Fuel Blending Templates

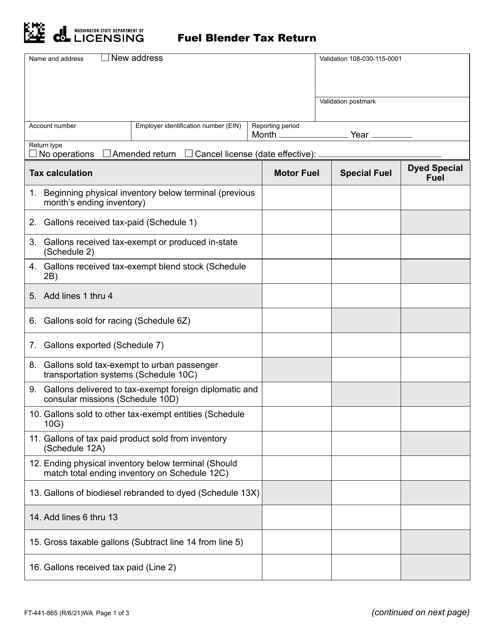

Fuel blending, also known as blended fuel, is a process that involves mixing different types of fuel together to create a new blend with specific characteristics. This practice is widely used in the energy industry to produce fuels that meet regulatory requirements or market demands.

Blended fuel is crucial in achieving optimal fuel performance, improving combustion efficiency, and reducing emissions. It allows for the customization of fuel properties, such as octane rating, oxygen content, and viscosity, to meet the specific needs of different applications.

