Sales Tax Exemption Form Templates

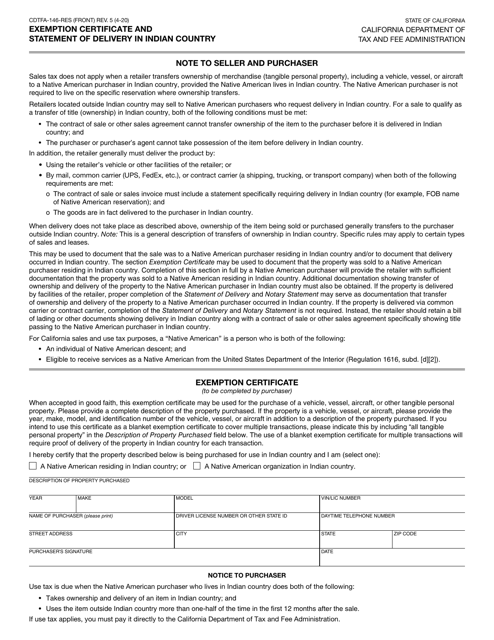

Sales tax exemption forms, also known as sales tax exempt forms or sales tax exemption documents, are official government forms that allow certain individuals or organizations to be exempt from paying sales tax on eligible purchases. These forms provide a means for individuals, businesses, and nonprofits to claim their exemptions and avoid paying unnecessary taxes.

Sales tax exemption forms are used by various entities, including nonprofit organizations, utility companies, data centers, commercial fishermen, and more, depending on the specific exemption criteria set by each state or province.

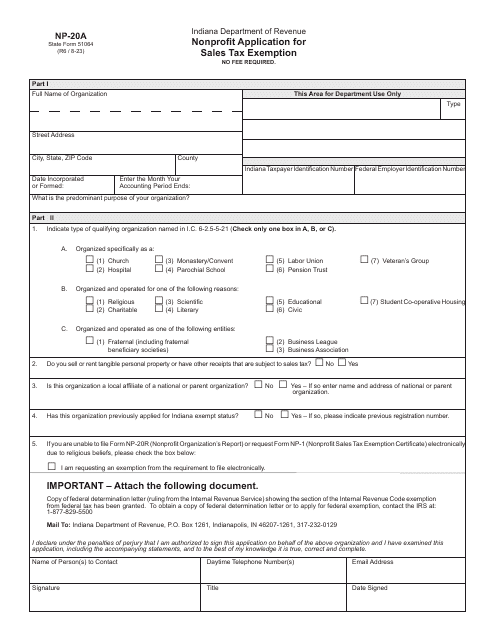

For example, in Indiana, the Form NP-20A (State Form 51064) is the Nonprofit Application for Sales Tax Exemption, while the Form ST-200 (State Form 48843) is used for Utility Sales Tax Exemption Application. These forms help eligible organizations navigate the process of applying for sales tax exemption in Indiana.

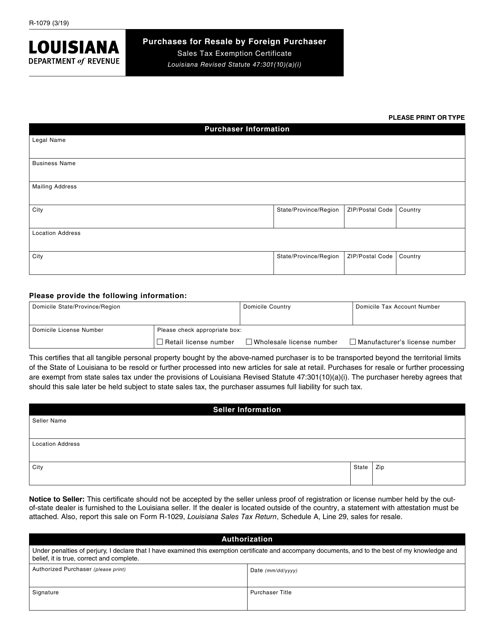

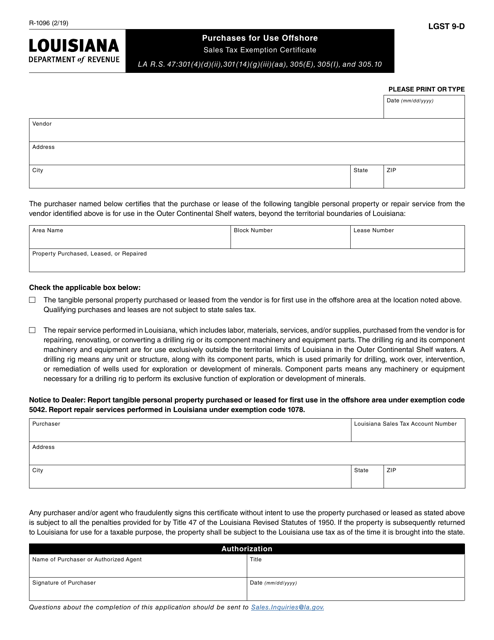

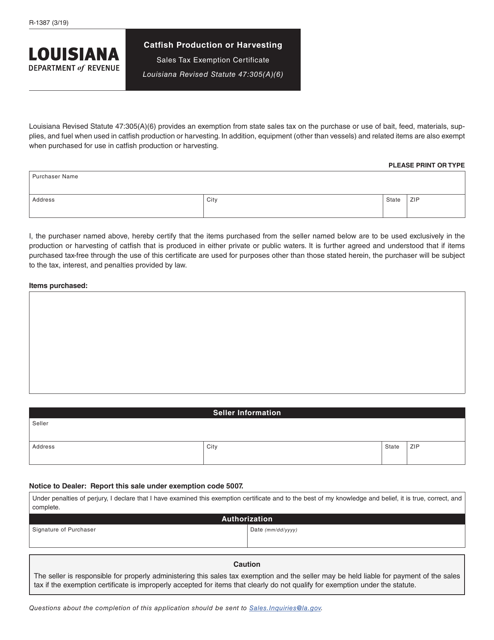

Similarly, in Louisiana, commercial fishermen can apply for a sales tax exemption using the Form R-1334 Application for Sales Tax Exemption for Commercial Fishermen. This form enables eligible fishermen to claim exemption on qualifying purchases related to their business operations in the state.

