Environmental Tax Templates

Looking to learn more about environmental tax and its significance? At USA, Canada, and other countries document knowledge system, we have a comprehensive collection of documents related to environmental tax. Our collection includes various forms and instructions provided by government agencies like the IRS and Canada Revenue Agency.

Environmental tax, also known as environmental taxes, plays a crucial role in promoting environmentally friendly practices and mitigating environmental damages. These taxes are levied on activities that have a negative impact on the environment, such as the disposal of scrap tires or the consumption of fuel. By imposing financial costs on these activities, environmental tax aims to deter harmful practices and encourage companies and individuals to adopt sustainable alternatives.

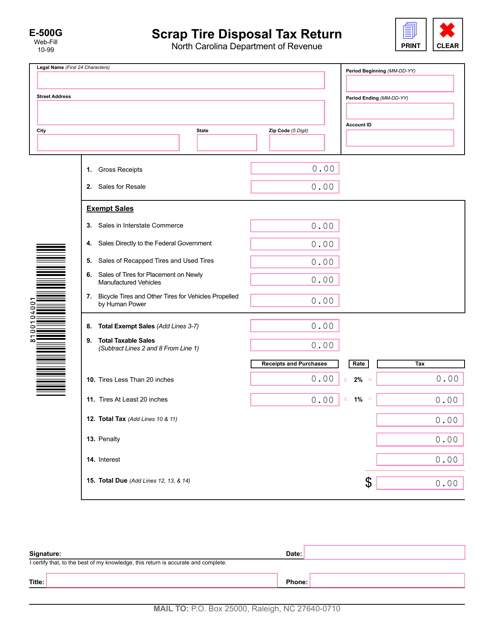

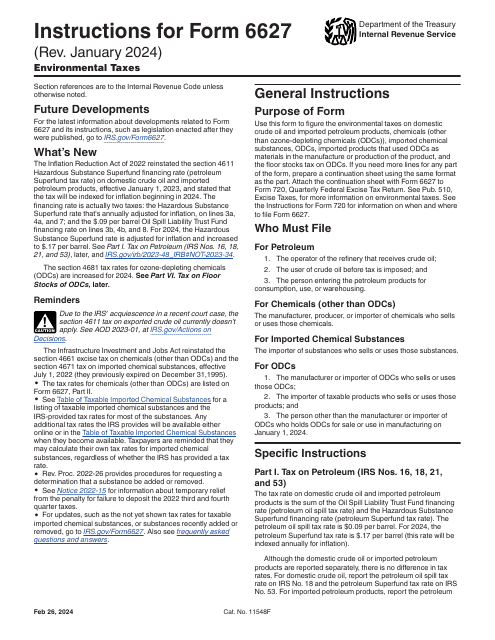

In our collection, you will find documents like the Form E-500G Scrap Tire Disposal Tax Return - North Carolina and IRS Form 6627 Environmental Taxes. These forms help businesses and individuals fulfill their tax obligations related to environmentally harmful activities. Additionally, we provide detailed instructions on how to complete IRS Form 6627 and other related forms, ensuring that you have the guidance you need to comply with tax regulations.

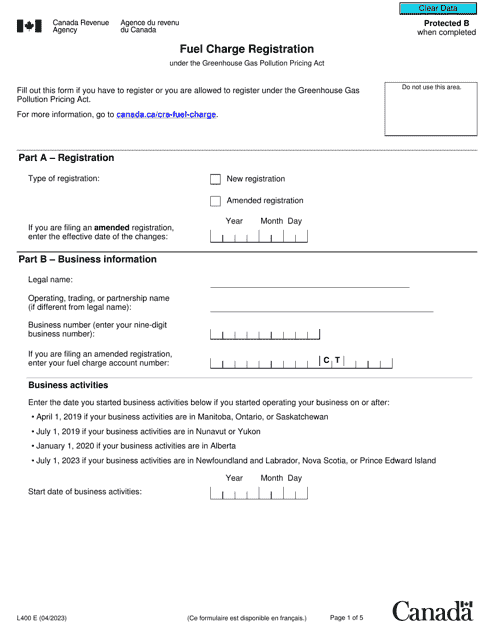

Canada's contribution to environmental taxation is also included in our collection, with forms like Form L400 Fuel Charge Registration. This document is essential for businesses operating in Canada to register for the fuel charge component of environmental tax.

Whether you are a taxpayer, tax professional, or simply interested in understanding the environmental taxation system, our collection of documents will provide you with valuable information and guidance. By exploring the various forms and instructions, you can gain insights into the scope of environmental tax and its implementation in different jurisdictions.

Stay informed about environmental tax and its implications by accessing our extensive collection of documents. Start exploring now to enhance your understanding of this crucial aspect of environmental sustainability.

Documents:

13

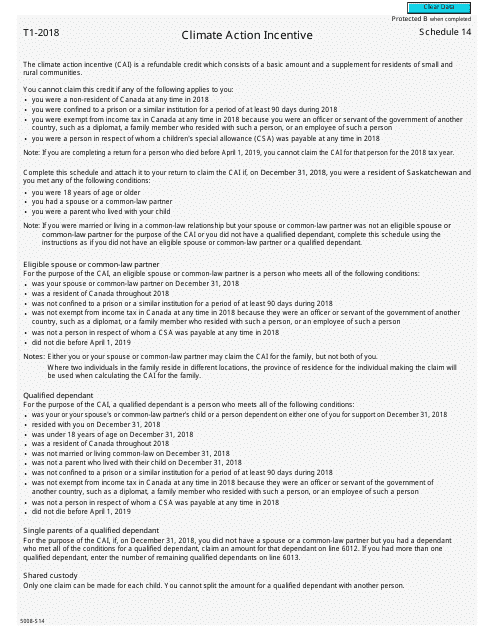

This document is used for completing Schedule 14 in Form 5008-S14 to claim climate action incentives in Canada.

This form is used for reporting and paying the scrap tire disposal tax in the state of North Carolina.

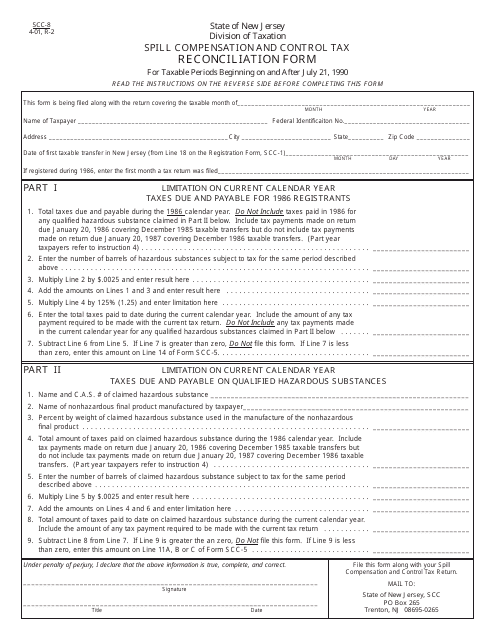

This Form is used for reconciling spill compensation and control tax in the state of New Jersey.