Secured Transactions Templates

Secured Transactions - Protecting Your Transactions with Confidence

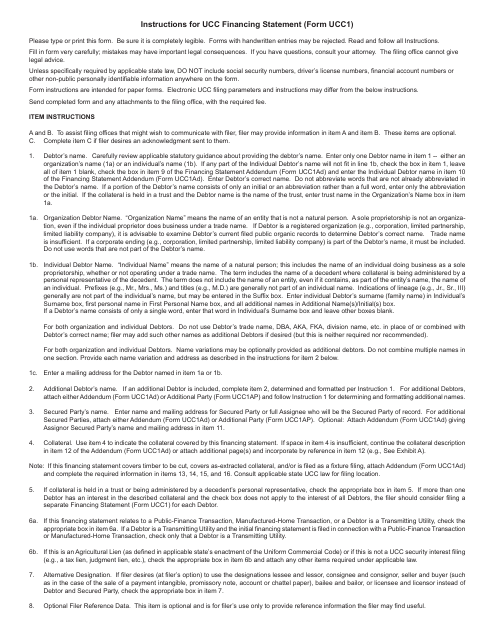

Secure your financial transactions and protect your assets with our comprehensive collection of documents and forms designed specifically for secured transactions. Whether you are a lender, borrower, or business owner, our extensive range of documents ensures you have the legal tools necessary to establish and maintain secure transactions.

Also known as transaction security or secure transactions, our secured transactions documents provide the framework for creating and enforcing security interests and collateral arrangements. These documents play a vital role in protecting the rights of both parties involved in a transaction, ensuring that the interests of lenders are secured and borrowers are provided with an added layer of protection.

