Distributive Share Templates

Are you looking for information on distributive share? Look no further! Our webpage provides comprehensive details about distributive share, also known as the distributive share of approved biodiesel and/or blended biodiesel tax credit in Kentucky, or the distributive share of approved recycling and/or composting equipment tax credit in Kentucky for use by general partnerships.

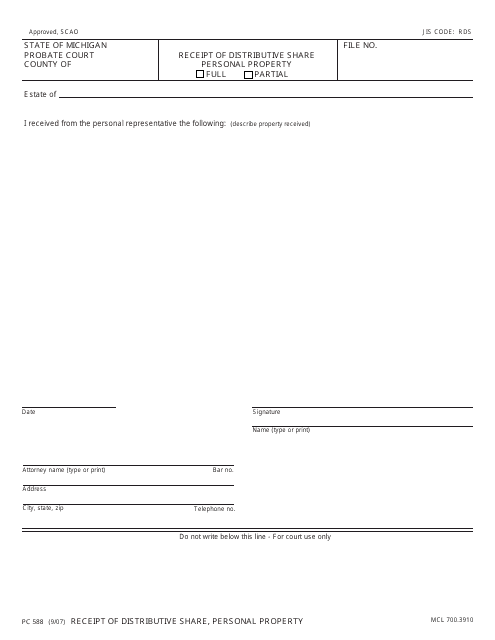

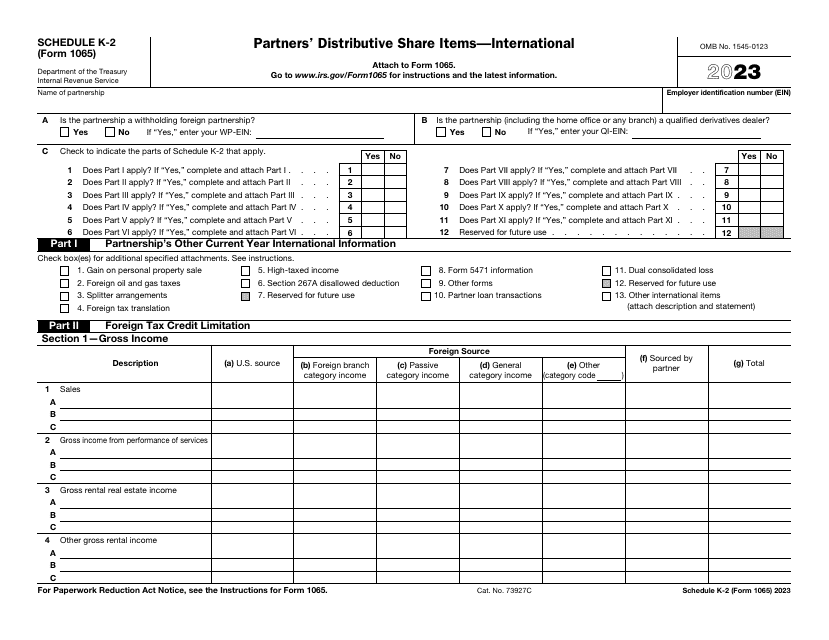

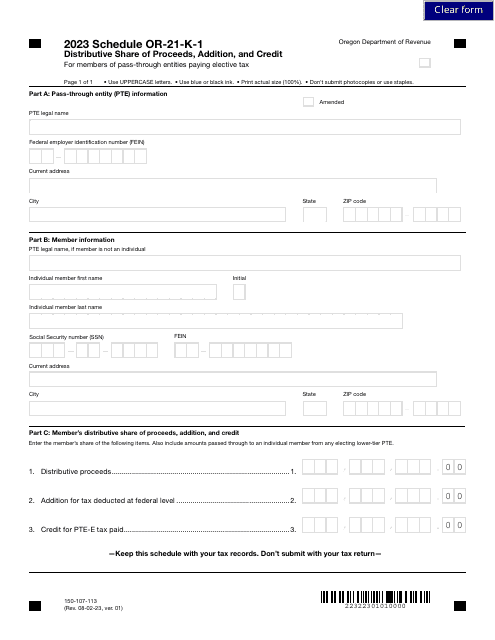

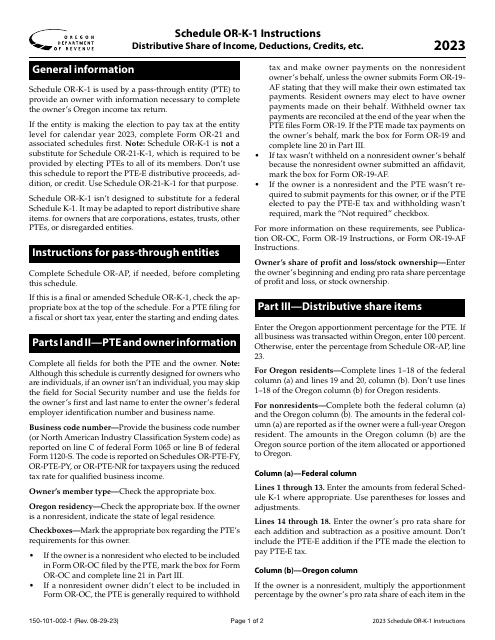

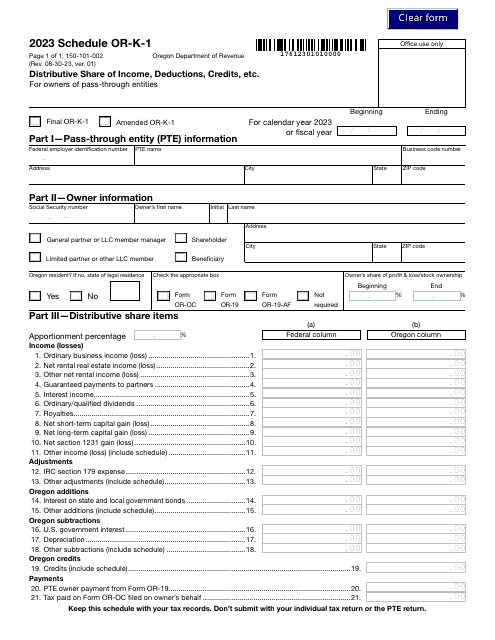

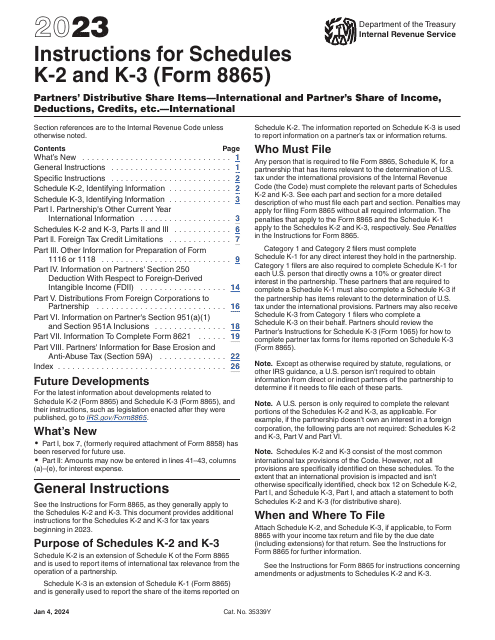

Additionally, we cover the receipt of distributive share for personal property in Michigan, the partners' distributive share items as reported on IRS Form 1065 Schedule K-2 for international partnerships, and the distributive share of proceeds, addition, and credit for members of pass-through entities paying elective tax in Oregon.

Our webpage contains all the information you need to understand distributive share and its various forms in different states and scenarios. Whether you're a taxpayer, a business owner, or an accountant, our webpage will guide you through the intricacies of distributive share and help you navigate the associated documentation.

So, if you're looking for expert information on distributive share, visit our webpage today and gain a thorough understanding of this important topic.

