Qualifying Charitable Organizations Templates

Are you looking to support a charitable cause? Learn about the different qualifying charitable organizations that you can contribute to and make a positive impact on your community. These organizations go by various names, such as qualifying charitable organizations or qualifying charitable organization.

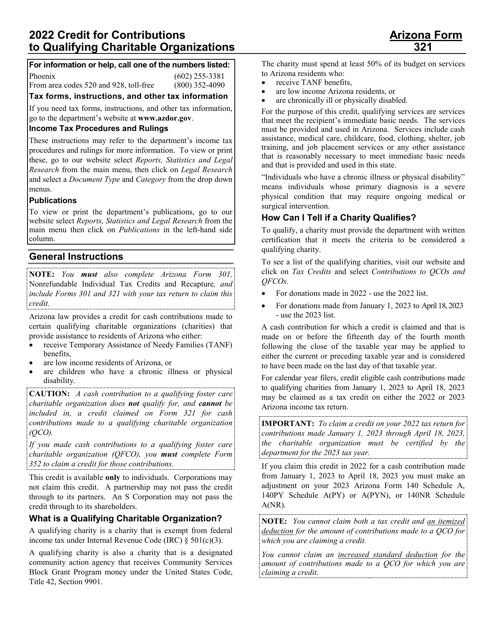

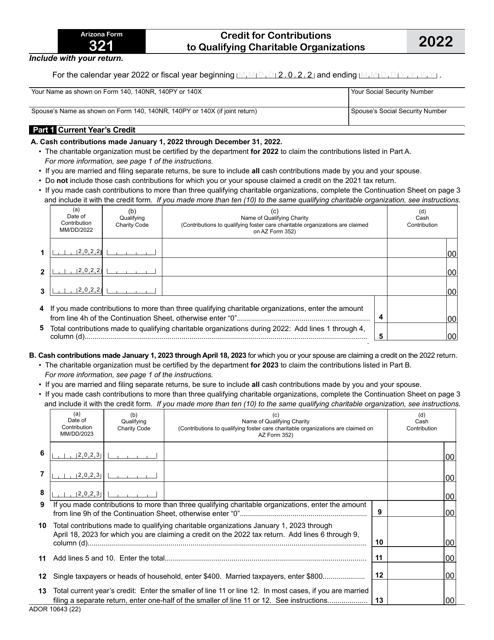

By donating to these organizations, you can not only make a difference but also enjoy various benefits. In some states like Arizona, you may even be eligible for tax credits through programs like the ADOR10643 Credit for Contributions to Qualifying Charitable Organizations.

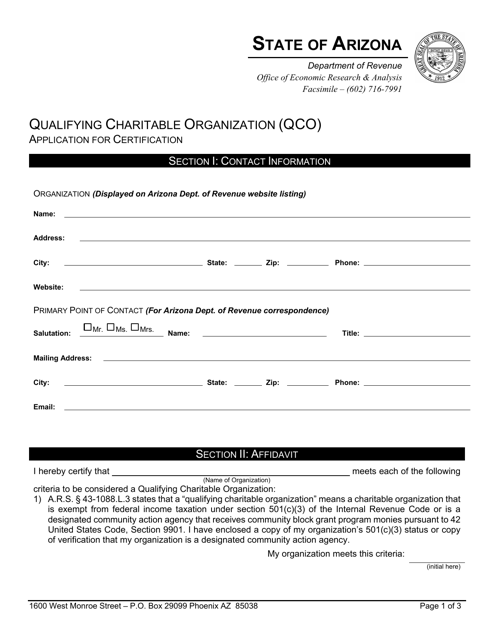

To get started, you can find the necessary documents for certification or claiming tax credits. These may include the Application for Qualifying Charitable Organization Certification, or the Arizona Form 321 (ADOR10643) Credit for Contributions to Qualifying Charitable Organizations. But don't worry, you won't be alone in the process. Detailed instructions for filling out these documents, such as the Instructions for Arizona Form 321, ADOR10643 Credit for Contributions to Qualifying Charitable Organizations, are readily available and will guide you through the process.

Make a difference today by supporting qualifying charitable organizations. Start your journey by exploring the resources and documents provided to ensure a seamless experience.

Documents:

6

This application is used for obtaining certification as a qualifying charitable organization in the state of Arizona.

This Form is used for applying for certification as a Qualifying Charitable Organization in Arizona.