Credit Agreement Templates

Are you looking for a comprehensive resource on credit agreements and related legal documents? Look no further! Our collection of credit agreements, also known as credit agreements or credit contracts, is designed to provide you with the necessary information and templates to navigate the world of lending and borrowing.

Whether you need a Personal Guarantee Template, a Subordination Agreement, or a Master Guarantee Agreement, our credit agreement library has got you covered. From initial rate schedules for consumer credit sales in South Carolina to transportation impact fee credit agreements in the City of Fort Worth, Texas, our vast range of document examples ensures that you can find the specific information and templates you need.

Our credit agreement collection is continuously updated to reflect the latest legal requirements and best practices across various jurisdictions. We strive to provide you with a one-stop resource that empowers you to understand and draft credit agreements accurately and confidently.

Don't waste hours searching for scattered information online or paying costly legal fees. Access our credit agreement library today and take control of your lending and borrowing needs. With our user-friendly interface and extensive document collection, you can save time, effort, and money while ensuring compliance with relevant regulations and achieving your financial goals.

Take advantage of our credit agreement library now to streamline your credit transactions and protect your interests. Start exploring today and unlock the power of comprehensive knowledge in the realm of credit agreements.

Documents:

15

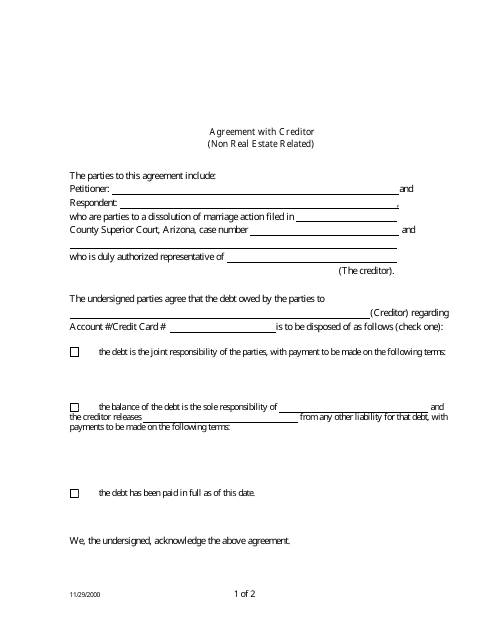

This document is a template used in Arizona for creating an agreement with a creditor that is not related to real estate. It helps in formalizing terms and conditions between the parties involved.

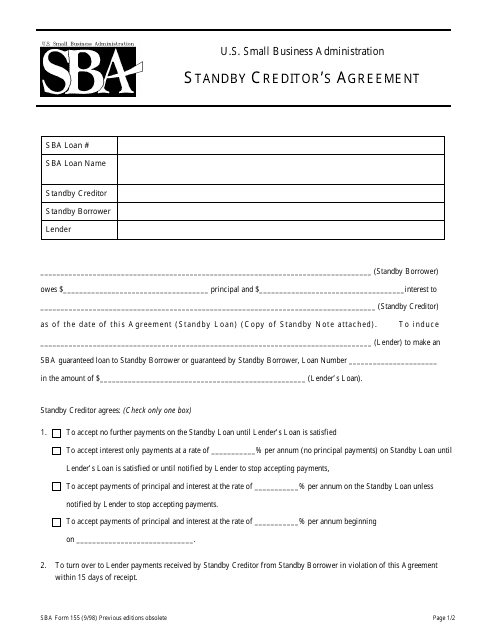

Use this document to formalize a subordination of lien rights of the Standby Creditor to the Small Business Administration (SBA) Lender's rights in the collateral.

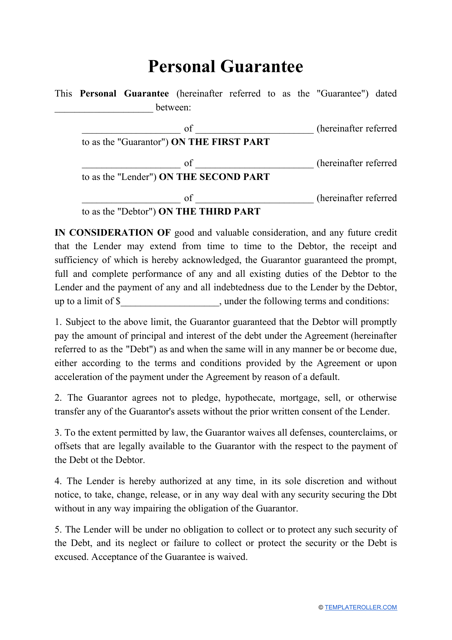

This form expresses a written promise by a guarantor to take responsibility for a debtor if they fail to pay their debt to a lender.

According to a Revolving Credit Agreement, a seller allows a buyer to make purchases under this account on the terms and conditions established in the agreement.

This form is used for creating a subordination agreement in the state of California. It allows for the prioritization of certain debts or liens over others.

This document provides the maximum interest rates for consumer credit sales in South Carolina.

This Form is used for medium term credits under the Electronic Compliance Program.

This form is used for creating a Mexican Promissory Note with a fixed interest rate for all types of credit.

This form is used for a Master Guarantee Agreement for agencies granting long term credits.

This form is used for submitting an irrevocable letter of credit for closure in the state of Wisconsin.

