Unstamped Cigarettes Templates

Looking for information about unstamped cigarettes? Our website provides a comprehensive guide to the legal and regulatory requirements surrounding the transportation, sales, and distribution of unstamped cigarettes.

Unstamped cigarettes, also known as non-tax-paid cigarettes, are tobacco products that lack the required tax stamps or markings indicating that the applicable taxes have been paid. These cigarettes present a significant concern for both government entities and legitimate businesses, as they can lead to the loss of tax revenue and the potential for illegal activities.

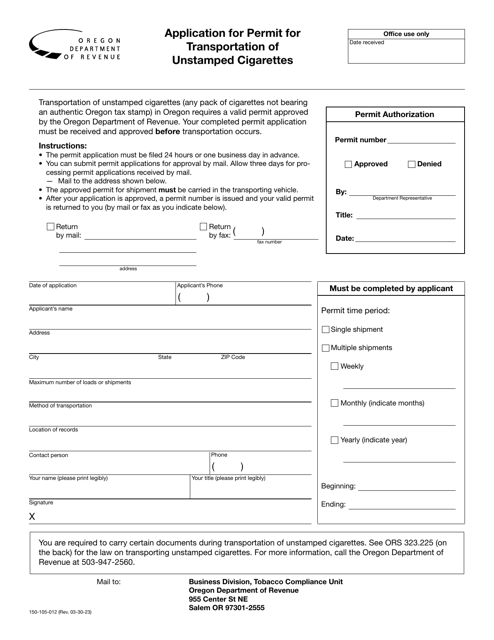

Our website offers a collection of documents that delve into the various aspects of unstamped cigarettes. These documents include application forms for permits related to the transportation of unstamped cigarettes, sales and transfer schedules within specific states, and record-keeping forms for distributors. Some of the alternate names for this collection of documents include non-tax-paid cigarettes documents and unstamped cigarette compliance forms.

If you want to ensure compliance with the law or gain a deeper understanding of the regulations surrounding unstamped cigarettes in your state or region, our website is your go-to resource. With our extensive collection of documents, you'll have all the information you need to navigate the complexities of this industry and stay on the right side of the law.

Documents:

13

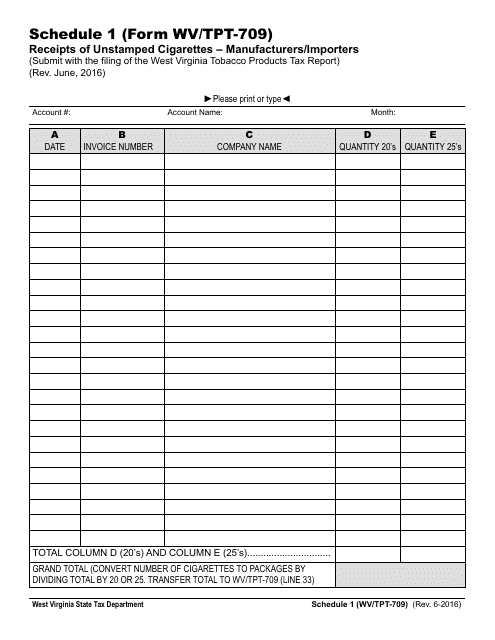

This form is used for reporting the receipts of unstamped cigarettes by manufacturers and importers in West Virginia.

