Public Employer Templates

Are you a public employer or in the public employment sector? It's important to understand and comply with the various regulations and requirements that apply specifically to your industry. As a public employer, there are specific documents and forms that you may need to familiarize yourself with.

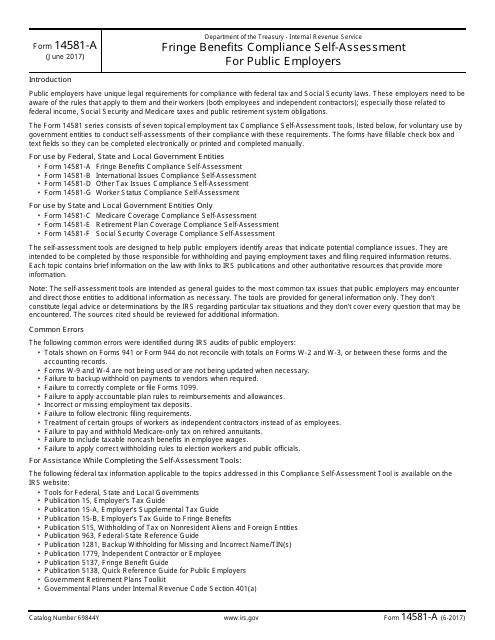

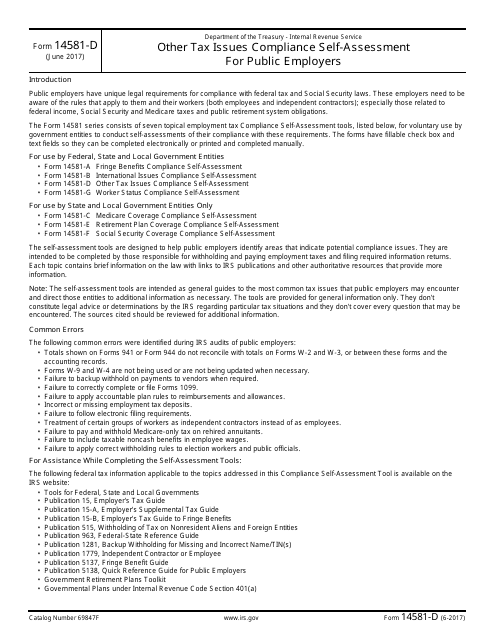

One common resource is the IRS Form 14581-A Fringe Benefits Compliance Self-assessment for Public Employers, which can help you ensure that you are properly providing fringe benefits to your employees. Additionally, the IRS Form 14581-D Other Tax Issues Compliance Self-assessment for Public Employers can assist you in addressing any other tax-related concerns you may have.

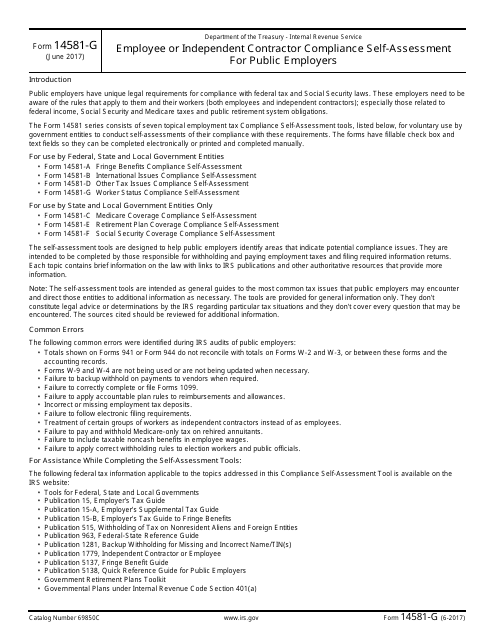

Another important document is the IRS Form 14581-G Employee or Independent Contractor Compliance Self-assessment for Public Employers. This form can help you determine whether your workers should be classified as employees or independent contractors, which has significant implications for taxes and other employment-related matters.

