Tax Collector Templates

Are you looking for information on tax collection and the role of tax collectors? Look no further! Our webpage provides you with a comprehensive guide to understanding and navigating the world of tax collection. Whether you're a taxpayer, a collector, or simply curious about the process, we've got you covered.

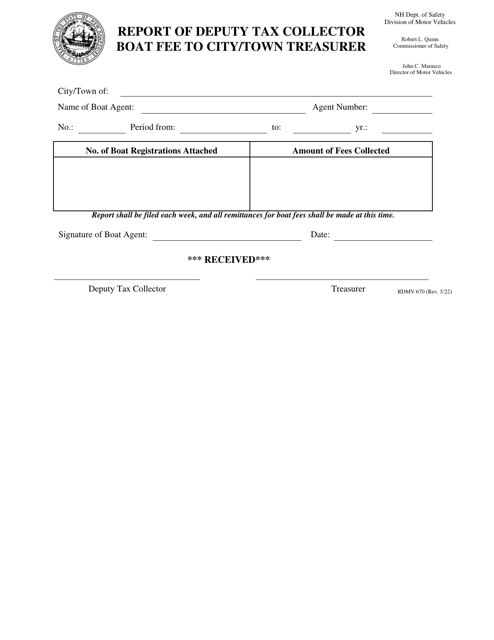

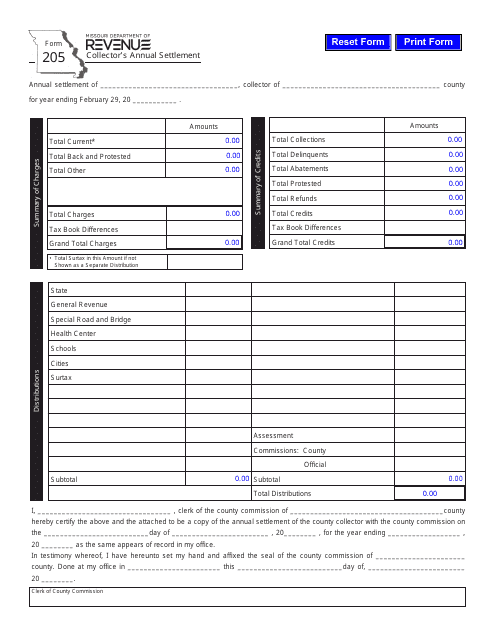

Tax collectors play a vital role in ensuring that individuals and businesses fulfill their tax obligations. They are responsible for administering and enforcing tax laws, interacting with taxpayers, and collecting the necessary funds for the government. Our webpage offers a wide range of resources and information related to tax collection, including tax collector's warrants, notices of excise tax delinquency, statements from tax assessors-collectors, and annual settlements.

We understand that tax collection can sometimes be a complex and confusing process. That's why we strive to provide you with easy-to-understand information and resources that will help answer your questions and ease any concerns you may have. Whether you're looking for forms, guidance, or general information on the role of tax collectors, our webpage has it all.

So, whether you're a tax collector looking for additional resources, a taxpayer wanting to ensure compliance, or simply curious about the world of tax collection, our webpage is your go-to destination. Explore our collection of tax collector's documents and alternate names such as "collector's tax form" and gain a deeper understanding of the important work done by tax collectors across the United States and beyond.

Documents:

6

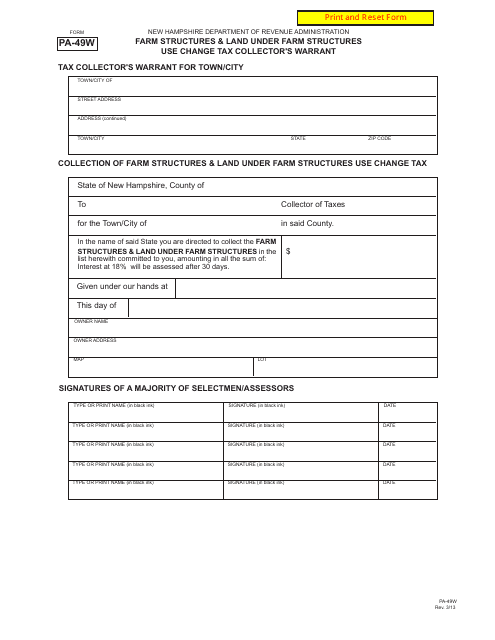

This form is used to report changes in the use of farm structures and land under farm structures for tax purposes in New Hampshire.

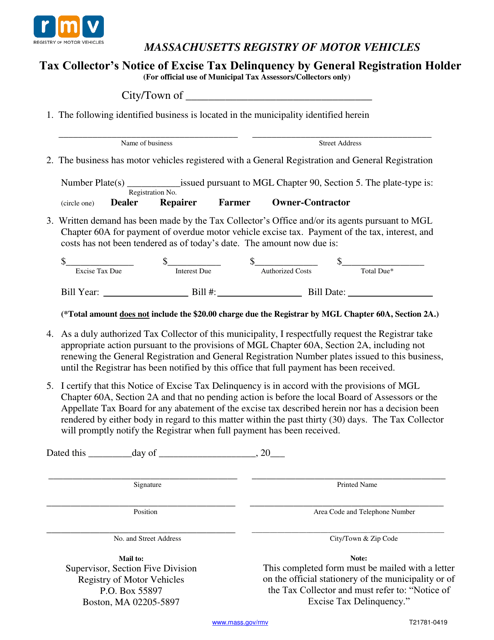

This form is used for tax assessors and collectors in Massachusetts to notify general registration holders of their delinquency in paying excise tax.

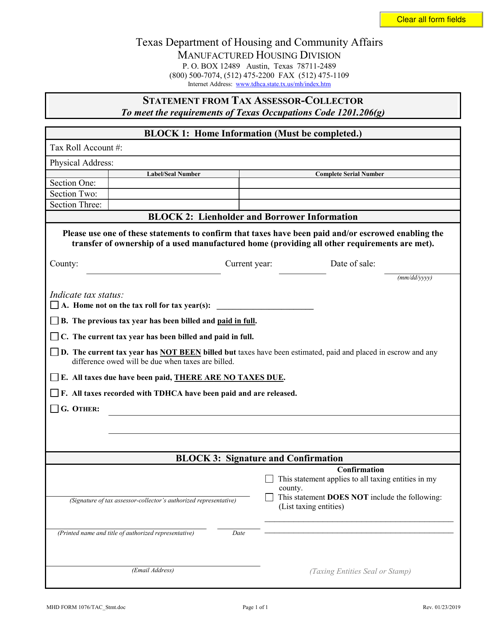

This Form is used for tax assessors and collectors in Texas to provide a statement of their taxes.