Business Acquisition Templates

Are you looking to expand your business or acquire another company? Our Business Acquisition documents collection provides you with all the necessary forms, instructions, and checklists to ensure a smooth and successful acquisition process. Whether you are based in Ohio, Canada, Nebraska, or Arizona, our comprehensive collection covers all your legal and financial needs.

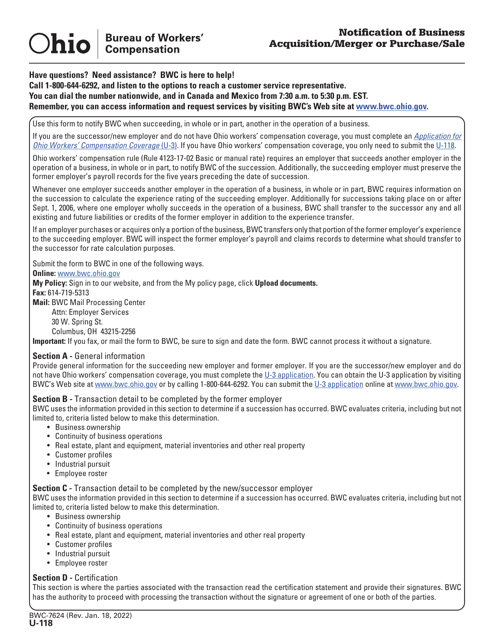

Our Form U-118 (BWC-7624) Notification of Business Acquisition/Merger or Purchase/Sale is specifically designed for businesses operating in Ohio. It is a crucial document that must be filed to notify the state about any business acquisition, merger, or purchase/sale.

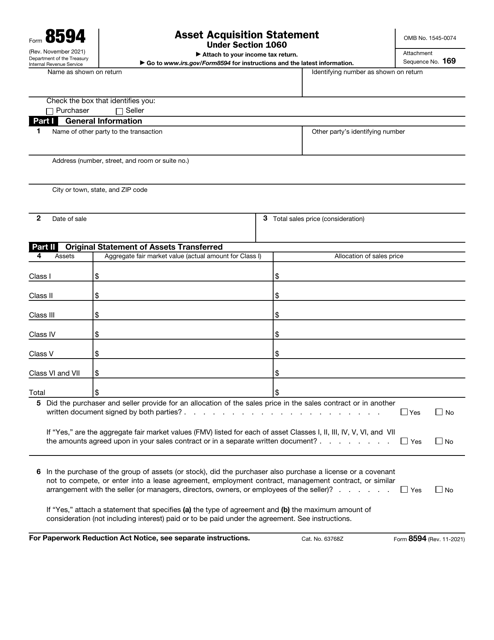

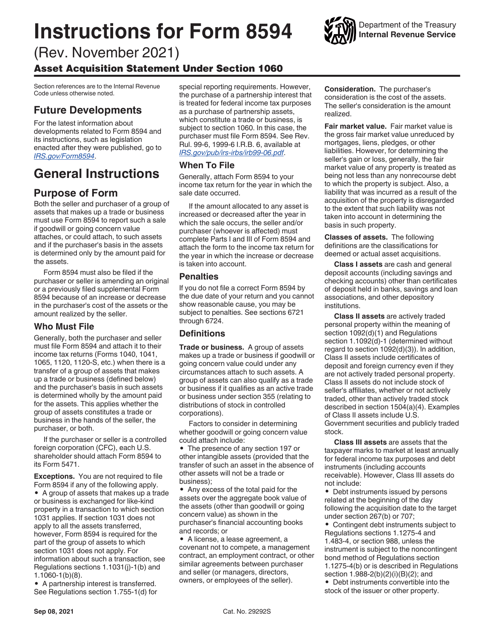

If you are involved in an asset acquisition under Section 1060 of the IRS Code, our Instructions for IRS Form 8594 Asset Acquisition Statement can guide you through the reporting requirements. This document is essential for accurately determining the tax consequences of the acquisition.

