Employee Tax Credit Templates

Are you a business owner looking for ways to save on taxes? One of the most lucrative options available to you is the Employee Tax Credit, also known as the Employees Tax Credit. This tax credit is designed to incentivize businesses to hire employees from certain designated areas or to provide training opportunities to their employees.

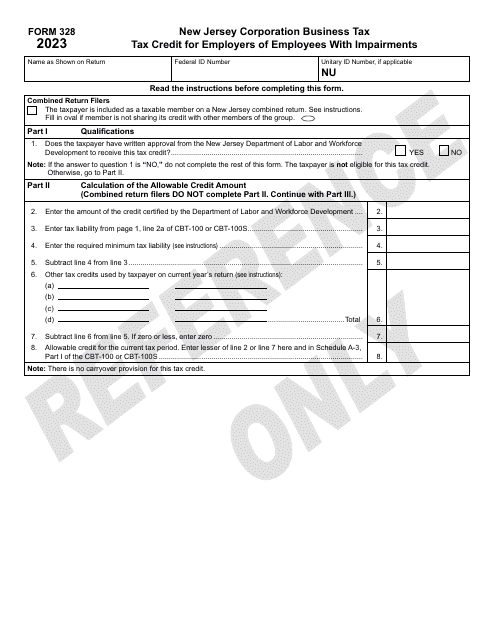

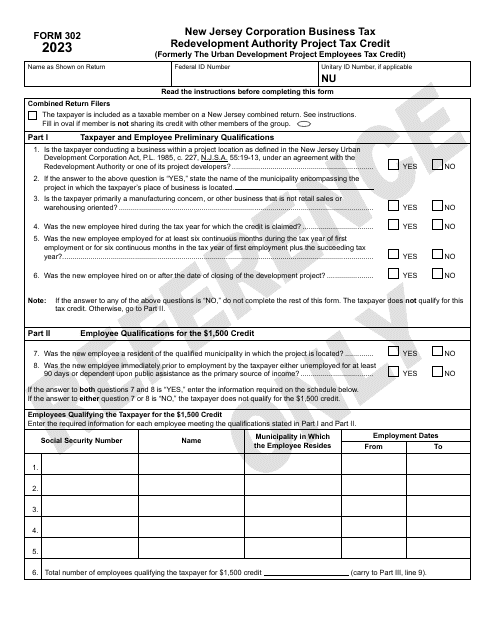

By taking advantage of the Employee Tax Credit, you can reduce your taxable income and potentially save thousands of dollars on your tax bill. The credit is available in various forms depending on your location and the specific program guidelines, so it's essential to consult the respective forms and instructions for your region.

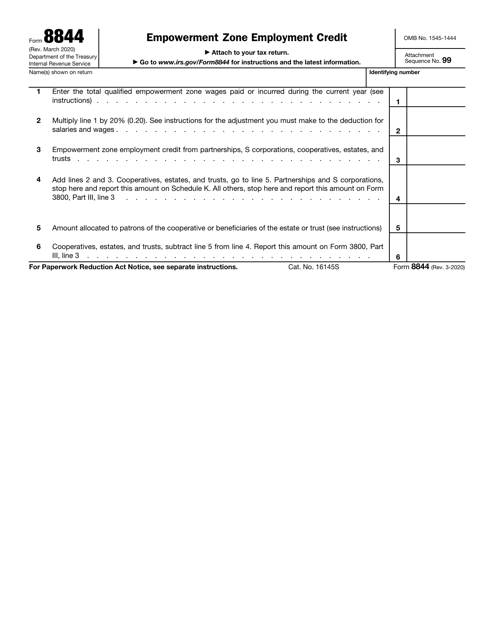

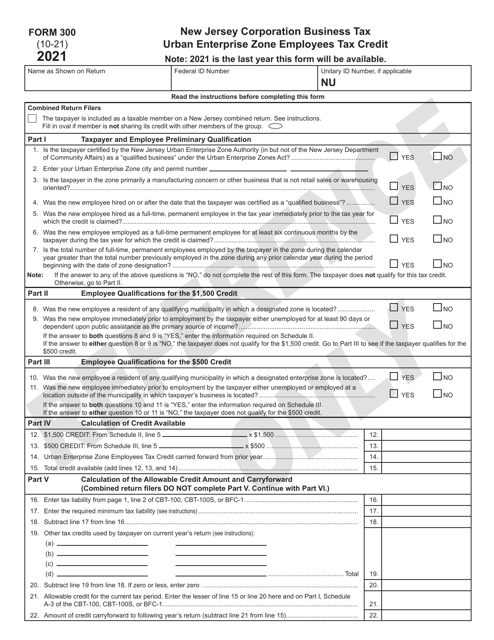

For example, in the United States, the Internal Revenue Service (IRS) provides Form 8844 Empowerment ZoneEmployment Credit, which allows you to claim tax credits for hiring employees from designated empowerment zones. Similarly, in New Jersey, businesses can take advantage of the Urban Enterprise Zone Employees Tax Credit and Credit Carry Forward by using Form 300. This form provides businesses with a credit for hiring employees from specific urban enterprise zones.

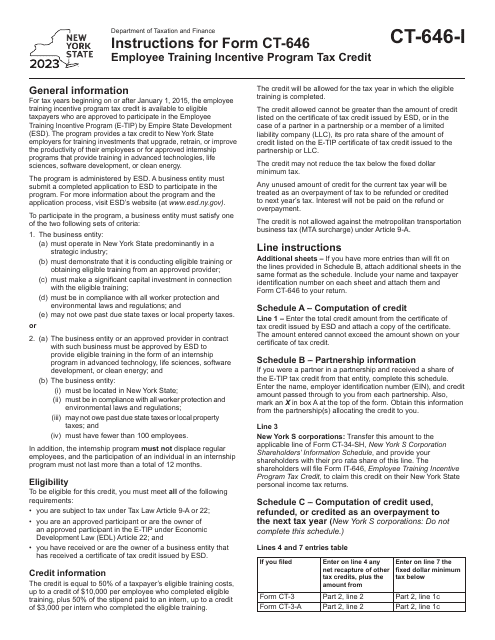

If you operate your business in New York, you can explore the Employee Training Incentive Program Tax Credit to receive tax credits for providing training opportunities to your employees. The instructions for Form CT-646 outline how to claim this credit and maximize your savings.

Whether you are a small business owner or a larger corporation, the Employee Tax Credit can provide significant financial benefits. By hiring employees from designated areas or investing in employee training, you not only contribute to the development of your community but also reap the rewards of tax savings.

Make sure to consult the appropriate forms and instructions provided by tax authorities in your jurisdiction to ensure you are eligible and properly claim the Employee Tax Credit. Take advantage of this valuable opportunity to reduce your tax burden and improve your bottom line. Your business deserves every advantage it can get, and the Employee Tax Credit is one that should not be overlooked.

Documents:

8