Diesel Fuel Tax Templates

Are you looking for information about diesel fuel tax and how it applies to your business? Look no further! Our website provides a comprehensive guide on diesel fuel tax regulations in various states, including California and New York.

Diesel fuel tax, also known as the diesel motor fuel tax, is a specific tax imposed on the sale or use of diesel fuel. This tax is designed to fund transportation infrastructure and other related expenses. It applies to individuals, partnerships, and businesses that use or sell diesel fuel for commercial purposes.

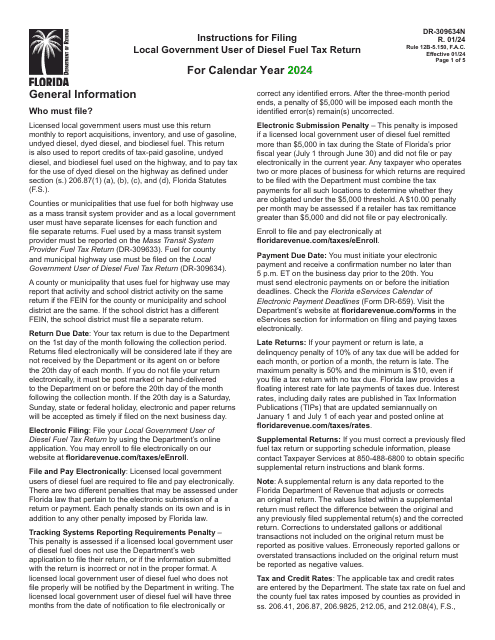

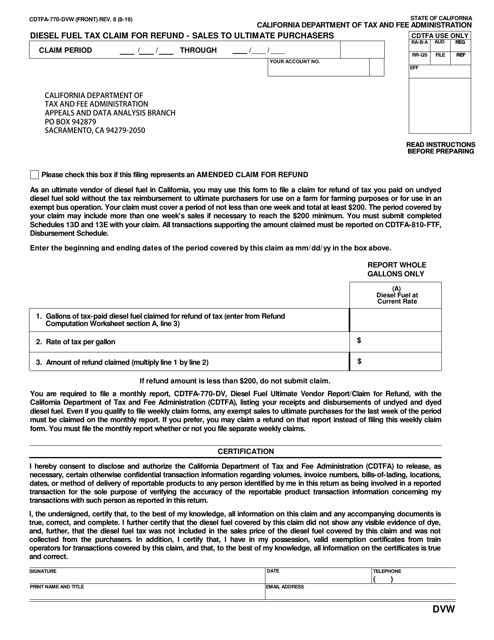

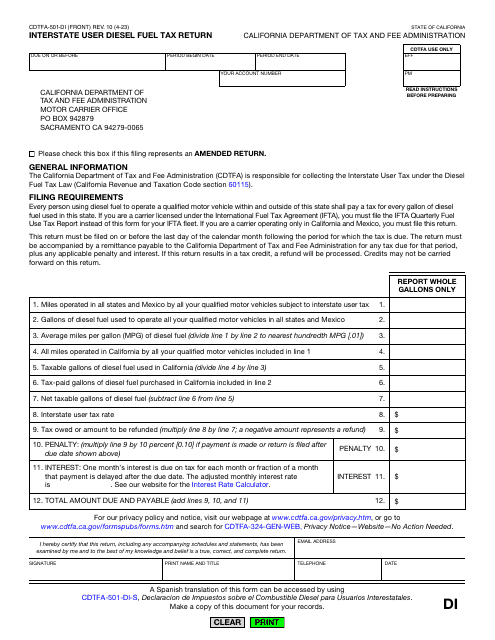

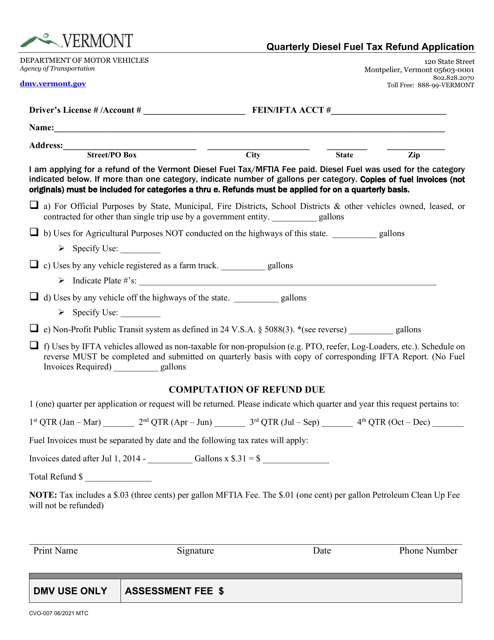

We offer a wide range of resources to help you understand and comply with diesel fuel tax requirements. Whether you need assistance in filing a diesel fuel tax claim for refund, submitting an interstate user diesel fuel tax return, or obtaining a diesel fuel tax license, we have the information you need.

