Transaction Privilege Tax Templates

Are you a business owner in need of information about transaction privilege tax? Look no further! Our webpage provides valuable resources and guidance regarding this important tax requirement.

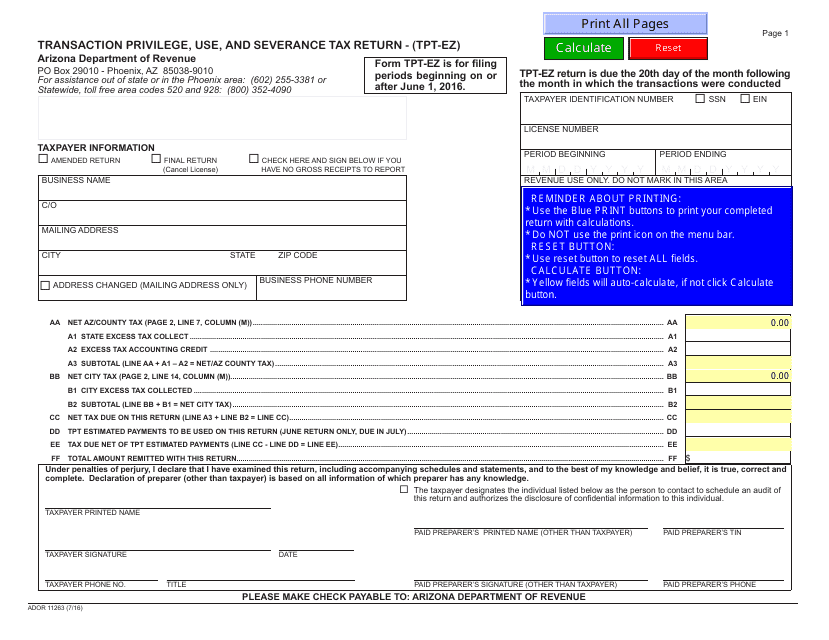

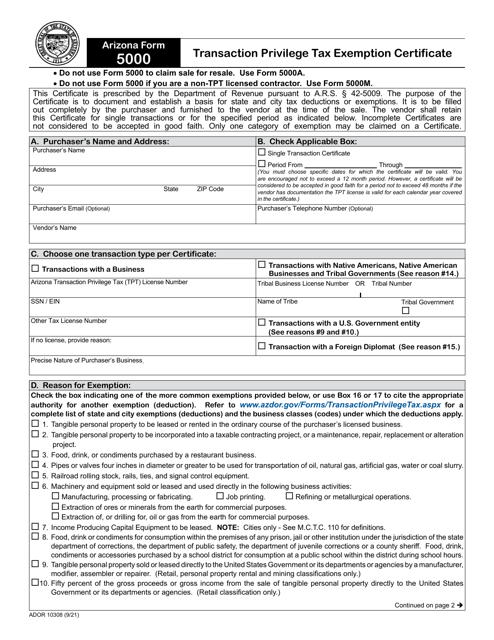

Whether you refer to it as transaction privilege tax, sales tax, or even by its alternate names like transaction privilege and use tax or severance tax, we have all the answers you need. Our webpage offers a comprehensive collection of documents pertaining to transaction privilege tax, including tax forms, exemption certificates, and instructions on how to file your returns accurately.

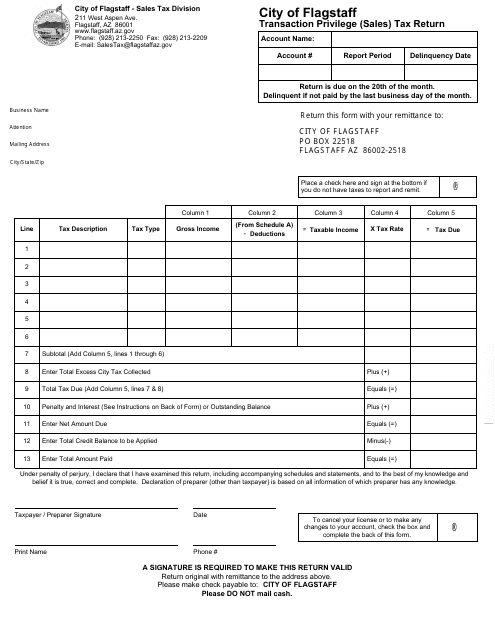

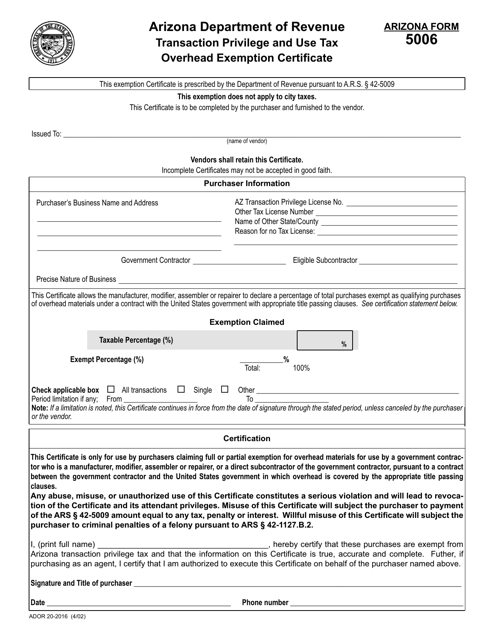

For instance, if you are a business operating in the City of Flagstaff, Arizona, you will find the Transaction Privilege (Sales) Tax Return specifically designed for your location. Similarly, if you require an Overhead Exemption Certificate for transaction privilege and use tax in Arizona, our webpage has the necessary Form 5006 (ADOR20-2016) to fulfill your requirements.

