Rental Taxes Templates

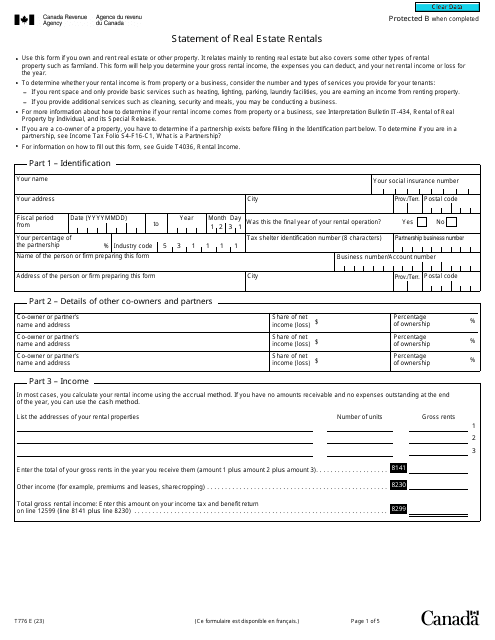

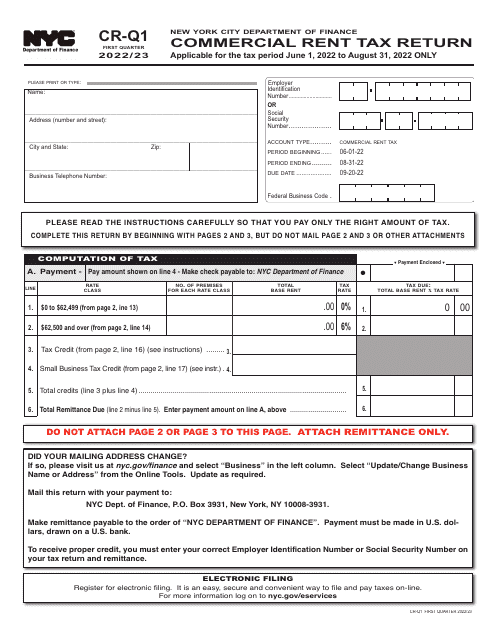

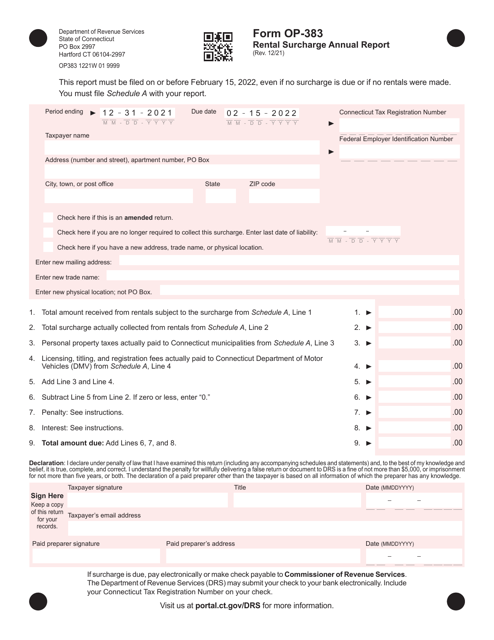

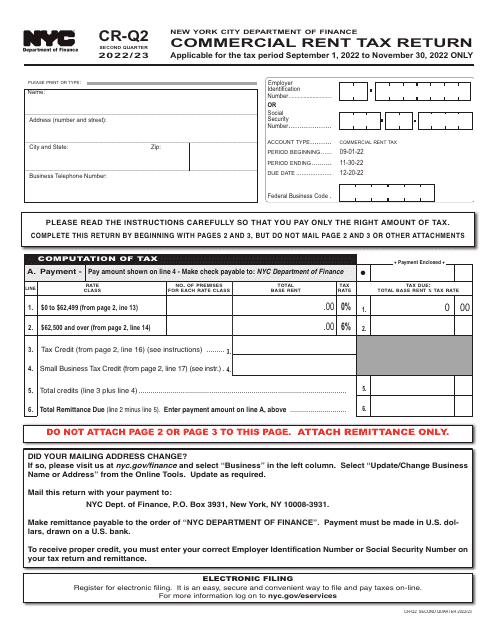

Are you a property owner who rents out residential or commercial spaces? If so, you may have questions about the rental taxes you need to pay. Rental taxes, also known as rentals tax or rental tax documentation, are the taxes levied on income generated from the rental or lease of properties. These taxes vary from state to state and can be quite complex.