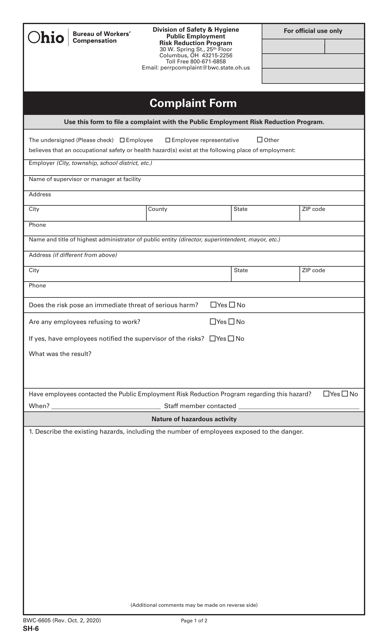

If you encounter any issues or concerns related to public employment, you may need to complete a Form SH-6 (BWC-6605) Complaint Form specific to the Public Employment Risk Reduction Program in Ohio. This form allows you to voice any complaints or grievances you may have.

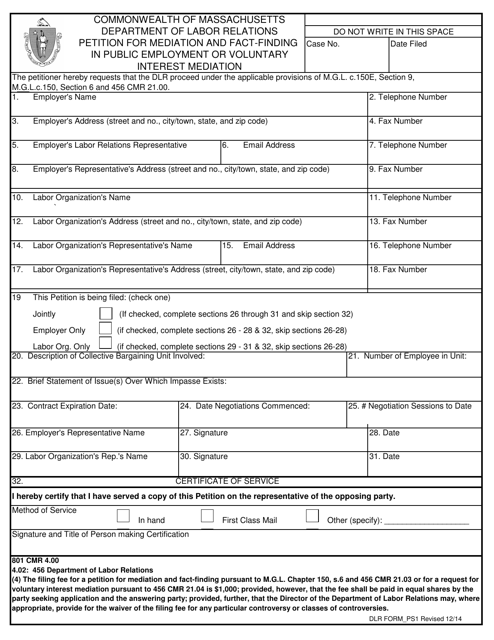

In Massachusetts, if you are seeking mediation or fact-finding in a public employment dispute, you may need to fill out a DLR Form PS1 Petition for Mediation and Fact-Finding in Public Employment or Voluntary Interest Mediation. This form initiates the process of seeking resolution through mediation or fact-finding.

Whether you refer to it as public employer documents, public employers' resources, or public employment paperwork, it's crucial to be aware of and stay informed about the various forms and documentation specific to your industry. By understanding and complying with these requirements, you can ensure that you are meeting legal obligations and providing a safe and fair workplace for your employees.

Documents:

11

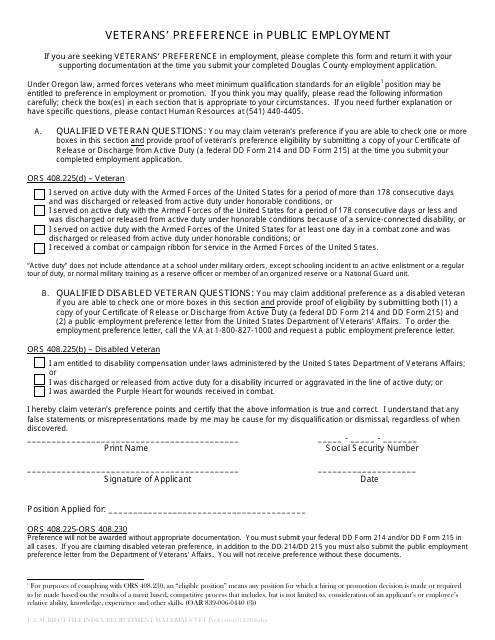

This document explains the Veterans' Preference in Public Employment policy in Douglas County, Oregon. Veterans are given preference when applying for public job opportunities in the county.

This Form is used for public employers to self-assess their compliance with fringe benefits regulations set by the IRS.

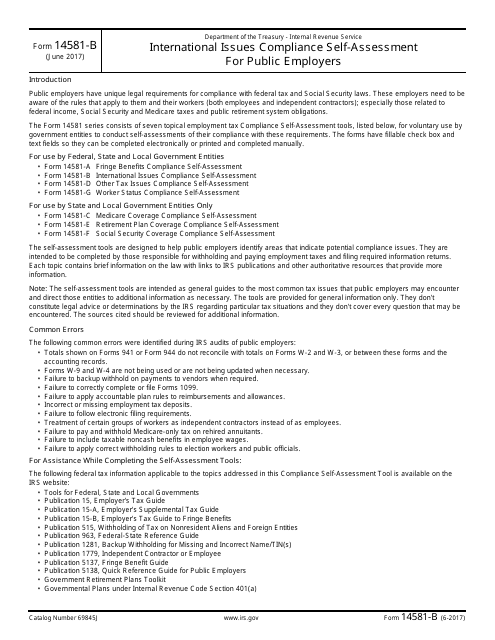

This form is used for public employers to self-assess their compliance with international issues related to taxation.

