Annual Filing Templates

Are you looking to file your annual business reports or claims? The annual filing process is an essential requirement in many jurisdictions to ensure businesses and organizations comply with regulatory standards. Annual filing forms provide a comprehensive overview of your company's financial and operational performance for a given year.

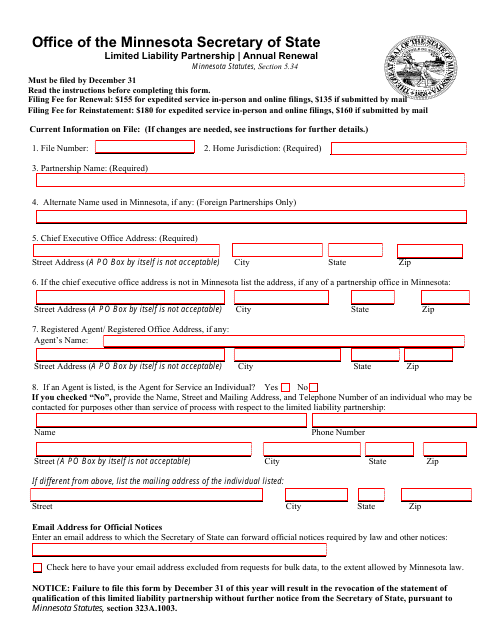

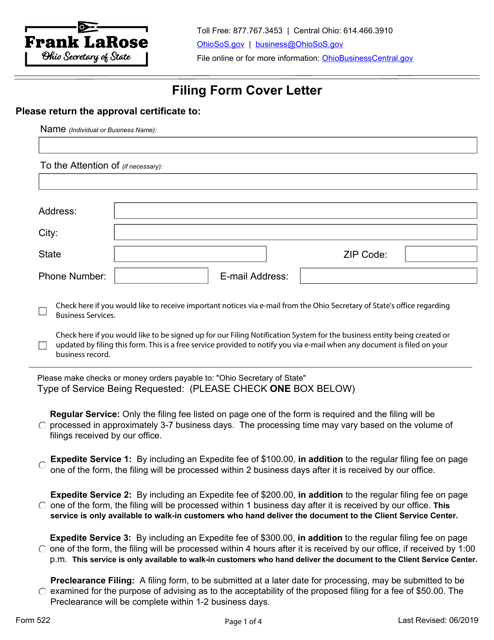

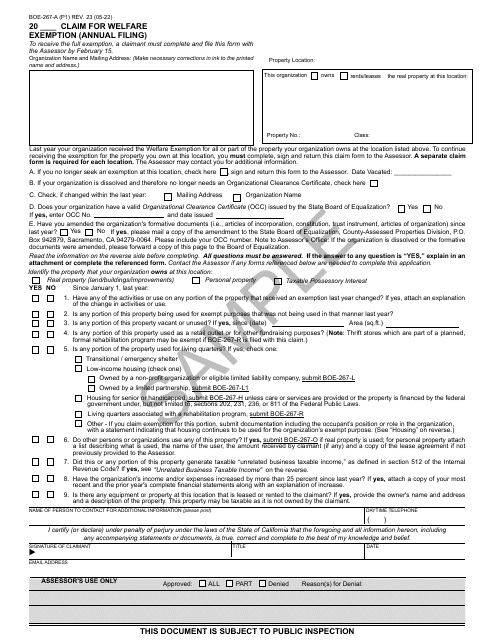

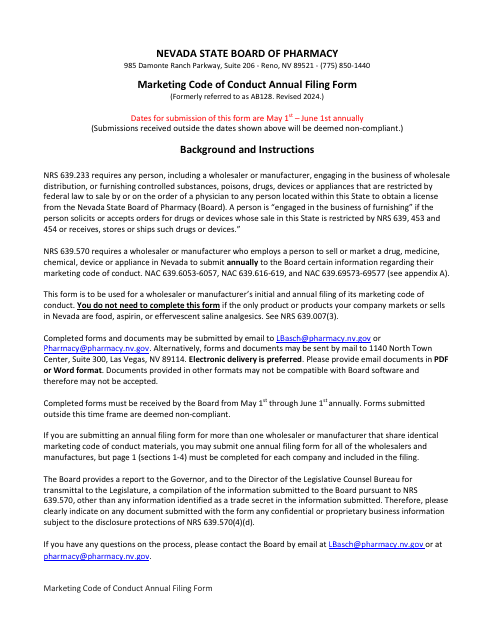

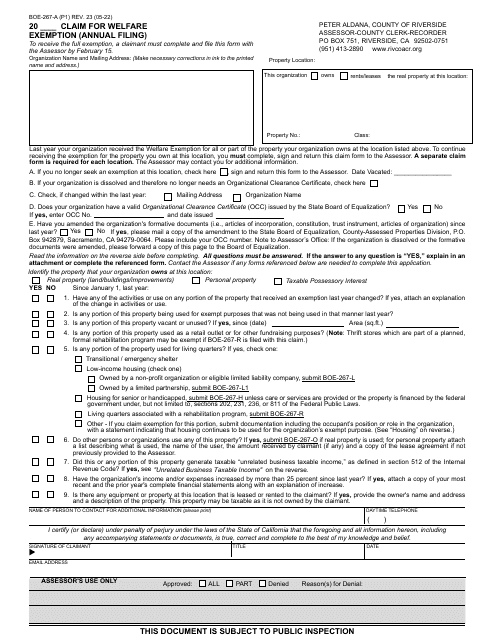

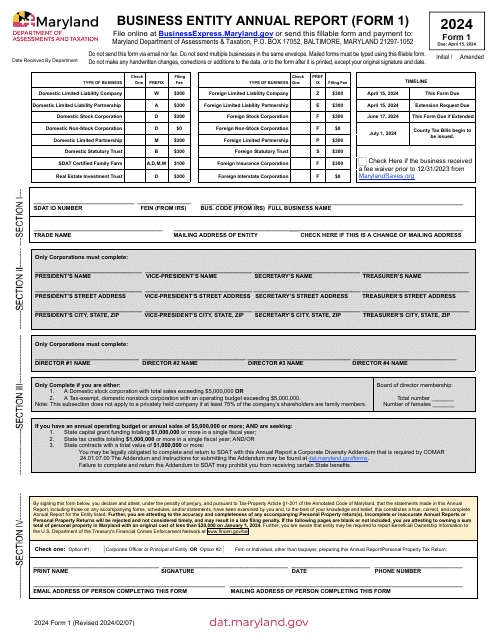

Whether you are a business operating in Texas, California, or any other state, the annual filing requirements may vary. Some popular forms include the Form 0723 Annual Filing Affidavit in Texas, Form BOE-267-A Claim for Welfare Exemption (Annual Filing) in California, and Form 1 Annual Report in Maryland.

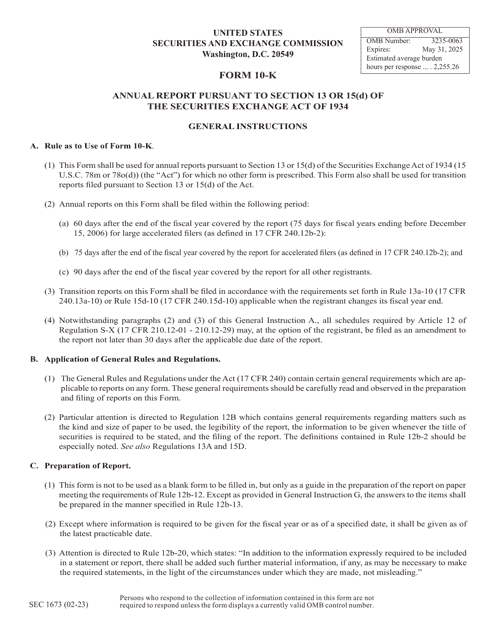

Completing these annual filing forms accurately is crucial to maintaining your business's legal standing and avoiding penalties. It allows regulatory authorities to assess your compliance with taxation, welfare exemption, or Securities Exchange Act requirements.

If you are a publicly traded corporation, you may need to file a Form 10-K (SEC Form 1673) Annual Report. This report provides investors, stakeholders, and the Securities and Exchange Commission (SEC) with detailed information about your company's financial performance, corporate governance, and risk factors.

Annual filings play a vital role in maintaining transparency and accountability within the business landscape. By submitting these reports, you demonstrate your commitment to compliance and ethical business practices.

Whether you need assistance with Texas Annual Filing Affidavit, California Welfare Exemption Claim, or Maryland's Annual Report, our team of experts is here to guide you through the process. Contact us today and ensure your annual filing is done accurately and on time.