Sales tax exemption forms are not only limited to the United States but are also utilized in other countries like Canada. For instance, in Ontario, Canada, the Form 3225E Guide for Completing the Application for Refund Summary and Schedule 12 Tes specifically caters to tax-exempt sales for exports out of Ontario.

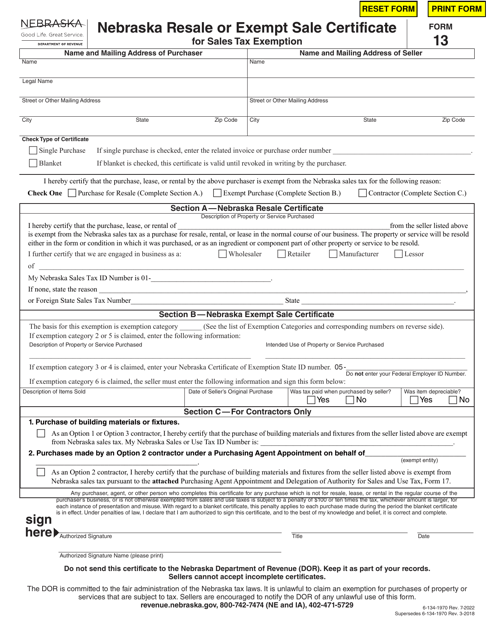

Applying for sales tax exemption can be a complex process, involving various eligibility requirements and documentation. It is crucial for individuals and organizations seeking sales tax exemption to understand the specific requirements of their jurisdiction and correctly complete the relevant forms.

By utilizing sales tax exemption forms, individuals and organizations can take advantage of the tax benefits they are entitled to and ensure compliance with the regulations set by their respective tax authorities.

If you are eligible for a sales tax exemption, it is important to consult with a tax professional or refer to the official government resources to access the appropriate form and obtain accurate guidance on completing and submitting the required documentation.

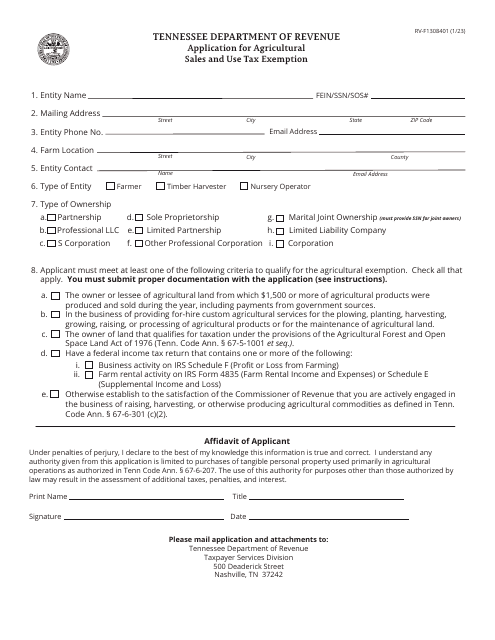

Documents:

150

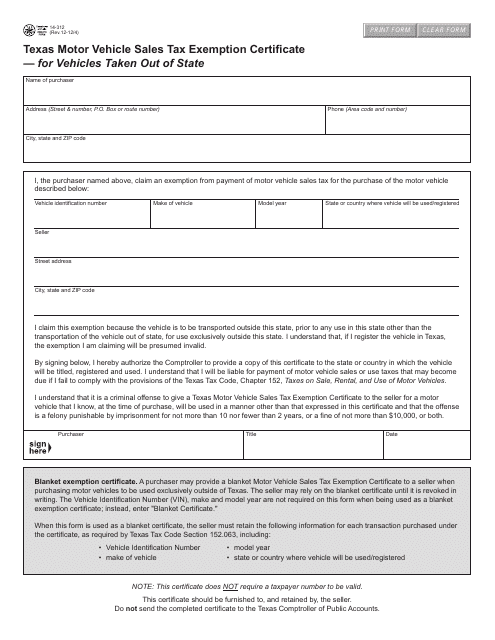

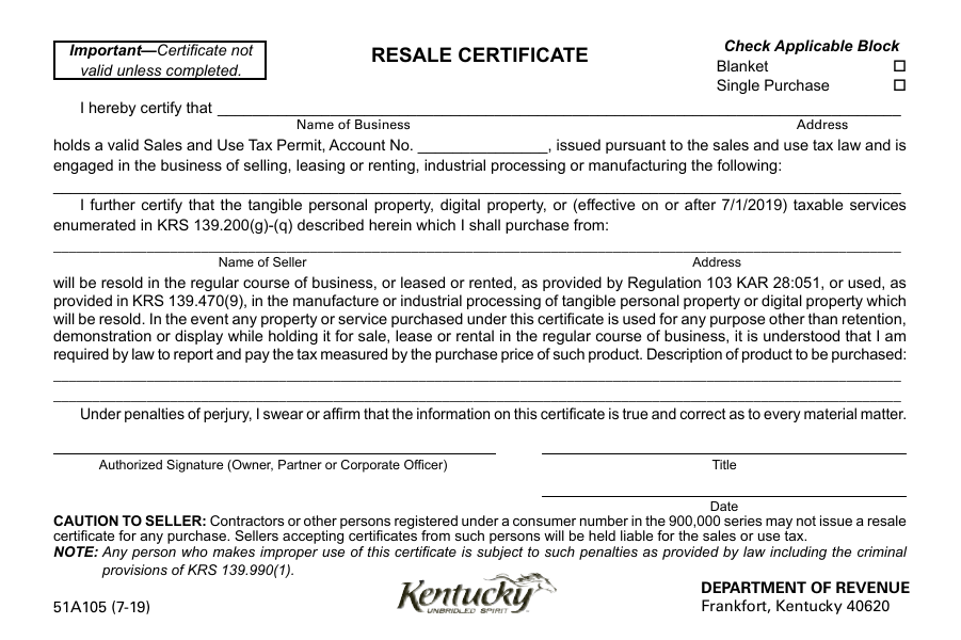

This form is used for claiming a sales tax exemption on motor vehicles that are taken out of the state of Texas.

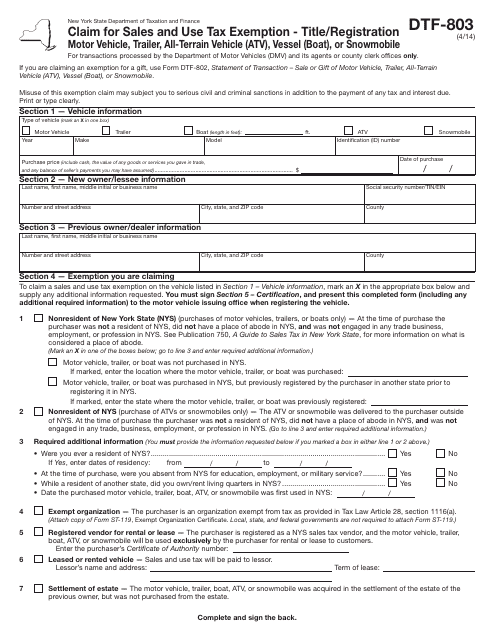

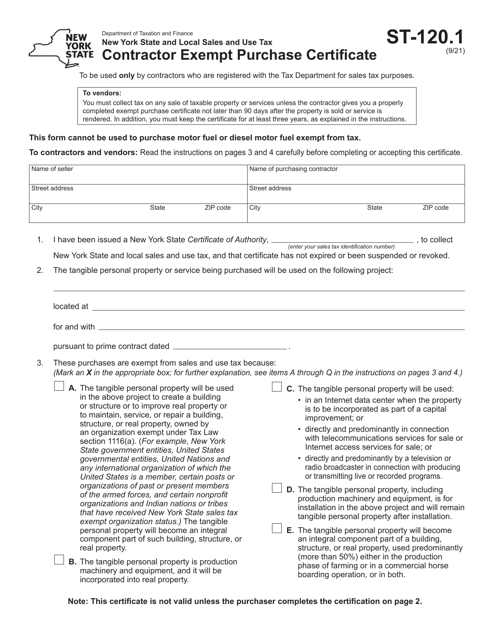

This form is used for claiming sales and use tax exemption when registering a title in New York.

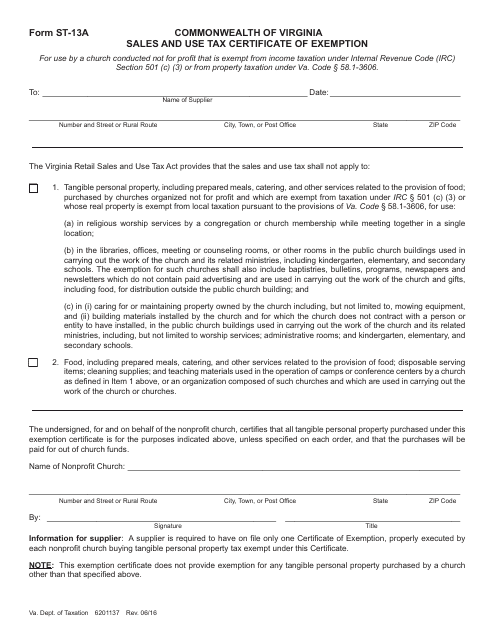

This document is used for claiming exemption from sales and use tax in Virginia. It is commonly used by individuals and organizations purchasing goods or services for certain exempt purposes.

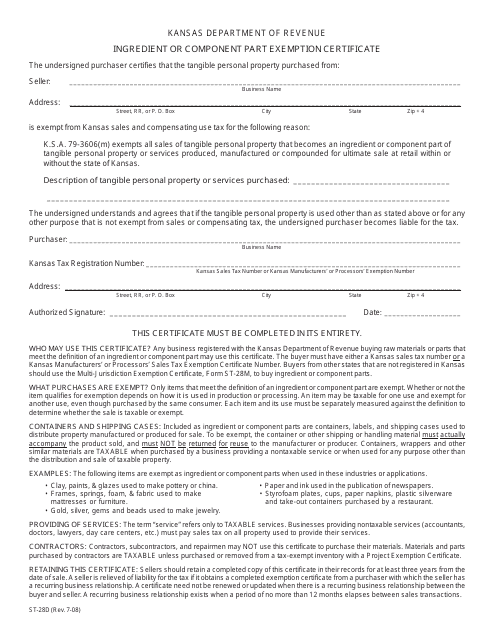

This document is used for claiming an exemption on certain ingredients or component parts in Kansas.