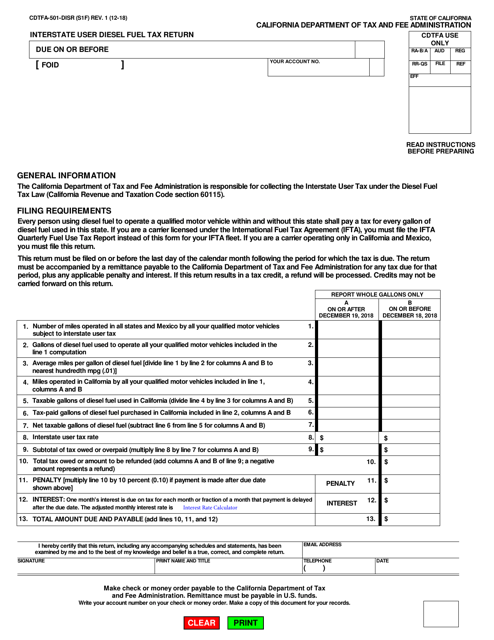

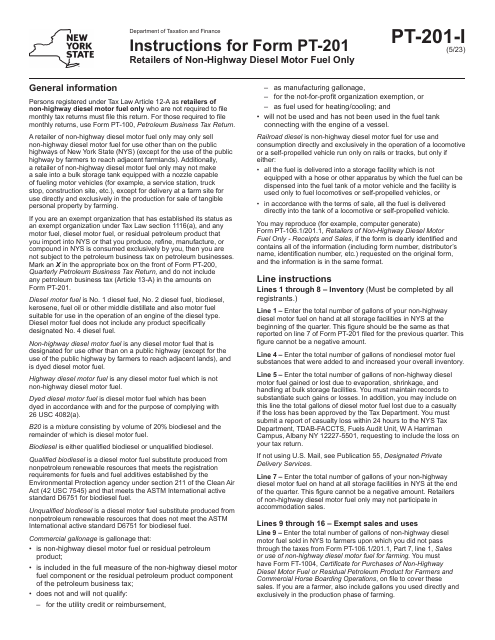

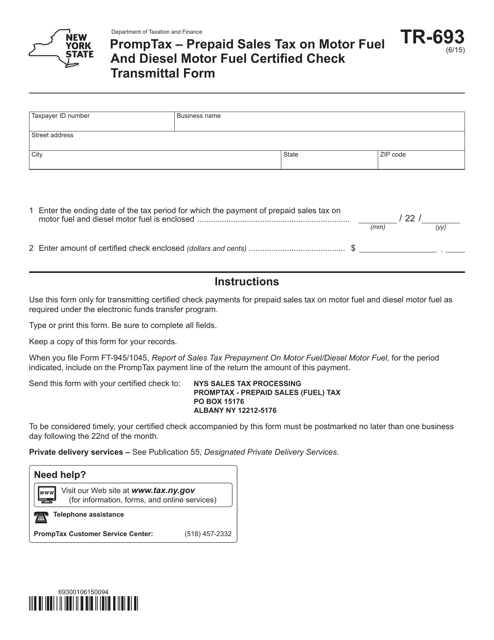

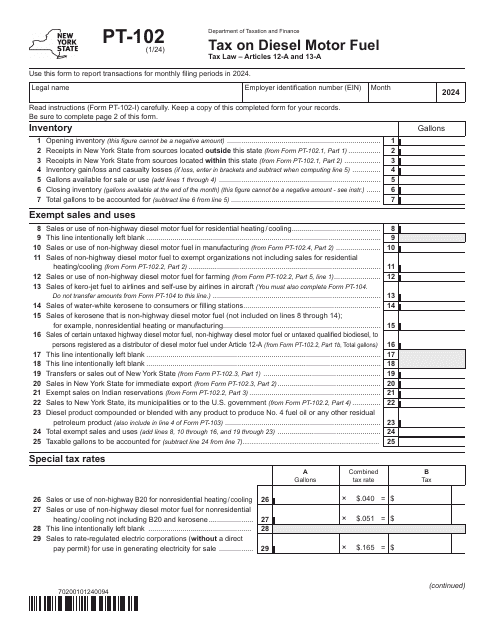

Our website is regularly updated with the latest forms, instructions, and guidelines issued by the relevant authorities. You can find resources such as the Form CDTFA-32 Diesel Fuel Tax Claim for Refund Questionnaire and the Form CDTFA-501-DISR Interstate User Diesel Fuel Tax Return specific to California. If you operate in New York, we provide resources like the Form PT-201 for retailers of non-highway diesel motor fuel and the Form TR-693 for promptax - prepaid sales tax on motor fuel and diesel motor fuel certified check transmittal.

We understand that navigating diesel fuel tax regulations can be complex, but our goal is to simplify the process for you. Our website is user-friendly and organized so that you can find the information you need quickly and easily. Our guides and instructions are written in plain language to ensure clarity and ease of understanding.

