Railroad Companies Templates

Railroad companies, also referred to as railroad company, are an integral part of the transportation industry. These companies play a crucial role in the movement of goods and people across the country. With a rich history and a vast network of tracks, railroad companies have contributed significantly to the growth and development of various regions.

At the heart of the railroad industry are the dedicated men and women who work tirelessly to ensure the smooth operation of train services. From engineers and conductors to maintenance crew and station personnel, each individual plays a vital role in the functioning of these companies.

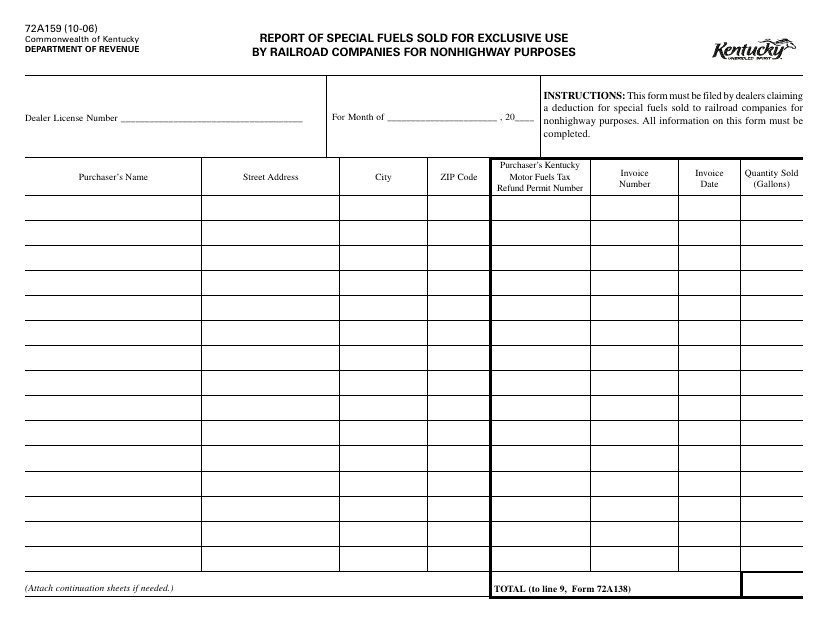

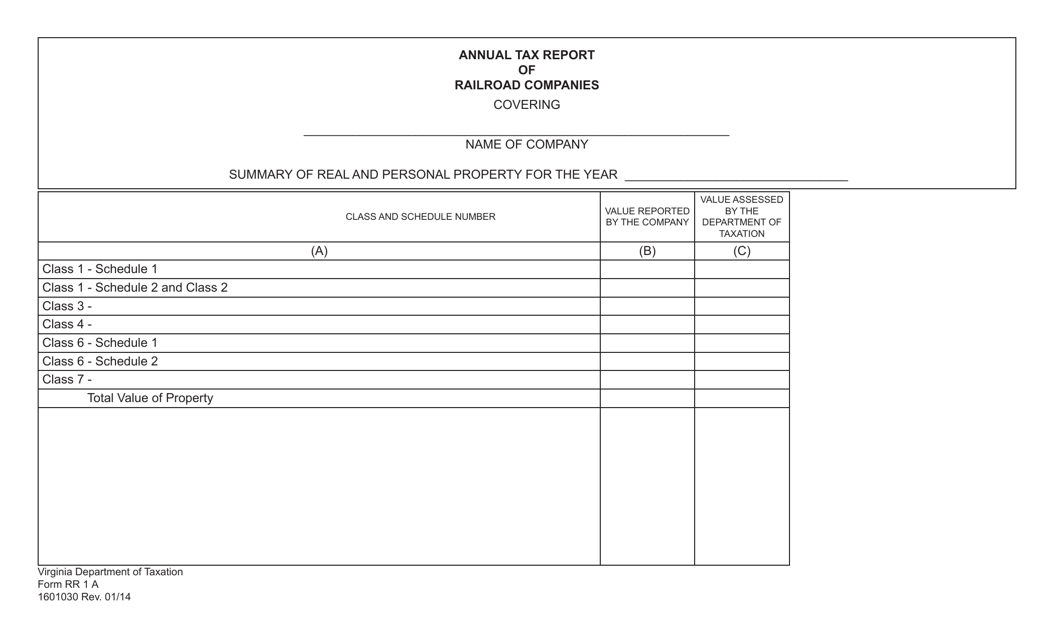

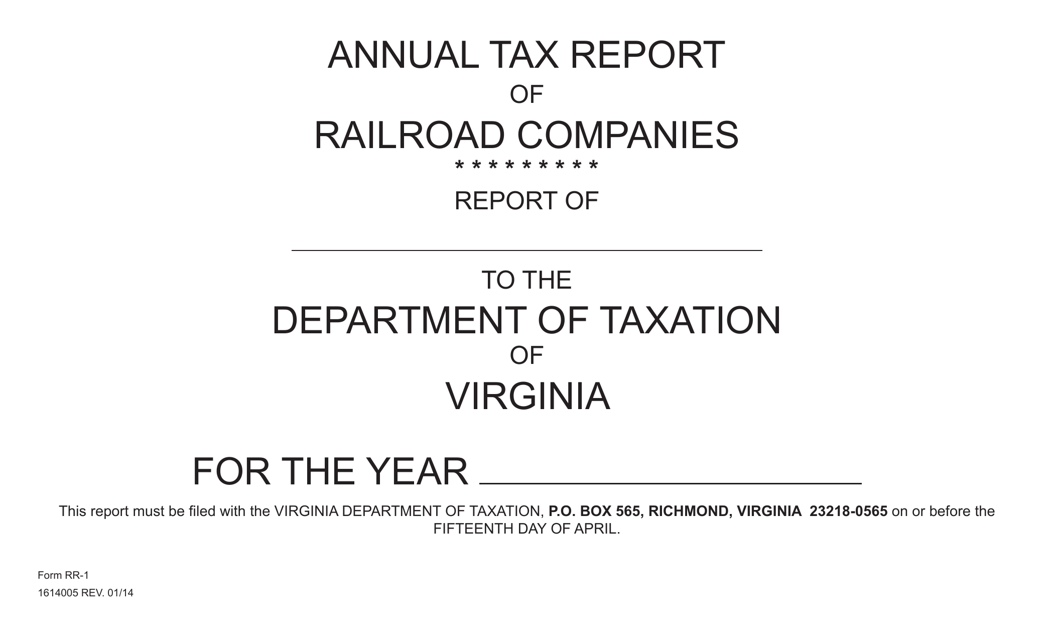

Railroad companies are subject to various regulations and requirements in different states. The Form 72A159 Report of Special Fuels Sold for Exclusive Use by Railroad Companies for Nonhighway Purposes in Kentucky, for example, highlights the importance of accurate reporting for tax purposes. Similarly, the Form RR1 Annual Tax Report of Railroad Companies Cover Page in Virginia provides a comprehensive overview of a railroad company's financials.

