Self Insured Employers Templates

When it comes to managing their employees' health insurance plans, many businesses opt to become self-insured employers. Being a self-insured employer means that the company takes on the financial risk of providing healthcare benefits to its employees, rather than relying on traditional insurance plans.

Self-insured employers enjoy greater flexibility and control over the design and administration of their health plans. They have the freedom to tailor their plans to meet the specific needs of their workforce, all while potentially reducing costs.

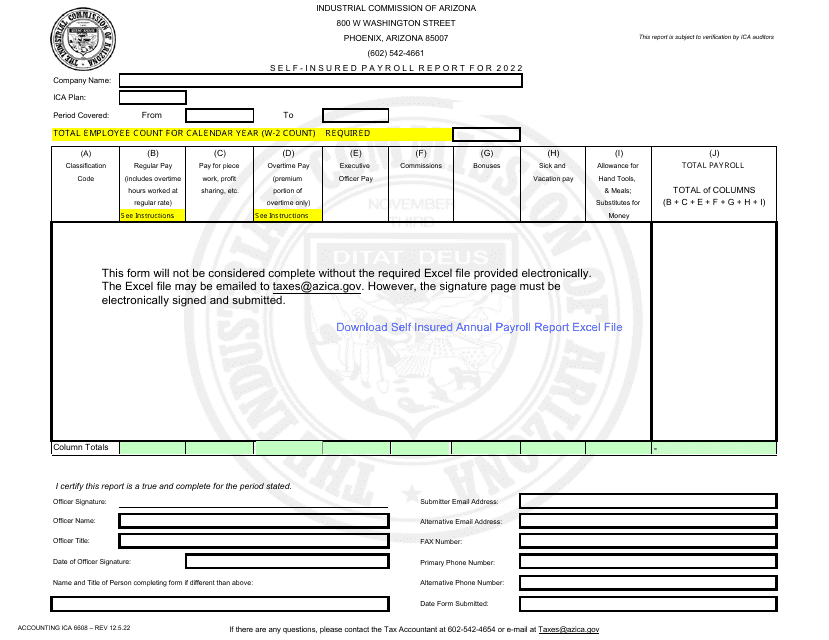

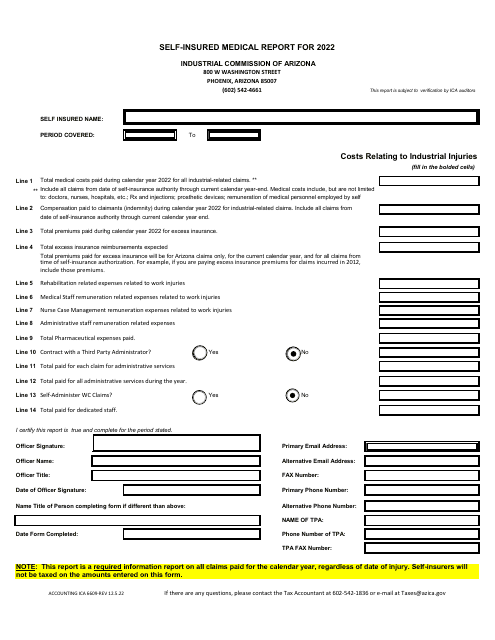

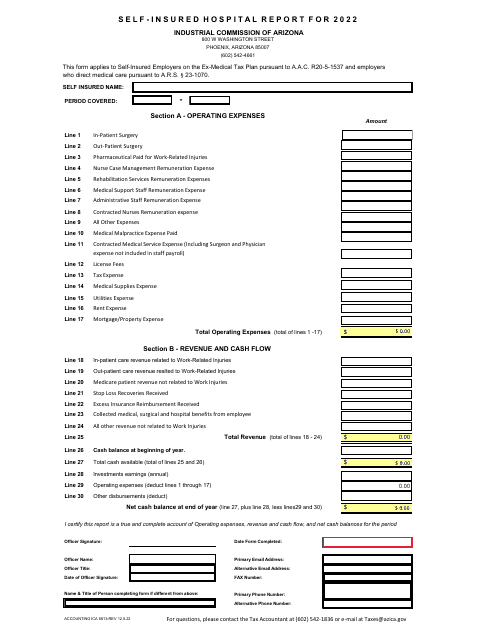

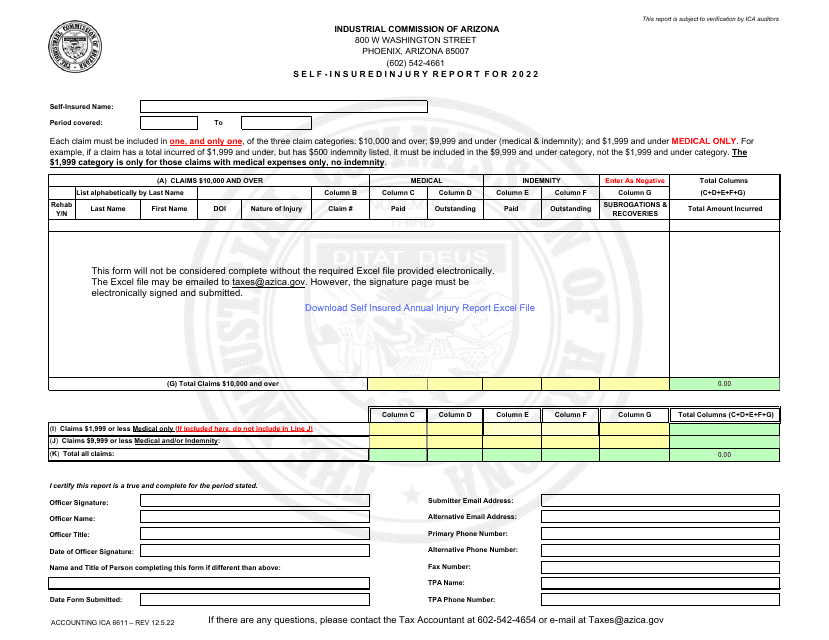