Documents:

41

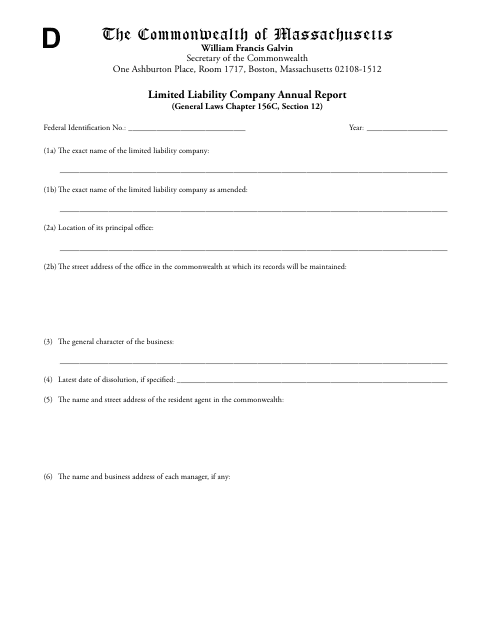

This Form is used for filing the annual report for a Limited Liability Company (LLC) in the state of Massachusetts.

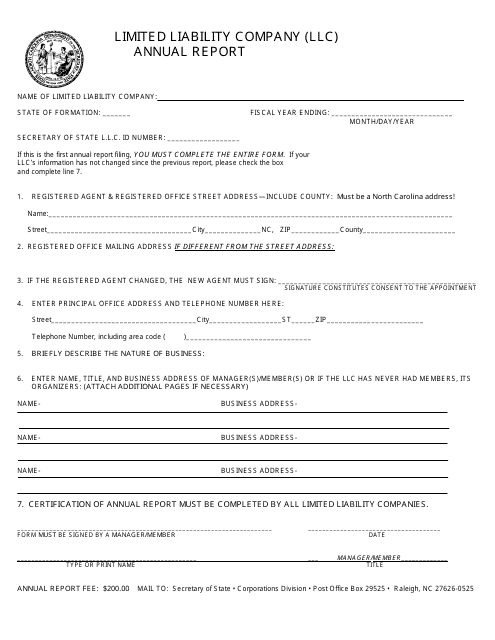

This Form is used for filing the annual report by Limited Liability Companies (LLCs) in North Carolina. It is a legal requirement to provide updated information about the business and its members to maintain active status as an LLC in the state.

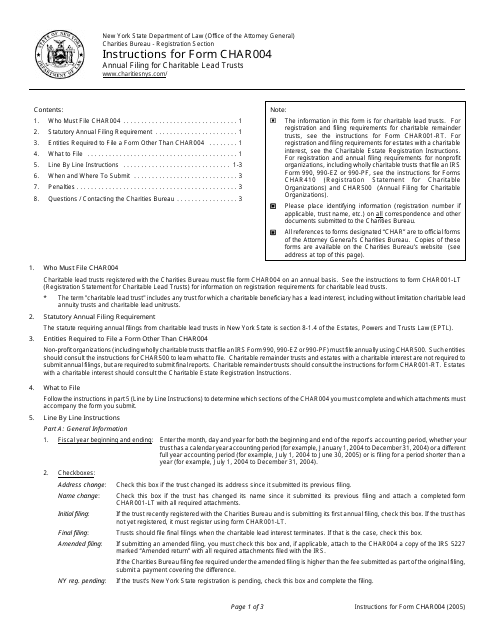

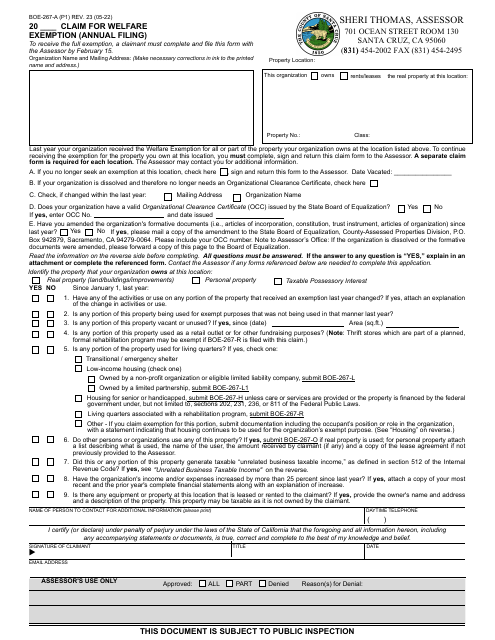

This Form is used for filing an annual report for charitable lead trusts in New York. It provides instructions on how to complete the form accurately.

