Tax Authorities Templates

Welcome to our webpage dedicated to tax authorities, also known as tax authorization forms or tax documents authorization.

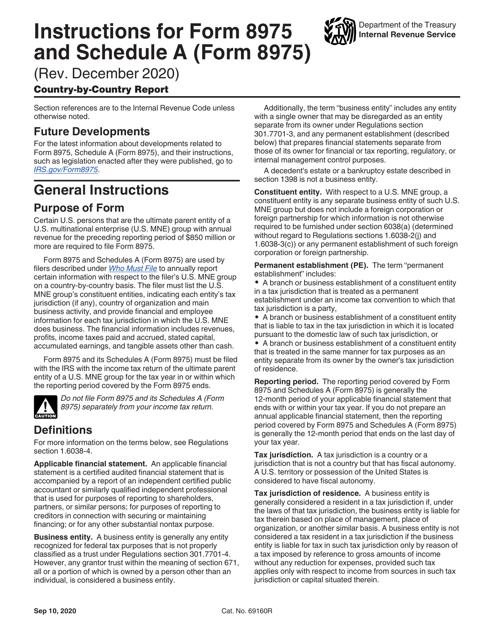

Tax authorities play a crucial role in regulating and overseeing tax matters in various jurisdictions. They are the governing bodies that enforce and administer tax laws, ensuring compliance and collection of taxes.