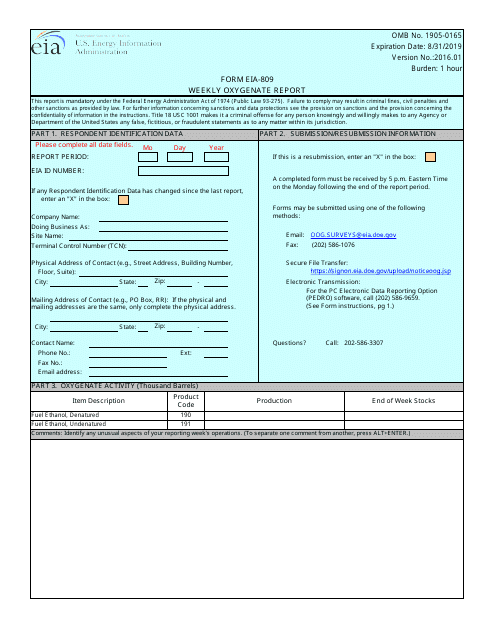

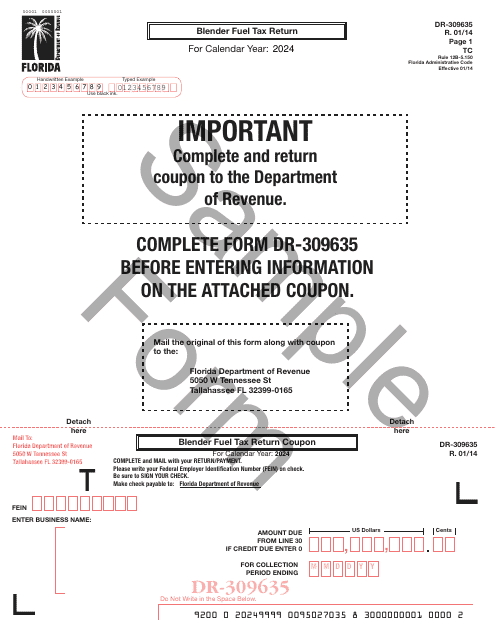

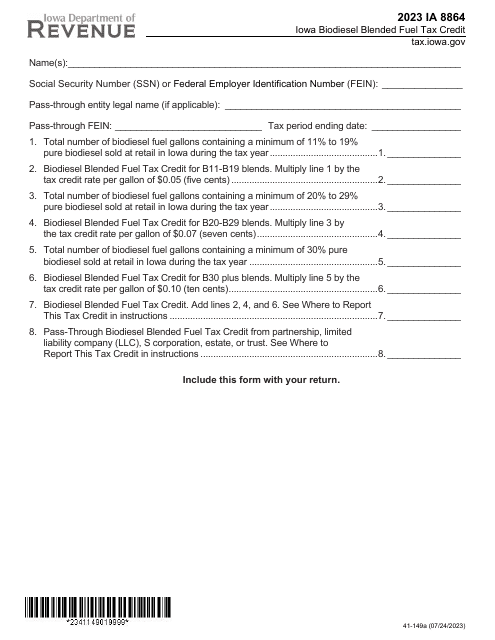

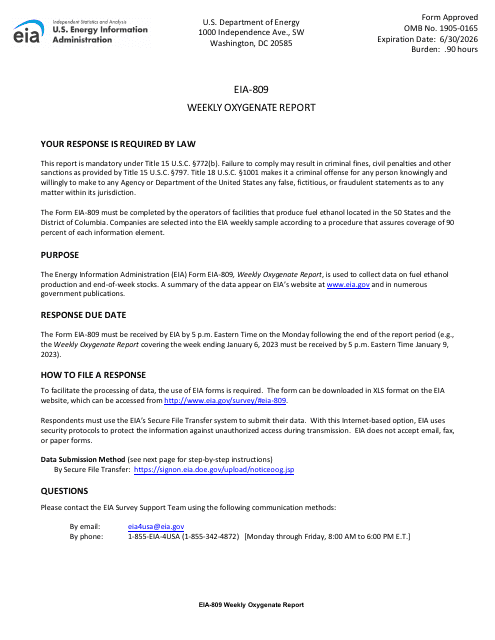

Fuel blending plays a vital role in ensuring compliance with state and federal regulations. Various forms and reports, such as the Form EIA-809 Weekly Oxygenate Report and the Form DR-309635 Blender Fuel Tax Return - Florida, are essential for monitoring and documenting the blending process.

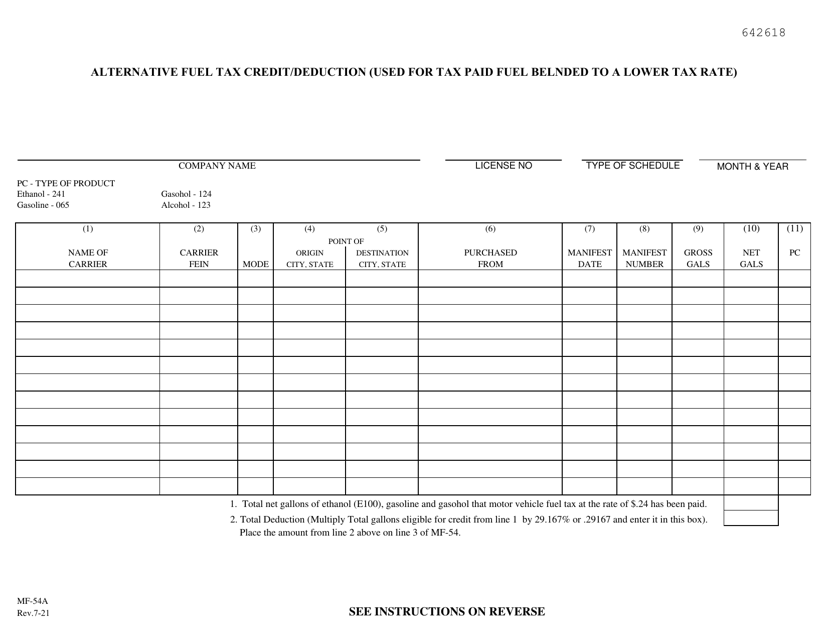

Moreover, fuel blending offers economic benefits by optimizing fuel costs and reducing reliance on higher-priced components. For instance, the Form MF-54A Alternative Fuel Tax Credit/Deduction (Used for Tax Paid Fuel Blended to a Lower Tax Rate) - Kansas provides incentives for blending fuels with a lower tax rate, encouraging fuel blenders to explore innovative blending techniques.