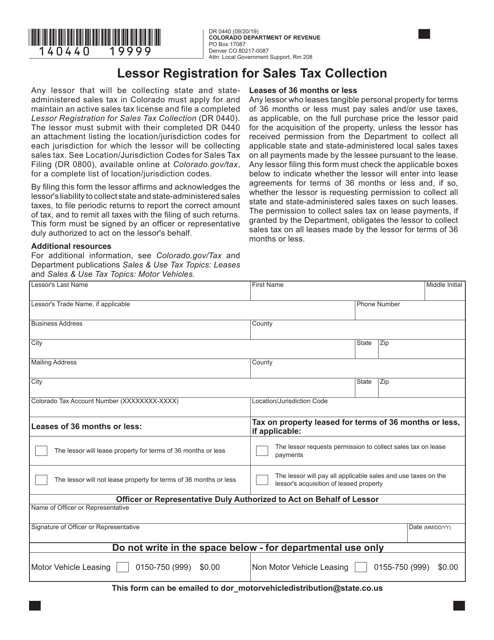

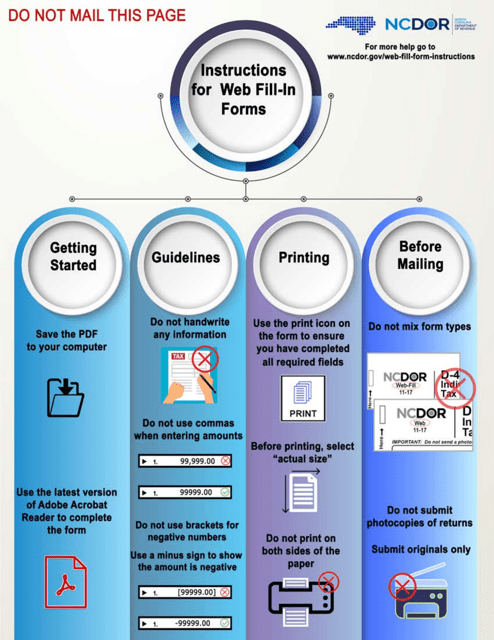

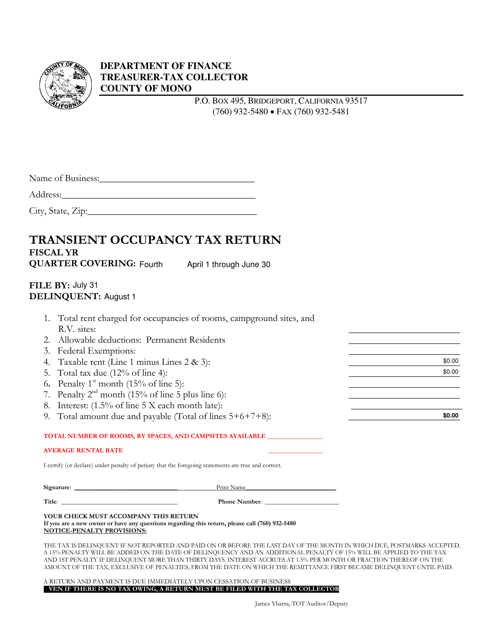

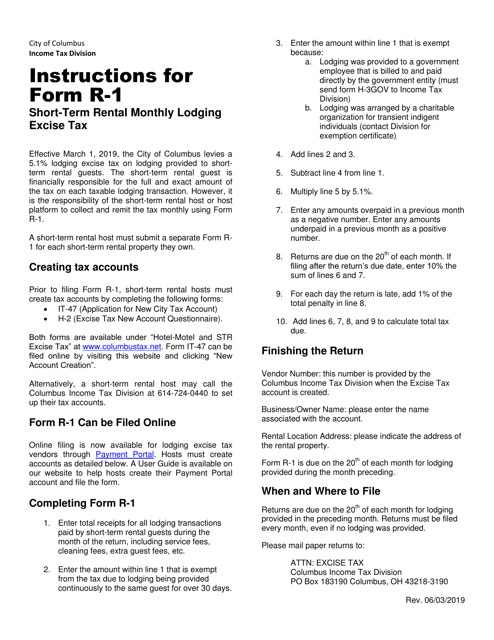

To help you navigate the world of rental taxes, we have compiled a comprehensive collection of rental tax forms and documents. Whether you need the Form DR0440 Permit to Collect Sales Tax on the Rental or Lease Basis in Colorado or the Transient Occupancy Tax Return in Mono County, California, our collection has got you covered. We also provide helpful instructions forfilling out forms like the Form R-1 Short-Term Rental Monthly Lodging Excise Tax in the City of Columbus, Ohio.

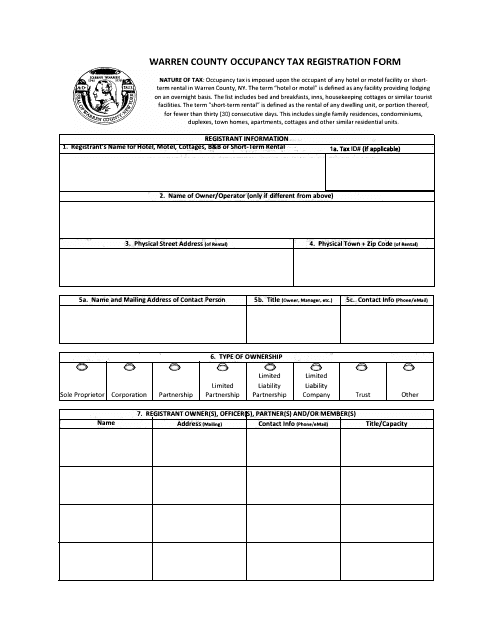