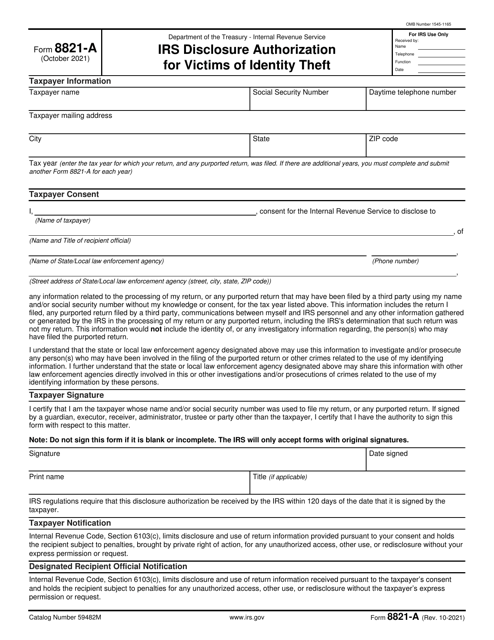

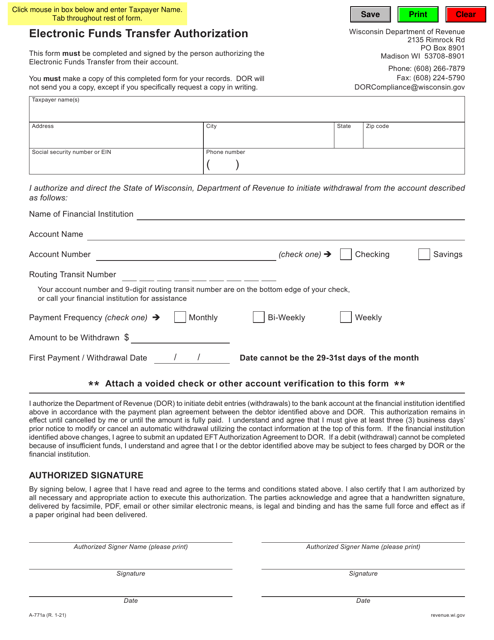

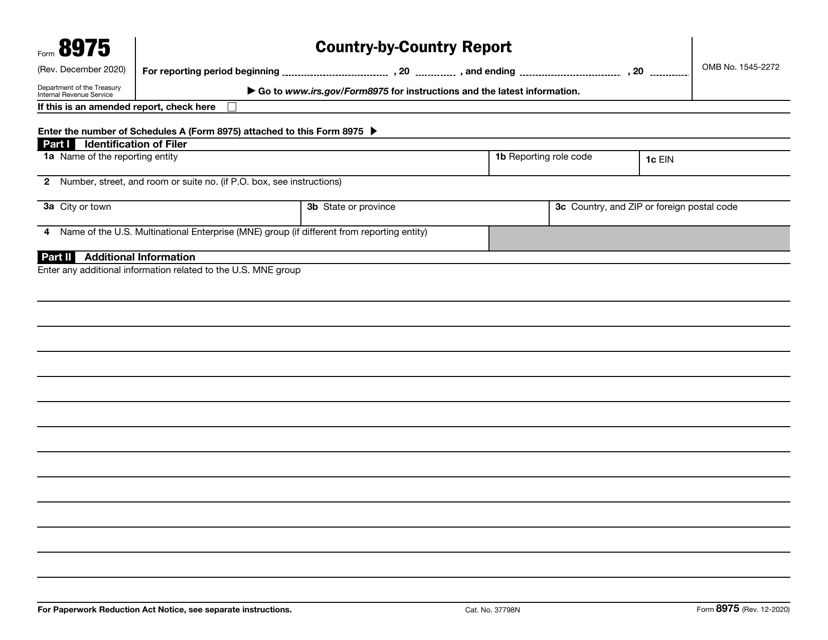

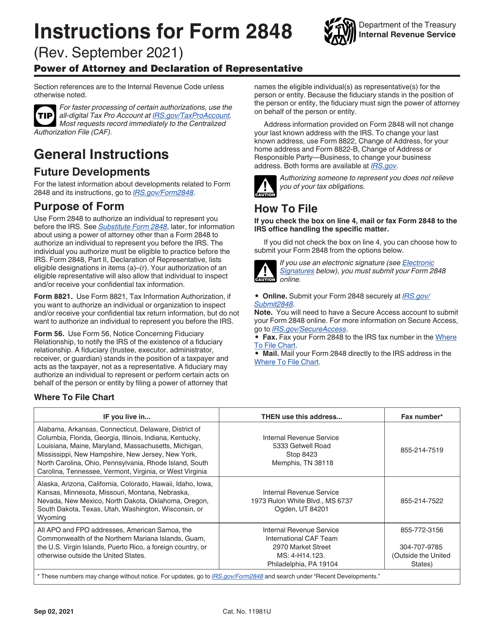

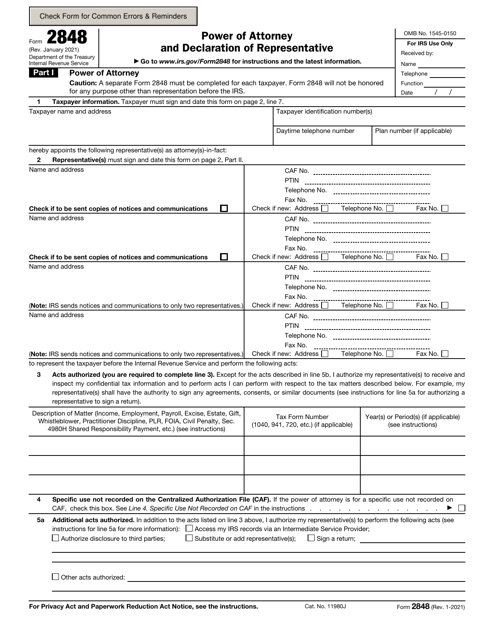

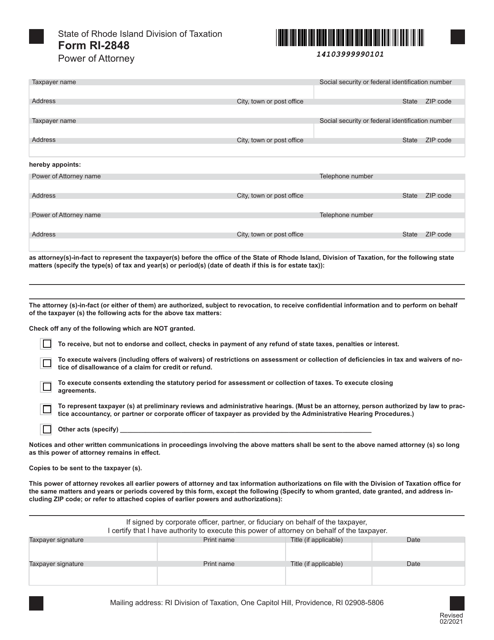

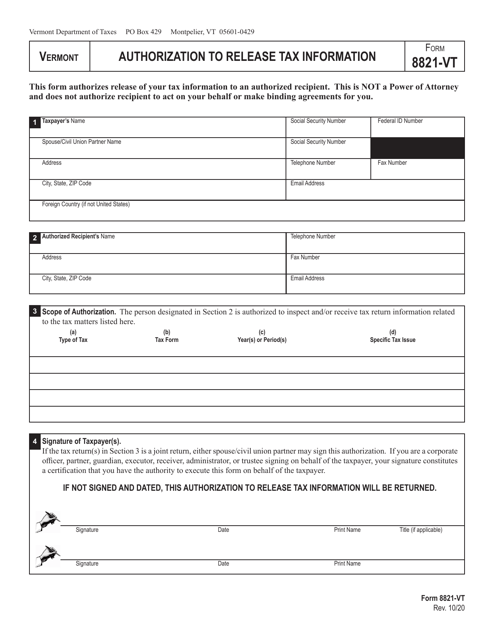

At our platform, we understand the importance of tax authorities and provide you with a comprehensive collection of tax authorization forms. These forms allow you to grant someone the power of attorney to act on your behalf in tax-related matters or authorize the disclosure of your tax information to third parties.