In summary, fuel blending, or blended fuel, is a vital practice in the energy industry that allows for the creation of fuels with specific properties to meet regulatory requirements and market demands. Through the blending process and various related forms and reports, fuel blenders can optimize fuel performance, comply with regulations, and achieve economic benefits.

Documents:

8

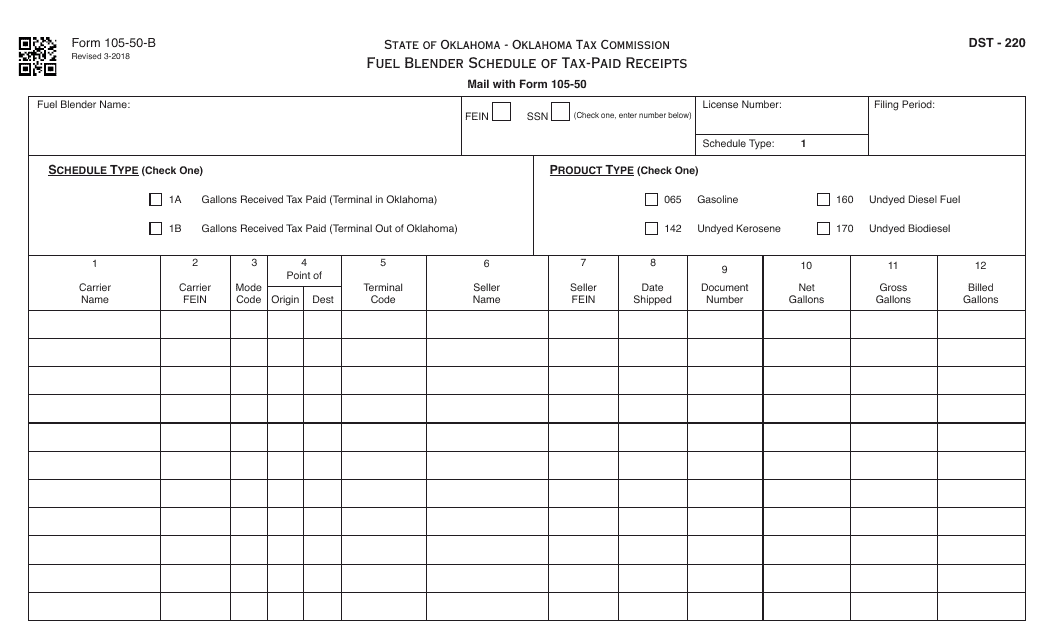

This form is used for reporting tax-paid receipts for fuel blending in Oklahoma.

This Form is used for reporting weekly data on oxygenate production and consumption. It helps the government track the usage of oxygenates in various industries.

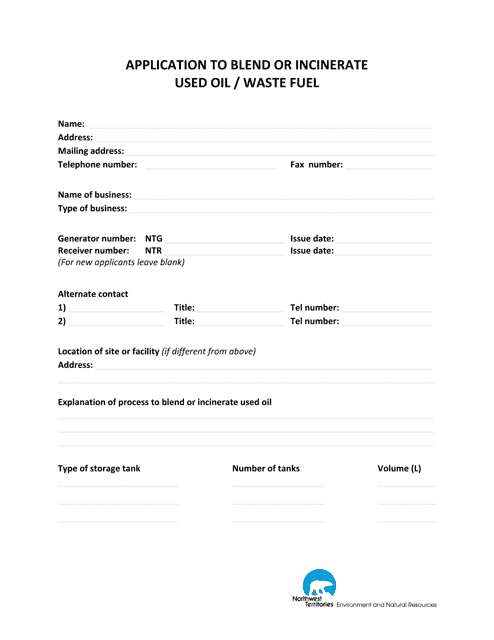

This document is an application for the disposal of used oil or waste fuel through blending or incineration in the Northwest Territories, Canada.