Understanding and complying with rental taxes is crucial to avoid penalties and ensure the smooth operation of your rental business. That's why our collection includes resources like the Occupancy Tax Registration Form in Warren County, New York, which will assist you in properly registering and reporting your rental income.

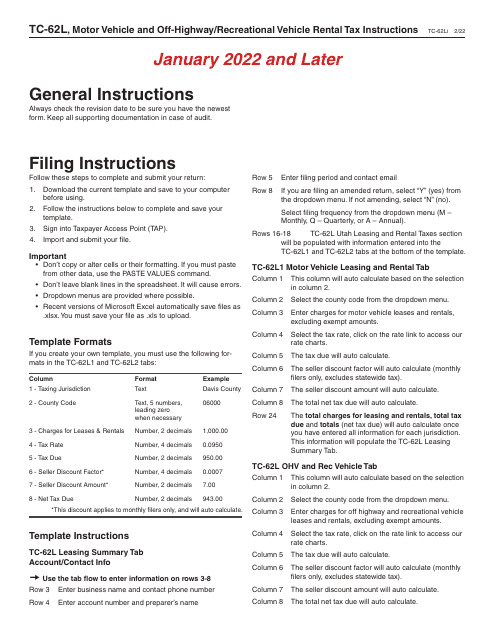

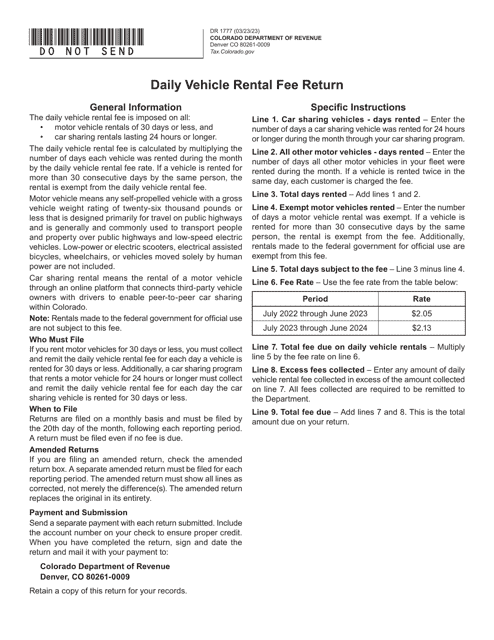

In addition to state-specific forms, we also offer comprehensive resources like the Form DR1777 Daily Vehicle Rental Fee Return in Colorado. This document is essential for rental businesses involved in the rental of vehicles and will provide you with all the necessary information to report your income accurately.