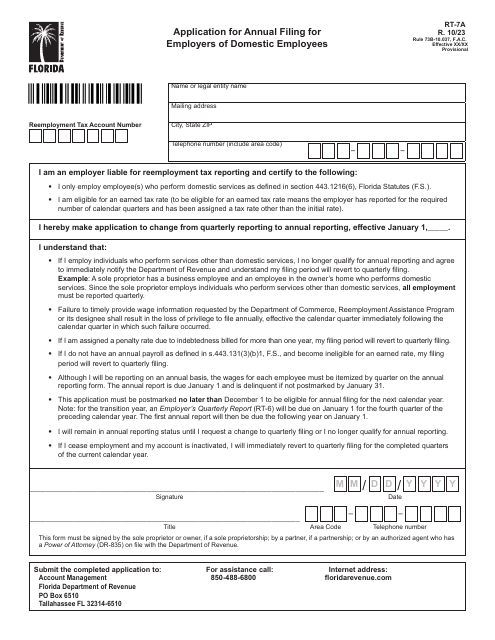

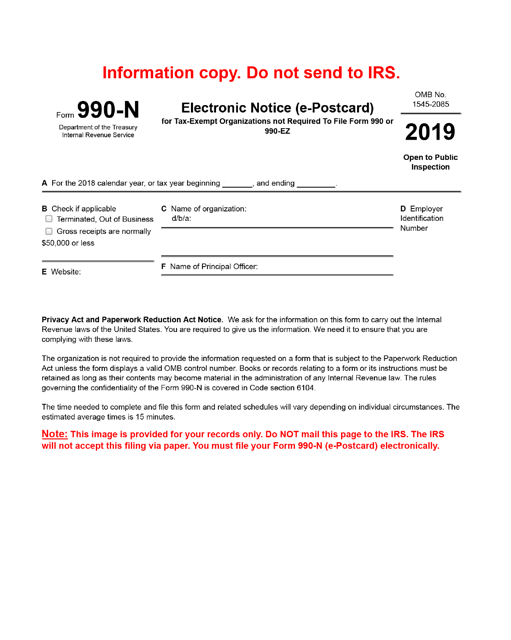

This is a fiscal document used by nonprofit organizations to report the main specifics of their operations to tax authorities.

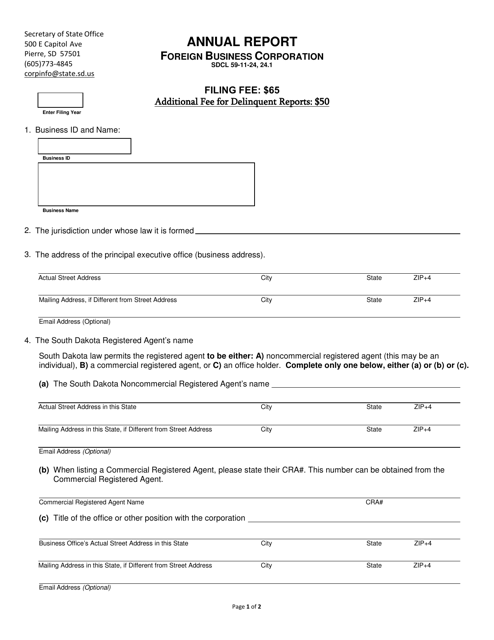

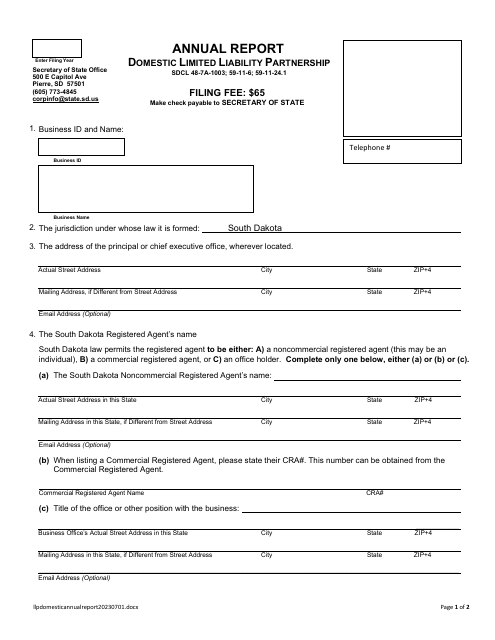

This annual report is filed by foreign corporations operating in South Dakota to provide information about their business activities and financial status.