To ensure compliance with regulations and streamline their self-insured operations, employers need access to a range of documents and forms. These documents, which can also be referred to as self-insured employer forms, play a crucial role in the day-to-day functioning of self-insured employers.

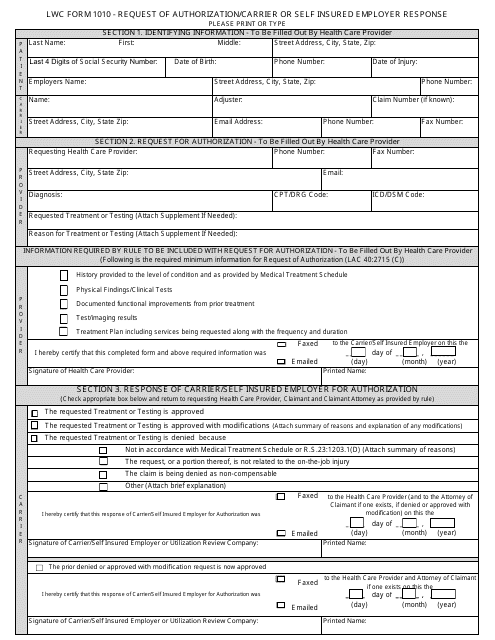

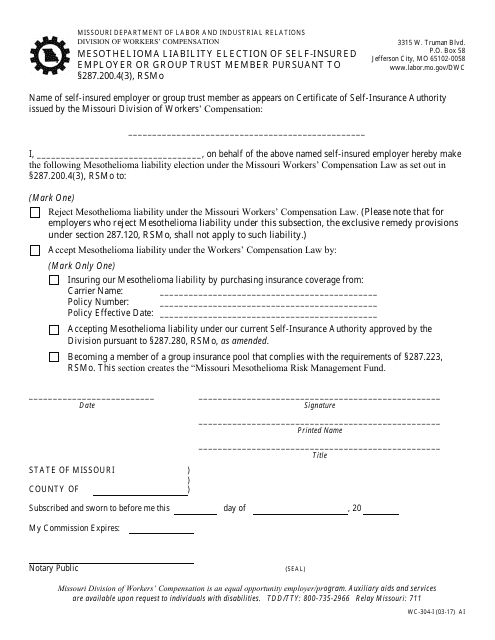

For example, there are forms such as the "Form 1010 Request of Authorization/Carrier or Self InsuredEmployer Response," which helps facilitate communication between the employer and the carrier. In certain states like Missouri, the "Form WC-304-I Mesothelioma Liability Election of Self-insured Employer or Group Trust Member Pursuant to 287.200.4(3), Rsmo" allows self-insured employers to make important liability elections.