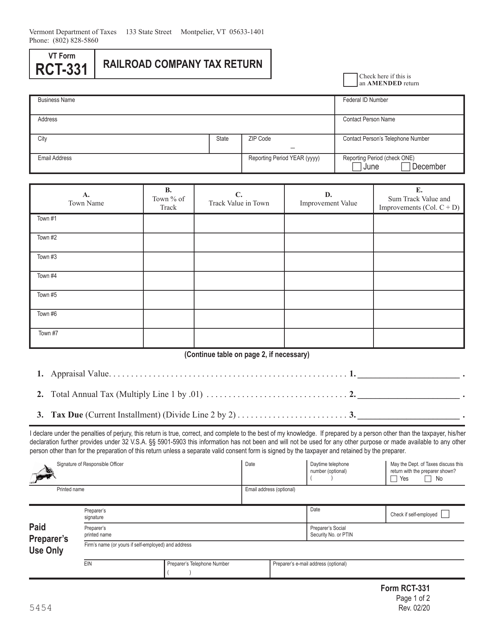

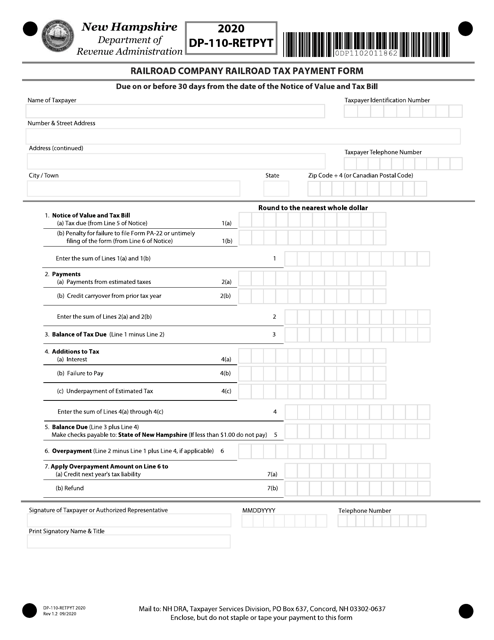

One of the primary responsibilities of railroad companies is to fulfill their tax obligations. Different states have different tax reporting requirements for railroad companies. For instance, the VT Form RCT-331 in Vermont is used by railroad companies to file their tax returns. In New Hampshire, the Form DP-110-RETPYT Railroad Company Railroad Tax Payment Form is utilized to ensure timely tax payments.

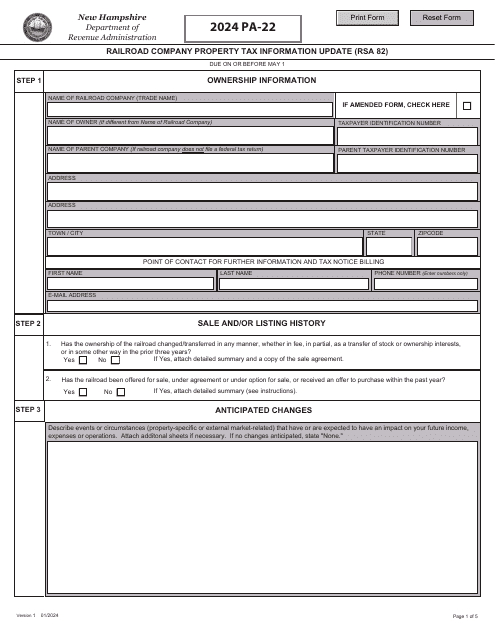

Another crucial aspect of the railroad industry is the assessment and taxation of railroad company properties. In New Hampshire, the Form PA-22 Railroad Company Property Tax Information Update is used to update property tax information, ensuring accurate and fair taxation.

Railroad companies have played an essential role in the development of transportation infrastructure, connecting various cities and enabling the growth of local economies. They have been instrumental in facilitating trade, supporting industrial growth, and providing reliable transportation services to both businesses and individuals.

In summary, railroad companies, or railroad company, are vital entities in the transportation sector. They are responsible for the efficient movement of goods and people, adhering to regulations, fulfilling tax obligations, and supporting the economic development of regions they serve.

Documents:

15

This form is used for reporting special fuels sold specifically for nonhighway purposes to railroad companies in Kentucky.

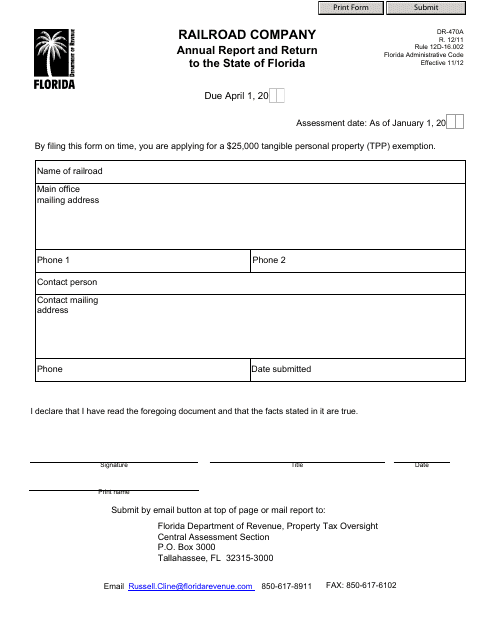

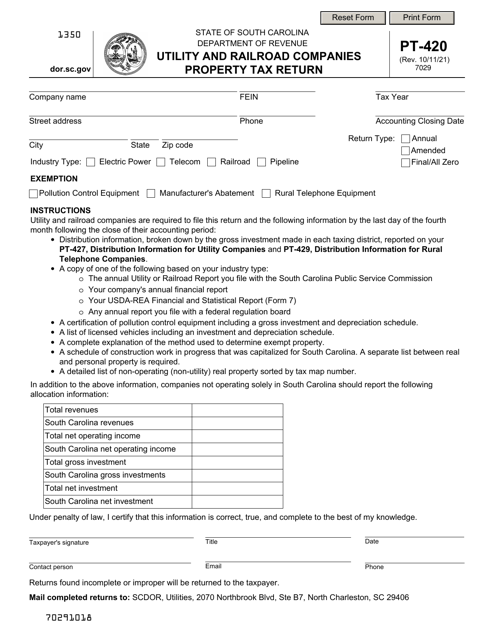

This form is used for railroad companies operating in Florida to submit their annual report and return to the State of Florida. It is a requirement by the state for railroad companies to provide information on their operations and finances.