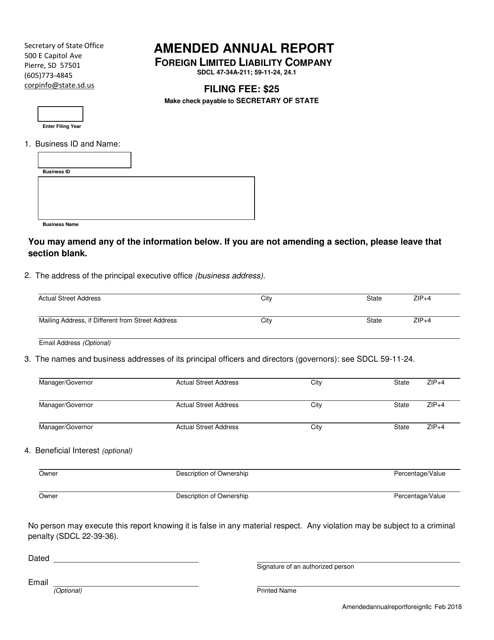

This document is used to update and correct the annual report filed by a foreign limited liability company in South Dakota.

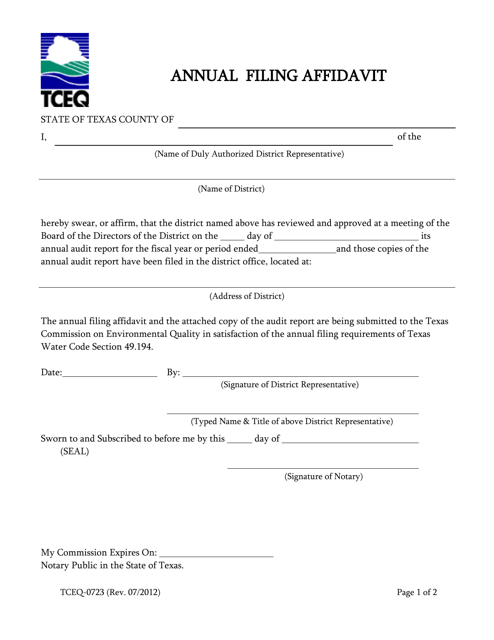

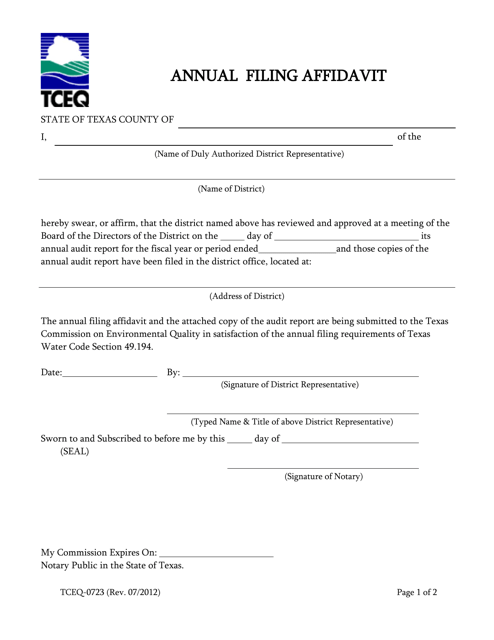

This form is used for annual filing affidavit in the state of Texas. It is a requirement for certain businesses to submit this affidavit to maintain compliance with state regulations.

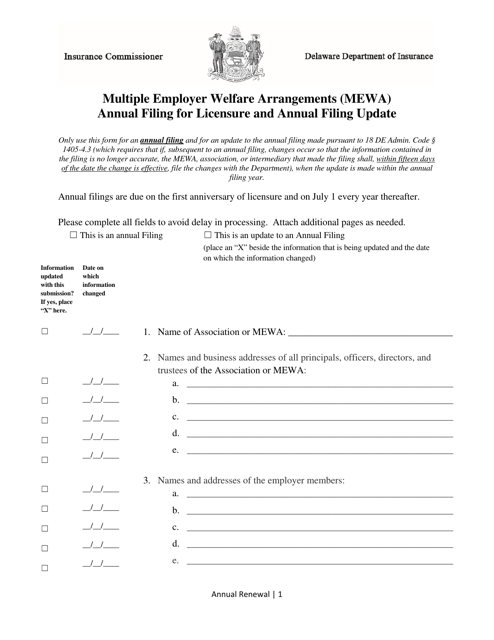

This document is for filing the annual licensure and updating the annual filing for Multiple Employer Welfare Arrangements (MEWAs) in Delaware. MEWAs provide welfare benefits to employees of multiple employers.