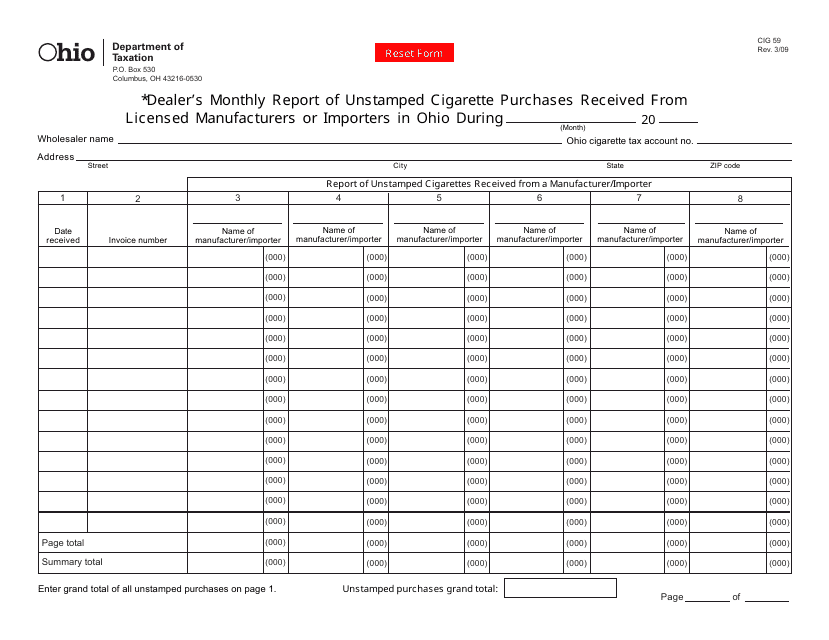

This form is used for dealers in Ohio to report the monthly quantity of unstamped cigarettes they have received.

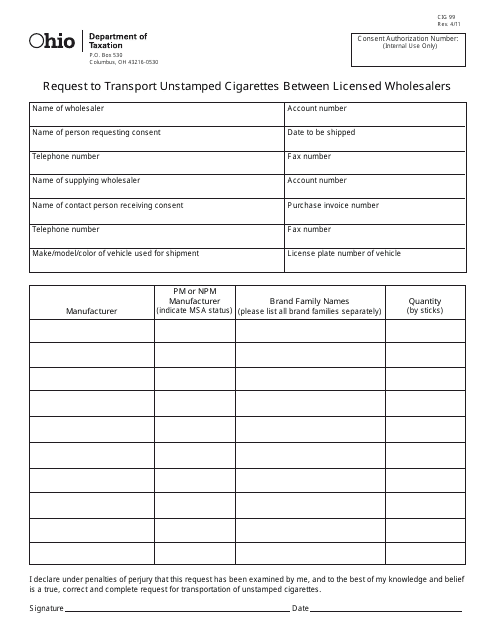

This form is used for requesting permission to transport unstamped cigarettes between licensed wholesalers in the state of Ohio.

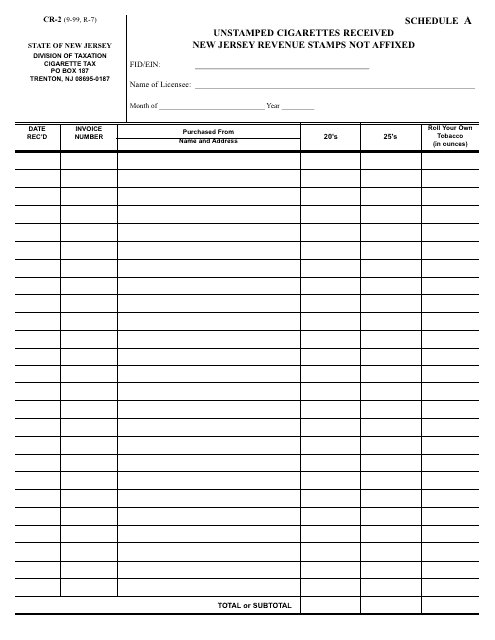

This form is used to report unstamped cigarettes received in New Jersey without the required revenue stamps affixed.

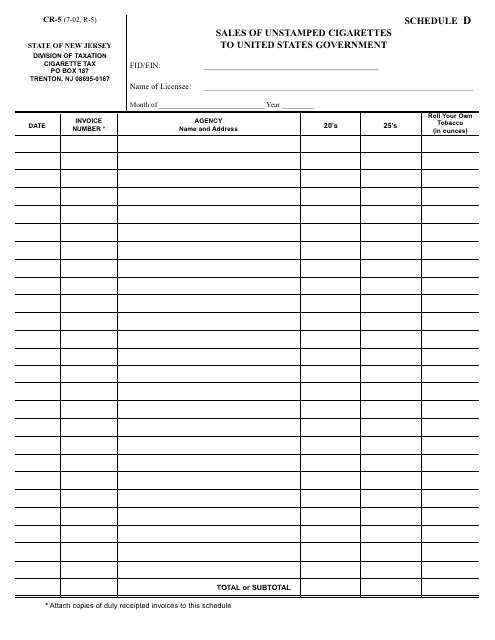

This form is used for reporting sales of unstamped cigarettes to the United States Government in New Jersey.