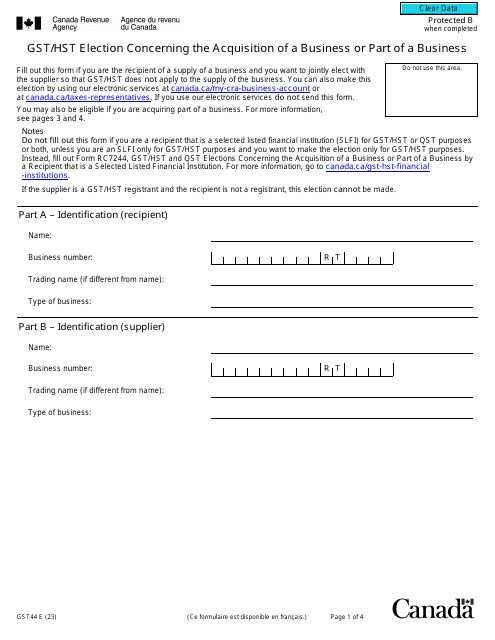

For businesses in Canada, our Form GST44 Gst/Hst Election Concerning the Acquisition of a Business or Part of a Business is indispensable. This document allows you to make an election concerning the Goods and Services Tax/Harmonized Sales Tax (GST/HST) related to the acquisition of a business or a part of a business.

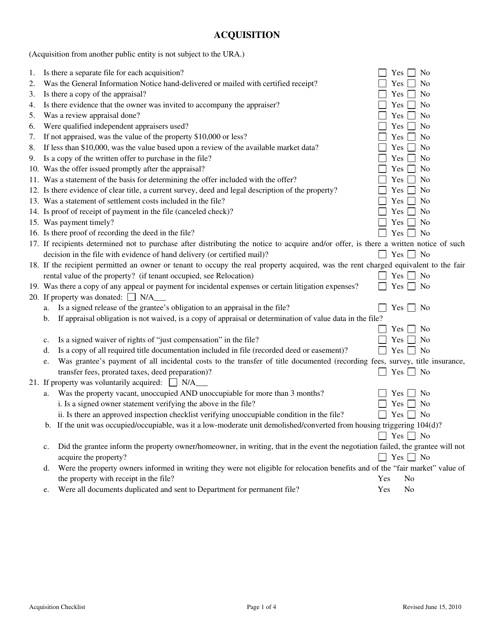

Planning an acquisition in Nebraska? Our Acquisition Checklist is your go-to resource. It covers all the important steps and considerations involved in acquiring a business in the state, ensuring that you don't overlook any essential details.

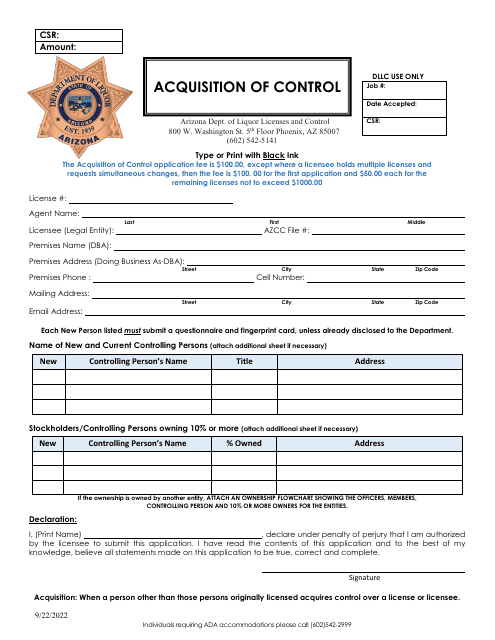

If you are based in Arizona and looking to acquire control of a business, our Acquisition of Control documents are essential. These documents provide you with the necessary forms and guidelines to navigate through the regulatory requirements and obtain the necessary approvals.

