Tax Savings Templates

Documents:

82

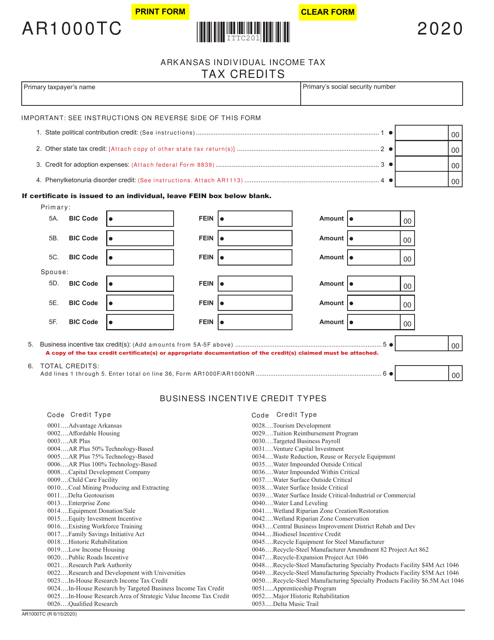

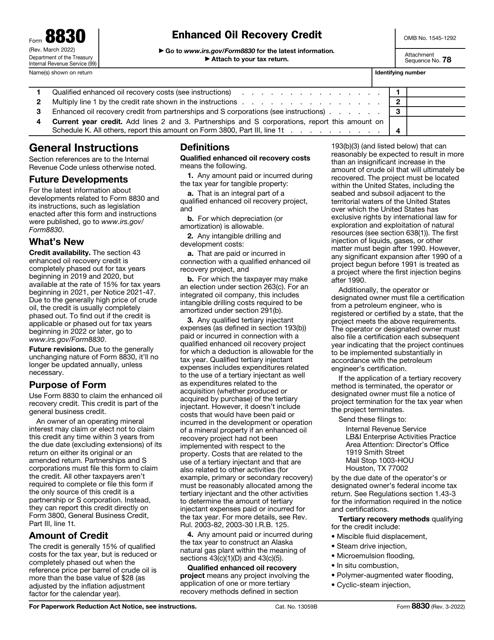

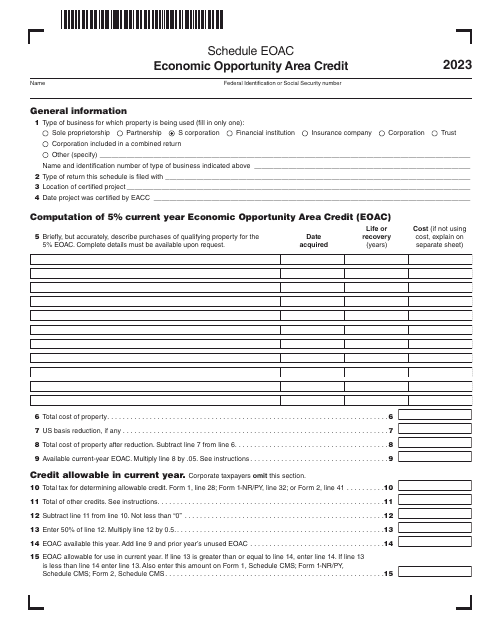

This Form is used for claiming tax credits on your Arkansas state taxes. It allows you to reduce the amount of tax you owe or increase your tax refund.

