Credit for Increasing Research Activities Templates

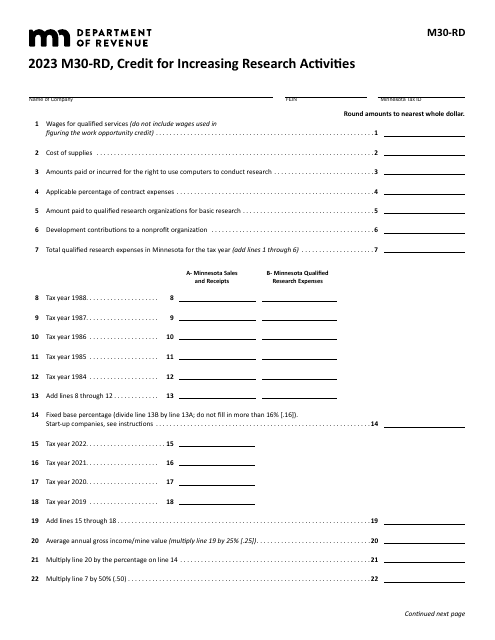

Are you a business involved in research and development activities? If so, you may be eligible for tax credits that can help offset the costs of your innovation. These credits, also known as the credit for increasing research activities or the credit for increased research activities, can provide significant financial incentives for businesses undertaking research activities.

The credit for increasing research activities is a tax benefit offered by the IRS and some individual states, such as Arizona. By taking advantage of this credit, businesses can lower their tax liability and potentially increase their bottom line. There are specific forms and instructions that businesses need to follow in order to claim this credit.

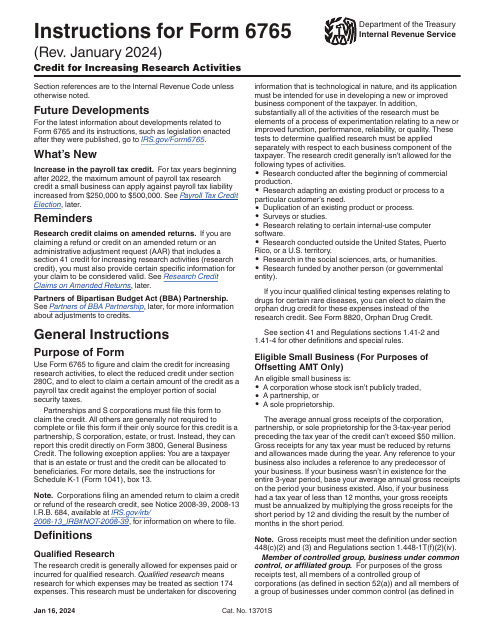

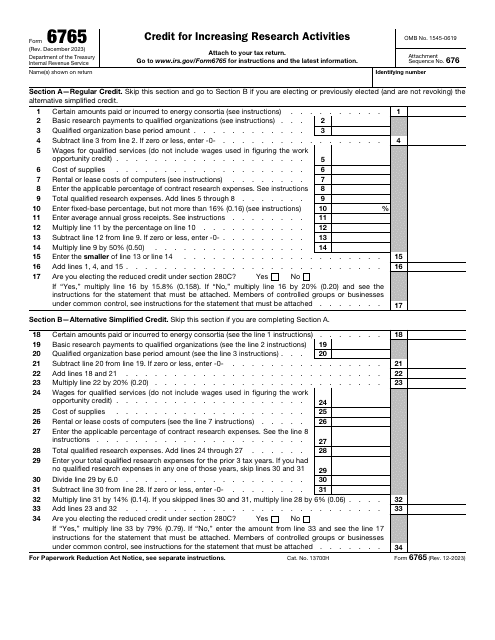

For businesses operating in the United States, the IRS Form 6765 is the primary document used to claim the credit for increasing research activities. This form provides detailed information on the calculation and documentation required to claim the credit. The Instructions for IRS Form 6765 Credit for Increasing Research Activities offer guidance on how to complete the form accurately and maximize the credit amount.