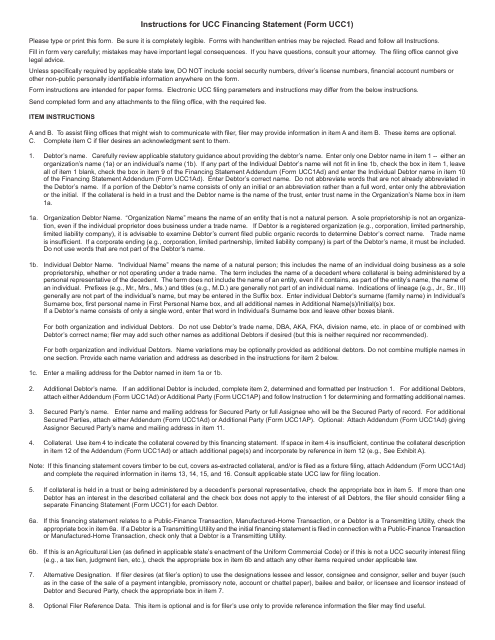

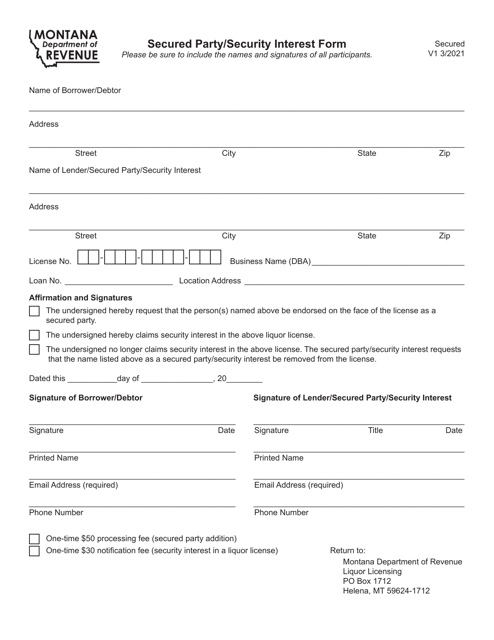

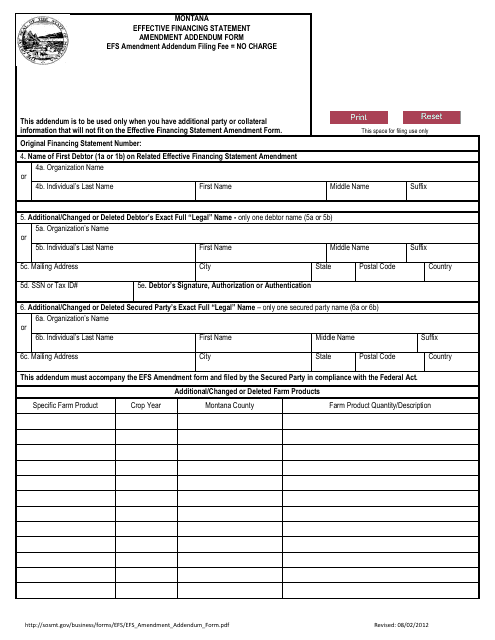

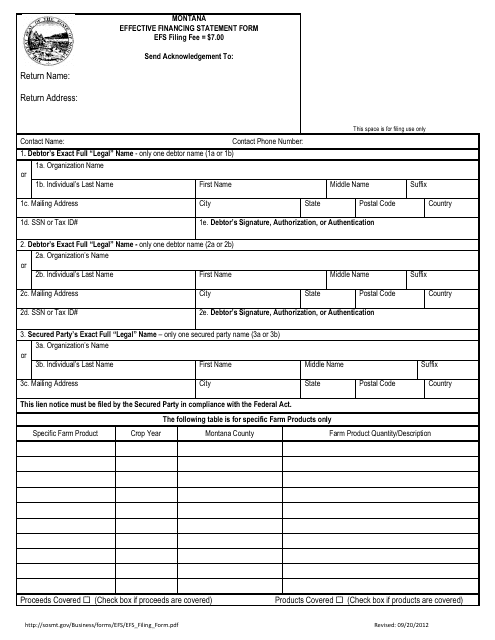

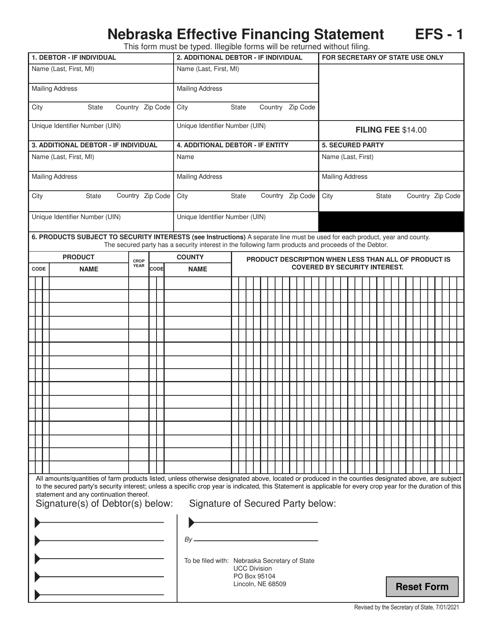

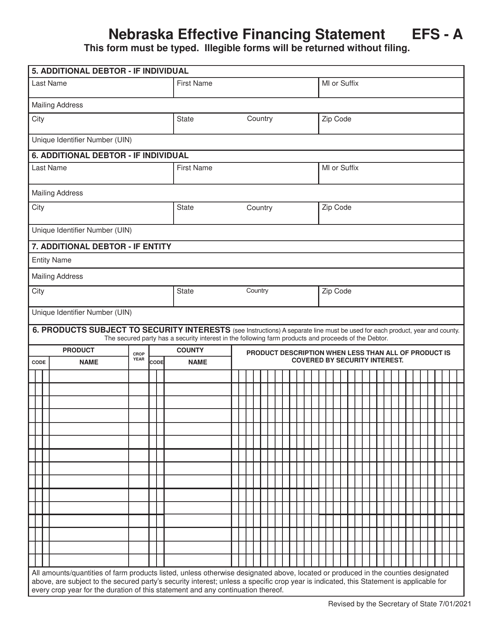

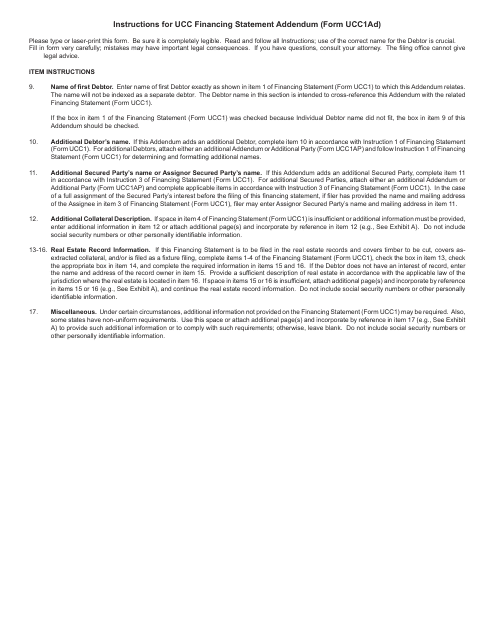

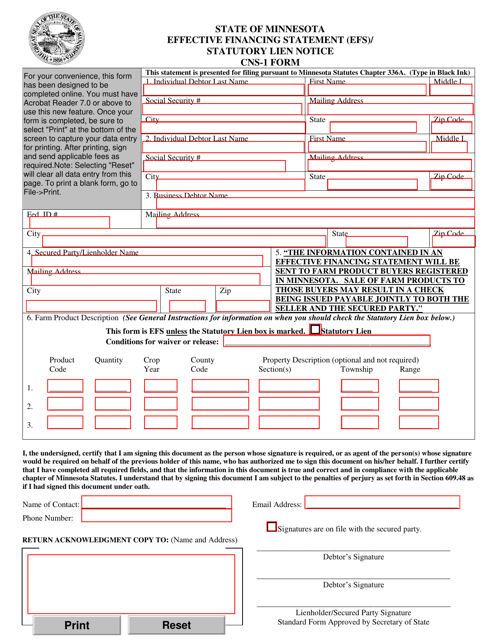

Our collection includes a variety of forms and templates, such as Secured Party/Security Interest Form, Effective Financing Statement Addendum Form, and Form EFS-A Nebraska Effective Financing Statement. These documents are meticulously crafted to adhere to the specific legal requirements of different jurisdictions, including Montana, Nebraska, and Georgia (United States).

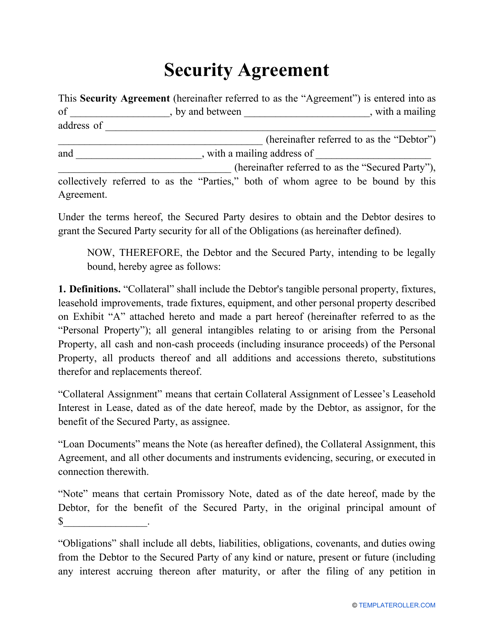

With our Security Agreement Template, you can establish clear terms and conditions for the asset-based lending, outlining the rights and obligations of all parties involved. This document serves as a crucial tool for safeguarding the interests of both the borrower and the lender, ensuring a secure and transparent transaction.

