Exempt Organization Templates

Documents:

115

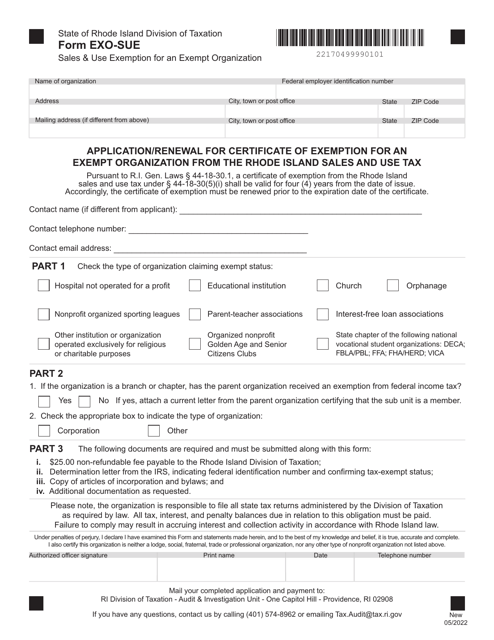

This form is used for applying or renewing a certificate of exemption for an exempt organization from the Rhode Island sales and use tax.

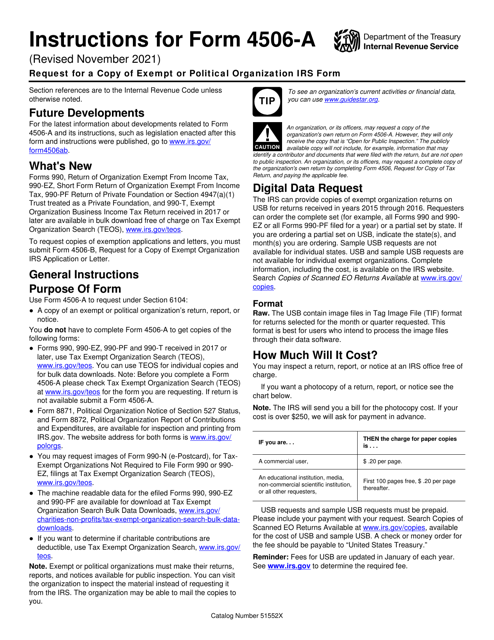

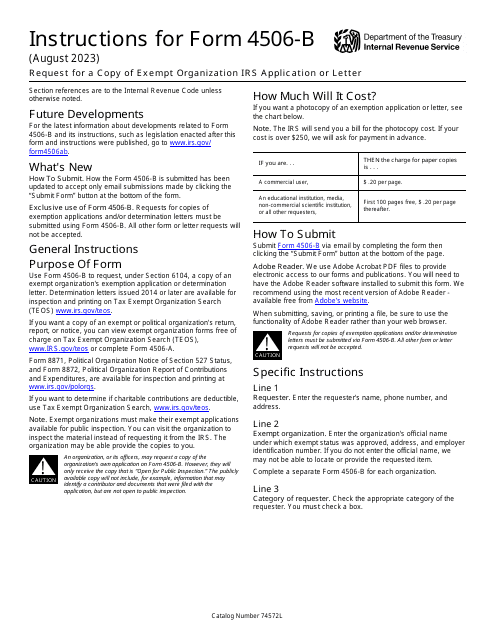

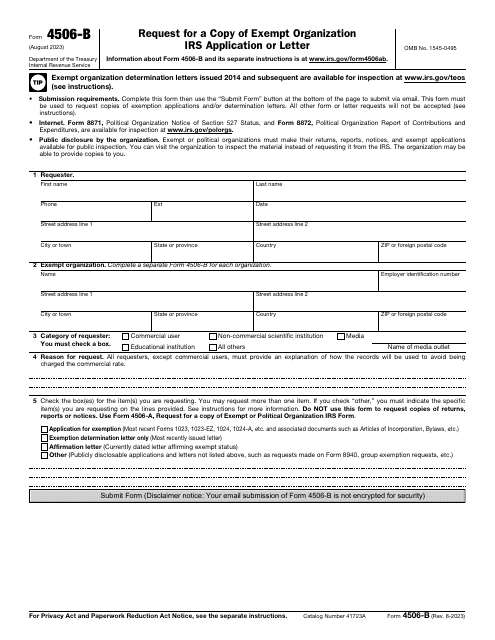

Instructions for IRS Form 4506-B Request for a Copy of Exempt Organization IRS Application or Letter