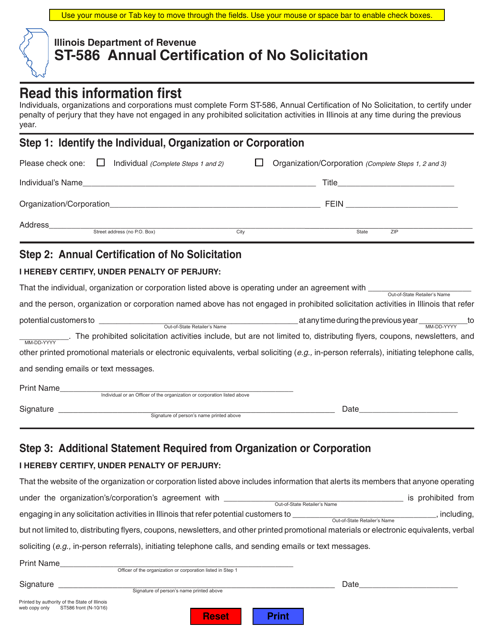

This Form is used for the Annual Certification of No Solicitation in the state of Illinois.

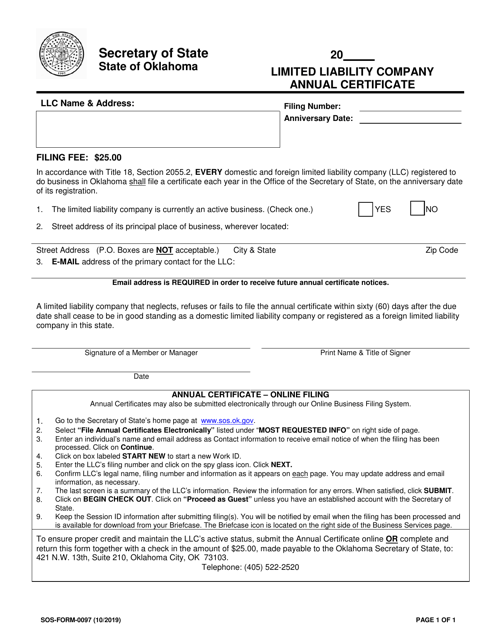

This Form is used for filing the Limited Liability Company Annual Certificate in Oklahoma.

This form is used for filing an annual affidavit in Texas, as required by the Texas Commission on Environmental Quality (TCEQ). It is used to declare compliance with certain environmental regulations or provide necessary information for environmental reporting purposes.

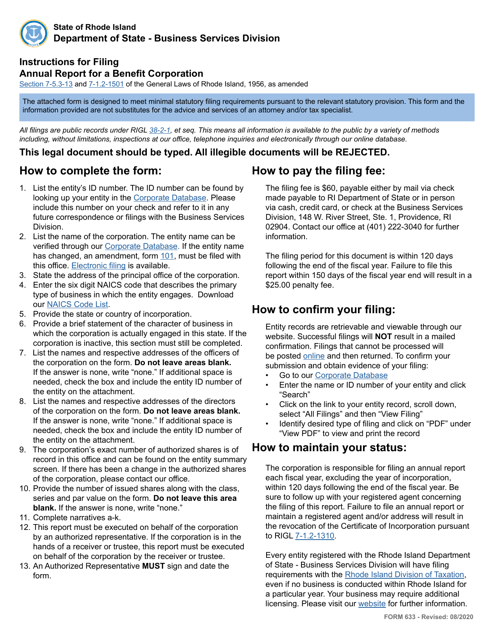

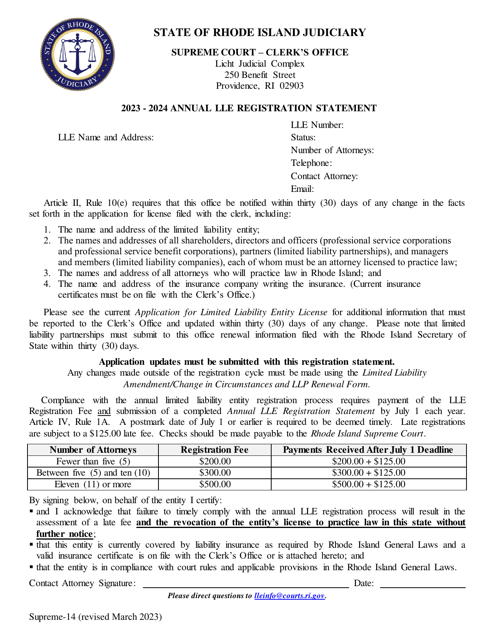

This Form is used for filing an annual report for a Benefit Corporation in Rhode Island.