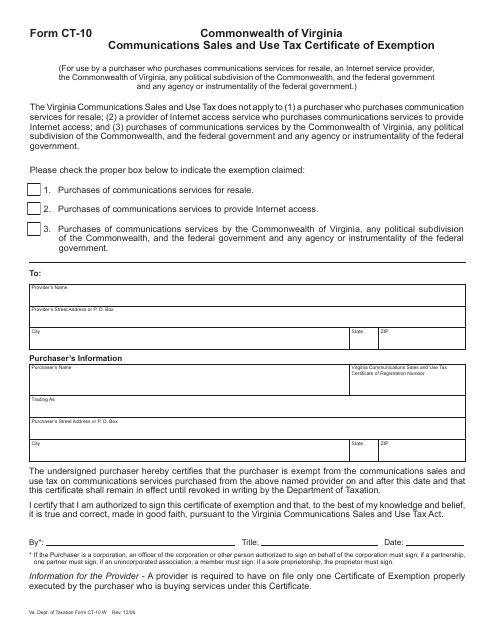

This form is used for obtaining a certificate of exemption from sales and use tax for communications services in the state of Virginia.

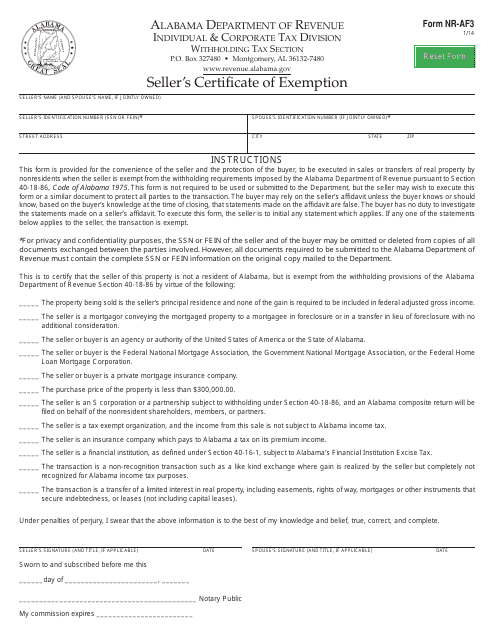

This form is used for sellers in Alabama to provide a certificate of exemption for certain transactions.

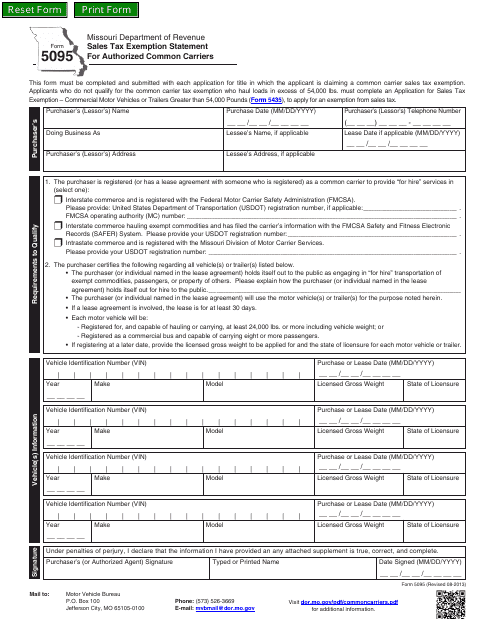

This form is used for authorized common carriers in Missouri to claim exemption from sales tax.

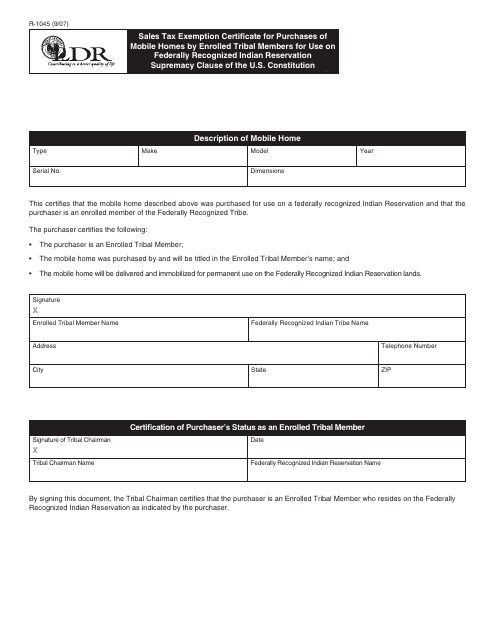

This form is used for claiming sales tax exemption on the purchase of mobile homes by enrolled tribal members for use on federally recognized Indian reservations in Louisiana.

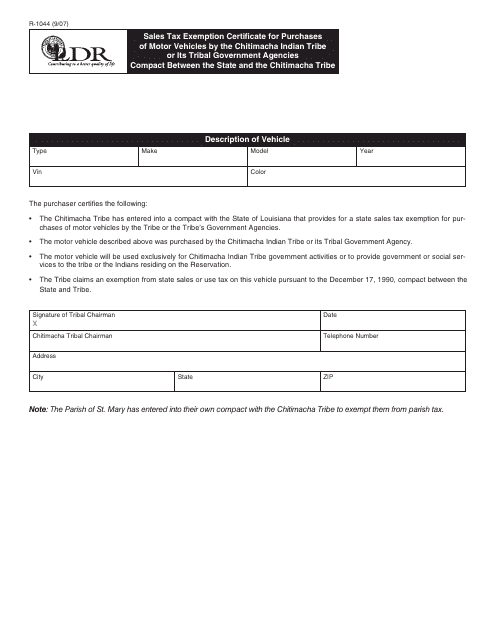

This document is used for claiming sales tax exemption when the Chitimacha Indian Tribe or its tribal government agencies in Louisiana purchase motor vehicles.