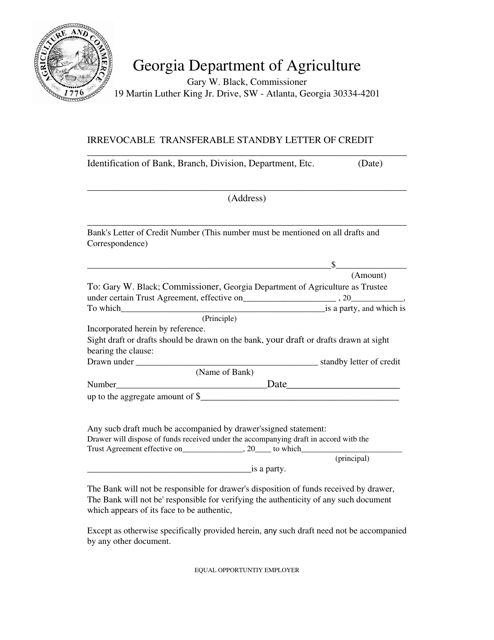

Additionally, our collection includes the Irrevocable Transferable Standby Letter of Credit, a document widely recognized for its role in international trade and transactions. This document guarantees payment to the beneficiary in the event that the applicant fails to fulfill their obligations, providing confidence and security to all parties involved.

Don't leave your transactions to chance — rely on our comprehensive collection of secured transactions documents to ensure the protection and security of your financial interests. Our library is constantly updated to reflect the latest legal requirements and best practices, giving you peace of mind and allowing you to transact with confidence.

Documents:

50

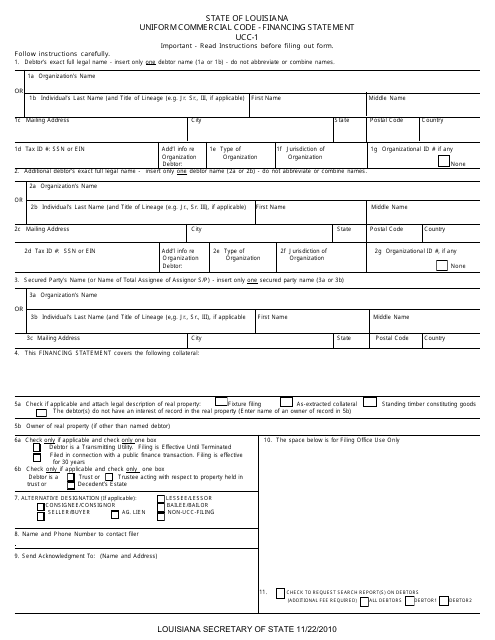

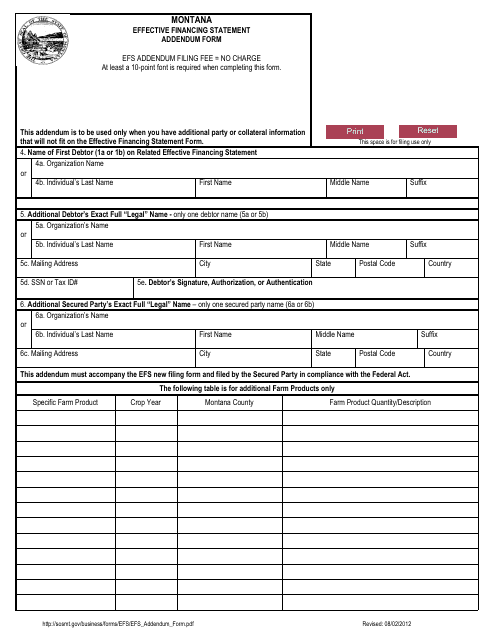

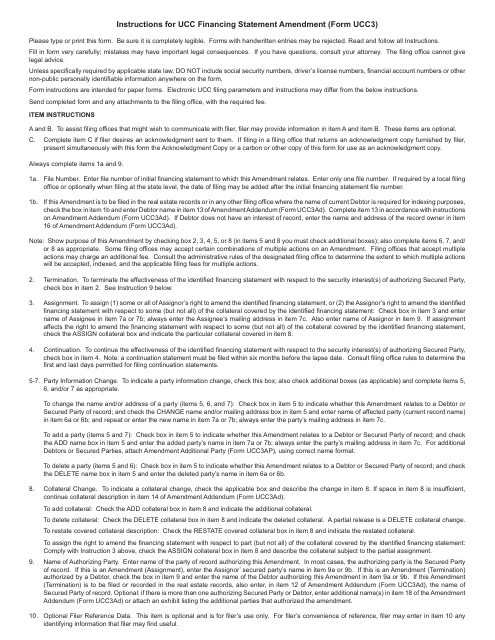

This form is used for filing a financing statement under the Uniform Commercial Code (UCC) in the state of Louisiana.