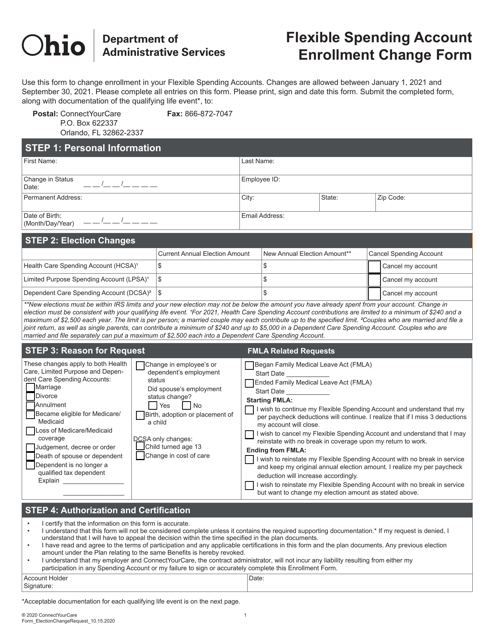

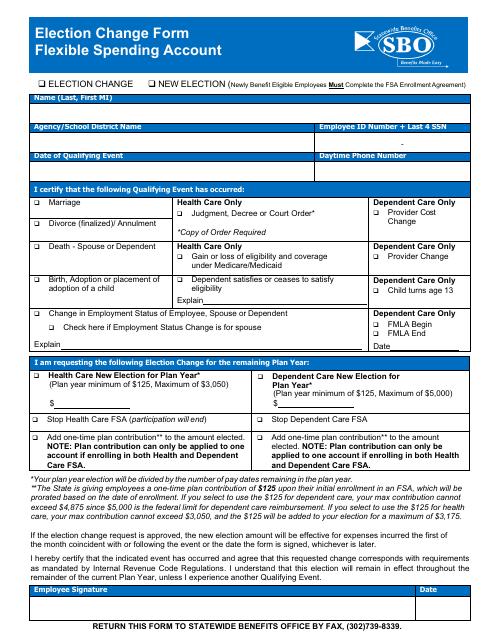

This Form is used for making changes to your Flexible Spending Account (FSA) enrollment in the state of Ohio.

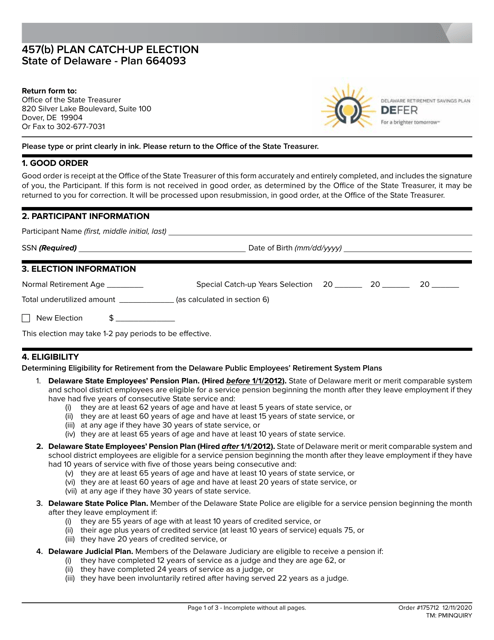

This document is for making catch-up contributions to a 457(b) retirement plan in the state of Delaware. It allows individuals to contribute additional funds to their retirement account to "catch up" on missed contributions.

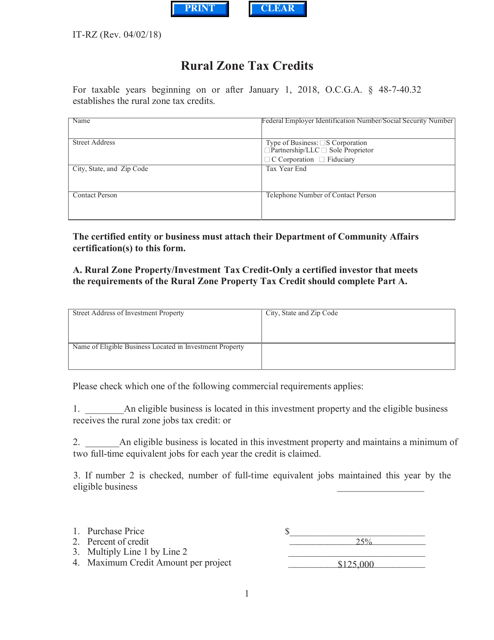

This form is used for claiming rural zone tax credits in the state of Georgia. It allows eligible individuals or businesses to receive tax credits for certain expenses incurred within designated rural zones.