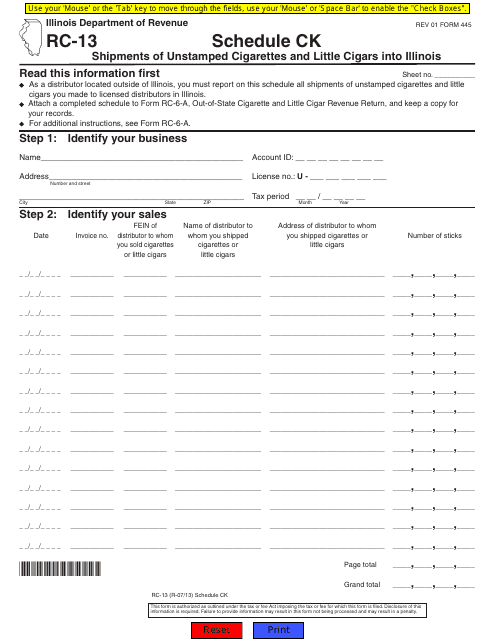

This form is used for reporting shipments of unstamped cigarettes and little cigars into Illinois.

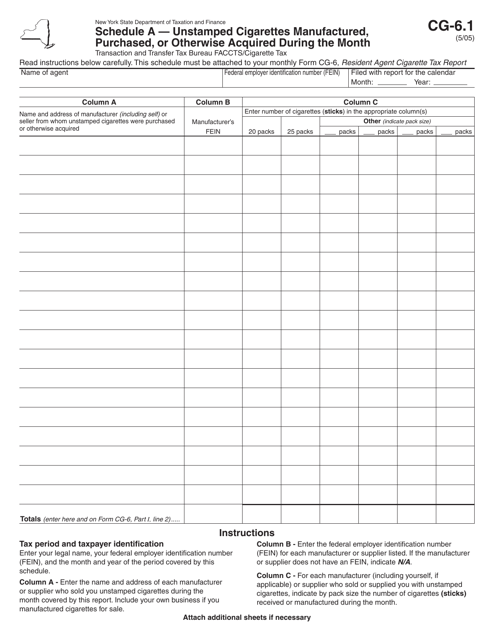

This Form is used for reporting information about the manufacturing, purchasing, or acquisition of unstamped cigarettes in New York during a specific month.

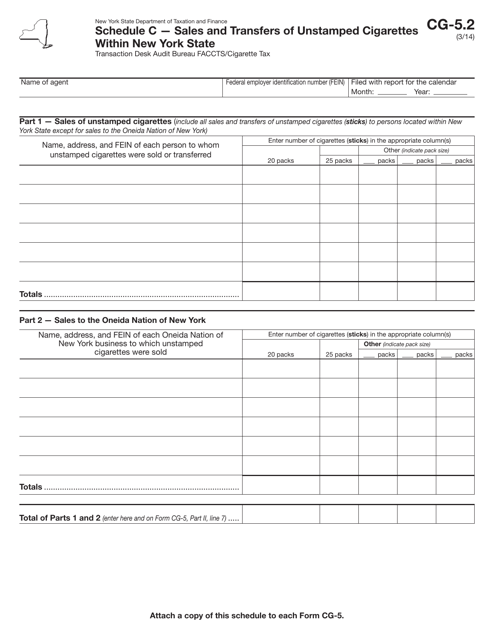

This form is used for reporting sales and transfers of unstamped cigarettes within New York State.

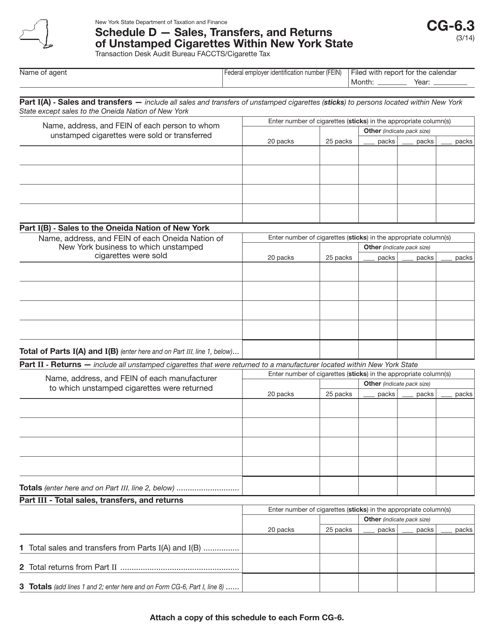

This form is used for reporting sales, transfers, and returns of unstamped cigarettes within New York State.