Stay on top of your rental tax obligations with our extensive collection of rental tax forms and documentation. Whether you are a landlord, property owner, or property manager, our resources will help you navigate the complexities of rental taxes and ensure compliance with the applicable laws and regulations.

Documents:

28

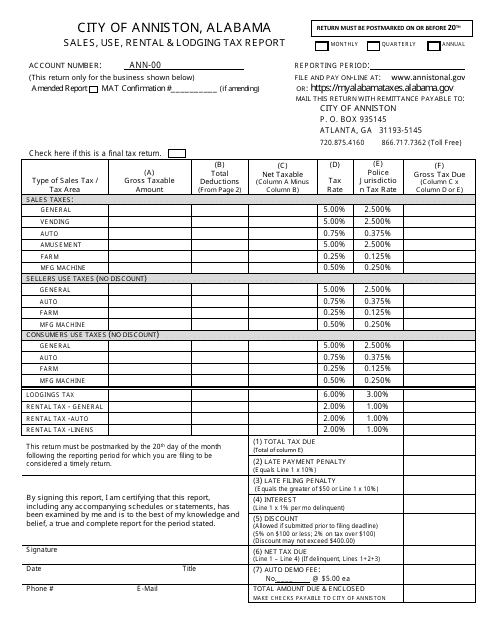

This document is used for reporting sales, use, rental, and lodging taxes in the City of Anniston, Alabama.

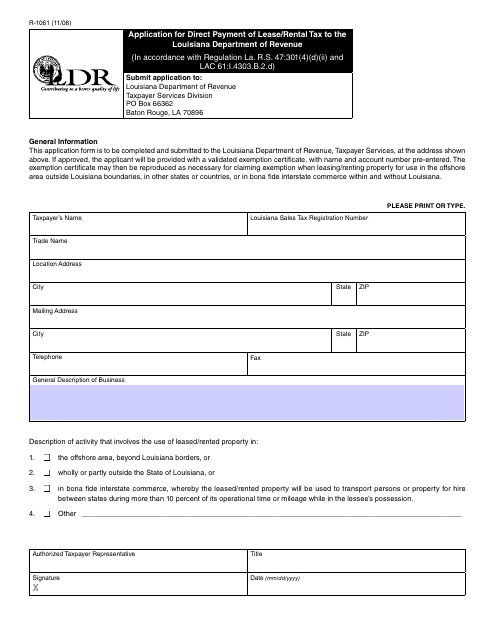

This form is used for applying for direct payment of lease/rental tax to the Louisiana Department of Revenue in Louisiana.