Whether you are a small business owner or a large corporation, understanding and complying with diesel fuel tax regulations is essential. Let us be your go-to resource for all things related to diesel fuel tax. Explore our website today and take the first step towards mastering diesel fuel tax compliance.

Documents:

14

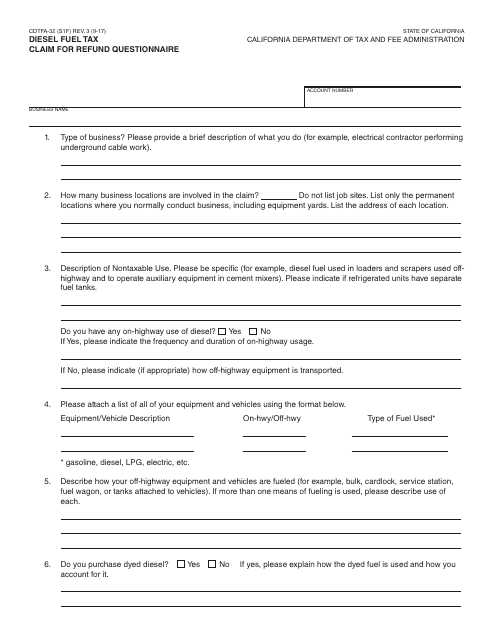

This form is used for claiming a refund on diesel fuel taxes paid in California. The questionnaire helps gather necessary information for processing the refund.

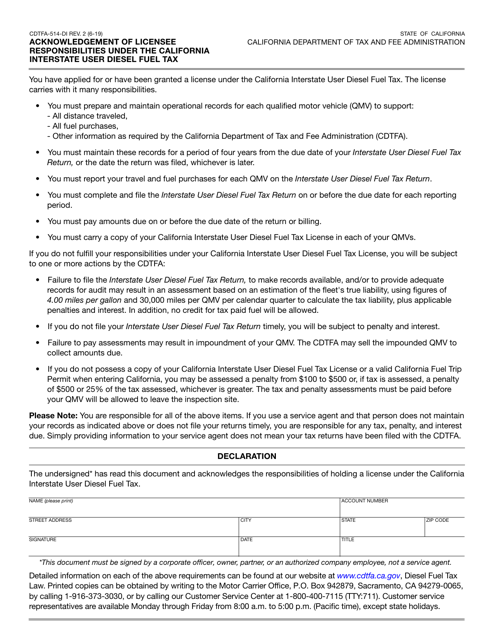

This document is used for individuals and partnerships in California to apply for a diesel fuel tax license for interstate use.

This form is used for transmitting certified checks for prepaid sales tax on motor fuel and diesel motor fuel in New York.