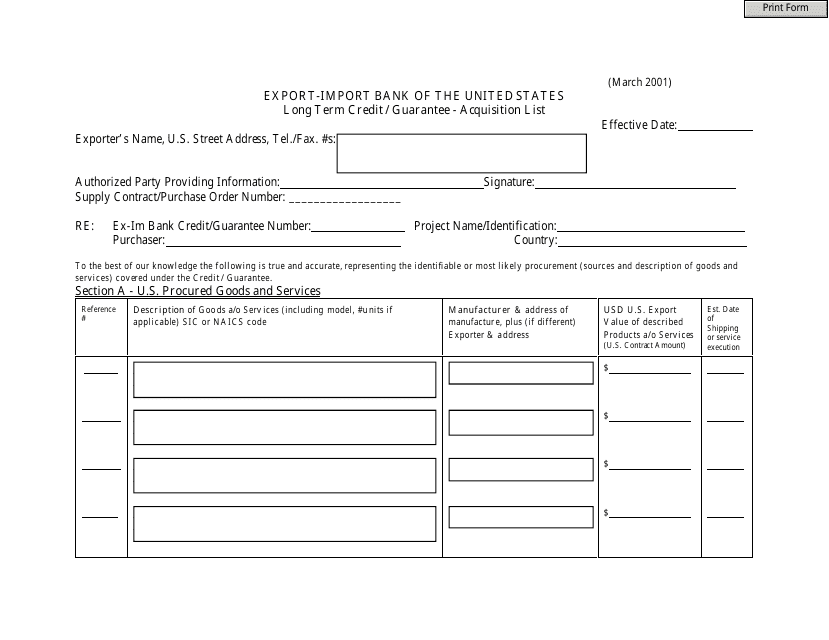

This document is a list of acquisitions that have been made with long-term credit or guarantee. It outlines the purchases or investments that have been financed through this method.

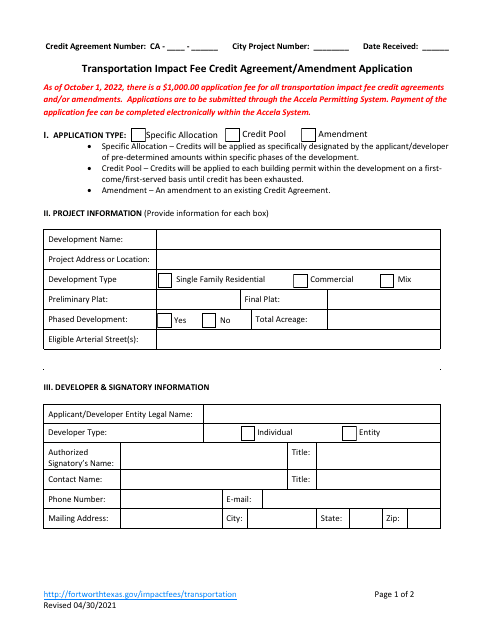

This document is for applying for an amendment to the transportation impact fee credit agreement in the City of Fort Worth, Texas.

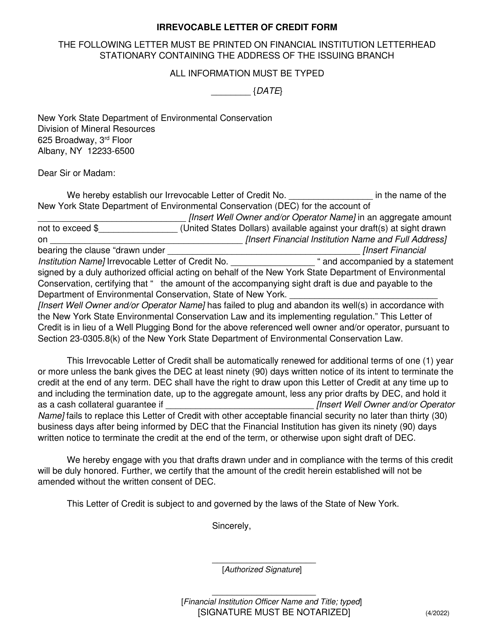

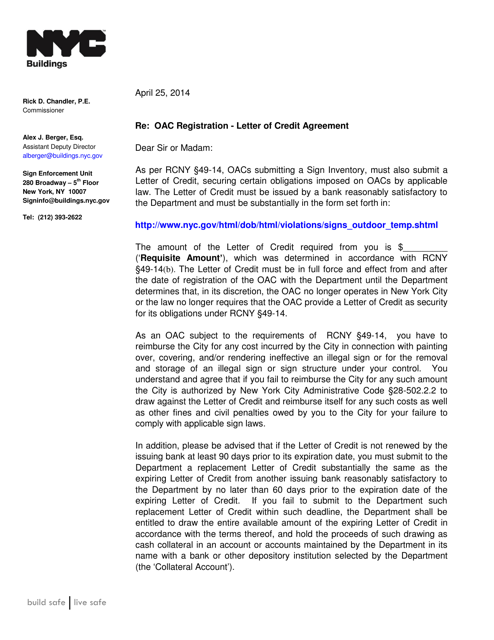

This document is for registering for OAC (Office of Administrative Courts) and establishing a Letter of Credit Agreement in New York City. It outlines the terms and conditions of the agreement between parties involved.