Individual Retirement Account Templates

An individual retirement account (IRA), also known as an individual retirement arrangement, is a tax-advantaged investment account designed to help individuals save for retirement. IRAs offer various tax benefits, making them a popular choice for long-term retirement planning.

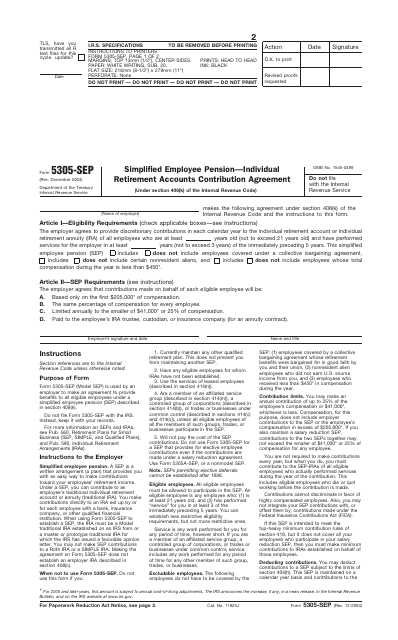

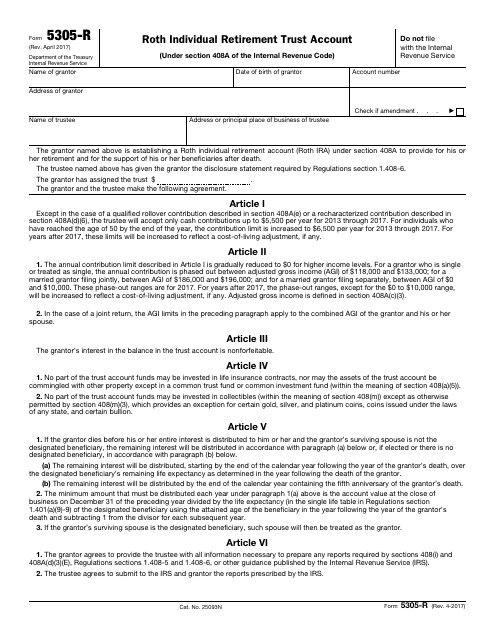

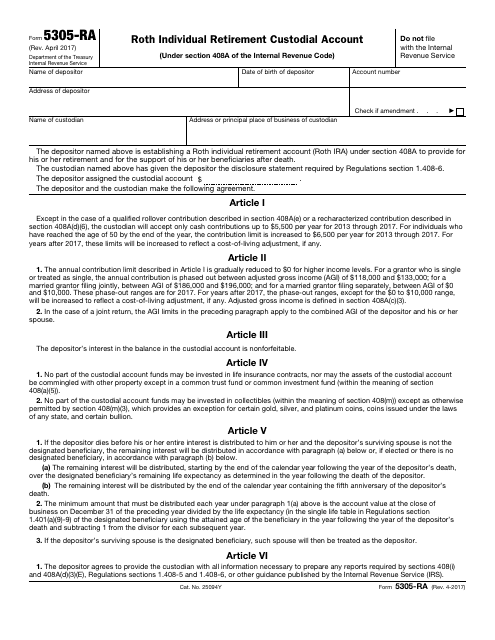

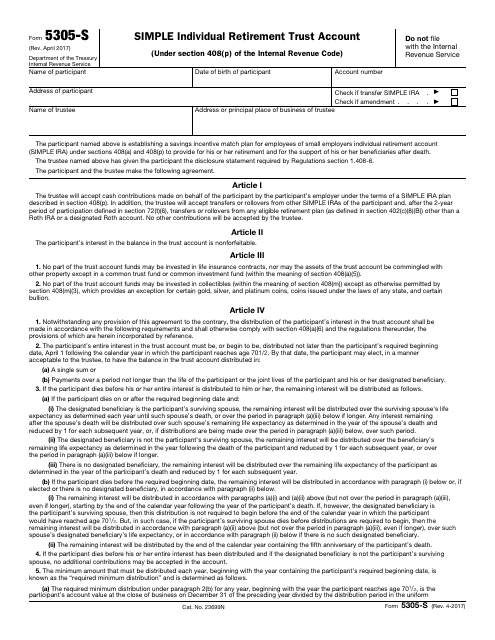

Whether you're looking to open a Roth IRA, a Simple IRA, or a traditional IRA, understanding the rules and regulations surrounding these accounts is essential. IRS Form 5305-R and IRS Form 5305-S are forms specifically tailored for setting up and managing Roth and Simple individual retirement trust accounts. These forms provide the necessary information for individuals to establish and contribute to their IRA accounts.