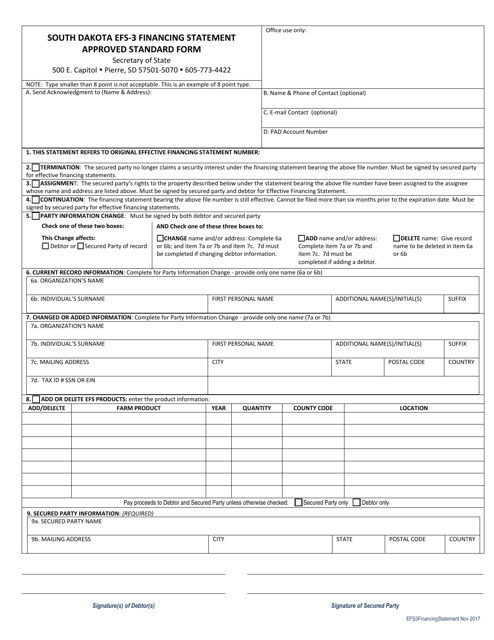

This Form is used as an addendum to an effective financing statement in the state of Montana. It provides additional information or amendments to the original statement.

This Form is used for making amendments to a financing statement in the state of Montana.

This Form is used for filing an effective financing statement in the state of Montana. It is a legal document that provides notice of a creditor's security interest in personal property.

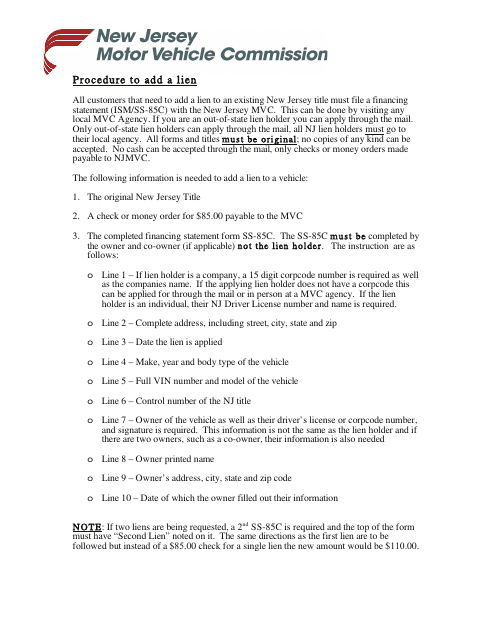

This Form is used for filing a financing statement in the state of New Jersey. It allows parties to establish a security interest in personal property for a loan or other financial arrangement.

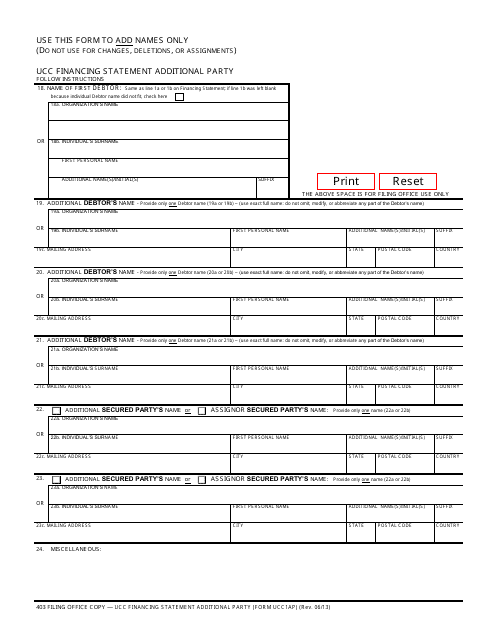

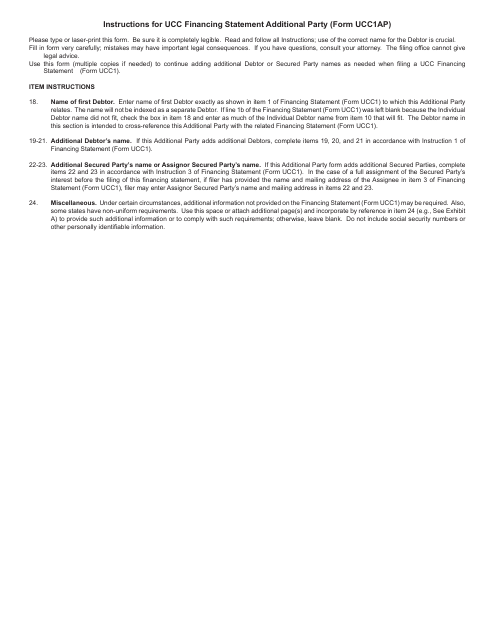

This form is used for adding an additional party to a UCC Financing Statement in the state of Oregon.

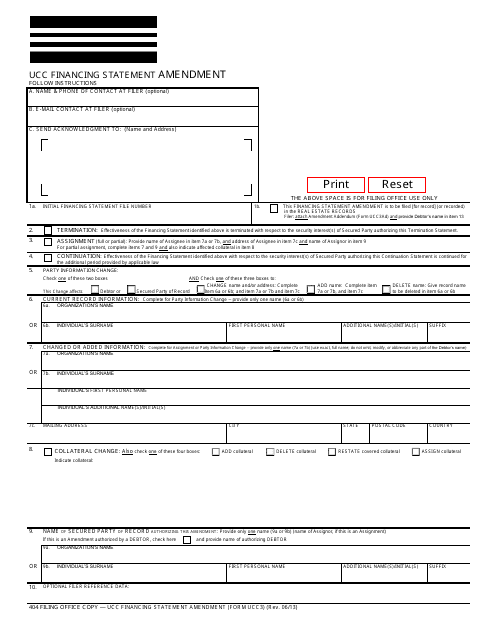

This document is used for making amendments to a financing statement filed under the Uniform Commercial Code (UCC) in the state of Oregon.