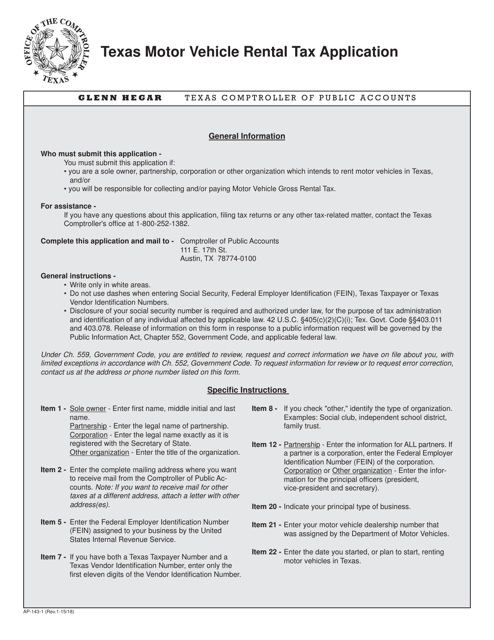

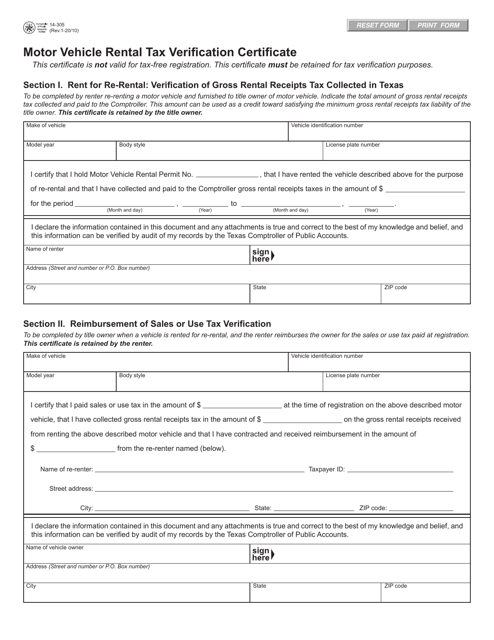

This Form is used for applying for the Texas Motor Vehicle Rental Tax in Texas.

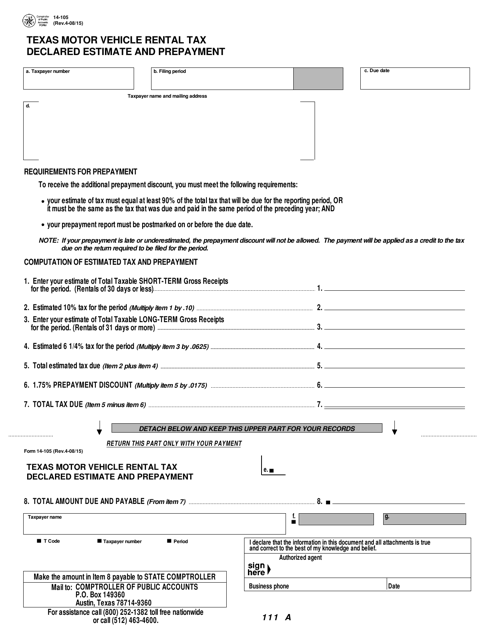

This Form is used for estimating and prepaying the motor vehicle rental tax in Texas. It is required for individuals or businesses engaged in renting motor vehicles.

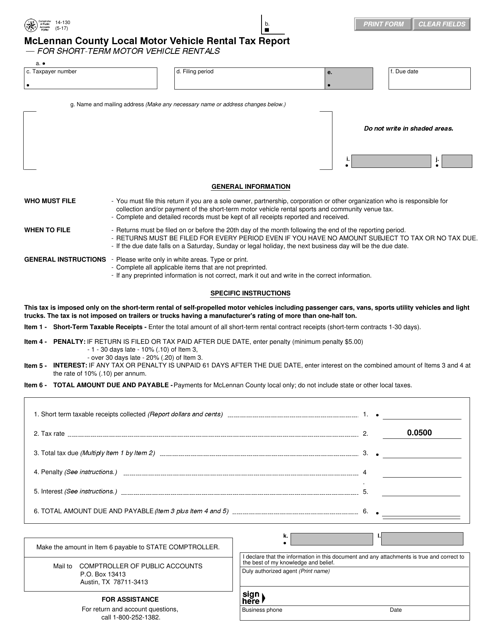

This form is used for reporting local motor vehicle rental tax for short-term vehicle rentals in McLennan County, Texas.