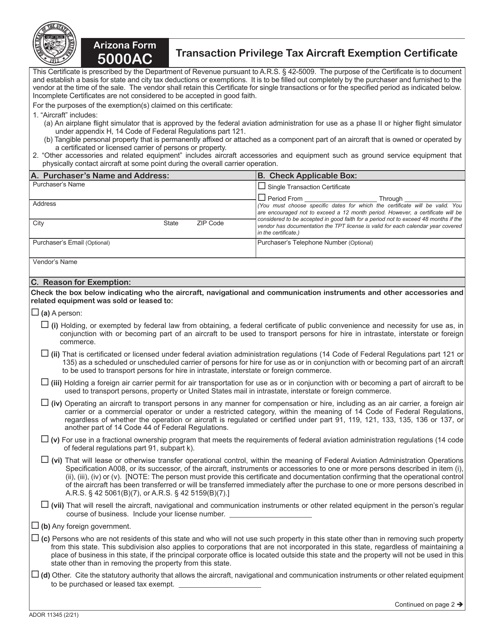

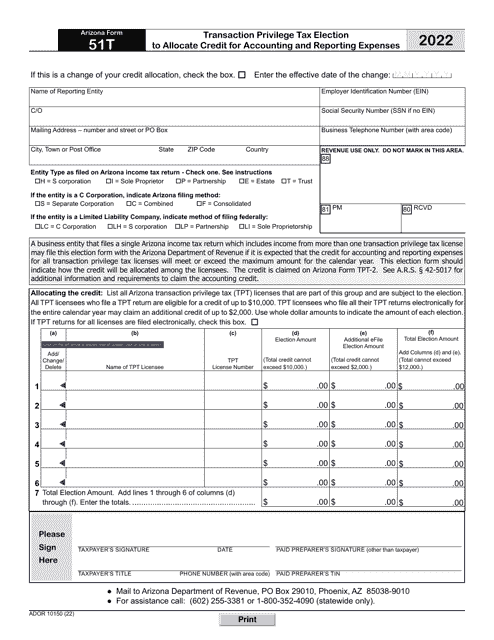

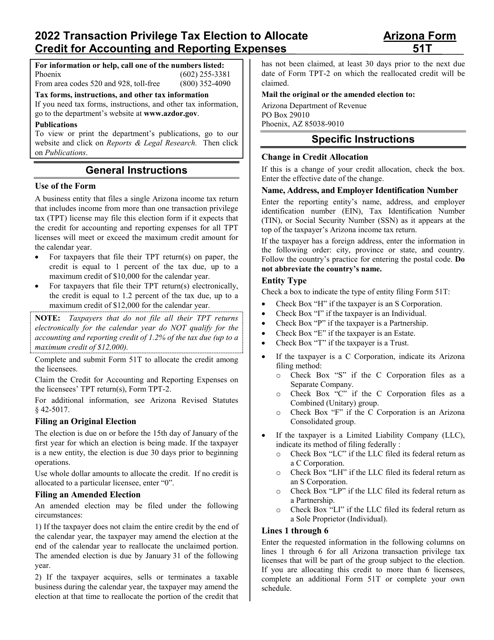

We also provide detailed instructions for various tax forms such as TPT-2 and TPT-1, helping you understand the process of reporting your transaction privilege, use, and severance taxes accurately. Additionally, if you are involved in the aviation industry, our webpage offers the Arizona Form 5000AC (ADOR11345) Transaction Privilege Tax Aircraft Exemption Certificate.

With our user-friendly interface and easily accessible documents, navigating through your transaction privilege tax obligations has never been easier. Stay compliant with the transaction privilege tax regulations in your jurisdiction by using our comprehensive document collection and expert guidance.

Note: Due to the nature of this service, we cannot provide actual documents. However, if you have any questions or need assistance with specific transaction privilege tax forms or documentation, our team is always available to help. Contact us today to ensure a smooth and hassle-free tax filing experience.

Documents:

15

This document is used for filing sales tax returns with the City of Flagstaff, Arizona.

This form is used for reporting transaction privilege, use, and severance taxes in Arizona. It is commonly known as the TPT-EZ form.

Transaction privilege tax (TPT) is a sales tax levied by the state of Arizona on vendors for the ability to conduct business in the state and this is a document that establishes the basis for state exceptions.