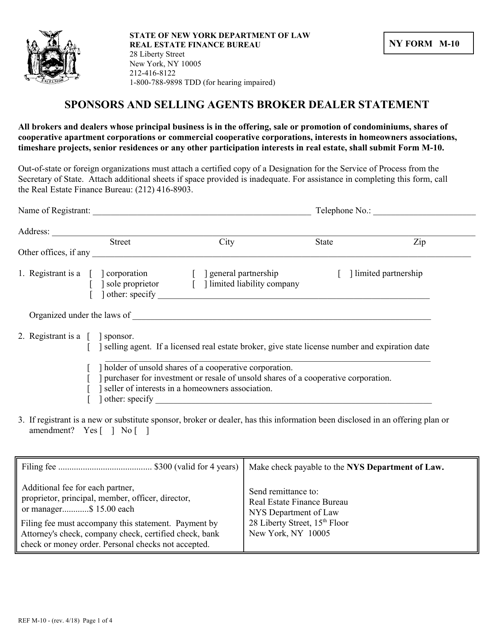

This document is used for submitting the sponsors and selling agents broker dealer statement in New York.

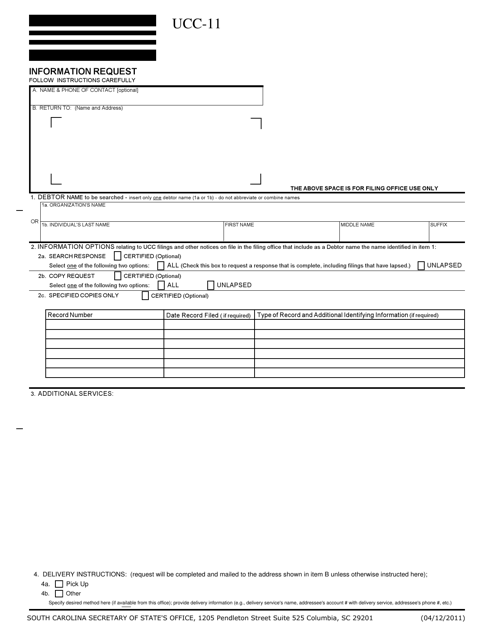

This Form is used for submitting an information request regarding the Uniform Commercial Code (UCC) in South Carolina.

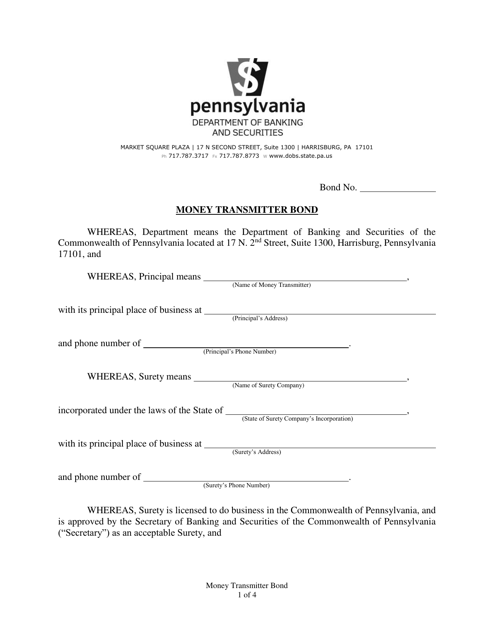

This document is a type of surety bond required for money transmitters in the state of Pennsylvania. It ensures that the money transmitter operates in compliance with state regulations and protects customers from financial loss.

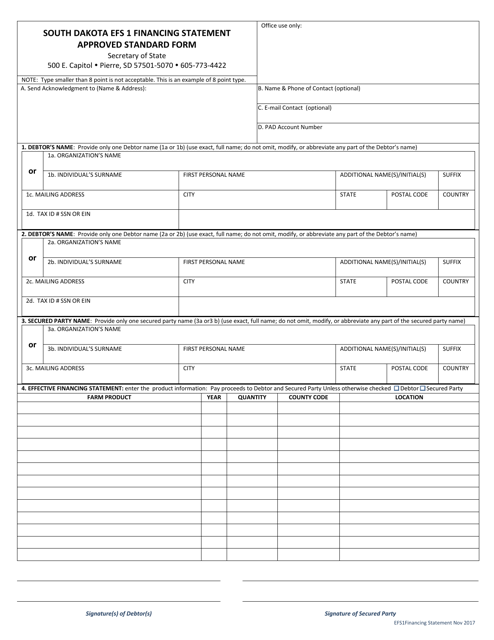

This document is used for filing a financing statement in South Dakota to provide notice of a security interest in personal property.

This Form is used for filing a financing statement in South Dakota. It is used to provide notice to the public that a secured party has a security interest in certain collateral.

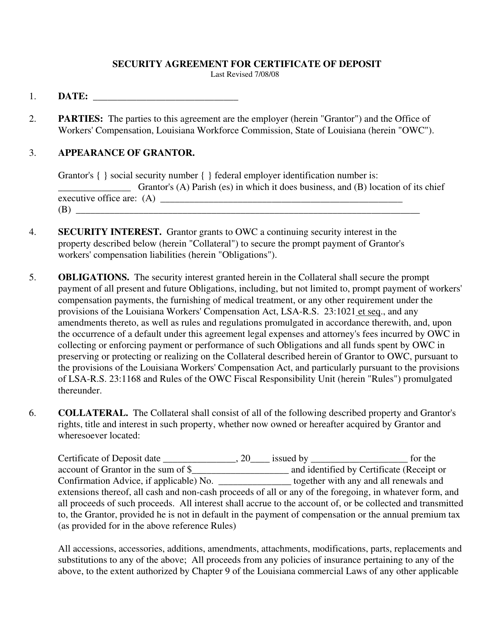

This document is used for securing a certificate of deposit in the state of Louisiana. It outlines the terms and conditions of the agreement between the depositor and the financial institution.