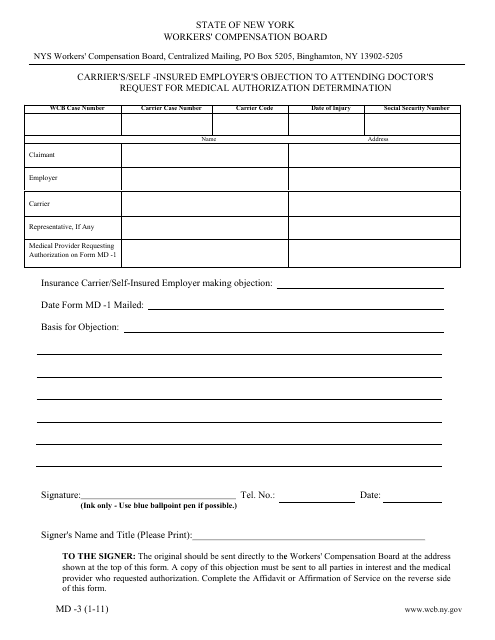

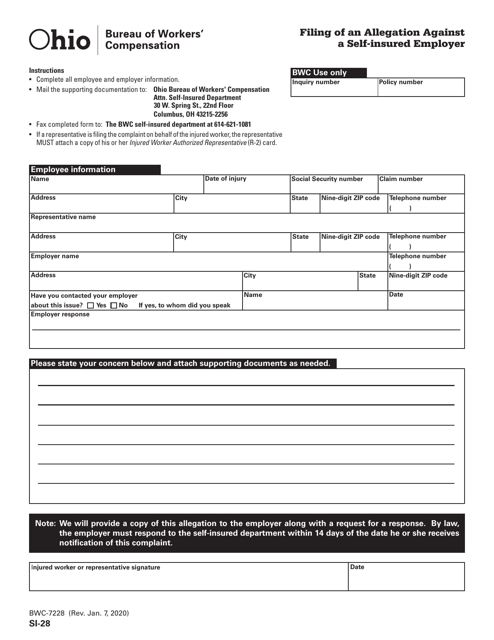

Other essential documents include the "Form MD-3 Carrier's/Self-insured Employer's Objection to Attending Doctor's Request for Medical Authorization Determination" in New York and the "Form SI-28 (BWC-7228) Filing of an Allegation Against a Self-insured Employer" in Ohio. These documents help to ensure proper authorization and claims management within the self-insured employer framework.

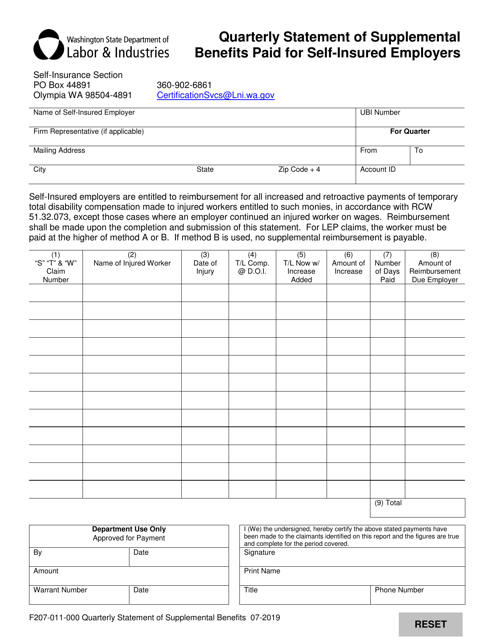

For self-insured employers operating in Washington, the "Form F207-011-000 Quarterly Statement of Supplemental Benefits Paid for Self-insured Employers" is an important document for reporting and tracking supplemental benefits.

