Unitary Business Templates

Are you looking for information on unitary business? Our webpage provides comprehensive details and resources on this topic. Also known as the combined reporting method, unitary business refers to the tax reporting system used by certain states and provinces in the United States and Canada.

Under this system, businesses that are part of a unitary group are required to file their taxes as a single entity, combining their incomes from various sources. This approach ensures that all aspects of the group's business activities are considered, allowing for a more accurate assessment of the overall tax liability.

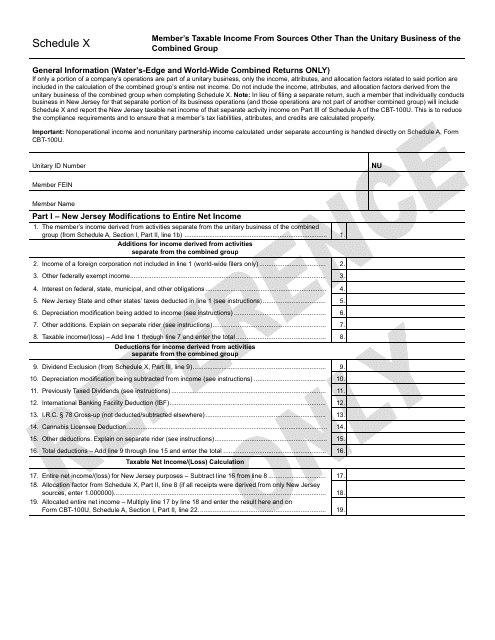

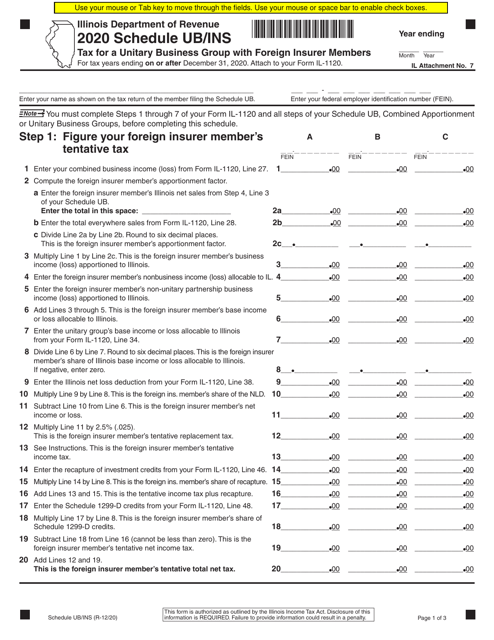

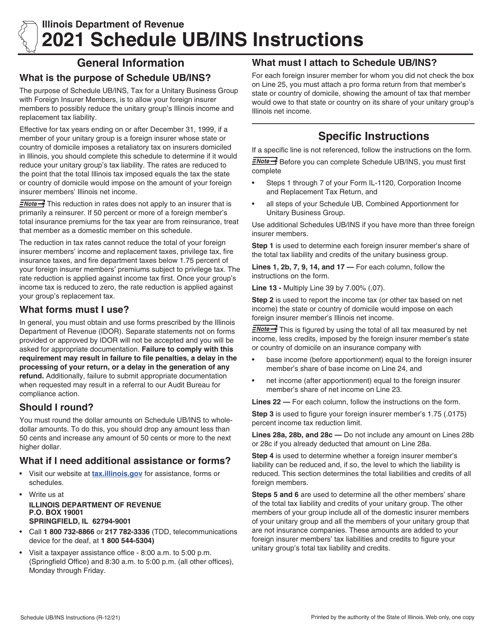

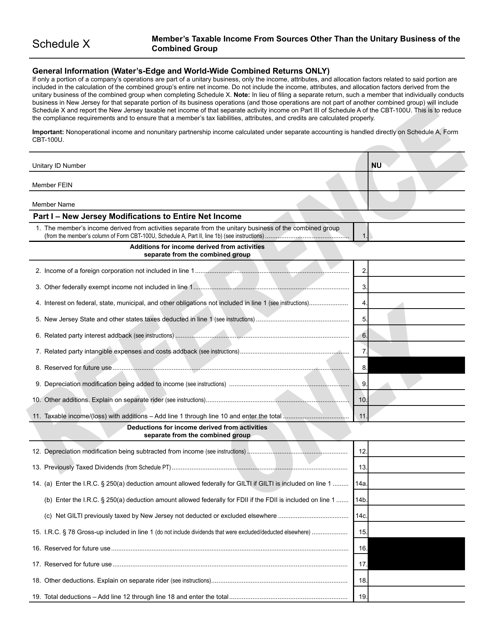

Our webpage offers a range of documents and forms related to unitary business, including schedules and instructions specific to different jurisdictions. For example, you will find forms such as the Schedule X Member's Taxable Income From Sources Other Than the Unitary Business of the Combined Group in New Jersey, the Form IL-1120 Schedule UB/INS Tax for a Unitary Business Group With Foreign Insurer Members in Illinois, and the Form CBT-100U Schedule X Member's Taxable Income From Sources Other Than the Unitary Business of the Combined Group in New Jersey.

Whether you are a business owner, tax professional, or simply interested in learning more about unitary business, our webpage is a valuable resource. Gain a better understanding of this tax reporting method and access the necessary forms and information to fulfill your filing obligations accurately and efficiently.

Explore our comprehensive collection of documents and resources related to unitary business today. Stay informed and ensure compliance with the unitary business reporting requirements in your jurisdiction.

Documents:

5

This form is used for reporting an individual or member's taxable income from sources other than the unitary business of the combined group in New Jersey. It is specifically for taxpayers filing Form CBT-100U.