Residence Homestead Exemption Templates

Are you a homeowner looking to save money on your property taxes? Look no further than the Residence Homestead Exemption, also known as the Residence Homestead Exemption Application or the Residence Homestead Exemption Affidavits.

The Residence Homestead Exemption is a program offered in various states, including Texas, that allows eligible homeowners to reduce the taxable value of their property. By applying for this exemption, homeowners can potentially save a significant amount on their annual property tax bill.

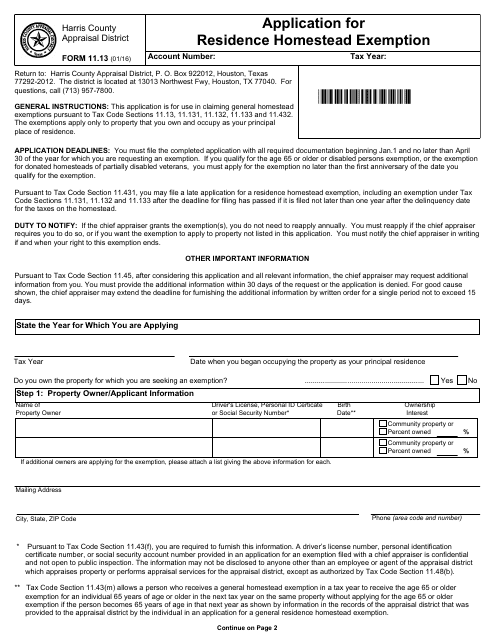

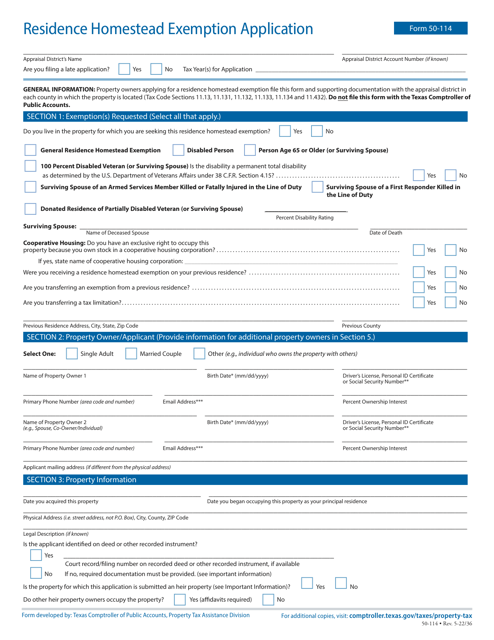

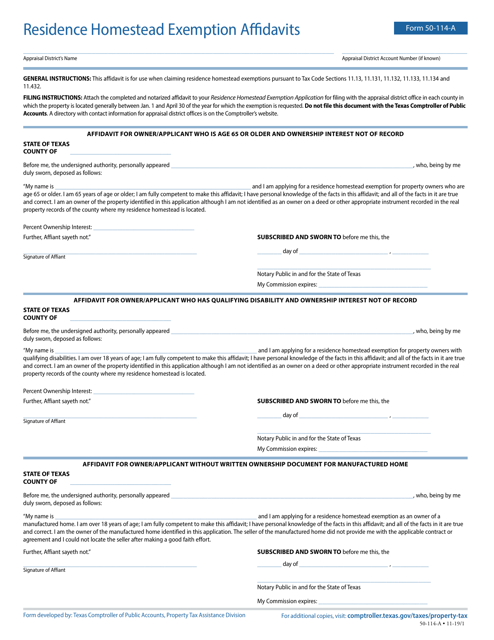

To apply for the Residence Homestead Exemption, homeowners need to fill out Form 11.13 Application for Residence Homestead Exemption or Form 50-114 Residence Homestead Exemption Application. These forms can be obtained from the Harris County Appraisal District in Texas or other relevant authorities. In addition, homeowners may need to submit supporting documents such as the Residence Homestead Exemption Affidavits (Form 50-114-A).

By taking advantage of the Residence Homestead Exemption, homeowners can enjoy the benefits of lower property taxes and potentially save thousands of dollars each year. Don't miss out on this opportunity to reduce your tax burden and keep more money in your pocket. Apply for the Residence Homestead Exemption today!

Note: This text is just an example and should be tailored to fit your website's content and target audience.

Documents:

5

This Form is used for applying for a residence homestead exemption with the Harris County Appraisal District in Texas.