This Form is used for applying for a tax abatement on real property in Washington, D.C.

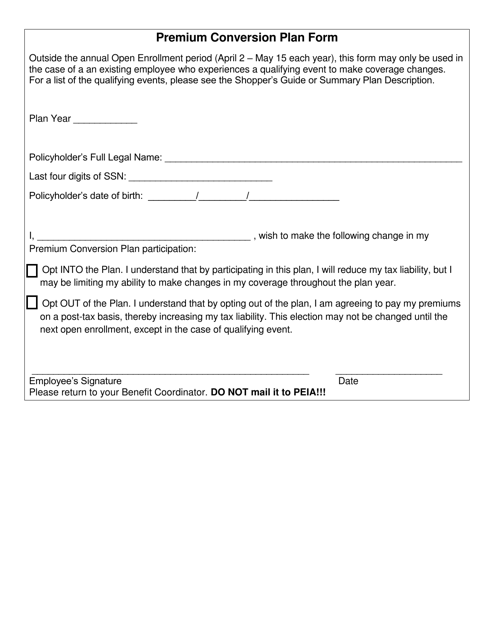

This Form is used for enrolling in the Premium Conversion Plan in West Virginia. It allows employees to pay for certain insurance premiums with pre-tax dollars.

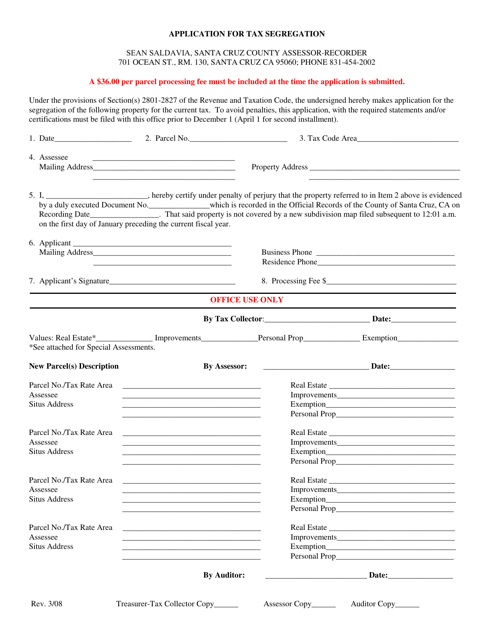

This document is an application form used in Santa Cruz County, California for requesting tax segregation. Tax segregation is a method of allocating costs of real property between different asset classes to optimize tax deductions.

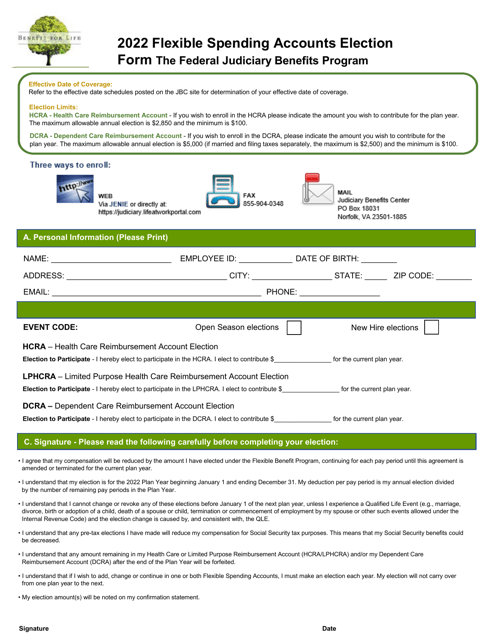

This Form is used for electing participation in Flexible Spending Accounts under the Federal Judiciary Benefits Program.