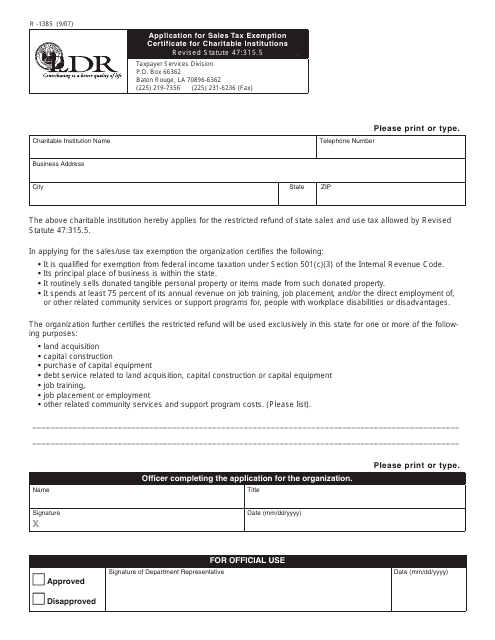

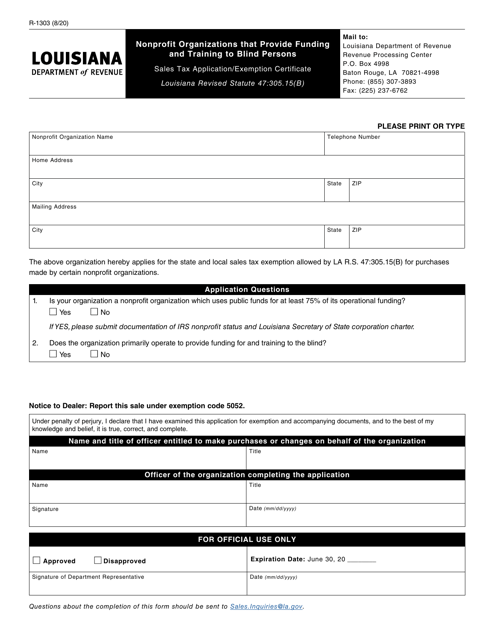

This Form is used for applying for a sales tax exemption certificate in Louisiana for charitable institutions.

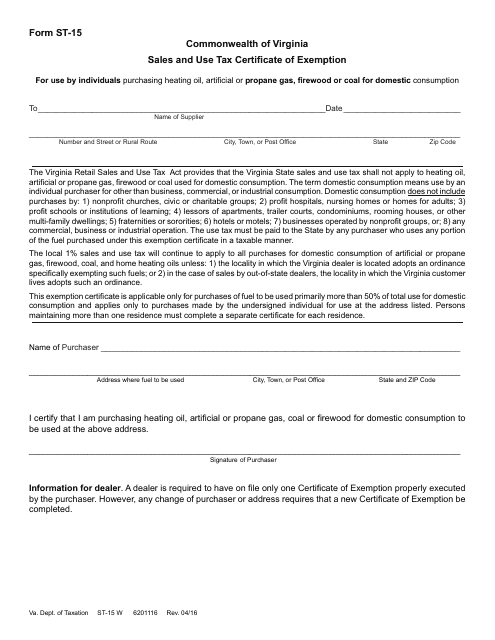

This form is used for claiming sales and use tax exemption in the state of Virginia.

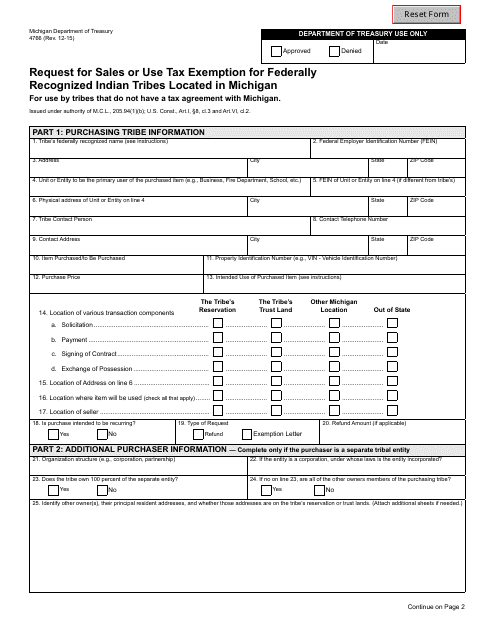

This form is used for requesting sales or use tax exemption for federally recognized Indian tribes located in Michigan.

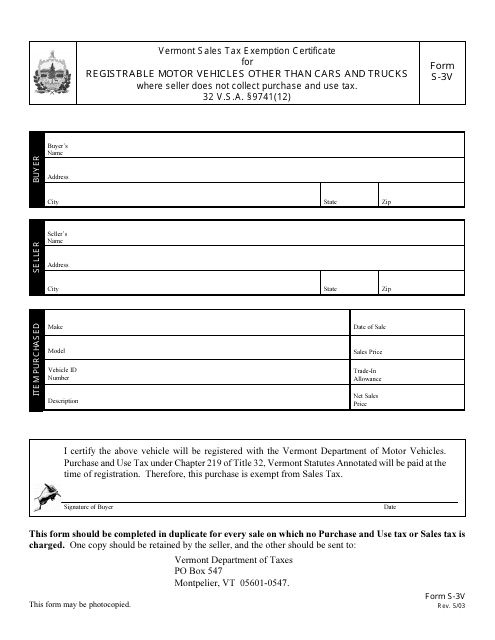

This Form is used for obtaining a sales tax exemption on motor vehicles in Vermont that are not cars or trucks. It is applicable for registration purposes.