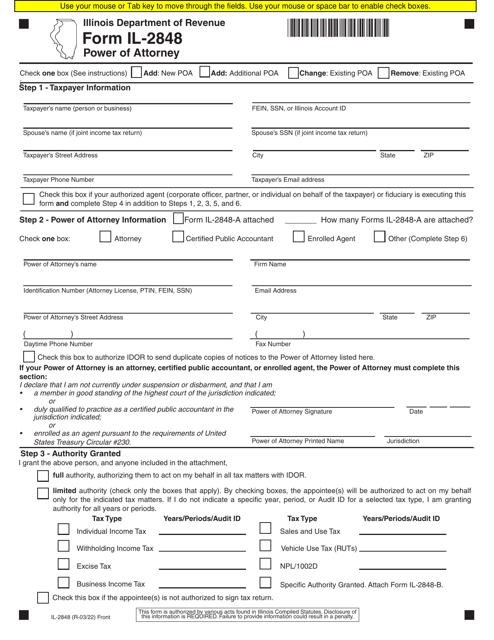

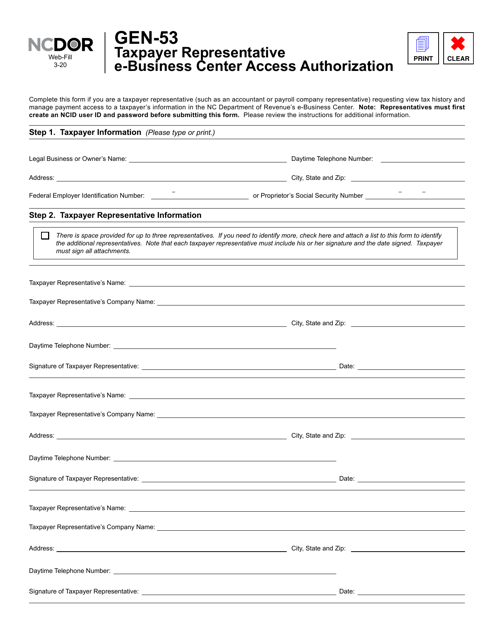

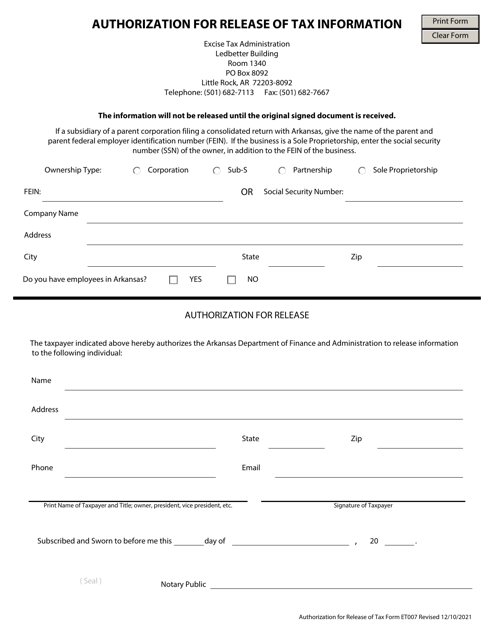

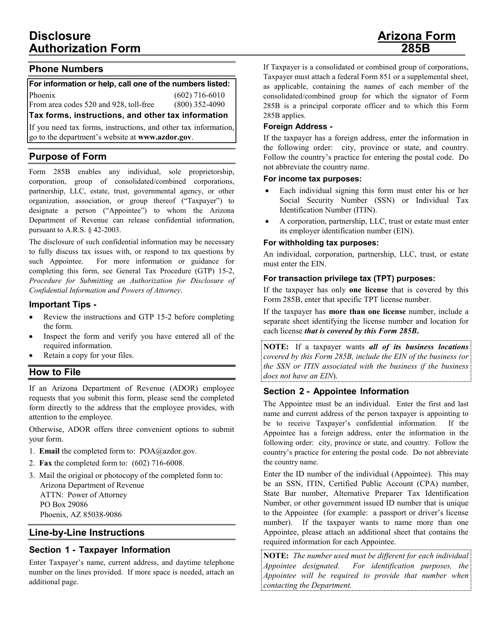

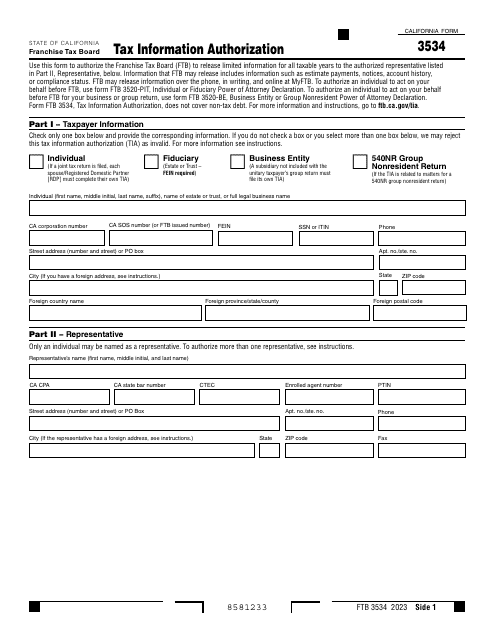

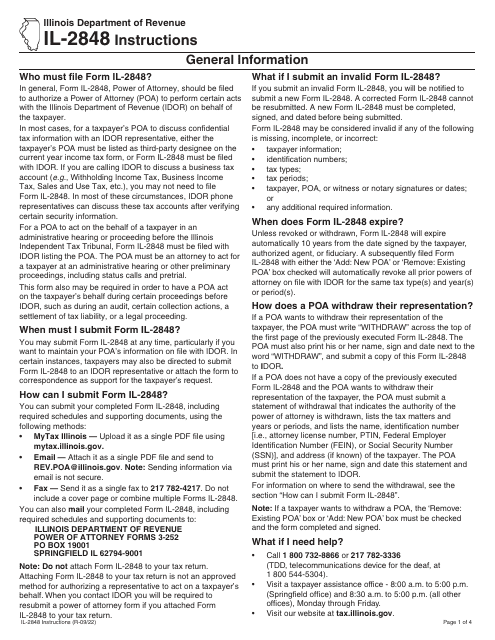

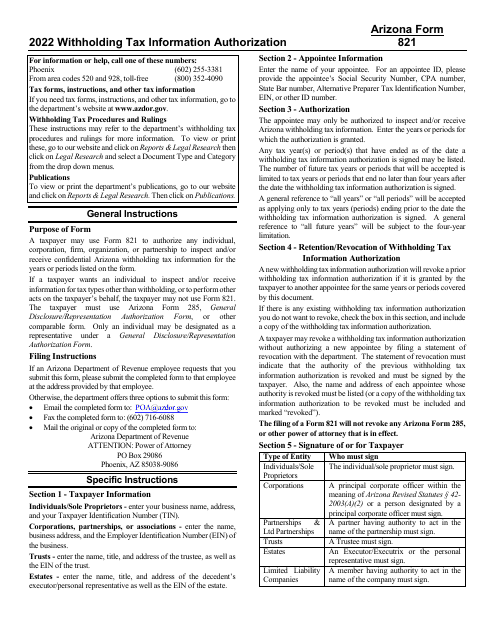

Some of the tax authorization forms you can find on our platform include Form IL-2848 Power of Attorney from Illinois, Form GEN-53 Taxpayer Representative E-Business Center Access Authorization from North Carolina, Form ET007 Authorization for Release of Tax Information from Arkansas, Instructions for Arizona Form 285B, ADOR10955 Disclosure Authorization Form from Arizona, and Form FTB3534 Tax Information Authorization from California.