Documents:

10

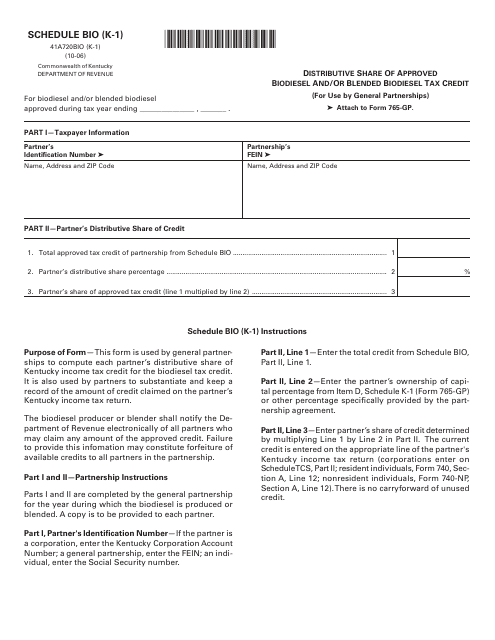

This form is used for reporting the distributive share of approved biodiesel and/or blended biodiesel tax credit in the state of Kentucky.

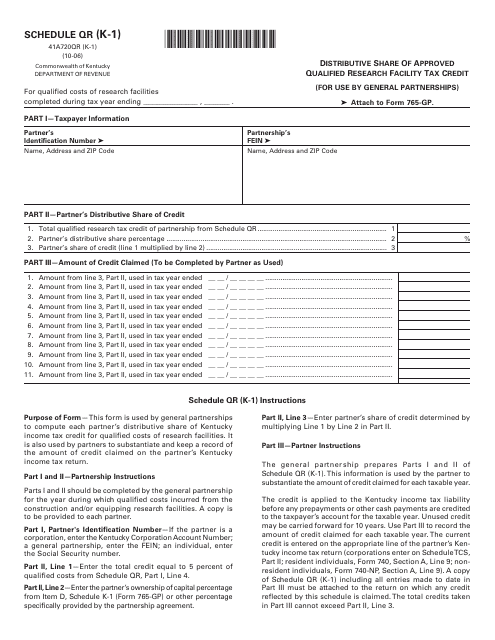

This Form is used for reporting the distributive share of the approved qualified research facility tax credit in Kentucky.

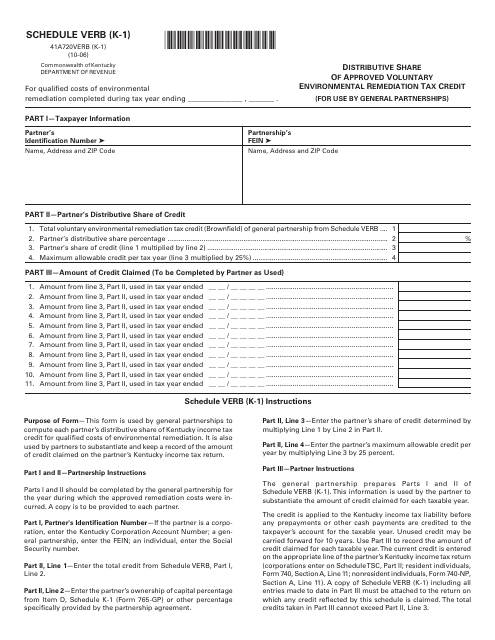

This form is used for reporting the distributive share of the approved voluntary environmental remediation tax credit in Kentucky for partnerships and limited liability companies (LLCs) filing as partnerships.

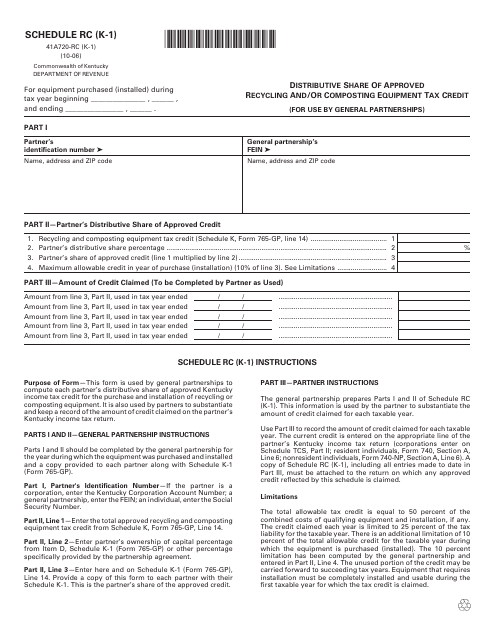

This Form is used for claiming the distributive share of approved recycling and/or composting equipment tax credit by general partnerships in Kentucky.

This Form is used for acknowledging the receipt of distributive share of personal property in the state of Michigan.