Whether you're a self-insured employer or are considering transitioning to this model, having access to the right documents is crucial. These documents, also known as self-insured employer forms, provide the necessary framework for efficient and compliant operations. By leveraging the freedom and control that come with being a self-insured employer, businesses can optimize their healthcare benefits while effectively managing costs and ensuring regulatory compliance.

Documents:

25

This Form is used to request authorization or for a carrier or self-insured employer to respond to a request.

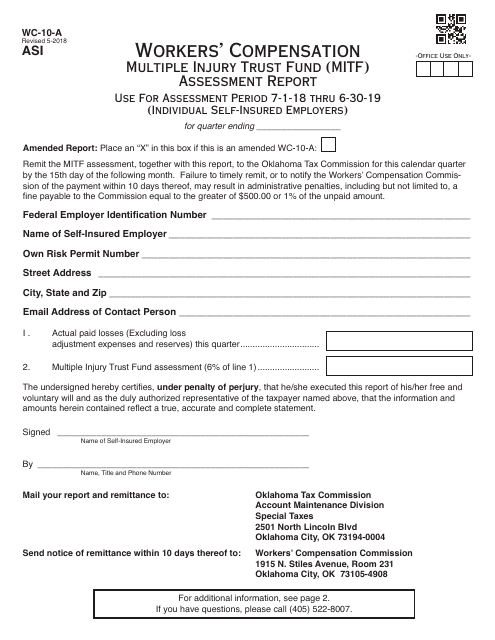

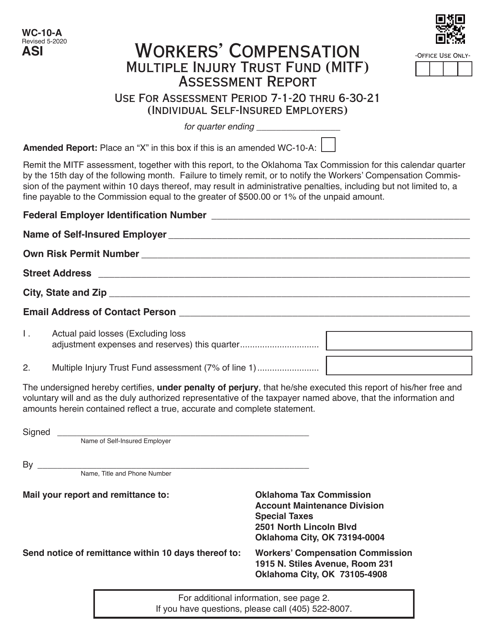

This document is used for reporting the assessment for the Oklahoma Workers' Compensation Multiple Injury Trust Fund. It is specifically for individual self-insured employers.

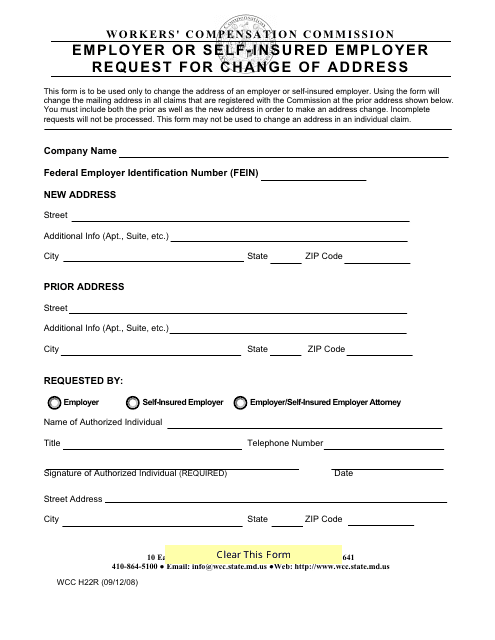

This form is used for employers or self-insured employers in Maryland to request a change of address.

This Form is used for employers or group trust members in Missouri to make a liability election for mesothelioma cases. This form is required by the Missouri Revised Statutes section 287.200.4(3).