These tax authorization forms are designed to meet the specific requirements of each jurisdiction, ensuring accuracy and compliance. Whether you are an individual or a business entity, our platform offers a convenient and user-friendly experience to help you navigate the complex world of tax authorities.

With our extensive collection of tax authorization forms, you can save time and effort by accessing the necessary documents from the comfort of your own home or office. Our platform ensures that you have all the required forms at your fingertips, making the process of granting power of attorney or authorizing tax information disclosure efficient and hassle-free.

We understand that dealing with tax matters can be overwhelming, especially when it comes to interacting with tax authorities. That's why we strive to simplify the process by providing you with the resources and tools you need to fulfill your tax-related obligations.

Trust our platform to provide you with the tax authorization forms you need to comply with the regulations set forth by tax authorities. Simplify your tax journey with our user-friendly interface and reliable collection of tax authorization forms. Start exploring our platform today and take control of your tax-related matters with ease.

Documents:

32

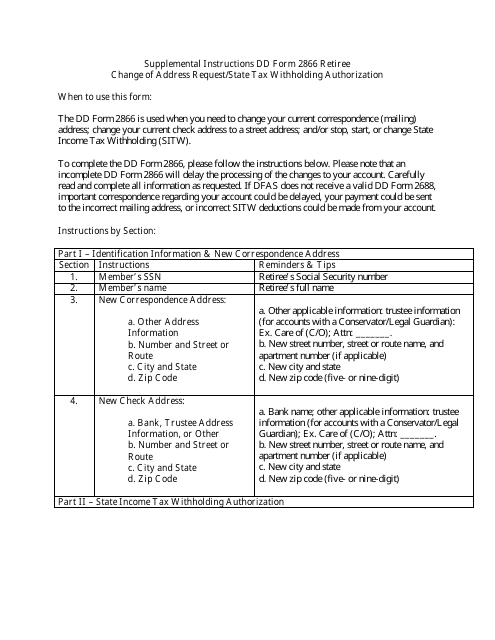

This document is used for retirees to request a change of address and authorize state tax withholding. It provides instructions on how to complete DD Form 2866.

