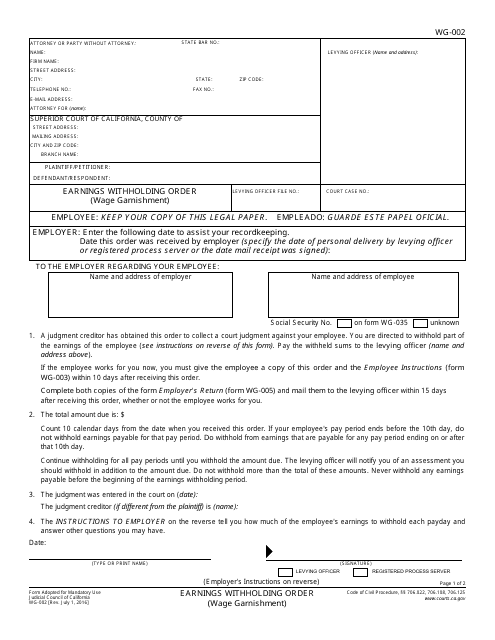

This form is used for requesting wage garnishment in California. It is known as Form WG-002 Earnings Withholding Order.

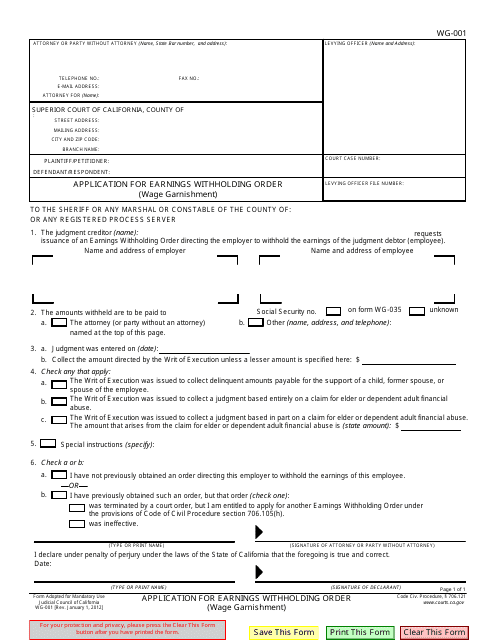

This document is used for applying for an earnings withholding order (wage garnishment) in California. It is used to collect unpaid debts by deducting a portion of the debtor's wages.

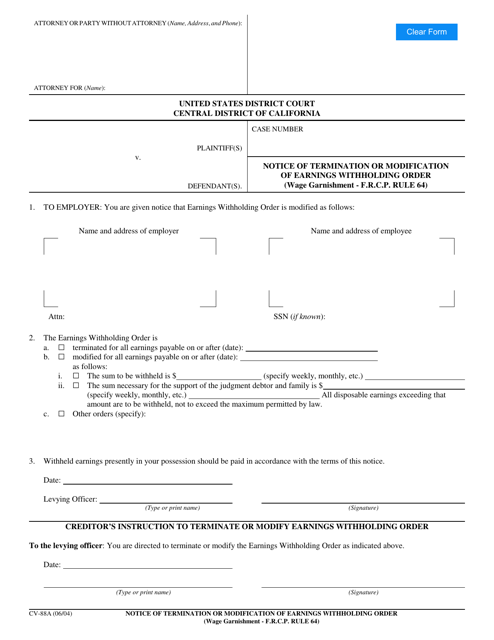

This Form is used for notifying the termination or modification of an earnings withholding order (wage garnishment) in the state of California, in accordance with the Federal Rules of Civil Procedure Rule 64.

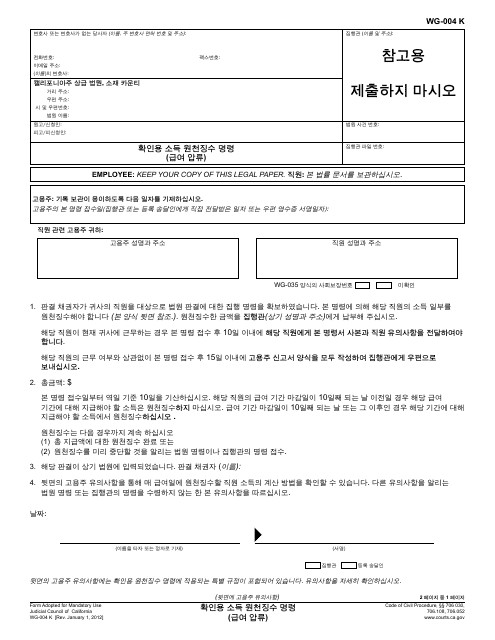

This document is used for obtaining an earnings withholding order for support, also known as wage garnishment, in California. It is specifically for cases involving Korean language.