This Form is used for public employers to assess their compliance with other tax issues for the purpose of tax compliance.

This document is used for public employers to assess compliance with employee or independent contractor classification rules.

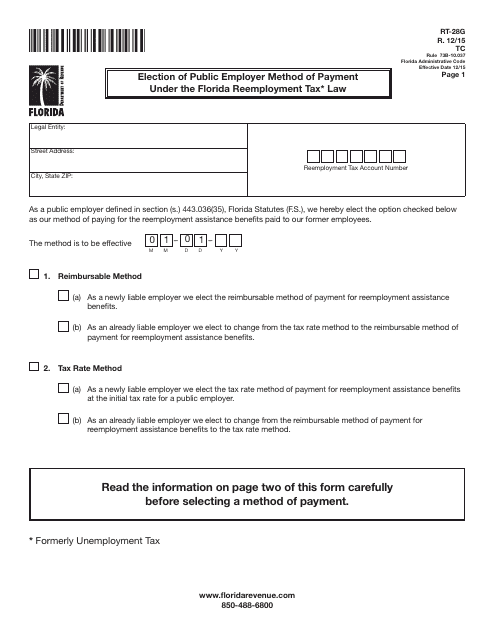

This form is used for employers in Florida to elect their method of payment for reemployment tax under the Florida Reemployment Tax Law.

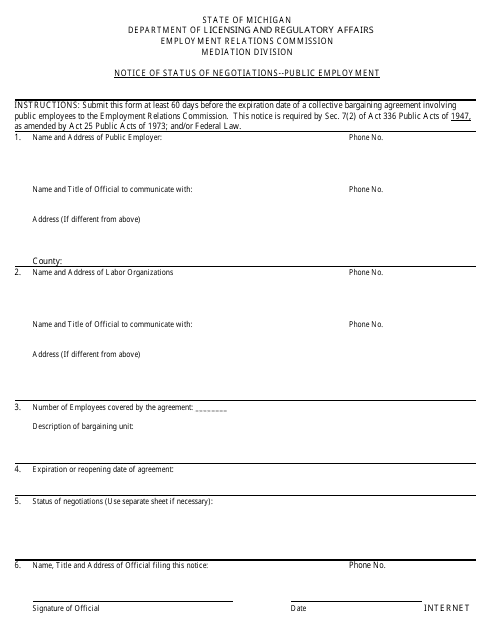

This document notifies individuals about the current status of negotiations for public employment in the state of Michigan. It provides updates on the ongoing discussions between the employer and the employees regarding employment terms and conditions.

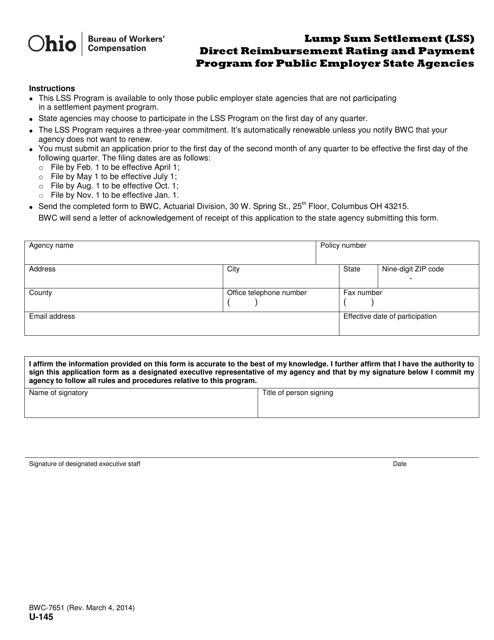

This Form is used for public employer state agencies in Ohio to apply for the Lump Sum Settlement (LSS) Direct Reimbursement Rating and Payment Program.

This form is used for filing a petition for mediation and fact-finding in public employment or voluntary interest mediation in Massachusetts. It is a necessary step for parties involved in a labor dispute to request the assistance of a mediator to help resolve their issues.