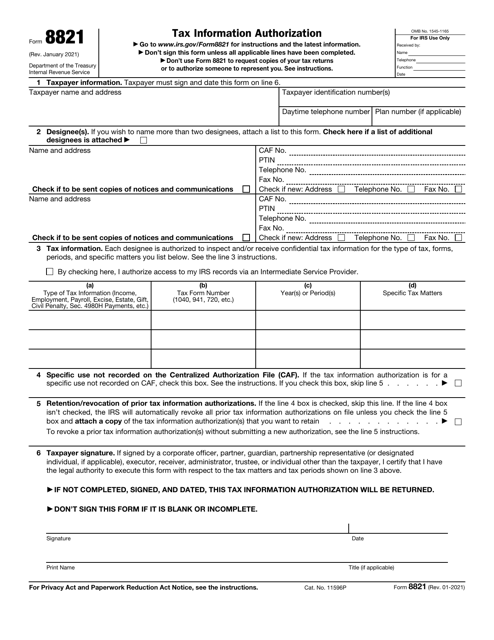

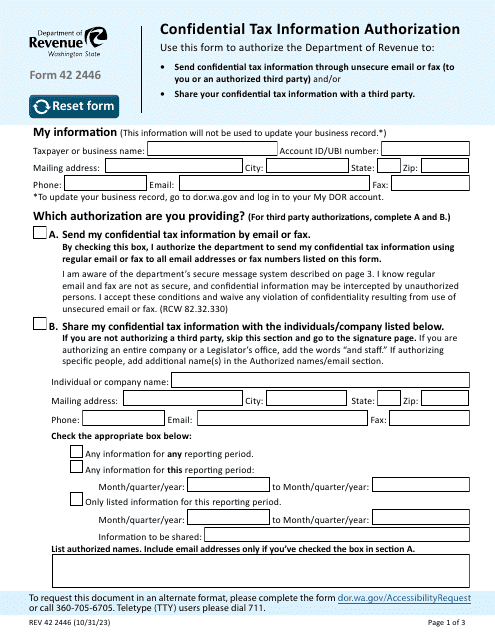

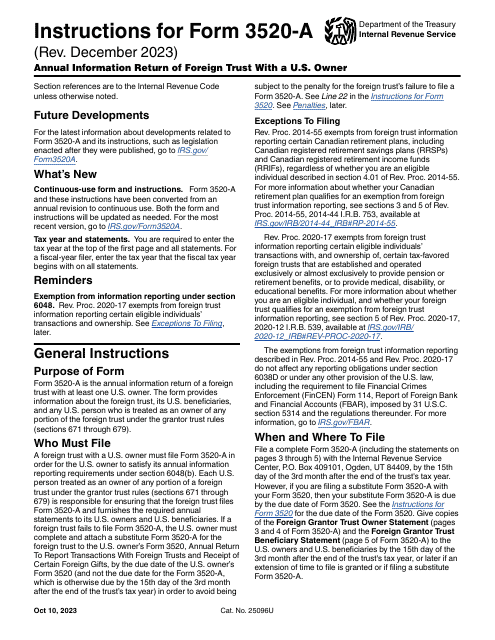

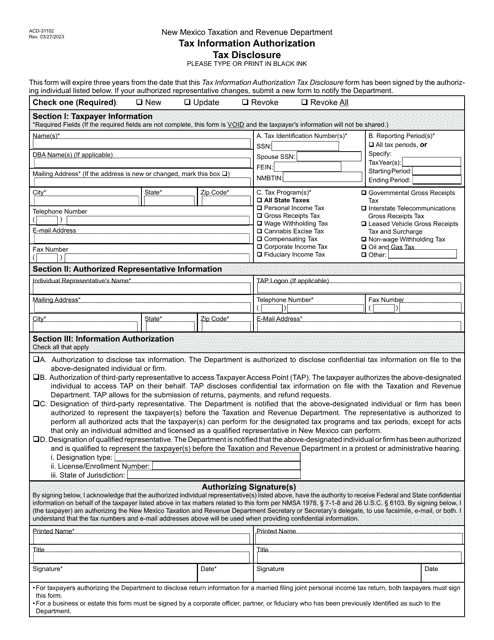

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

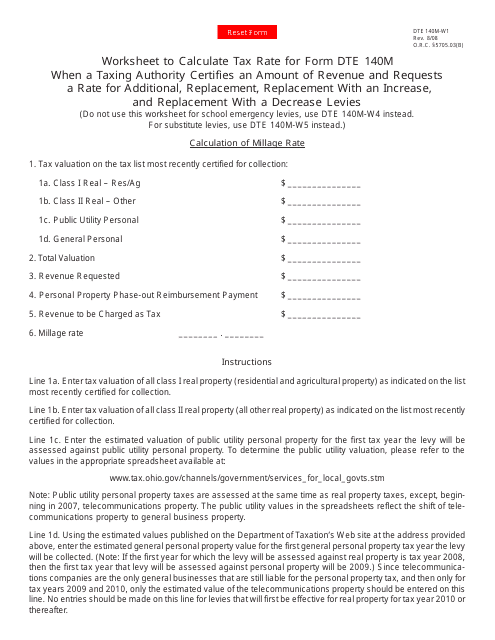

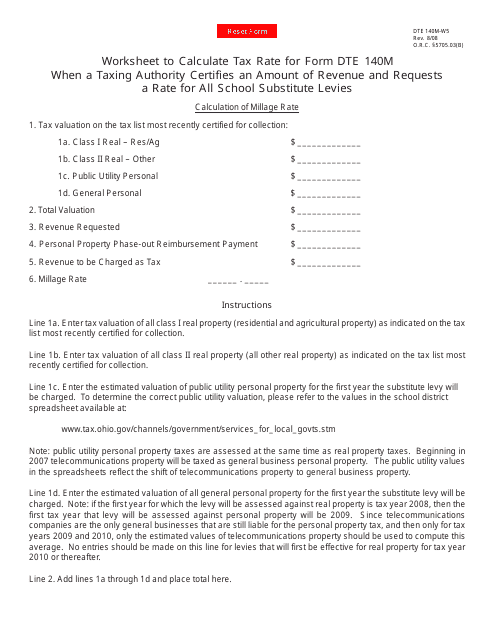

This form is used for calculating tax rates in Ohio when a taxing authority requests additional, replacement, or increased levies. It is used to determine the tax rate based on certified revenue amounts.

