Railroad Taxes Templates

Are you looking for information on railroad taxes or railway taxes? Look no further! Our website provides a comprehensive resource on the taxation of railroad companies and private rail car owners. Whether you are a railroad company or an individual with a private rail car, understanding your tax obligations is essential.

Railroad taxes, also known as railway taxes or railroad tax, refer to the taxes imposed on the gross earnings of railroad companies or the ownership of private rail cars. These taxes vary from state to state, and it is crucial to comply with the specific requirements of each jurisdiction.

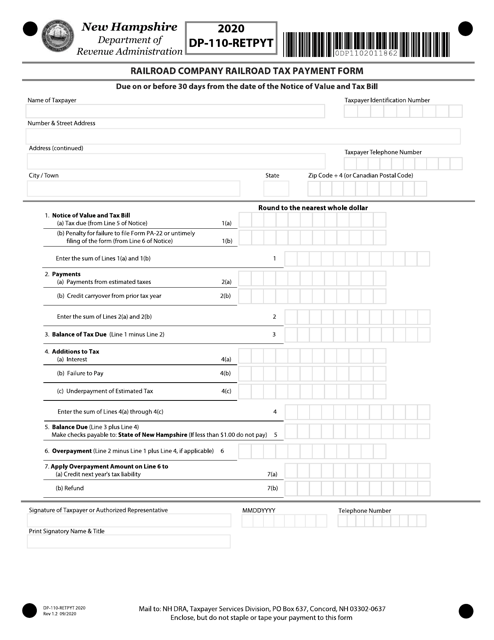

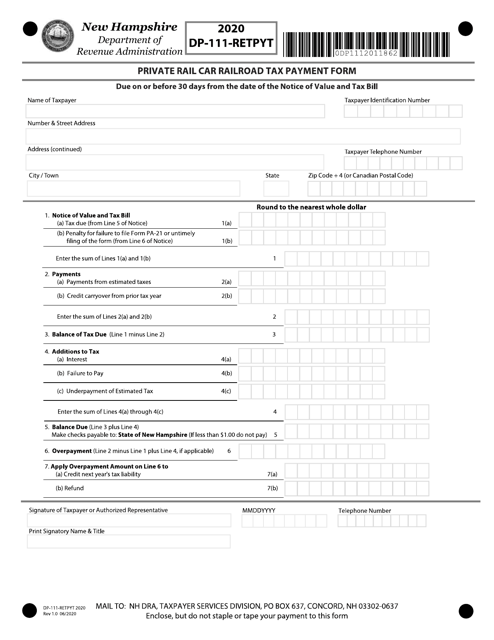

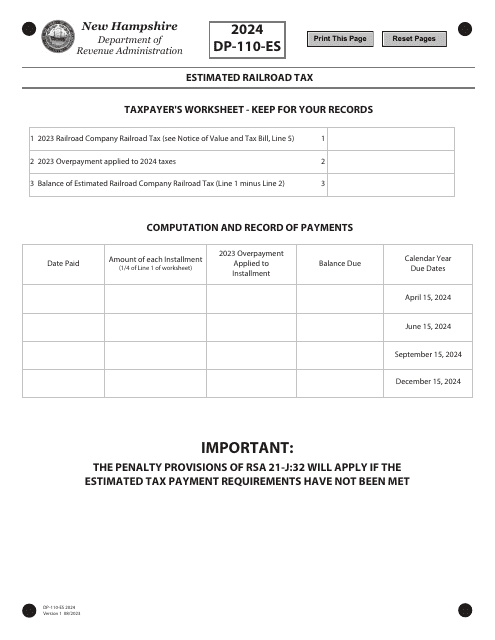

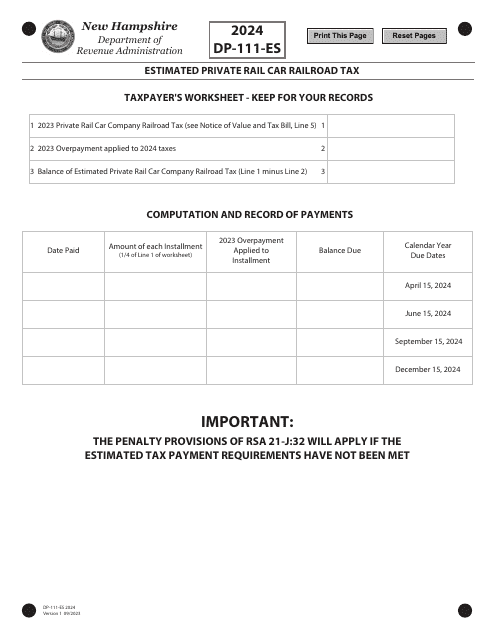

Our website offers a wealth of information on railroad tax forms and filing procedures. For example, you can find information on the Form DP-111-RETPYT Private Rail Car Railroad Tax Payment Form in New Hampshire, which is used to make tax payments for private rail cars. We also provide details on the Form DP-111-ES Estimated Private Rail Car Railroad Tax, essential for estimating and paying taxes owed in New Hampshire.