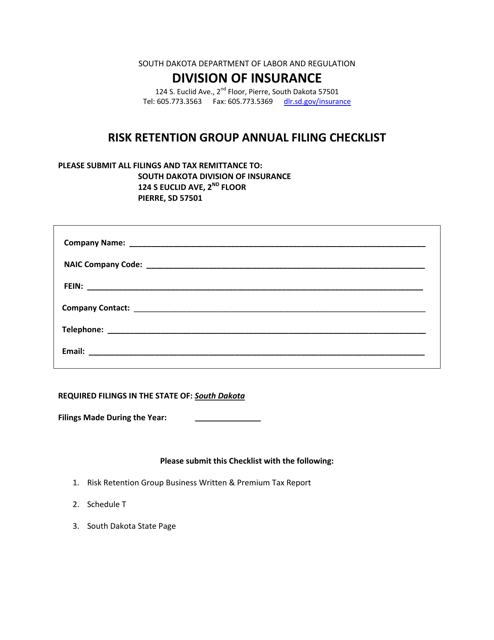

This document is a checklist for Risk Retention Groups in South Dakota to complete their annual filings. It outlines the necessary steps and requirements for filing.

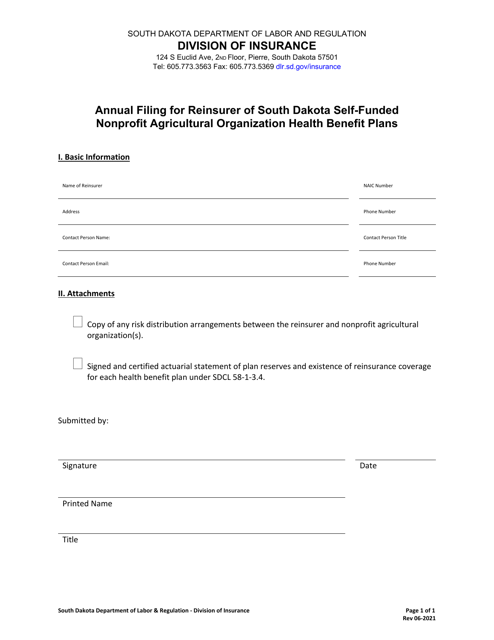

This document is used for the annual filing of a reinsurer for South Dakota self-funded nonprofit agricultural organization health benefit plans.

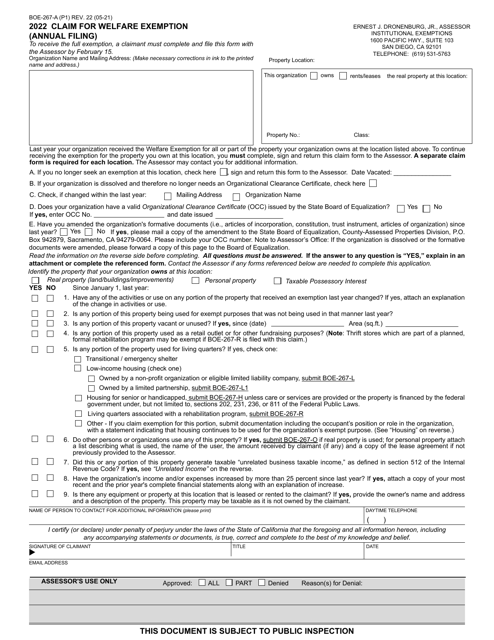

This form is used for filing an annual claim for welfare exemption in San Diego County, California. It is specifically for organizations seeking to exempt certain property from property taxes based on their welfare purposes. This document helps organizations apply for the exemption.