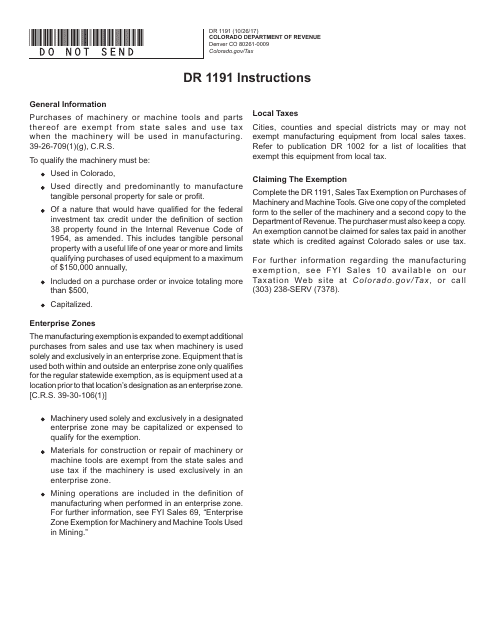

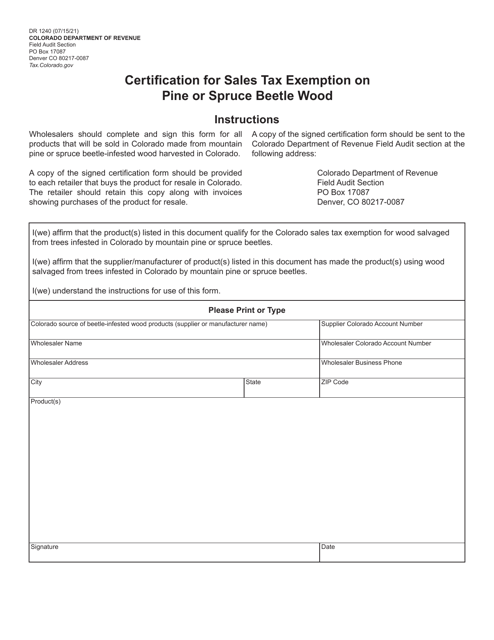

This form is used for claiming sales tax exemption on purchases of machinery and machine tools in Colorado.

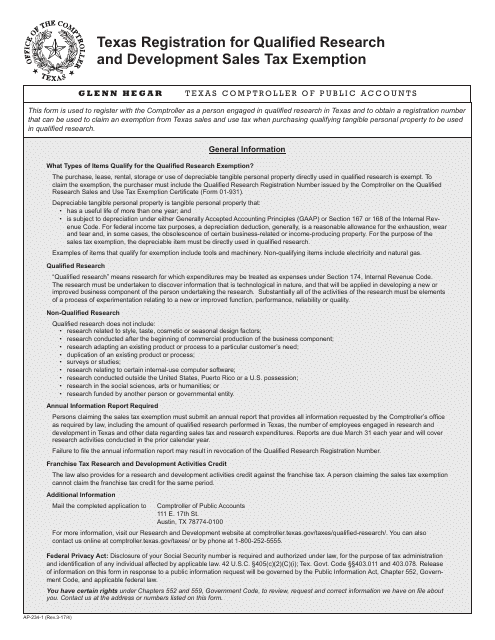

This form is used for businesses in Texas to register for a sales tax exemption for qualified research and development activities.

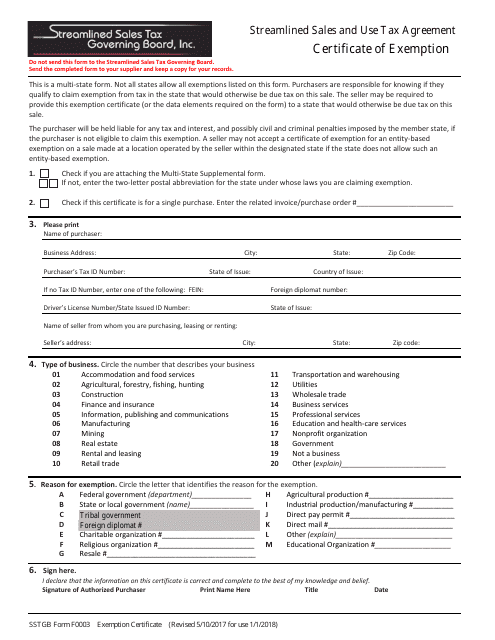

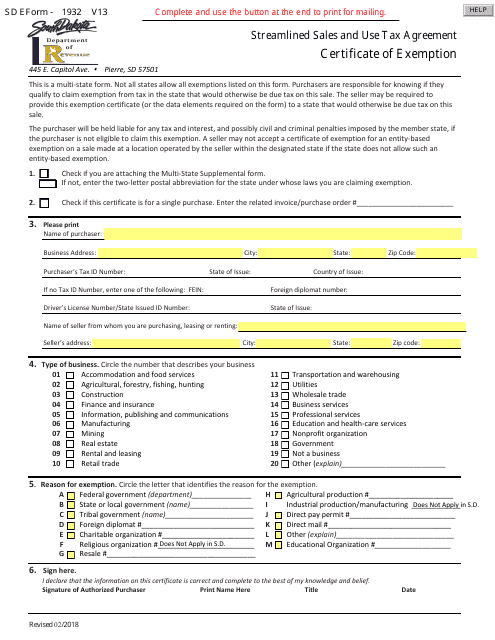

This form is used for applying for a Certificate of Exemption under the Streamlined Sales and Use Tax Agreement in West Virginia.