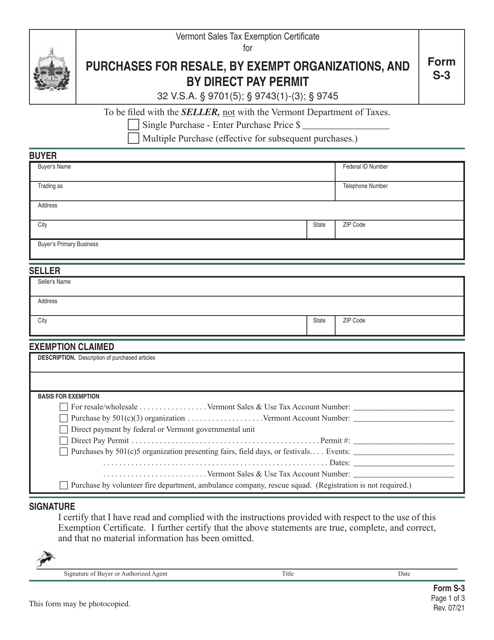

This form is used for claiming a sales tax exemption in Vermont for purchases intended for resale, made by exempt organizations, or made by individuals holding a direct pay permit.

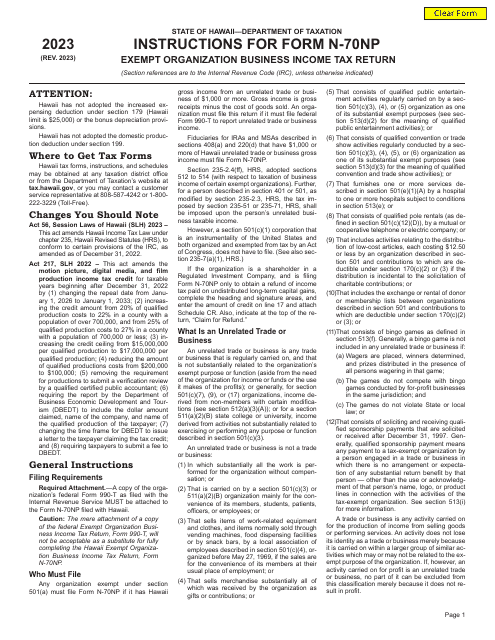

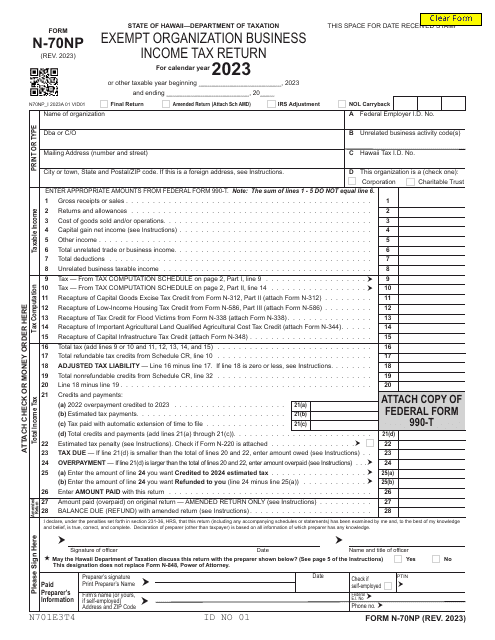

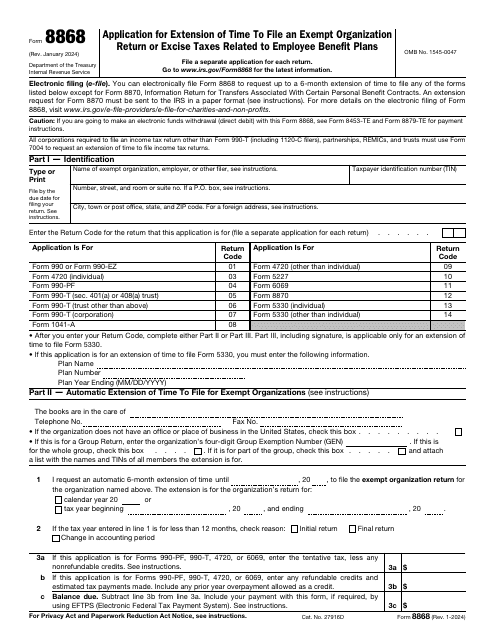

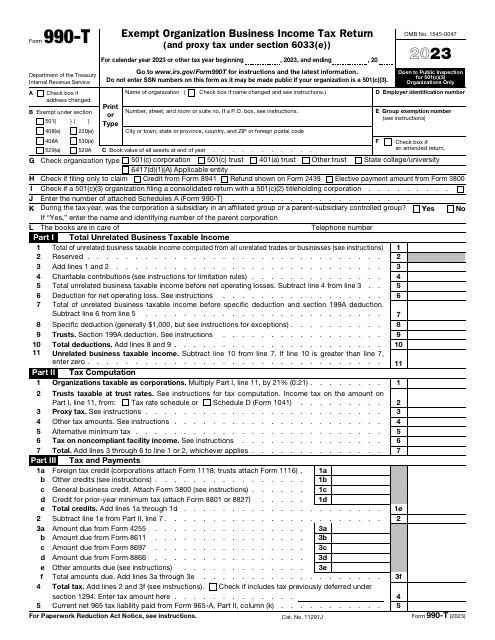

This is a formal IRS form that exempt organizations have to use to inform the fiscal authorities about late filing of a return.

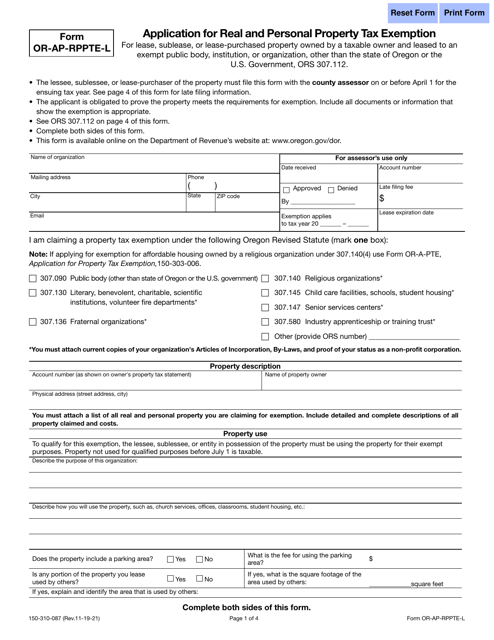