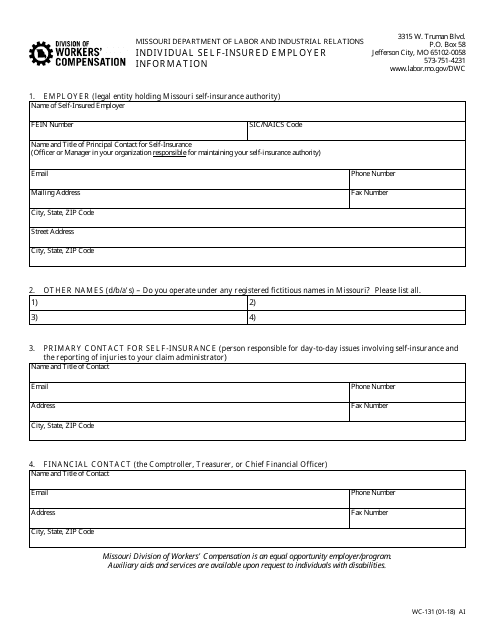

This Form is used for individual self-insured employers in Missouri to provide information to the state.

This form is used for carriers or self-insured employers in New York to object to a request made by an attending doctor for medical authorization determination.

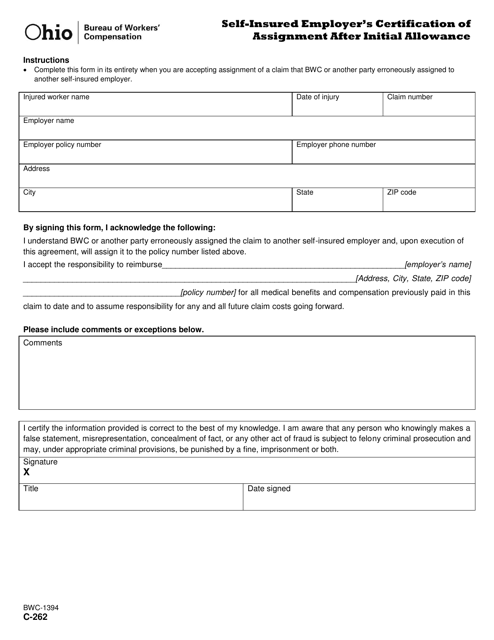

This form is used for self-insured employers in Ohio to certify the assignment after the initial allowance. It is necessary for employers to provide this certification to ensure proper handling of workers' compensation claims.

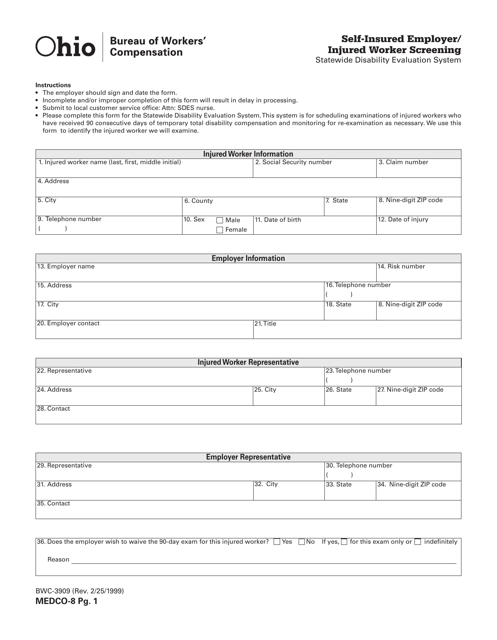

This form is used for self-insured employers and injured workers in Ohio to conduct screening for the Statewide Disability Evaluation System.

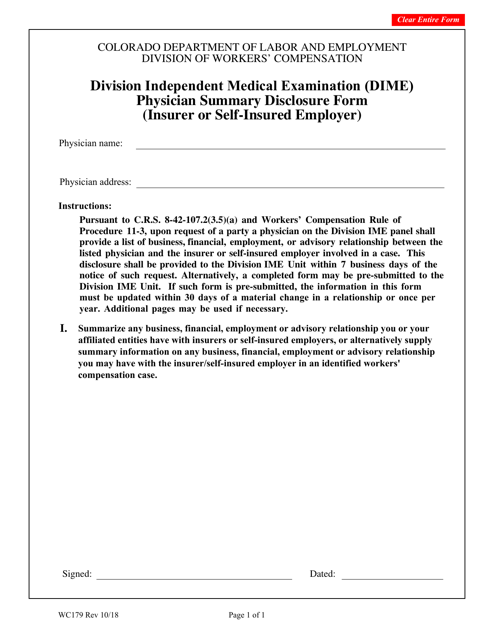

This Form is used for disclosing the summary report of the Independent Medical Examination (IME) conducted by the Division Independent Medical Examination (DIME) physician to the insurer or self-insured employer.