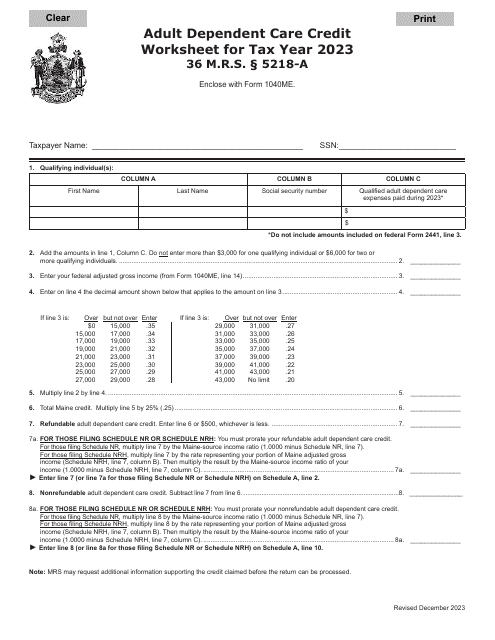

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

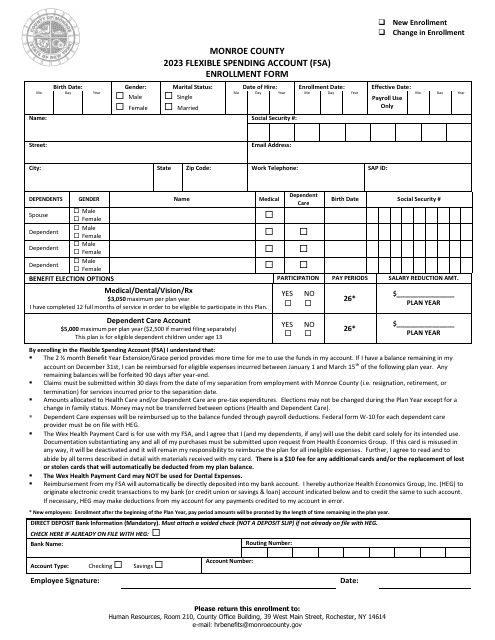

This document is for enrolling in a Flexible Spending Account (FSA) in Monroe County, New York. It allows individuals to set aside pre-tax funds to pay for eligible medical expenses.