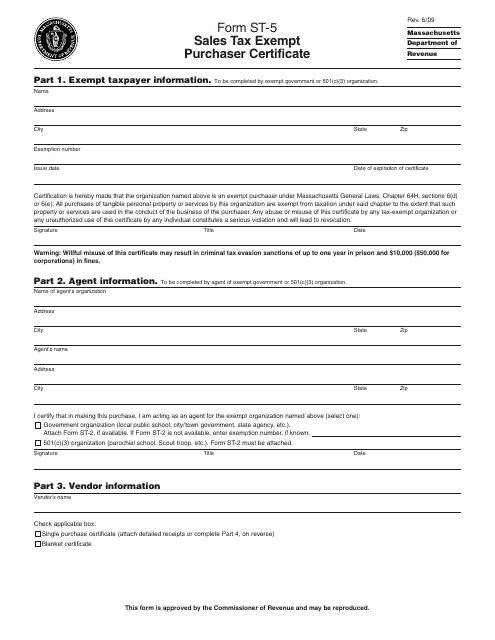

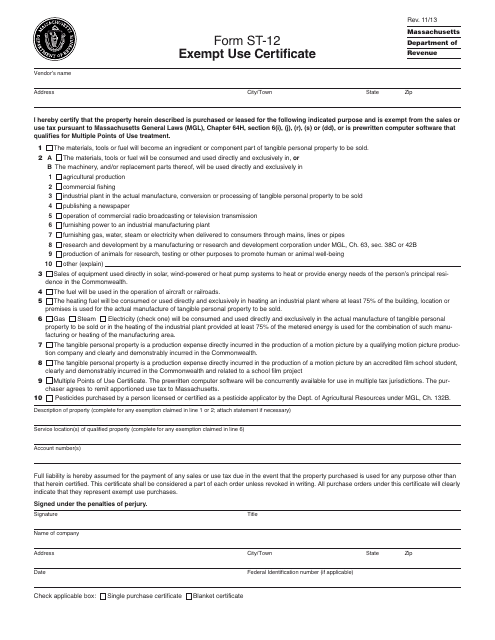

This form is used for Massachusetts purchasers to claim exemption from sales tax.

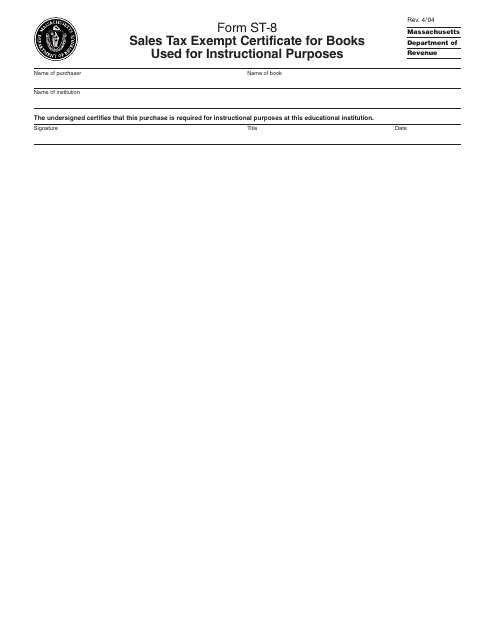

This form is used for claiming sales tax exemption on books used for educational purposes in Massachusetts.

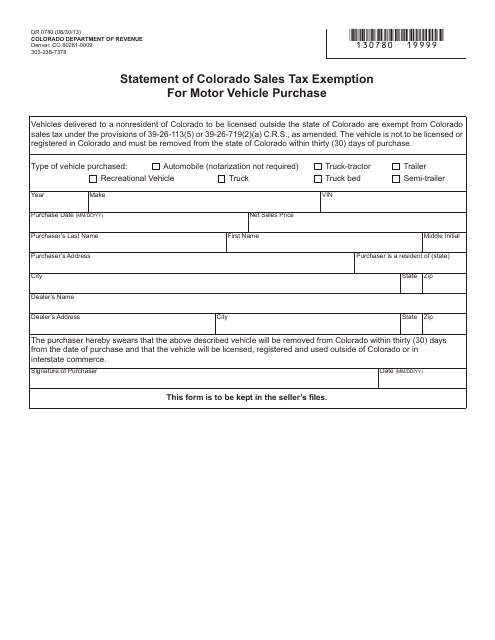

This form is used to declare an exemption from sales tax when purchasing a motor vehicle in Colorado.

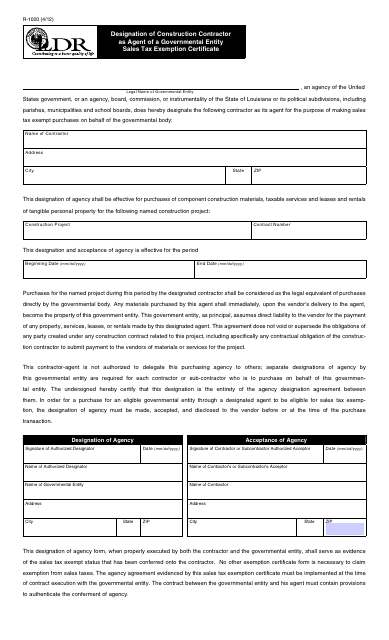

This document certifies that a construction contractor has been designated as an agent of a governmental entity for sales tax exemption in Louisiana.