This form is used for railroad companies in Virginia to report a summary of their real and personal property for the annual tax report.

This Form is used for filing the Annual Tax Report of Railroad Companies in the state of Virginia.

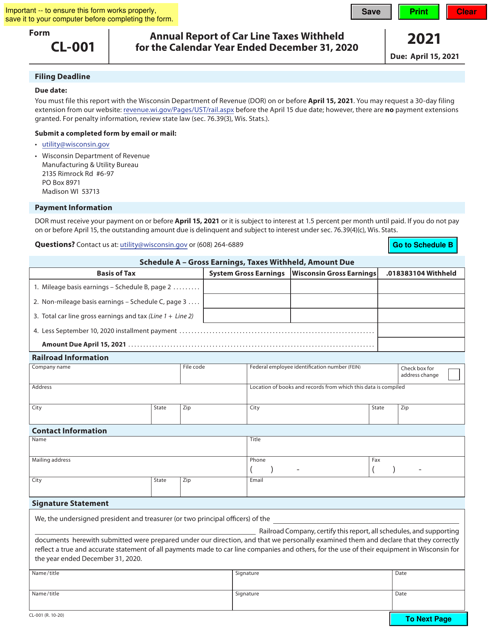

This form is used for the Railroad Company's Annual Report of Car Line Taxes Withheld in the state of Wisconsin.

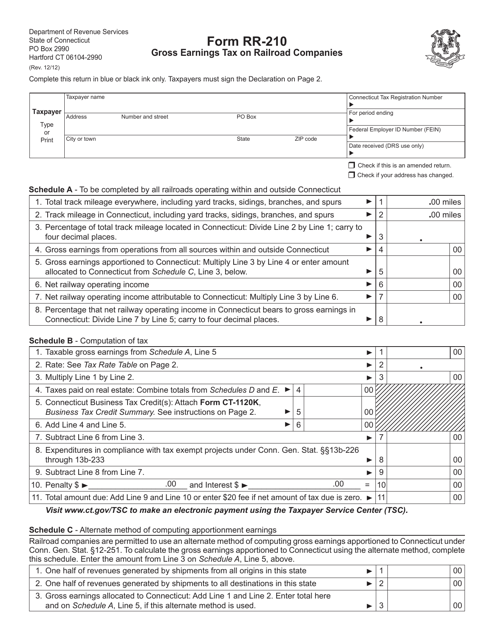

This Form is used for reporting and paying the Gross Earnings Tax on Railroad Companies in the state of Connecticut.

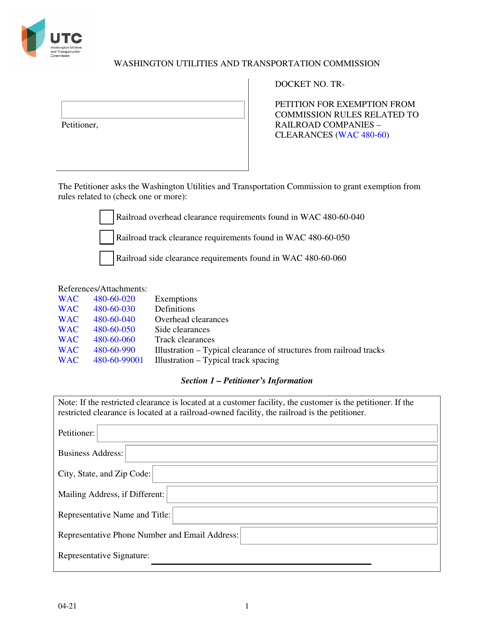

Petition for Exemption From Commission Rules Related to Railroad Companies - Clearances - Washington

This document is for petitioning an exemption from commission rules related to railroad company clearances in Washington.