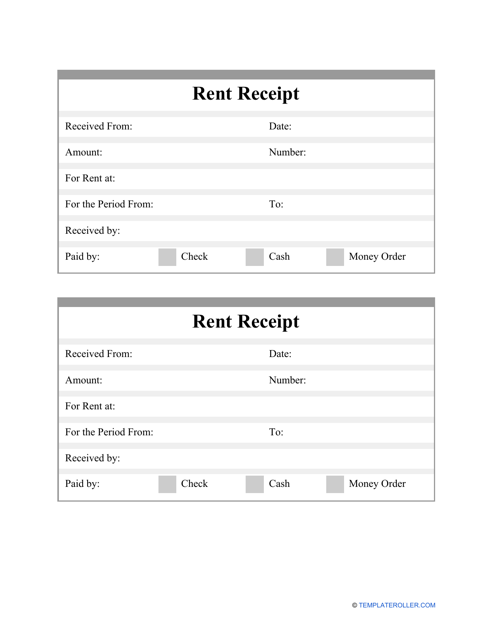

An individual may use this document to record their weekly or monthly rent payment and confirm that the payment has been made.

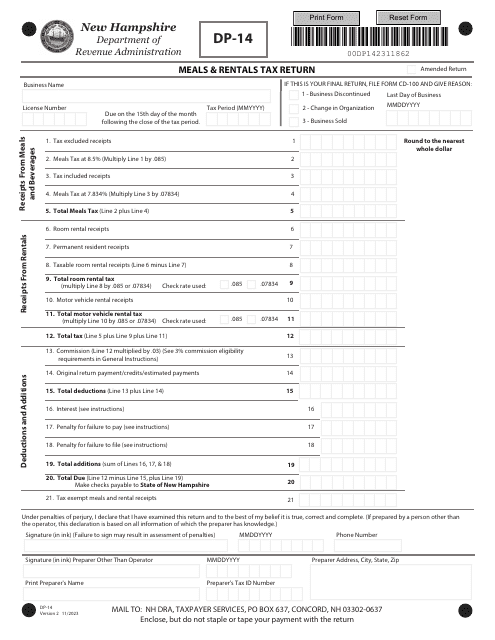

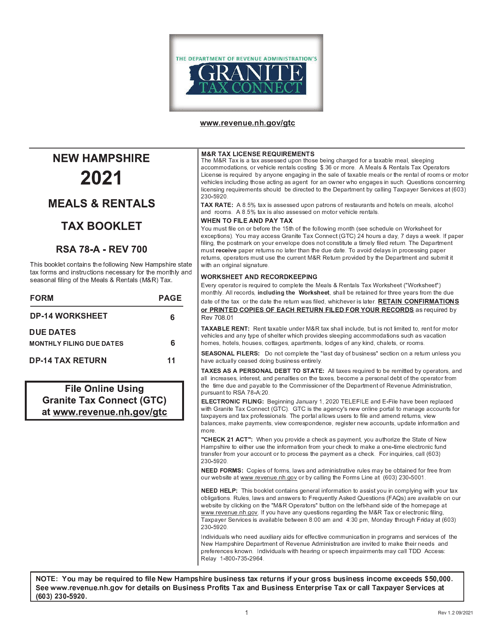

This document provides information about the Meals & Rentals Tax in New Hampshire. It includes instructions on how to calculate and report the tax as well as guidance on exemptions and filing requirements.

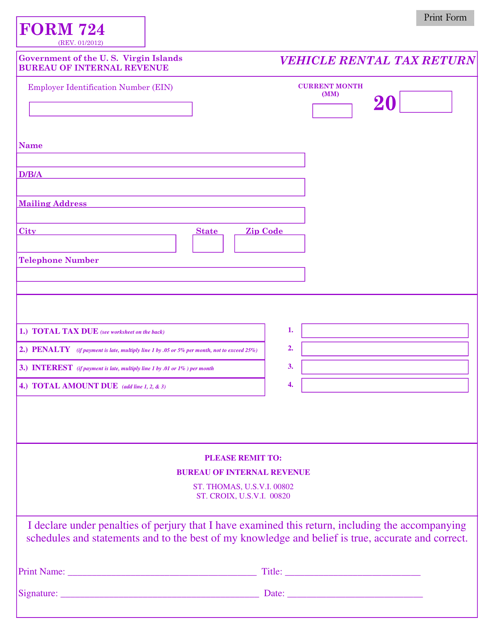

This form is used for reporting vehicle rental taxes in the US Virgin Islands.