With our Business Acquisition documents collection, you can streamline the acquisition process, minimize risks, and ensure compliance with the applicable laws and regulations. Don't let the complex nature of business acquisitions deter you from pursuing growth opportunities. Let our comprehensive collection of documents guide you every step of the way.

Documents:

11

This is a fiscal form designed for taxpayers that carried out a sale of assets used for a business or trade.

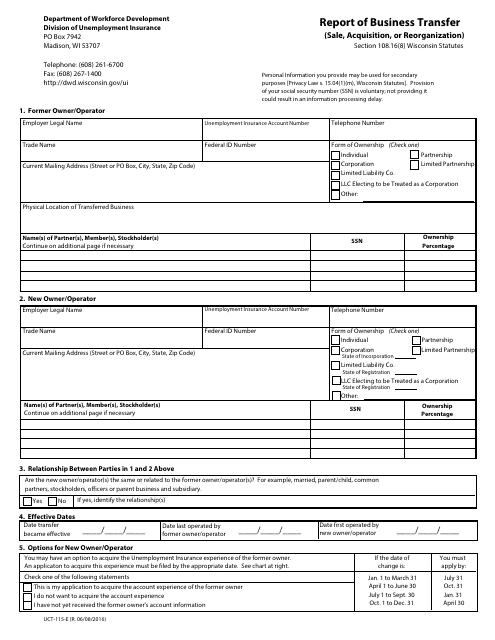

This form is used for reporting business transfers such as sales, acquisitions, or reorganizations in the state of Wisconsin. It ensures compliance with applicable laws and regulations.

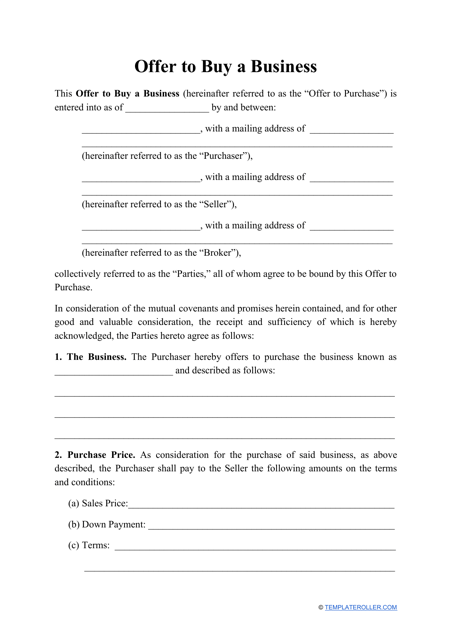

The purpose of the Offer to Buy a Business offer is to provide information about the conditions in which a prospective business purchaser is willing to close the deal.

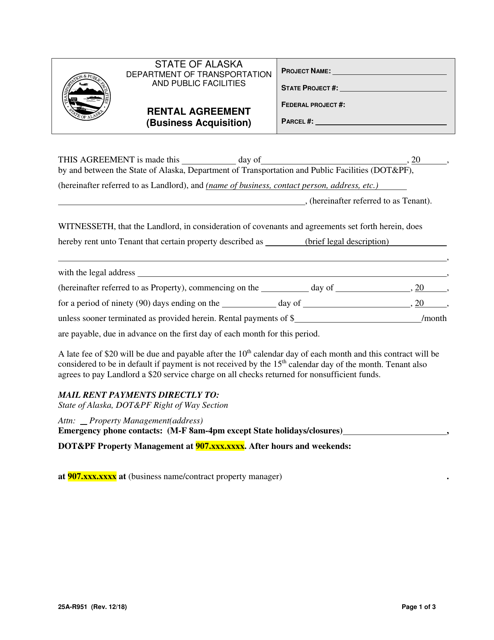

This form is used for creating a rental agreement for the acquisition of a business in Alaska.

This document provides a checklist for businesses in Nebraska to follow when going through an acquisition process. It outlines the steps and considerations involved in acquiring another company.

This Form is used for initiating the process of acquiring control over a company or business entity in the state of Arizona.