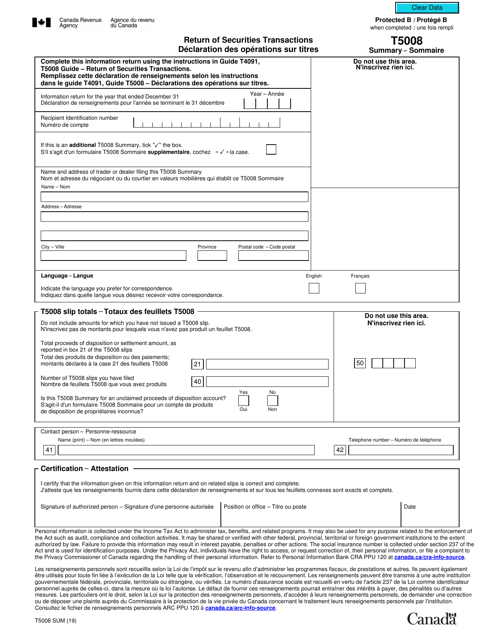

This form is used for reporting securities transactions in Canada. It is available in both English and French languages.

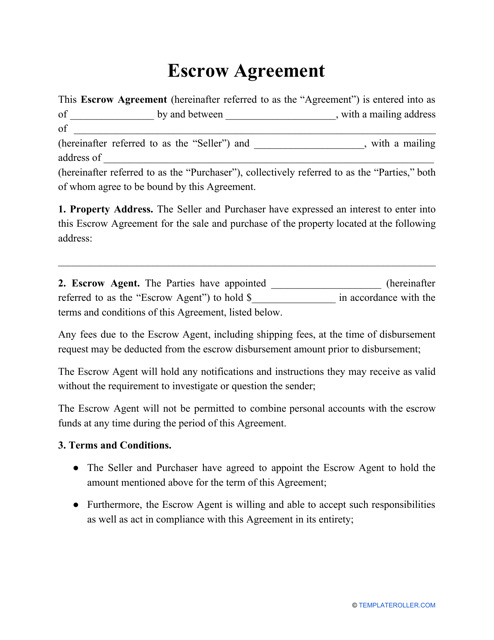

This document outlines the intention of two parties to deposit assets with a third party.

This is a formal document signed by a lender and a borrower in which the borrower provides their property or interest in an asset as collateral for a loan.

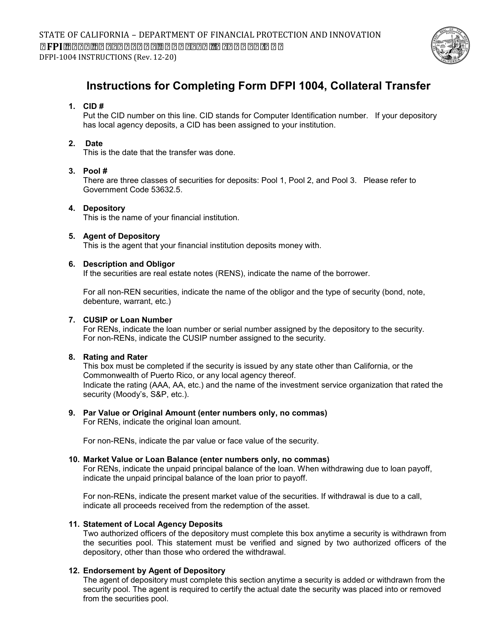

This document provides instructions for completing Form DFPI-1004 Collateral Transfer, which is used in the state of California. The form is used to transfer collateral related to certain financial transactions.

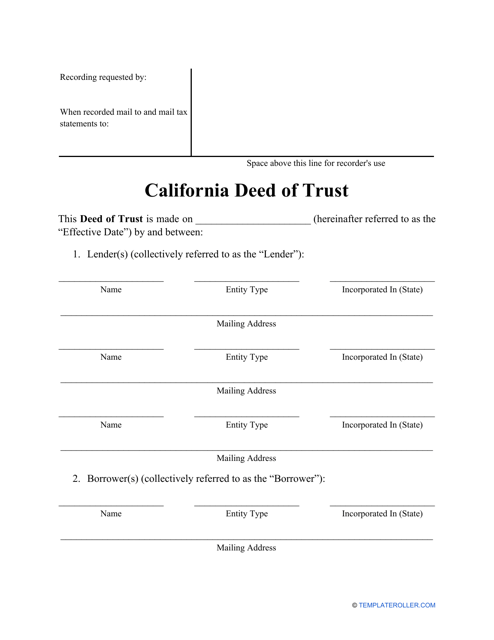

Complete this printable Deed of Trust template when making your own Deed in the state of California.