This document is used for filing the Transient Occupancy Tax Return in Mono County, California.

This form is used for reporting and paying the monthly lodging excise tax for short-term rentals in the City of Columbus, Ohio. It provides instructions on how to accurately complete the form and submit the tax payment.

This form is used to report and remit the Motor Vehicle and Off-Highway/Recreational Vehicle Rental Tax in Utah. It provides instructions on how to fill out and submit the form accurately.

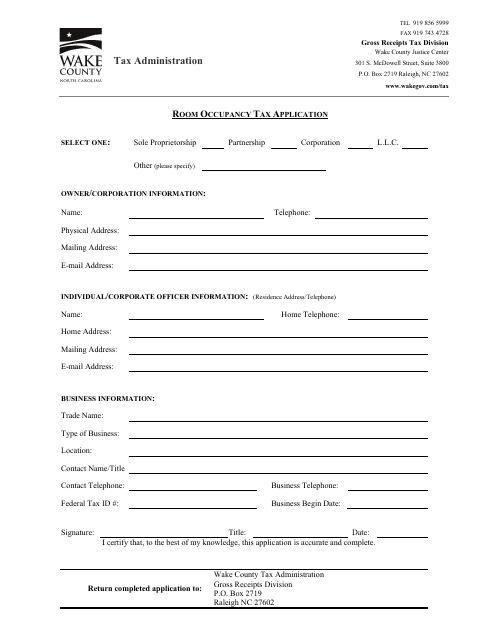

This document is an application form for individuals or businesses in Wake County, North Carolina to apply for the Room Occupancy Tax. This tax is applied to rentals of accommodations such as hotels and vacation rentals.

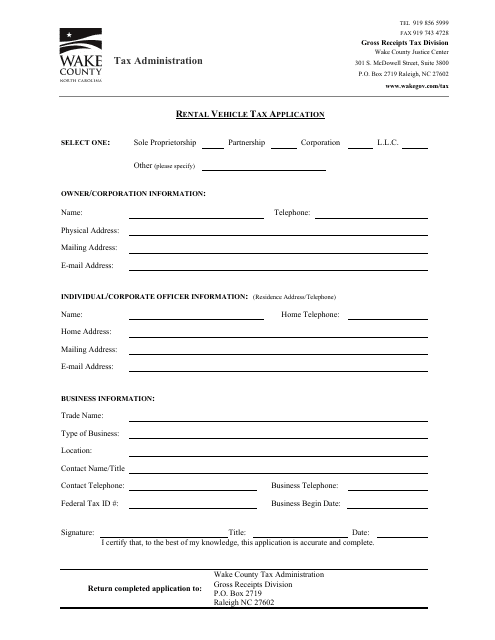

This document is for applying for rental vehicle tax in Wake County, North Carolina. It is used to report and pay taxes related to renting vehicles in the county.

This form is used for registering for the occupancy tax in Warren County, New York.

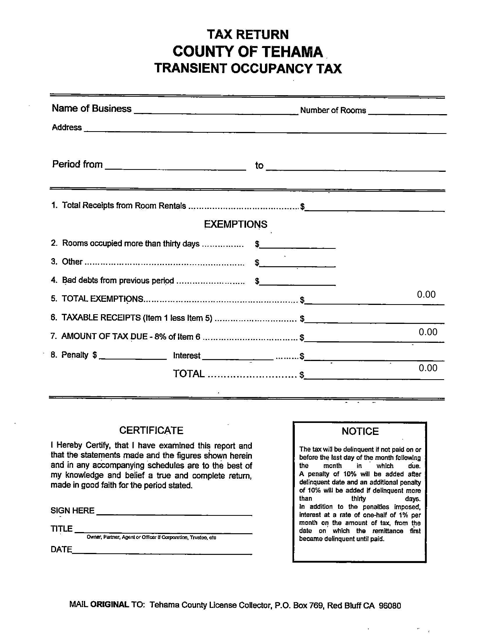

This document pertains to the Transient Occupancy Tax in Tehama County, California. It provides information about the tax and its regulations for individuals or businesses who provide temporary lodging services in the county.