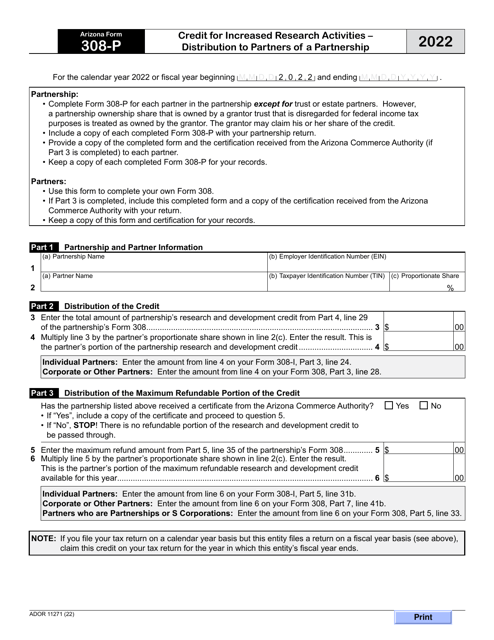

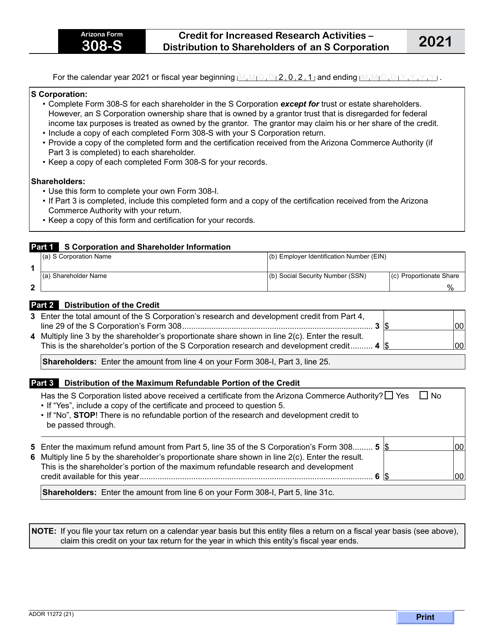

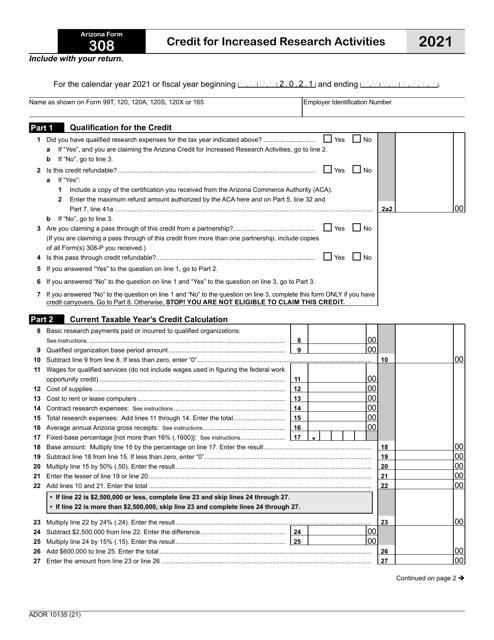

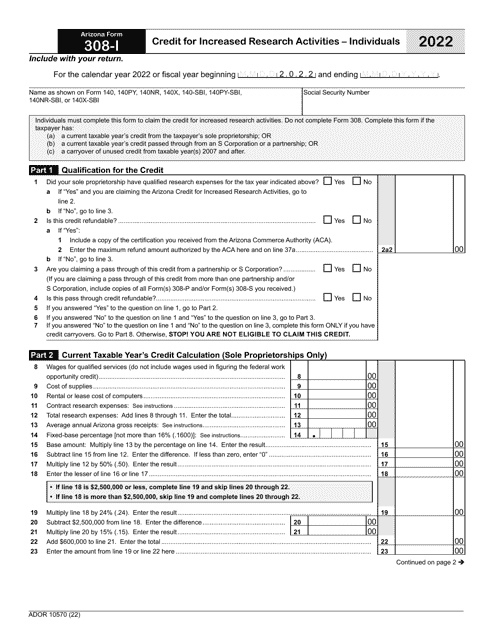

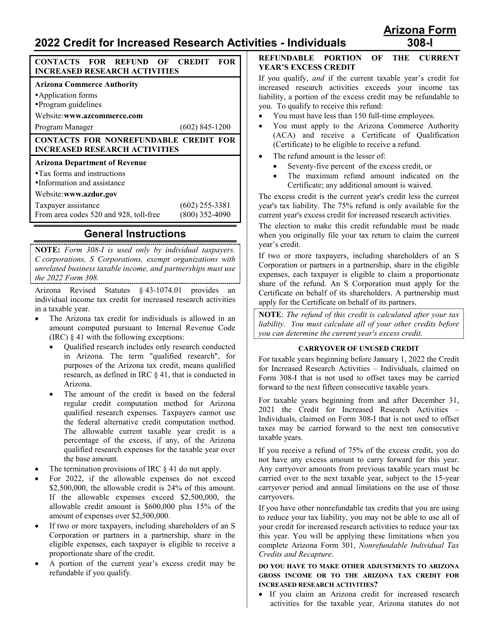

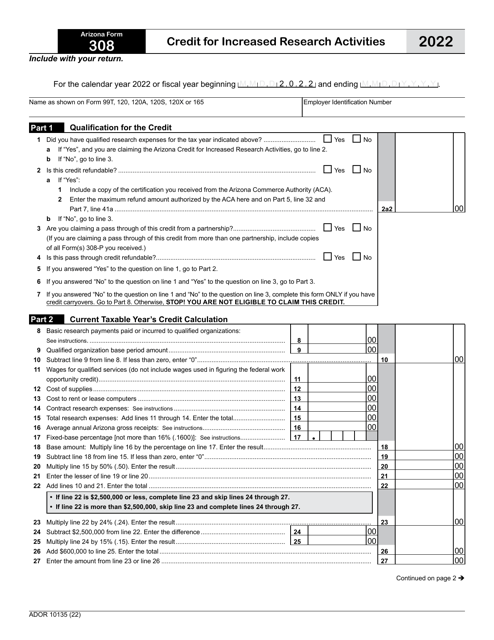

In addition to the federal credit, individual states like Arizona also offer their own version of the credit for increased research activities. For example, Arizona Form 308 (ADOR10135) Credit for Increased Research Activities - Arizona is used to claim the credit at the state level. Similar to the federal form, Arizona Form 308-I (ADOR10570) Credit for Increased Research Activities - Individuals - Arizona provides instructions on how to complete the form for individual taxpayers.

If you're interested in taking advantage of the credit for increasing research activities or the credit for increased research activities, it's important to understand the eligibility criteria and the documentation required. Consulting with a tax professional or utilizing specialized software can help ensure that you're maximizing your tax savings while complying with all applicable regulations.

Note: This text represents an SEO description for a webpage about the credit for increasing research activities.

Documents:

18

This is a document you may use to figure out how to properly complete IRS Form 6765

This Form is used for applying for the Credit for Increased Research Activities in Arizona for shareholders of an S Corporation. It allows shareholders to claim a credit for research and development expenses incurred by the corporation.

This Form is used for claiming a credit for increased research activities in Arizona.

This Form is used for claiming the Credit for Increased Research Activities in the state of Arizona.