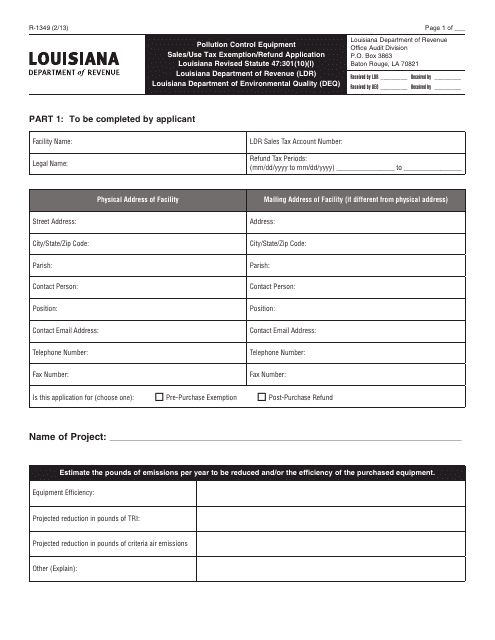

This type of document is an application form used in Louisiana to request an exemption or refund for sales or use tax related to pollution control equipment.

This document is a form used in Massachusetts for claiming exemption from certain taxes. It is known as the ST-12 Exempt Use Certificate.

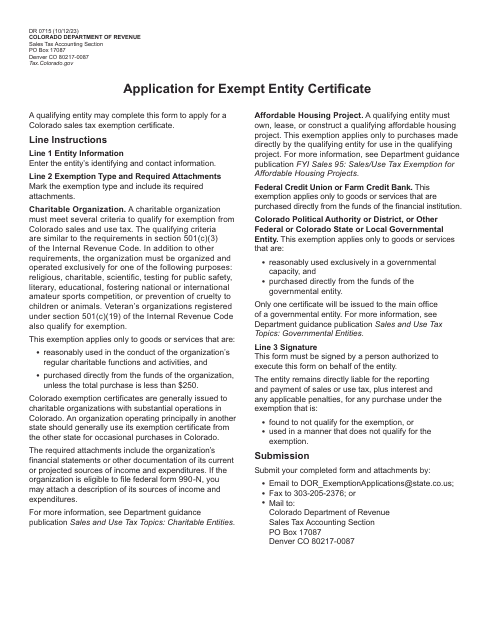

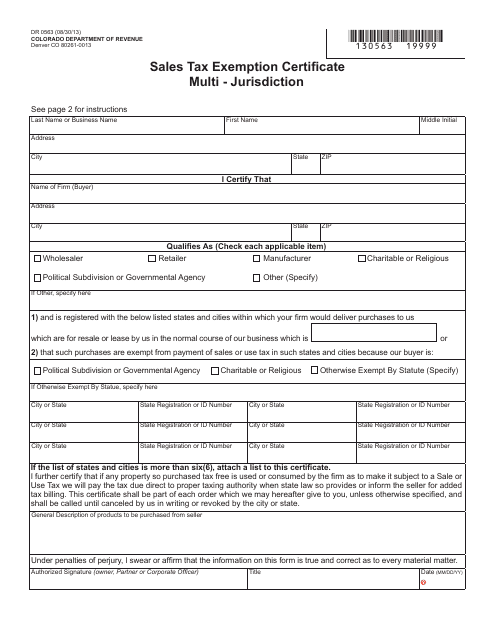

This form is used for requesting sales tax exemption in multiple jurisdictions in the state of Colorado.

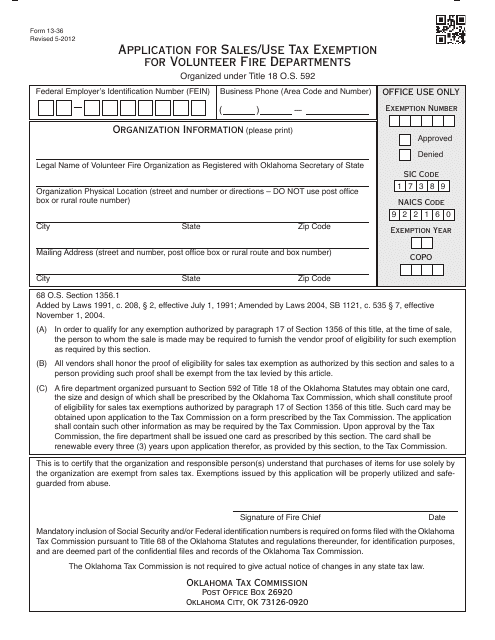

This document is used for volunteer fire departments in Oklahoma to apply for sales/use tax exemption.

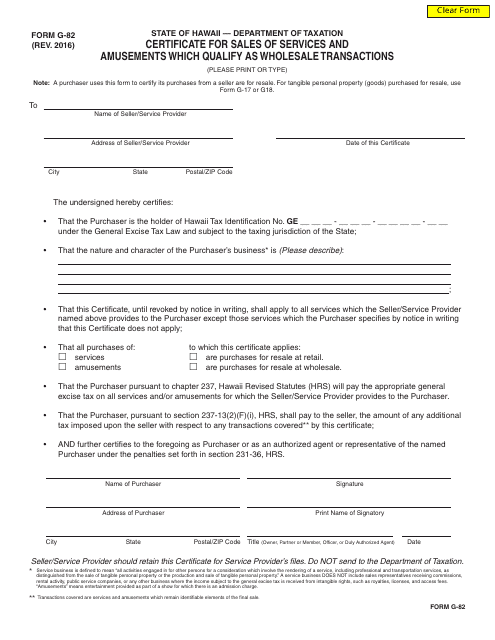

This Form is used for certifying sales of goods, services, and amusements that qualify for the phased-in wholesale deduction in Hawaii.