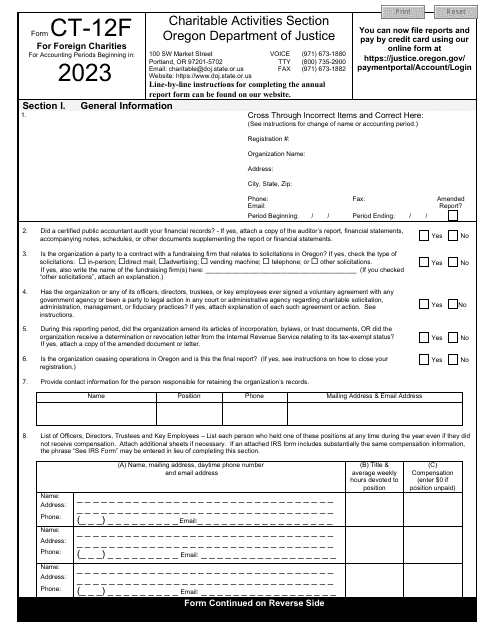

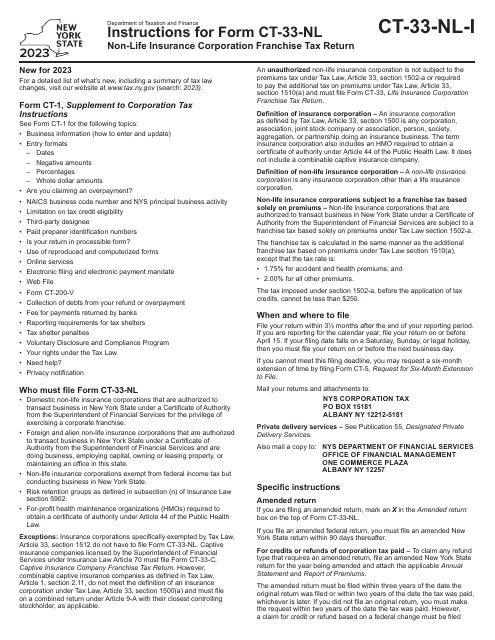

This form is used for the annual report and registration renewal for master trustees in Oregon.

This form is used for claiming a welfare exemption for property in Riverside County, California on an annual basis.

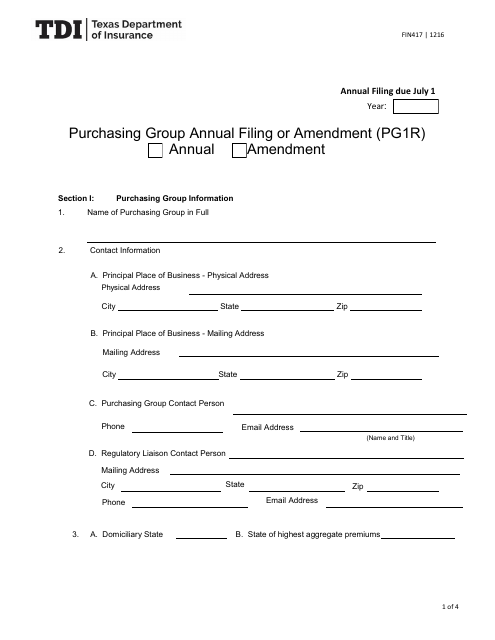

This form is used for the annual filing or amendment of purchasing group information in the state of Texas.

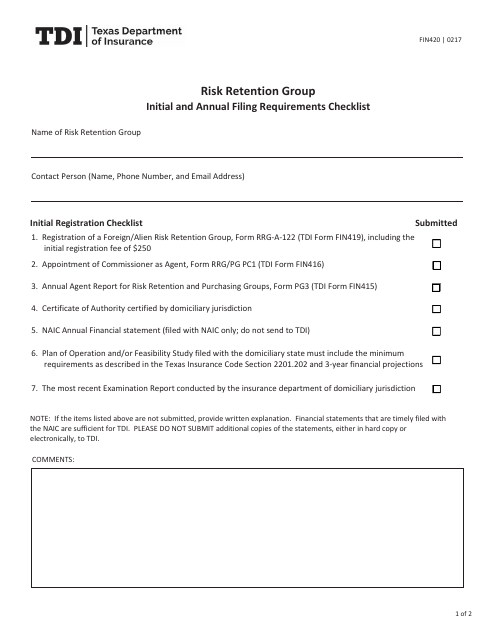

This form is used for the initial and annual filing requirements checklist for Risk Retention Groups in Texas. It outlines the necessary steps and documentation needed for compliance.