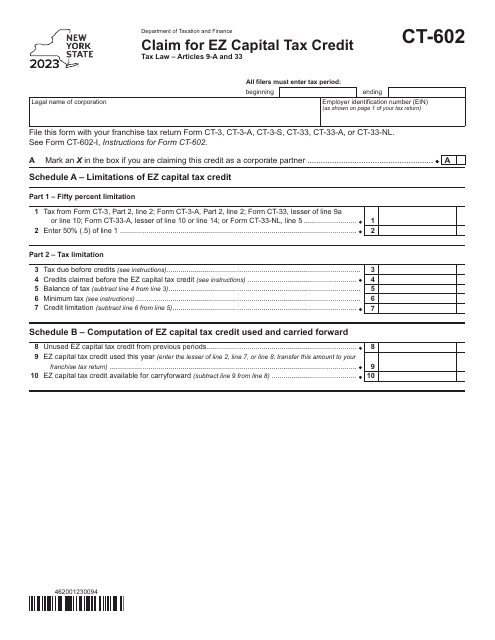

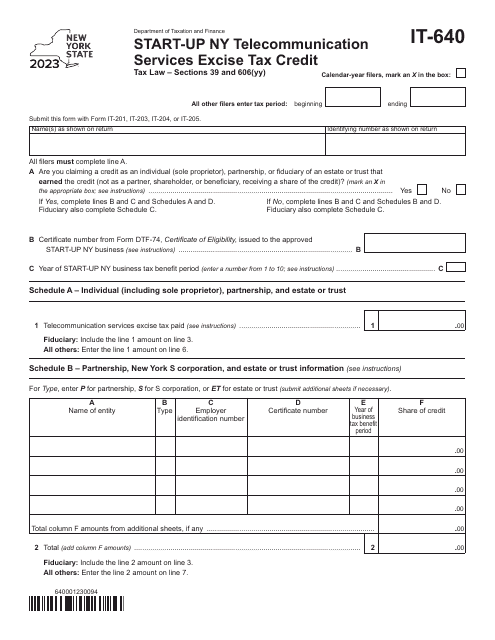

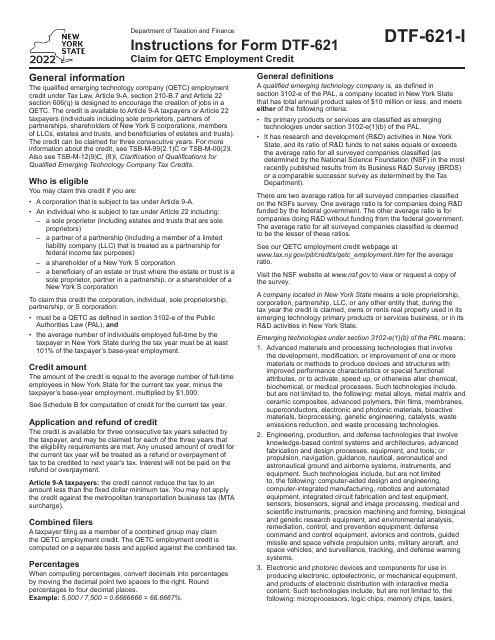

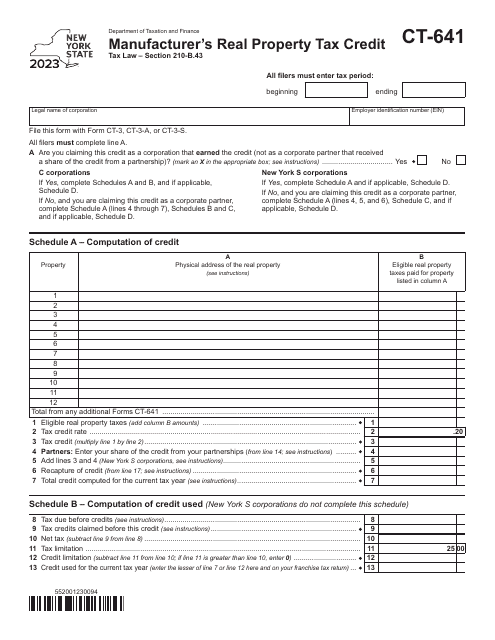

This Form is used for claiming the QETC Employment Credit in the state of New York. It provides instructions on how to fill out and submit the form to receive the credit.

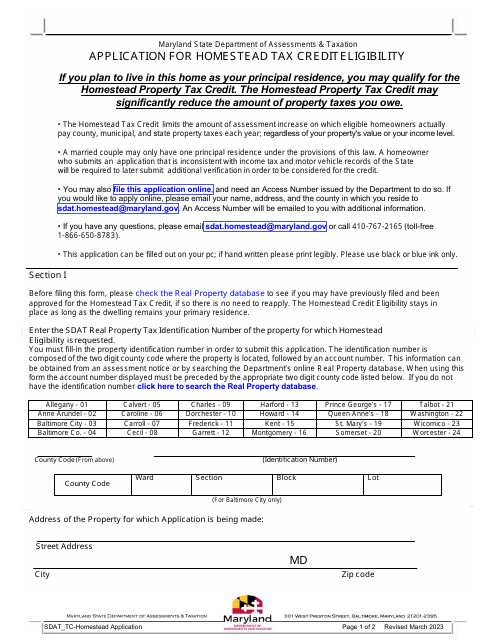

This document is an application for the Homestead Tax Credit eligibility in the state of Maryland. The Homestead Tax Credit is a program that provides property tax relief to eligible homeowners. To apply, you must meet certain criteria, such as owning the property as your primary residence.