This Form is used for claiming an exemption from transaction privilege and use taxes related to overhead expenses in Arizona.

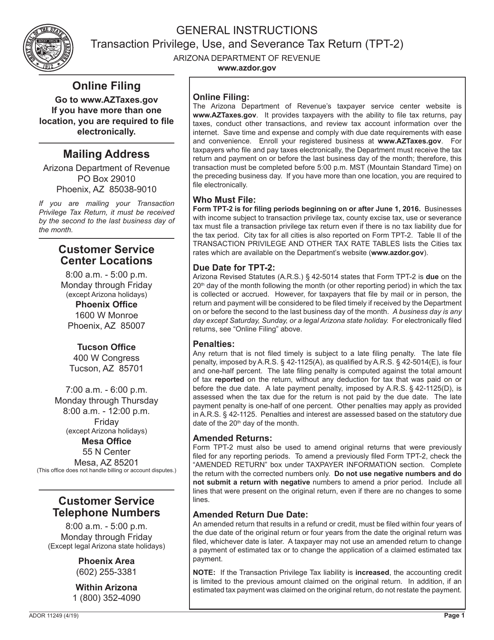

This Form is used for filing the Transaction Privilege, Use, and Severance Tax Return in Arizona. It provides instructions for completing Form TPT-2, ADOR11249.

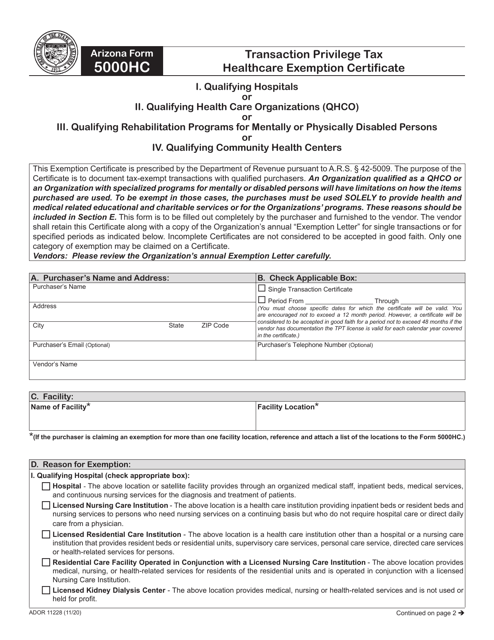

Arizona Form 5000HC (ADOR11228) Transaction Privilege Tax Healthcare Exemption Certificate - Arizona

This document is used for claiming an exemption from transaction privilege tax for healthcare-related transactions in Arizona.

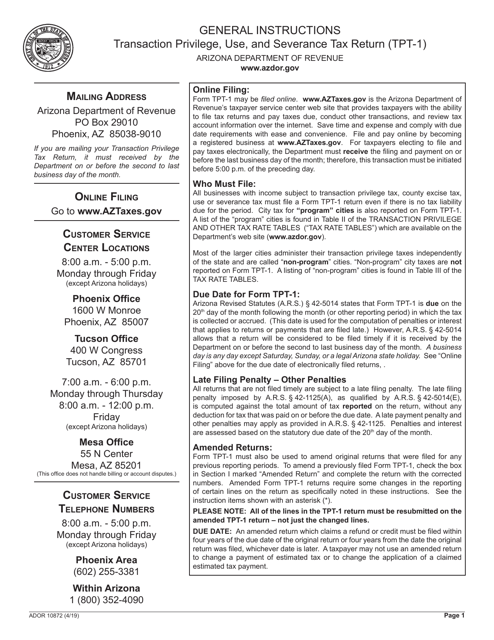

This Form is used for filing the Transaction Privilege, Use, and Severance Tax Return in the state of Arizona. It provides instructions on how to accurately fill out and submit the form to the Arizona Department of Revenue (ADOR).

This document is used for applying for an aircraft exemption certificate for transaction privilege tax in Arizona.

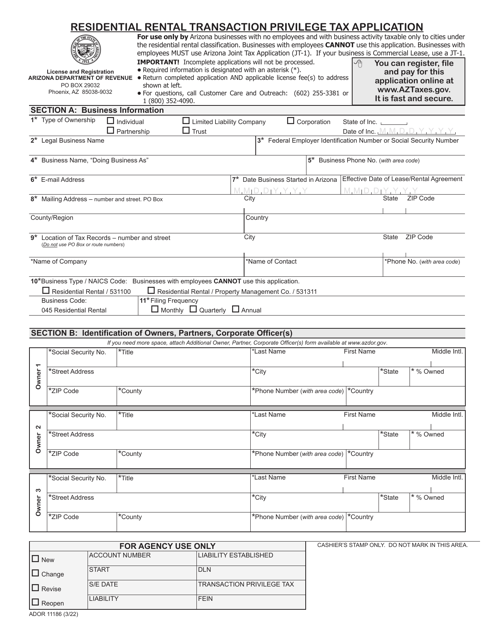

This Form is used for applying for the Residential Rental Transaction Privilege Tax in the state of Arizona.