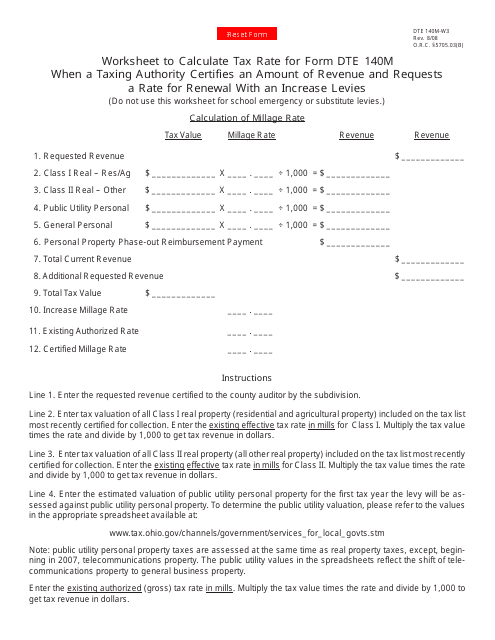

This form is used for calculating the tax rate when a taxing authority in Ohio certifies an amount of revenue and requests a rate for the renewal with an increase in levies.

This form is used to calculate the tax rate for Form DTE 140M when a taxing authority certifies an amount of revenue and requests a rate for all school substitute levies in Ohio.

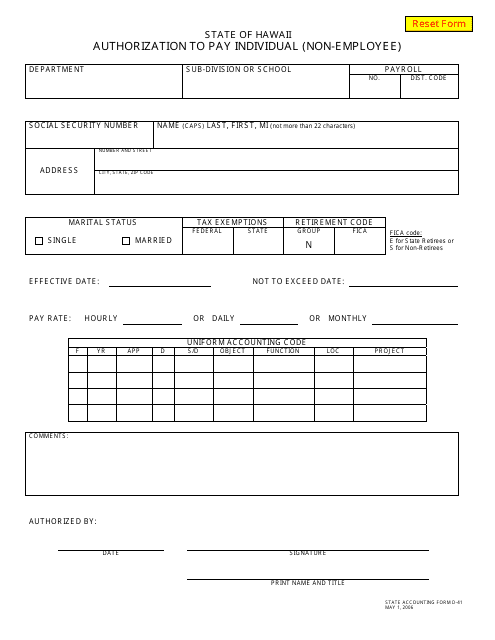

This Form is used for authorizing payment to an individual who is not an employee in the state of Hawaii.

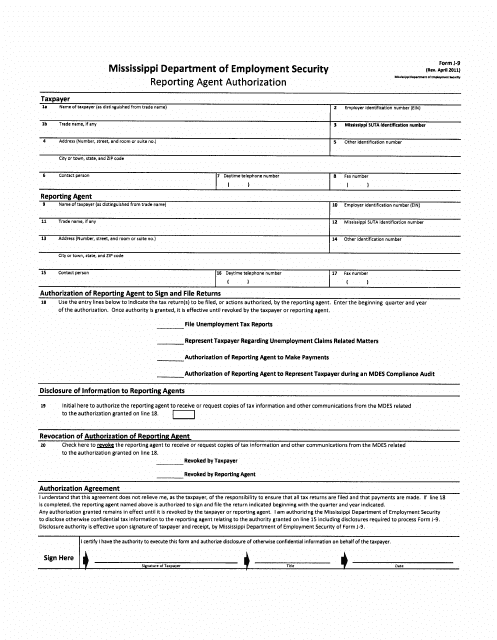

This form is used for authorizing a reporting agent to file tax returns on behalf of a taxpayer in the state of Mississippi.

