Commercial Activity Tax Templates

Welcome to our webpage dedicated to Commercial Activity Tax (CAT)!

CAT, also known as the Commercial Activity Tax, is a state-imposed tax on the privilege of doing business in a specific jurisdiction. This tax applies to a wide range of business activities, including sales, gross receipts, and certain other activities. Our webpage provides a comprehensive guide on CAT and its implications for businesses operating within the jurisdiction.

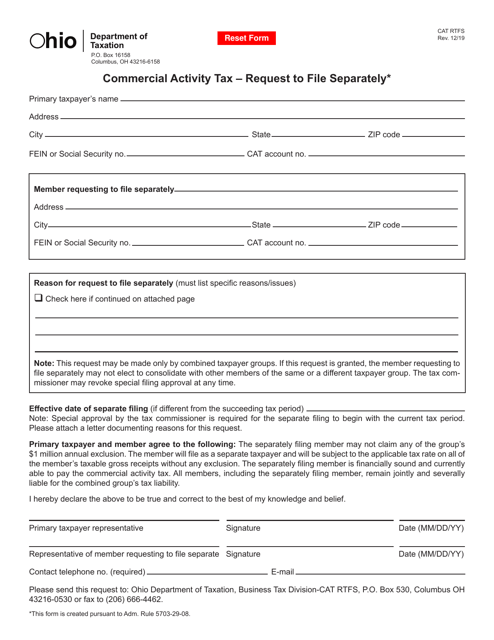

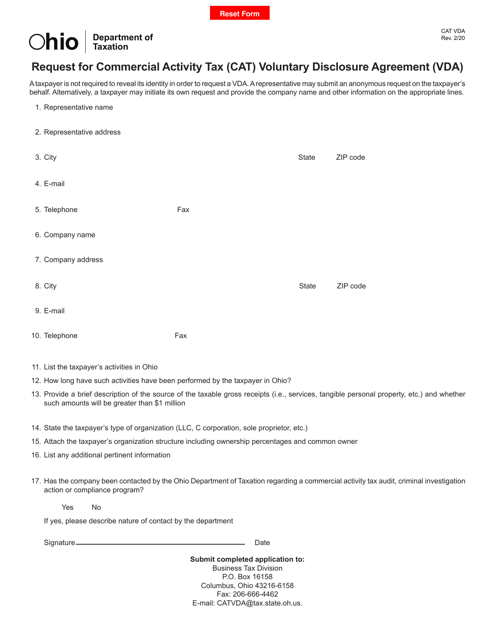

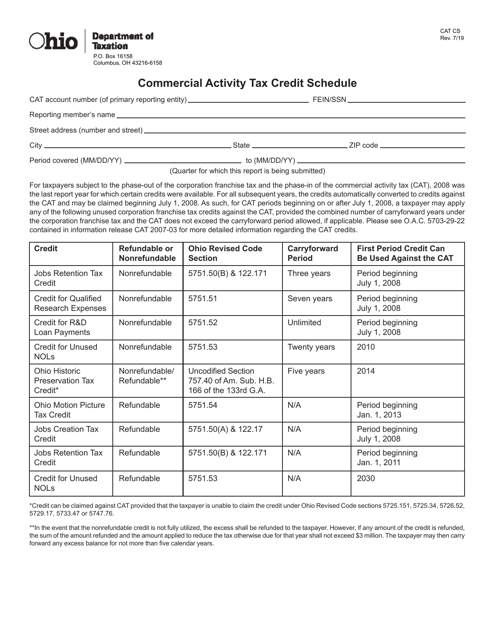

At our webpage, you will find a variety of resources to help you navigate the complexities of the Commercial Activity Tax. We have detailed information on filing requirements, including forms and instructions for filing separately or requesting a Voluntary Disclosure Agreement (VDA). Our webpage also offers an overview of the Commercial Activity Tax Credit Schedule (CAT CS) and how it can benefit eligible businesses.

Whether you are a new business owner or an established company, understanding and complying with the Commercial Activity Tax is essential. Our webpage serves as a valuable resource to stay up-to-date with the latest regulations and requirements. Stay informed about changes to the tax code and explore strategies to optimize your tax planning.

Don't hesitate to explore our webpage and take advantage of the wealth of information available. We are here to support you in navigating the world of commercial taxation and ensuring compliance with the Commercial Activity Tax. Our goal is to empower businesses with the knowledge they need to thrive in this competitive landscape.

Documents:

7

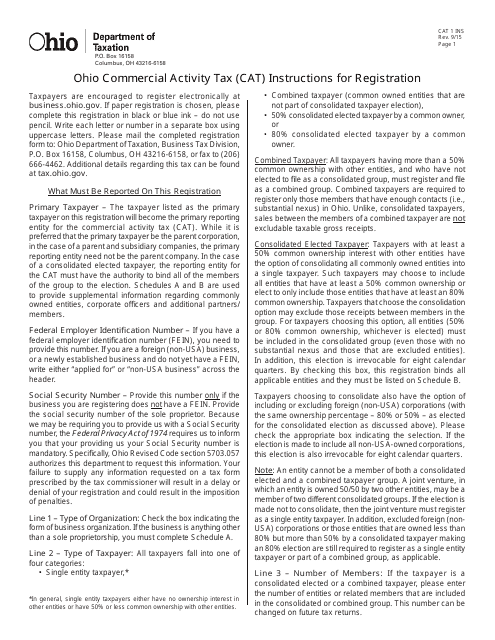

This Form is used for registering for the Commercial Activity Tax (CAT) in the state of Ohio. It provides instructions on how to complete the registration process and fulfill the tax obligations for businesses engaging in commercial activities in Ohio.

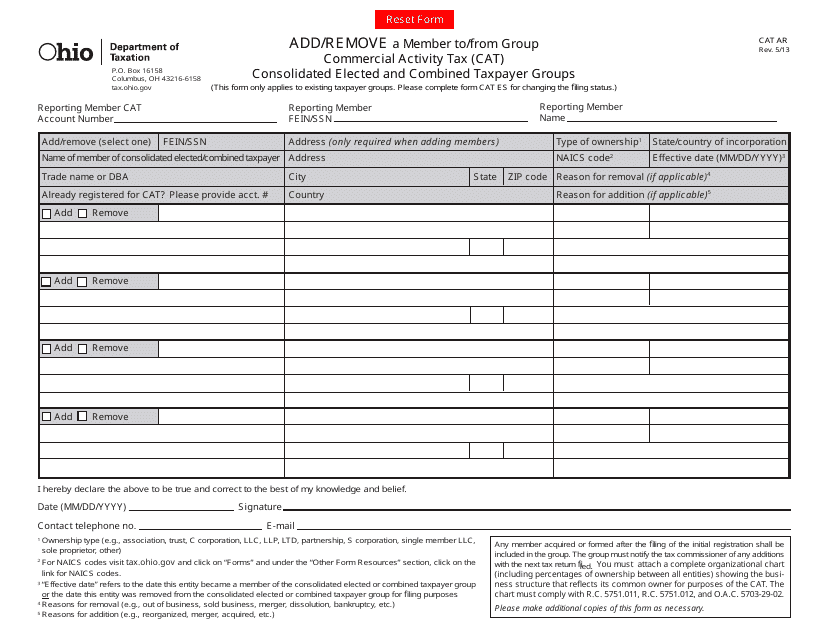

This Form is used for adding or removing a member to/from a Group Commercial Activity Tax (CAT) Consolidated Elected and Combined Taxpayer Groups in Ohio.