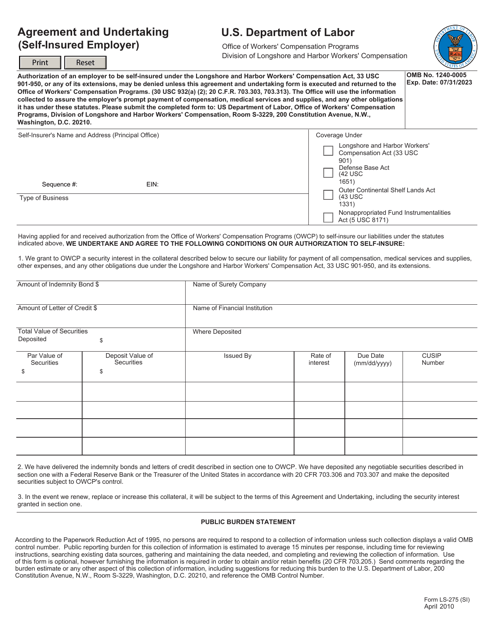

This Form is used for self-insured employers to complete an Agreement and Undertaking.

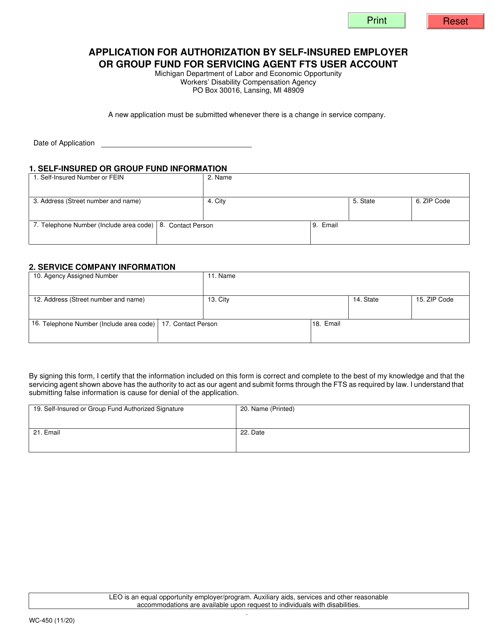

This form is used for self-insured employers or group funds in Michigan to apply for authorization to use the FTS User Account for their servicing agent.

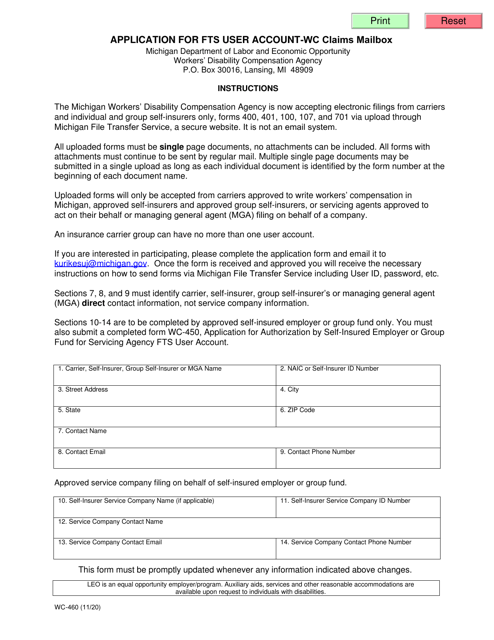

This document is used for carriers and self-insured employers in Michigan to apply for an FTS user account.

