Passive Activity Loss Templates

Passive Activity Losses - Maximize Your Tax Benefits

Welcome to our comprehensive resource center for passive activity losses. Whether you're a business owner, real estate investor, or individual taxpayer, understanding the intricacies of passive activity loss limitations is crucial for optimizing your tax benefits.

Also known as passive activity losses or PAL, these guidelines aim to prevent taxpayers from using losses generated by passive activities to offset income from active activities. By delving into our collection of informative documents, instructions, and forms, you'll gain a firm grasp on how to navigate the complex landscape of PAL regulations.

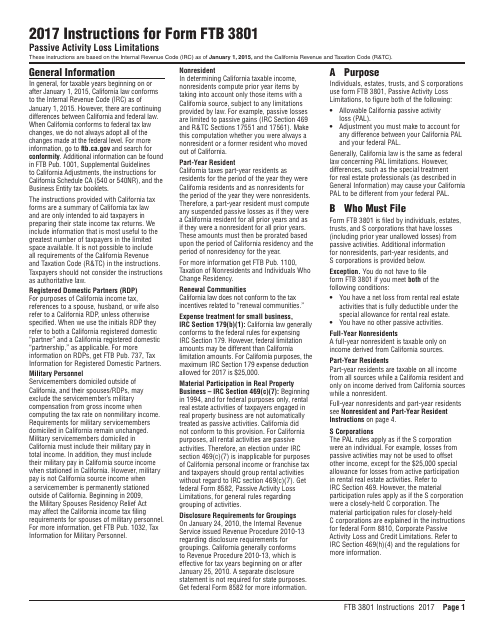

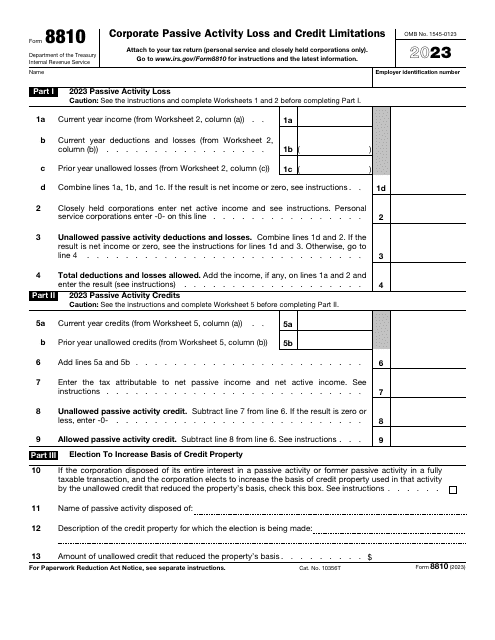

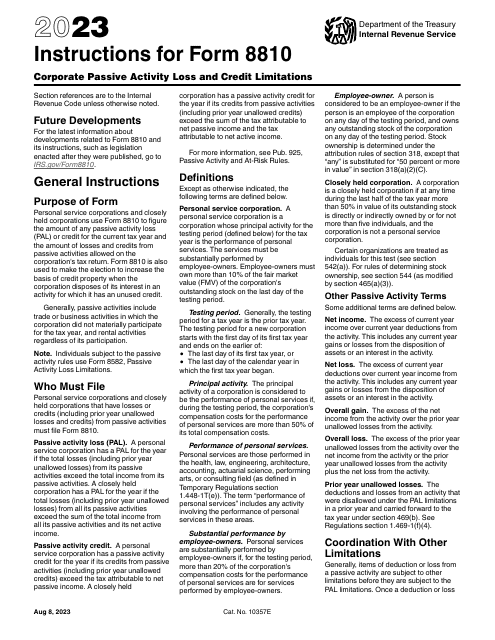

Our resources cover a wide range of topics, including the California-specific Instructions for Form FTB3801, which delve into passive activity loss limitations specific to the state. Additionally, we provide guidance on IRS Form 8810, which pertains to corporate passive activity loss and credit limitations. You'll find instructions for this form, as well as helpful insights to ensure you accurately complete the documentation.

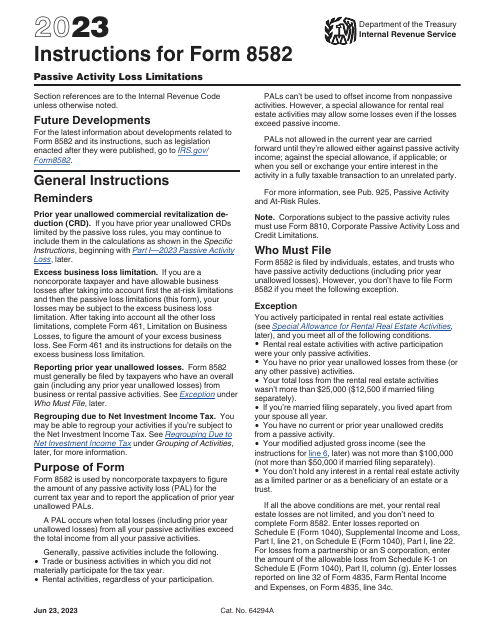

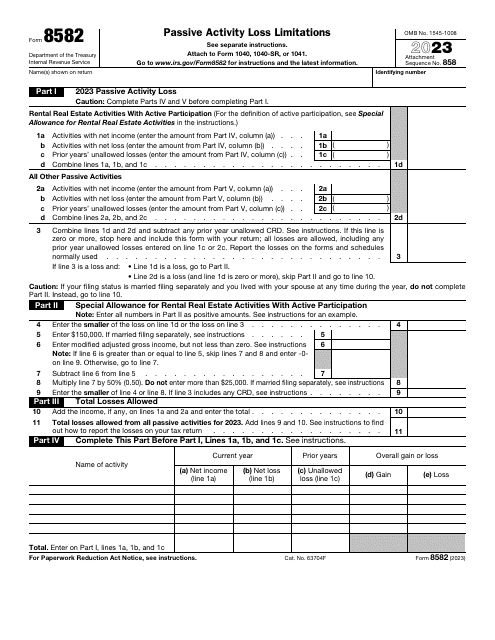

If you're seeking information on passive activity loss limitations for individuals, our collection includes IRS Form 8582, a comprehensive guide to calculating limits on these losses. Furthermore, we offer detailed instructions for IRS Form 8810, providing clarity on corporate passive activity loss and credit limitations.

With our user-friendly platform, you can easily access the information you need. Our resources ensure you stay up to date with the latest regulations and guidelines surrounding passive activity loss limitations. Discover how to maximize your tax benefits while complying with federal and state requirements.

Take advantage of our extensive knowledge base to make informed financial choices and strategically manage your passive activity losses. Empower yourself with the information you need to optimize your tax planning and stay ahead of the game. Start exploring our comprehensive collection of passive activity loss resources today.

Documents:

7

This document provides instructions for completing Form FTB3801, which is used to calculate and report passive activity loss limitations for individuals and businesses in California. The form helps taxpayers determine the amount of passive activity losses they can deduct on their state tax returns.

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.