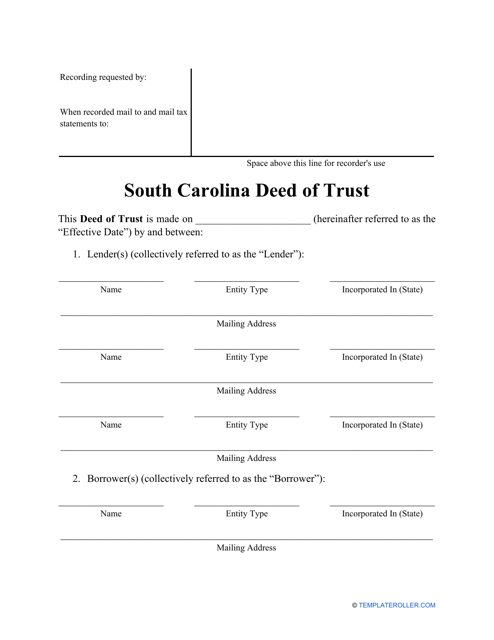

Complete this printable Deed of Trust template when making your own Deed in the state of South Carolina.

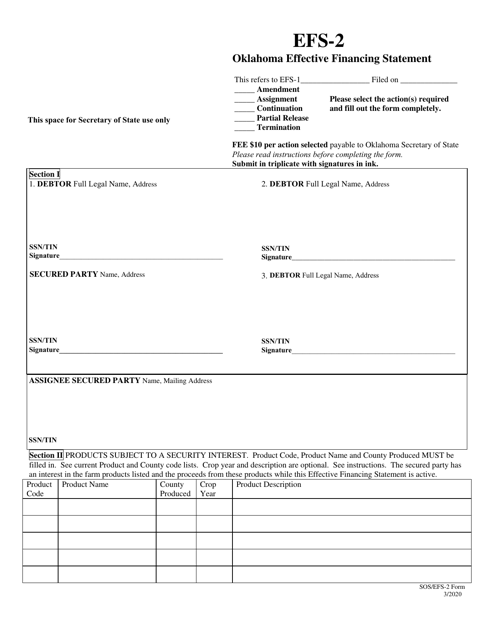

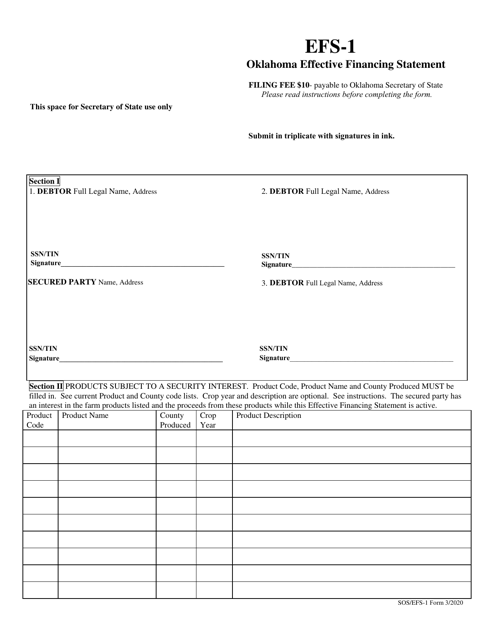

This form is used for filing an effective financing statement in the state of Oklahoma. It is required to provide notice of a security interest in personal property, such as a car or equipment.

This form is used for filing an effective financing statement in Oklahoma. It is required to secure a lender's interest in a specific piece of property.

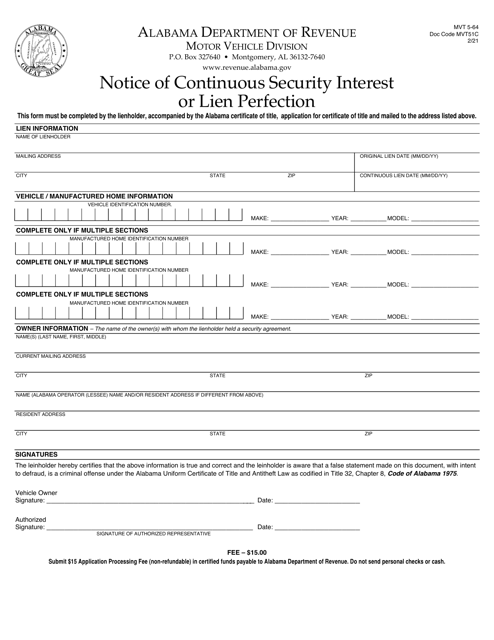

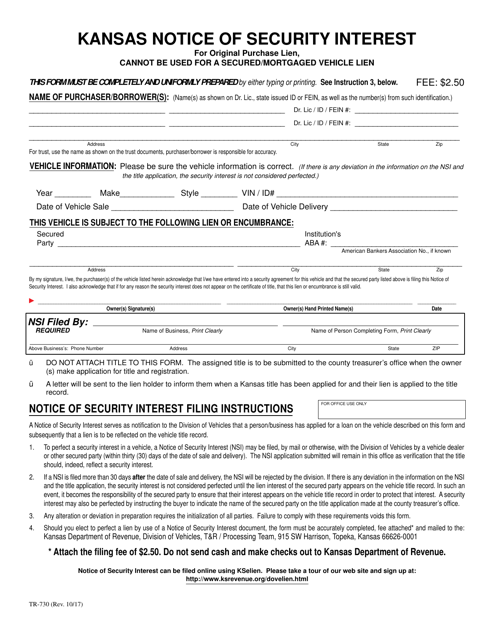

This form is used for filing a notice of security interest in Kansas. It is typically used when a creditor wants to claim a security interest in certain property or assets of a debtor.