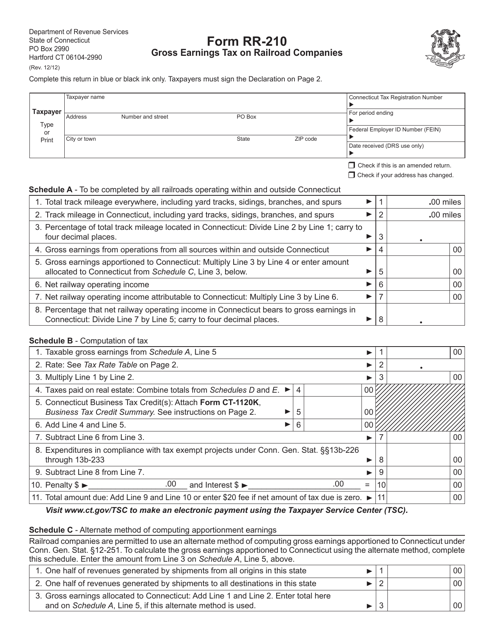

If you are a railroad company operating in Connecticut, our website provides guidance on the Form RR-210 Gross Earnings Tax on Railroad Companies. This form is necessary for reporting and paying taxes based on the gross earnings of railroad companies in Connecticut.

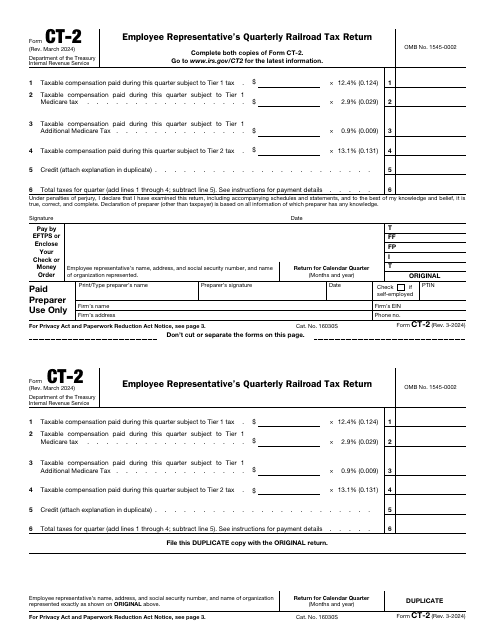

In addition to state-specific forms, we also offer information on federal taxes related to the railroad industry. For instance, the IRS Form CT-2 Employee Representative's Quarterly Railroad Tax Return is applicable to employee representatives who represent railroad workers in their dealings with the Social Security Administration.

Understanding and fulfilling your railroad tax obligations is critical to avoiding penalties and ensuring compliance with the law. Our website provides the necessary resources and guidance to navigate the complexities of railroad taxes. Stay informed and ensure you meet all your tax obligations with our comprehensive information on railroad taxes, railway taxes, and railroad tax forms.

Documents:

9

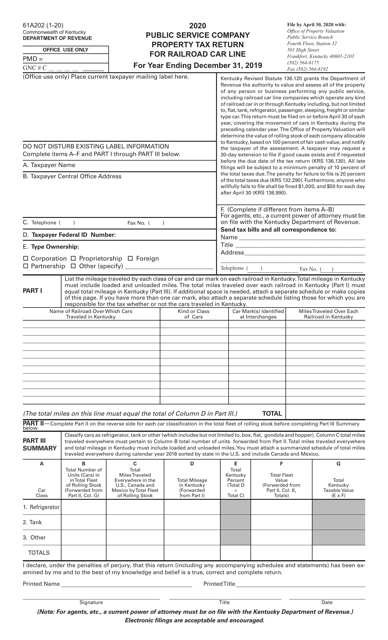

This form is used for public service companies operating railroad car lines in Kentucky to file their property tax return.

This Form is used for reporting and paying the Gross Earnings Tax on Railroad Companies in the state of Connecticut.