This Form is used for applying for a real and personal property tax exemption in Oregon for lease, sublease, or lease-purchased property owned by a taxable owner and leased to an exempt public body, institution, or organization.

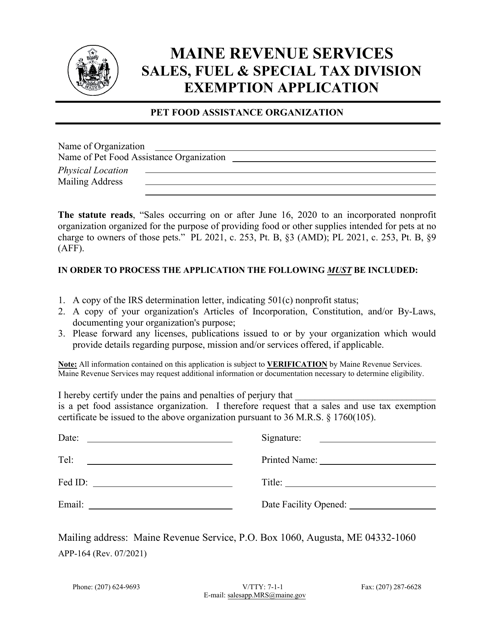

This form is used for organizations in Maine that provide pet food assistance to apply for an exemption from certain taxes.

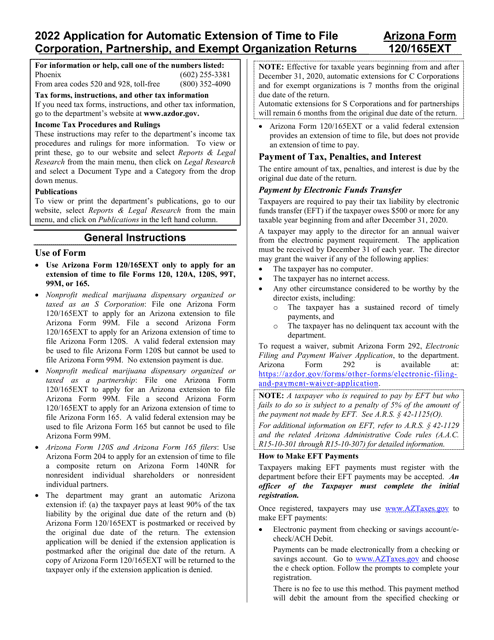

This type of document is used for requesting an automatic extension of time to file corporation, partnership, and exempt organization returns in Arizona.