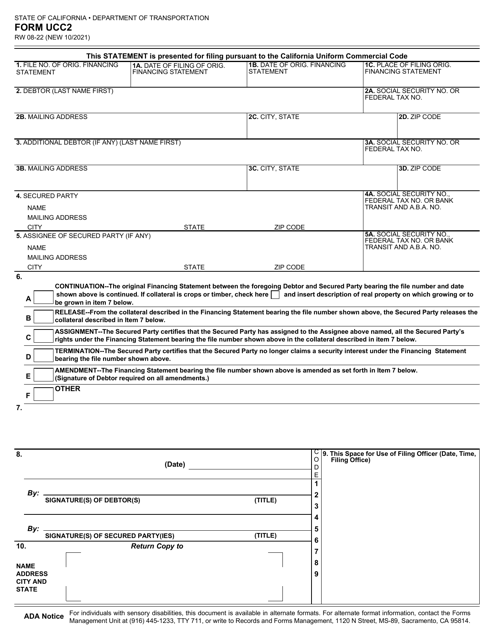

This form is used for filing a UCC2 financing statement in California. It is required for secured transactions involving personal property.

This document is a legally binding agreement used in Georgia (United States) for guaranteeing payment in a business transaction.

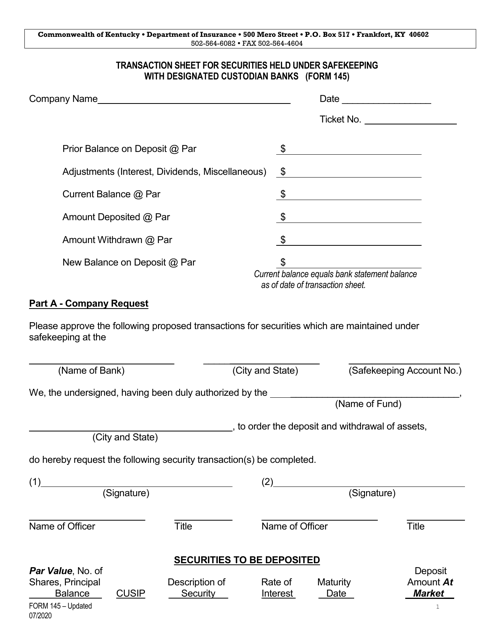

This Form is used for reporting transactions of securities held under safekeeping in Kentucky.

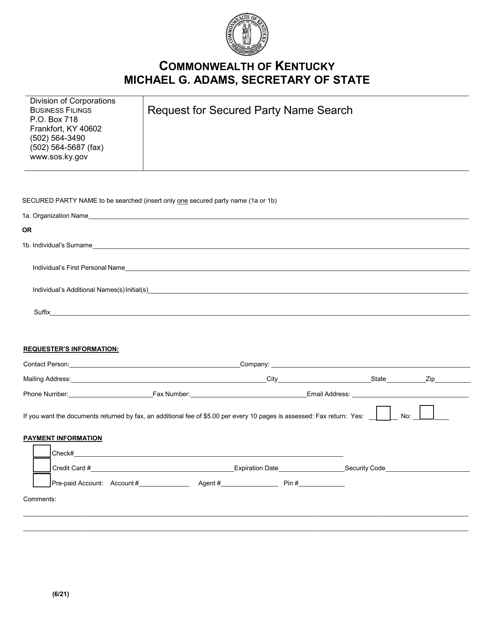

This Form is used for requesting a search of secured party names in the state of Kentucky. It allows individuals to access information about existing secured parties that have filed financing statements.

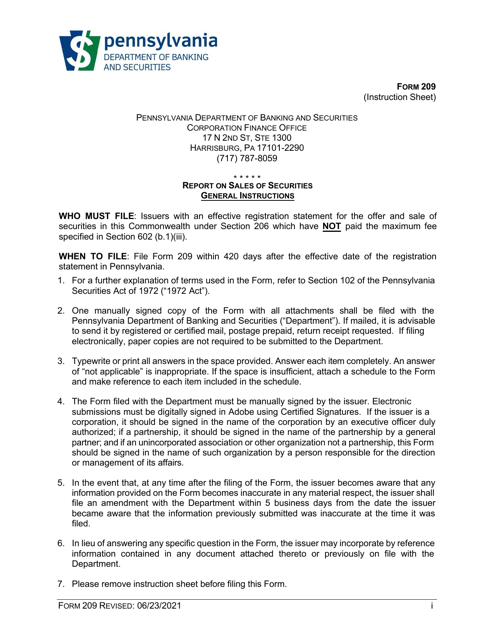

This form is used for reporting the sales of securities in Pennsylvania. It is important for individuals and businesses to accurately report their sales to comply with state regulations.

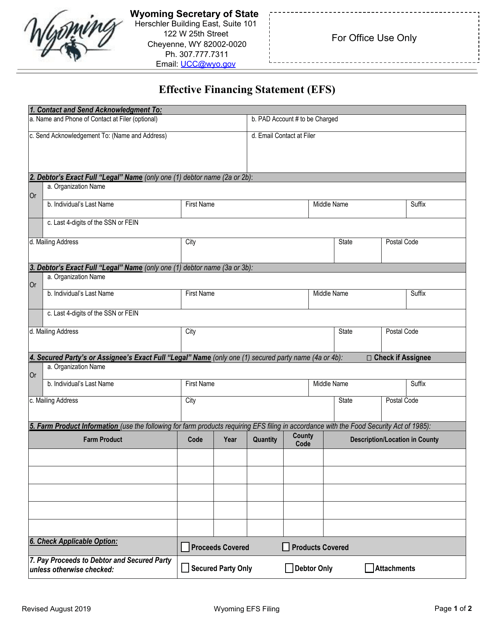

This document is used for filing a financing statement in Wyoming to establish a security interest in collateral for a loan or financial transaction.