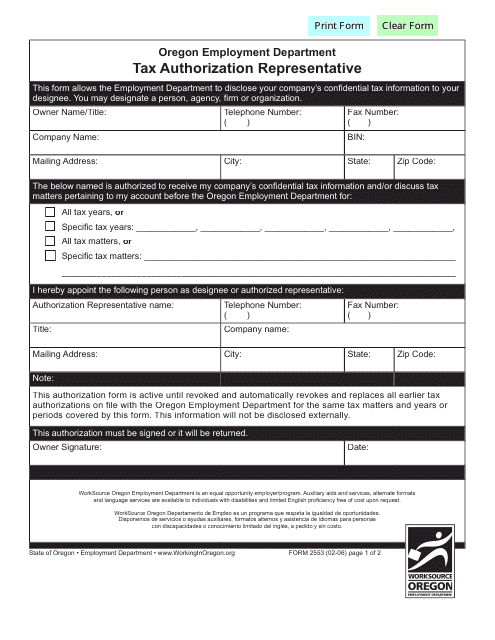

This form is used for authorizing a representative to act on your behalf for tax purposes in the state of Oregon.

This is a formal statement used by a taxpayer to entrust their representative to perform specific actions in their name.

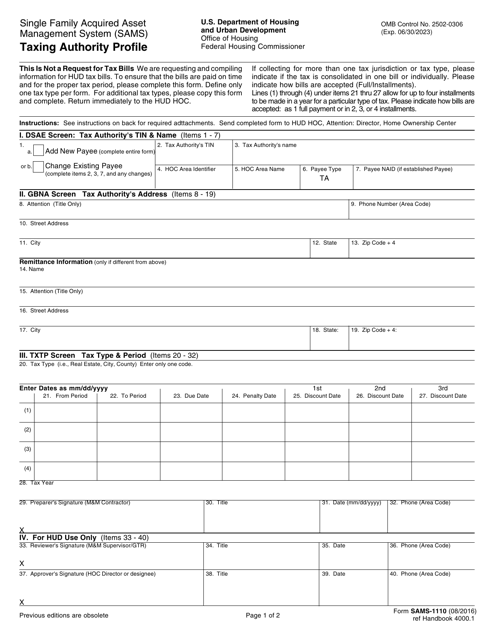

This form is used for providing information about a taxing authority, such as a government agency or municipality, for tax purposes.

This document is used for disclosing authorization in Arizona.

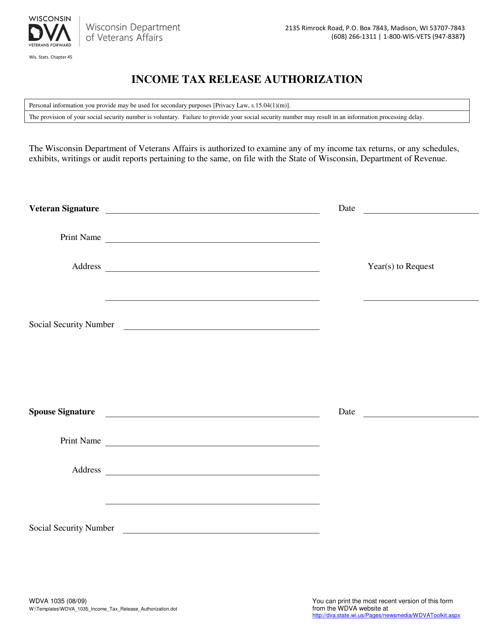

This form is used for authorizing the release of income tax information in the state of Wisconsin.

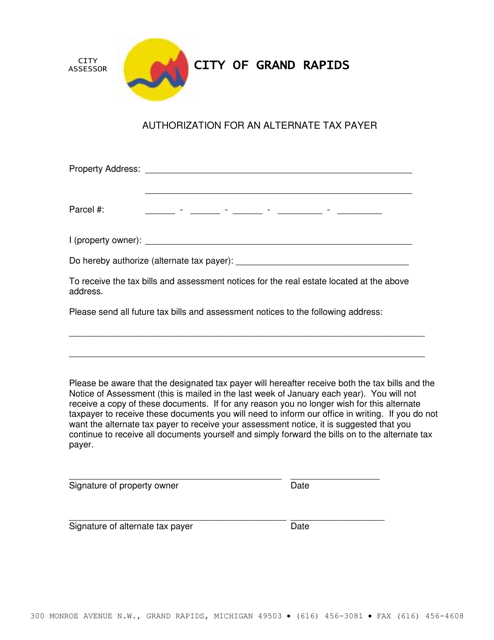

This document is used to authorize an alternate taxpayer in the City of Grand Rapids, Michigan. It allows someone else to file taxes on behalf of the taxpayer.