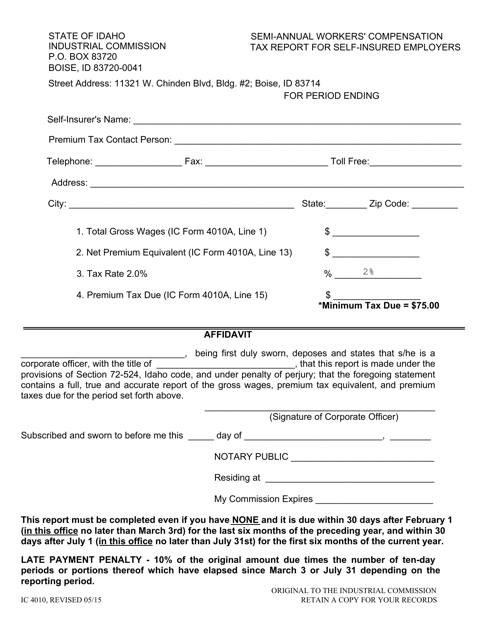

This form is used for self-insured employers in Idaho to report their semi-annual workers' compensation tax.

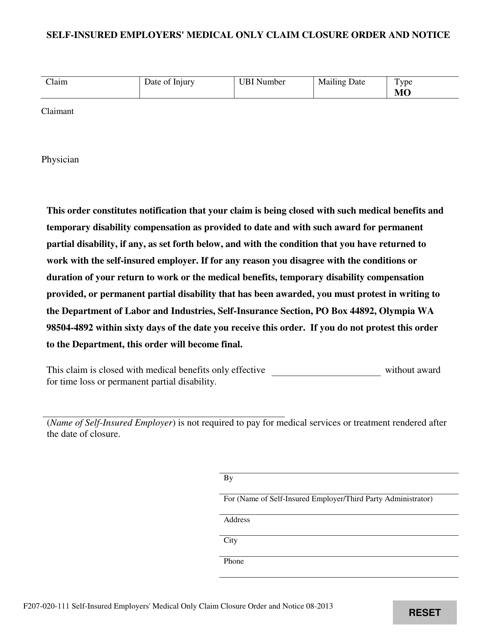

This document is used for self-insured employers in Washington to formally close a medical-only claim and notify the parties involved.

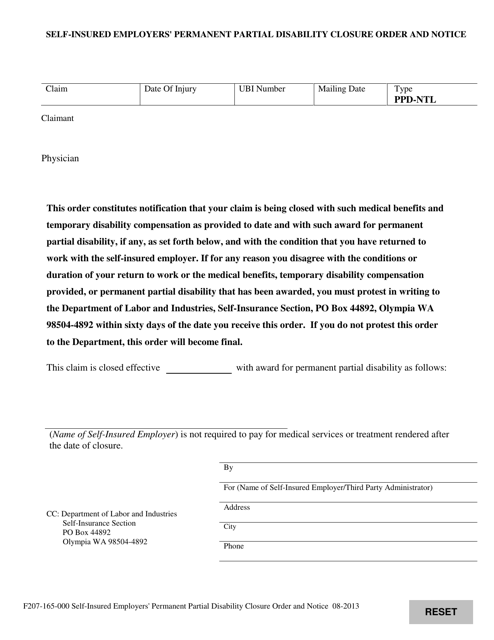

This document is used for notifying self-insured employers in Washington about permanent partial disability closure orders and provides relevant information regarding the closure process.

This form is used for self-insured employers in Washington to report quarterly statements of supplemental benefits paid.

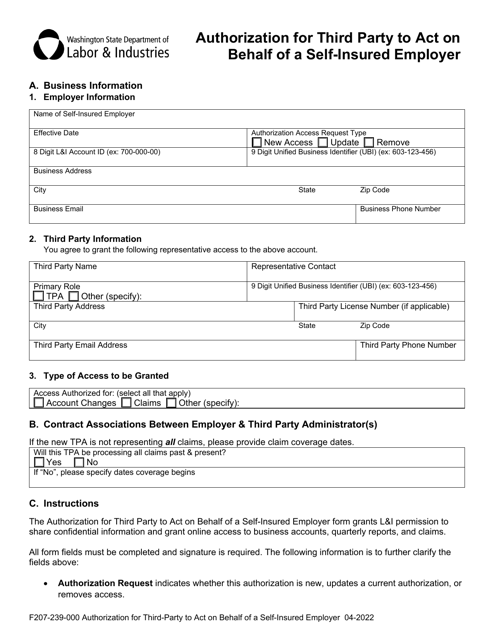

This Form is used for authorizing a third party to act on behalf of a self-insured employer in Washington state.