Passive Foreign Investment Company Templates

A Passive Foreign Investment Company, also known as a PFIC, refers to a specific type of investment vehicle used by individuals and businesses to invest in foreign companies. This document group provides essential information and forms required to properly report and file taxes related to PFIC investments.

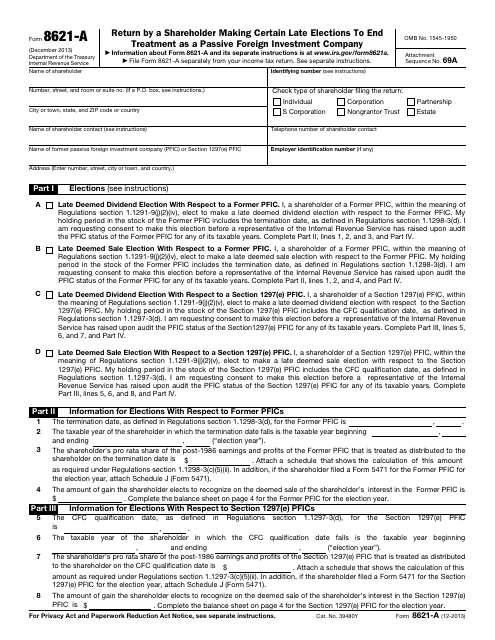

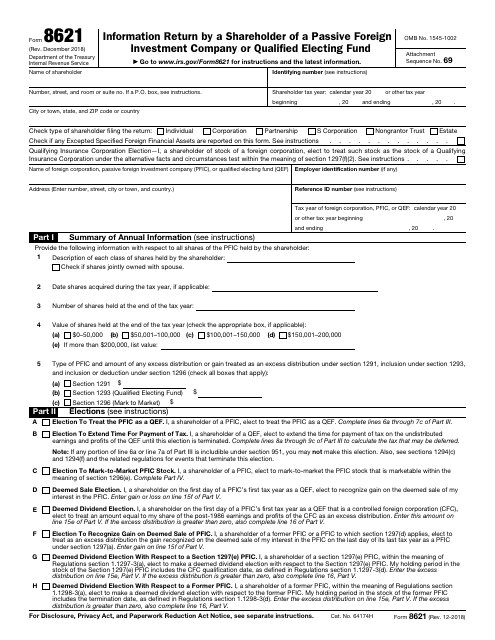

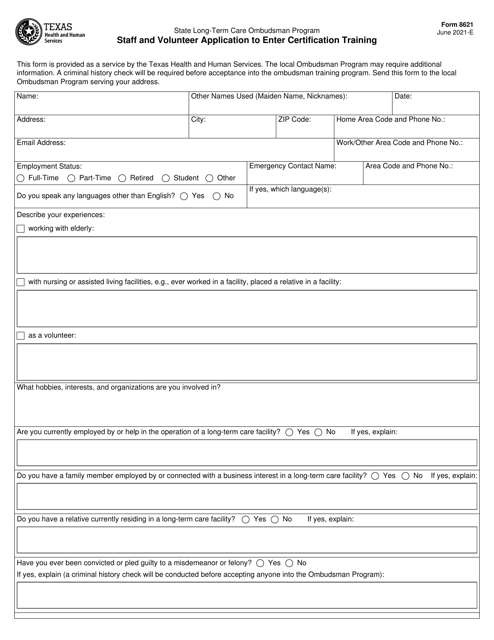

One of the key documents in this collection is the IRS Form 8621, which serves as an information return for shareholders of a Passive Foreign Investment Company. This form is used to fully disclose the details of the investment and the shareholder's taxable income. Additionally, the IRS Form 8621-A is available for shareholders who need to make certain late elections to end treatment as a PFIC.

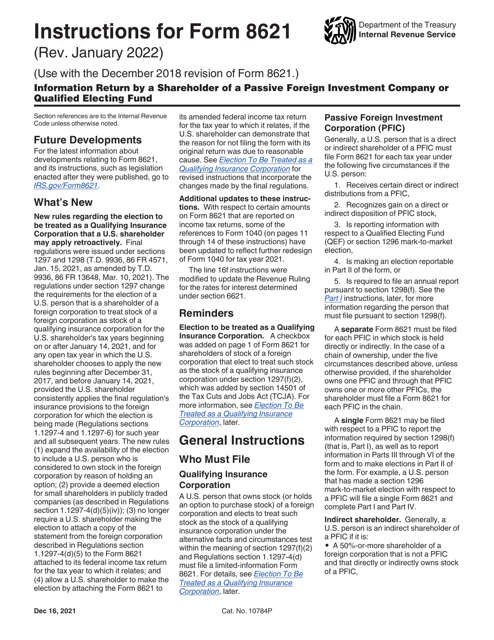

Understanding and properly completing these forms can be complex, which is why the Instructions for IRS Form 8621-A and Form 8621 are included in this document group. These instructions provide step-by-step guidance, clarifying the requirements and making the filing process easier for individuals.

It's important to note that shareholders of a PFIC may also need to file the IRS Form 5471, which is the Information Return of U.S. Persons With Respect to Certain Foreign Corporations. This form is used to report ownership and transactions with foreign corporations, ensuring compliance with tax regulations.

Whether you're an individual investor or a business with PFIC investments, having access to these documents and instructions is crucial for proper tax reporting and compliance. They provide the necessary information and guidance to navigate the complexities of PFIC investments and ensure accurate tax filing.

Investing in foreign companies can offer unique opportunities, but it's important to understand the tax implications and comply with regulations. With this comprehensive document group, you'll have the resources you need to navigate the world of PFIC investments and stay on top of your tax obligations.

Documents:

8

This Form is used for shareholders who need to make certain late elections to end treatment as a Passive Foreign Investment Company.

This form is used for reporting information about a shareholder's investment in a passive foreign investment company or qualified electing fund to the IRS.

This document provides instructions for completing IRS Form 8621-A, which is used by shareholders who are making certain late elections to end their treatment as a Passive Foreign Investment Company.