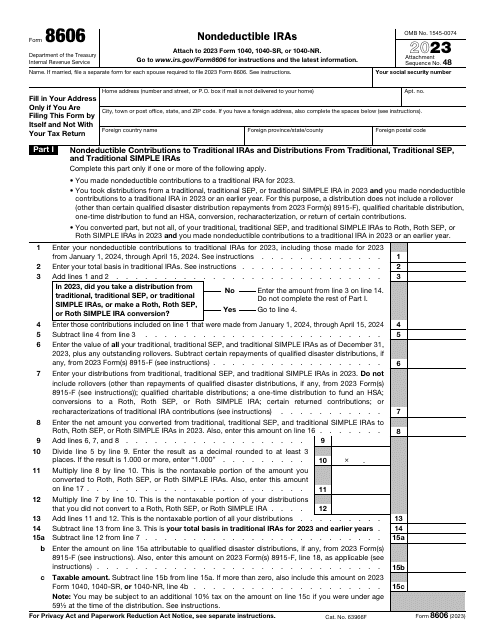

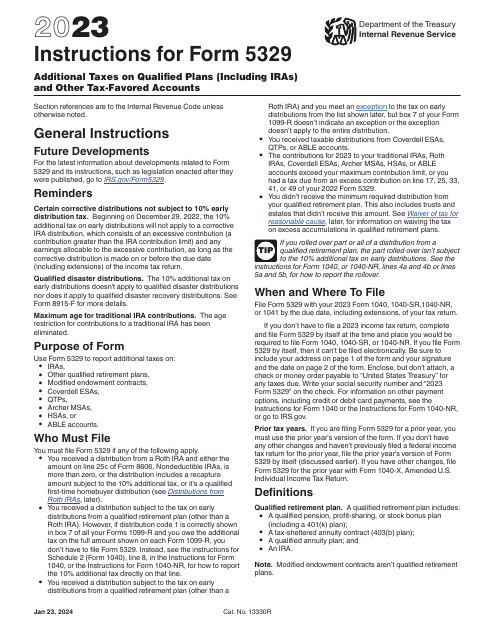

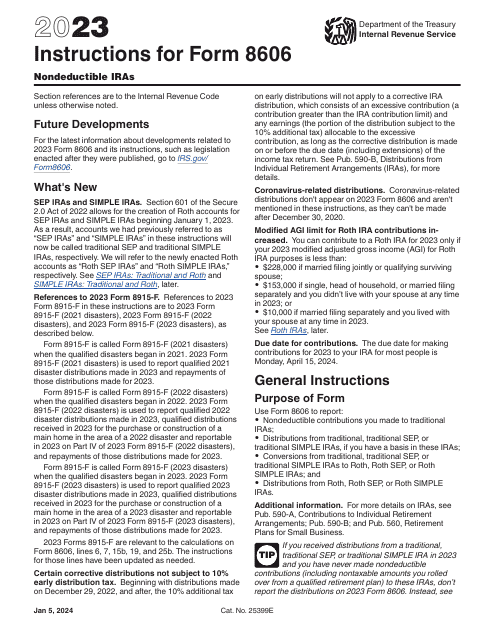

Instructions for IRS Form 5329 and IRS Form 8606 are vital resources for individuals who need guidance on additional taxes and reporting requirements associated with qualified plans, including IRAs, and other tax-favored accounts. These forms help ensure compliance with tax laws and provide clarity on any penalties or taxes that may apply to specific IRA transactions.

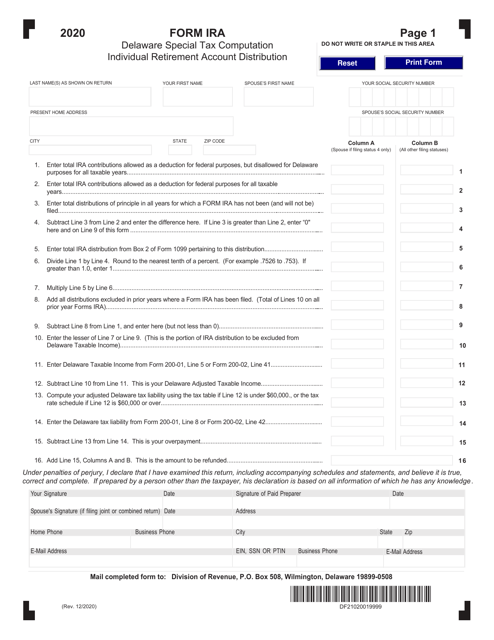

Additionally, there are specialized forms, such as the IRA Delaware Special Tax Computation Individual Retirement Account Distribution form. These forms are designed to address specific scenarios or requirements unique to certain jurisdictions or circumstances.

Navigating the world of individual retirement accounts can be complex, but having access to the right forms and resources can simplify the process. Stay informed and make the most of your retirement savings with the help of these essential documents.

Documents:

13

This is a formal agreement signed by an employer to arrange a simplified employee pension.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

The purpose of this form is to provide the IRS with information on taxpayers who make nondeductible contributions to their Individual Retirement Account (IRA).